STO Series Part 1: History and Current Status of Japan’s Security Token Market

Japan’s Crypto Market that Turned Crisis into Opportunity

1. Introduction

1.1. Launch of Korean Security Token Guidelines

Starting in 2017 and peaking in 2021, the digital asset investment market has gone through a number of events and incidents and has come to rival the traditional investment market in terms of its impact on the public. As the digital asset investment market has grown in size, there have been an increasing needs for the establishment of a regulatory system to create a safe investment environment for investors. The Korean government echoed this and included “Establishment of Digital Asset Infrastructure and Regulatory System(Financial Services Commission)” in its 110th National Tasks announced in May last year.

On the 5th of a certain month, the Korean Financial Services Commission (FSC) released guidelines for a regulatory system governing the issuance and distribution of security tokens, marking the beginning of the domestic security token market in Korea. Prior to the FSC’s announcement, security tokens were issued and distributed by real estate fragment investment platforms like Casa, LucentBlock, and Funble, which had been selected as innovative financial services through the ‘Financial Regulation Sandbox’ implemented in May 2019. The announcement of guidelines is significant as it marks an official move to regulate token securities by amending the Act on Electronic Registration and the Capital Markets Act.

While it seems certain that a security token market will open in Korea, it would be helpful to look at countries that have already introduced security tokens and used them for real-world financing to get a hint of how the domestic market will develop. While many of the world’s leading capital markets, such as the United States, Singapore, and Japan, have been already utilizing token securities, I think the most insight into the domestic token securities market can be gained from the case of Japan, which has already been issuing and distributing security tokens under regulation through legislative changes several years ago. Let’s take a closer look at the development history and current status of the Japanese security token market.

2. Main Content

2.1. The Growth of Japan’s Security Token Market

Leader in cryptocurrency investment

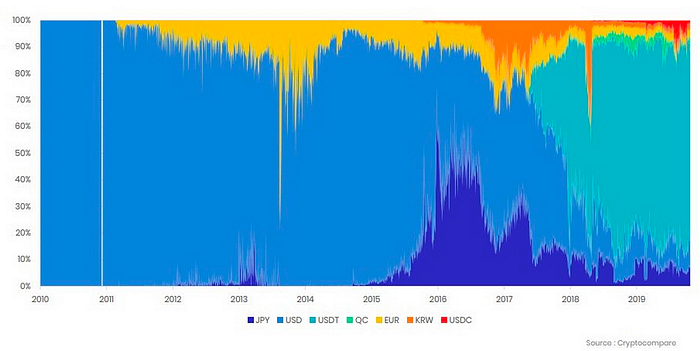

To understand the current situation in Japan, where laws are being amended and the issuance and distribution of token securities are being managed at the national level, it is necessary to examine the history of the Japanese virtual currency investment market. Japan was one of the first countries in the world to actively invest in virtual currencies, and the Mt.Gox bitcoin exchange in Shibuya, Tokyo was at the forefront of this movement. Although Mt.Gox is no longer in operation, in 2013, when it was the world’s largest bitcoin exchange, the yen had a market share of nearly 20% in the global bitcoin market, according to Cryptocompare.

The First Crisis, Mt.Gox

After a brief period of glory, the Japanese virtual currency market experienced its first crisis. In 2014, Mt.Gox hack, where about 70% of the world’s bitcoins were traded, resulted in the theft of 850,000 bitcoins worth $473 million, leaving many investors around the world, including Japan, without their assets.

Following the Mt.Gox incident, there have been calls for the establishment of a legally-based investor protection system to prevent similar situations from occurring in the future. This sentiment has been echoed on an international level. For instance, at the 41st G7 Summit held in Elmau, Germany in June 2015, it was directly stated that proper regulation of virtual currencies is necessary:

“We will take further steps to increase the transparency of all financial flows, including the regulation of virtual currencies and other new payment methods.” — Among the G7 Elmau Summit

The Financial Action Task Force(FATF) also emphasized the need for investor protection in virtual currencies in its June 2015 Guidance for a Risk-Based Approach to Virtual Currencies, noting that countries should have regulations and registries in place for anti-money laundering and combating the financing of terrorism(AML/CFT).

1st Amendment in 2016

In response to international calls for regulations to protect investors, as well as growing calls for regulation of virtual currency investments in Japan, the Japan Financial Services Agency(FSA) announces the first amendment. The amendments targeted the Payment Services Act, which regulates the transfer and settlement of funds, and the Act for Prevention of Transfer of Criminal Proceeds, which was enacted to curb terrorist financing after the FATF’s comments above. The first amendment, revised in 2016, was implemented in April of the following year, and the details are shown in the chart below.

The intention of the above amendments is to minimize the risk to investors in the new asset market of cryptocurrencies by allowing only exchanges and tokens approved by FSA to conduct investment activities in Japan. As of February 2023, there are currently a total of 30 companies authorized to operate as cryptocurrency exchanges in Japan, all of which are regulated by the FSA. Compared to Korea, where an amendment to the Act on Reporting and Using Specified Financial Transaction Information(Special Act) with similar content was passed on March 5, 2020, and took effect in March of the following year, Japan has shown a move to manage cryptocurrency investment at the national level about four years ahead of Korea.

In addition, in March 2018, Japan established the “Study Group on Virtual Currency Exchange Business, etc.” and held 11 consultations from April to December of the same year to find appropriate regulations for various activities related to cryptocurrencies. Also in April 2018, 16 cryptocurrency exchanges in Japan came together to establish a self-regulatory organization called the Japan Virtual and Crypto Assets Exchange Association(JVCEA). Compared to the establishment of the Digital Asset eXchange Alliance(DAXA) in June 2022, which was established by the five major domestic exchanges, JVCEA was a fairly quick regulatory overhaul. The JVCEA works in close relationship with the FSA to manage exchange operations and cryptocurrency listings in Japan, and as of 2023, there are a total of 40 members registered in JVCEA. Most of them are registered with the FSA and provide services as cryptocurrency exchanges, and JVCEA contributes to the creation of a healthy cryptocurrency investment ecosystem in Japan by regularly disclosing details related to cryptocurrency investment in the country, such as the amount of trading by members(exchanges), the amount of spot trading, and the number of user accounts as well as newly listed tokens.

The Second Crisis, Consecutive Exchange Hacks

Despite tireless efforts to protect investors in the wake of Mt.Gox, including amendments to the Payment Services Act and the establishment of a self-regulatory organization, Japan once again faced a crisis. In January 2018, a hack at Coincheck resulted in the theft of over 500 million NEM tokens, valued at approximately $530 million. The shocking incident at Coincheck, which was one of Japan’s largest exchanges at the time, was enough to bring back memories of the 2014 Mt.Gox debacle and raise calls for more stringent regulation.

Furthermore, a report by the Virtual Currency Exchange Business Research Group, released by the FSA in December 2018, noted that once businesses utilizing virtual currencies were officially recognized under the first amendment to the Payment Services Act, numerous derivatives transactions became active, making cryptocurrency investment primarily speculative. In 2017, more than 80% of the total volume of cryptocurrency trading in Japan was of a speculative nature, including derivatives such as margin trading, suggesting that this situation far deviated from the original purpose of the first amendment to revise the designation of assets as currencies. In addition, as new forms of trading utilizing tokens such as Contracts For Differences (CFDs) and Initial Coin Offerings (ICOs) emerged, the government recognized the limitations of regulating them through the first amendment alone and began preparing for the second amendment.

2nd Amendment in 2019

The second amendment was made in May 2019 and came into effect in the following May 2020. In addition to the Payment Services Act, which was covered in the first amendment, the amendment also included the Financial Instruments and Exchange Act, which corresponds to Korea’s Capital Markets Act to strengthen the regulation of cryptocurrencies in general. The details of the second amendment are as follows:

The second amendment showed a move to strengthen investor protection through amendments to the Payment Services Act. In particular, it created regulations that strictly separate exchange assets from investor assets and required exchanges to keep investors’ assets in cold wallets, which showed an intention not to repeat the damage caused by Mt.Gox and Coincheck scandals. Exceptions were made to allow the storage of investor assets in hot wallets only when it is necessary to facilitate cryptocurrency exchange business, but even then, exchanges are required to store an amount of cryptocurrency equal to the investor’s assets on their own for normal withdrawals.

In the Financial Instruments and Exchange Act, regulating derivatives using cryptocurrencies has been a focus of attention. In particular, amendments to the act on security token, which is a hot topic in Korea as of now, were made at that time. This was to ensure that security tokens, which had emerged as a new way of raising funds, were regulated in the face of widespread skepticism about ICOs at the time. ICOs exploded in Japan in January 2018, raising $16.7 billion in capital by October of that year, but due to the lack of clear regulations and investor protection measures at the time, investment fraud was common and shareholders’ rights were often not guaranteed. In response, the FSA defined a new funding method called STO (Security Token Offering), which takes the advantages of ICOs’ blockchain technology and tokens, but applies securities to apply clear issuance rules and further protect investors.

STOs brought flexibility and efficiency to Japan’s capital markets that were not found in traditional financing methods such as stock or bond issuance. Add to that, since the government had already laid the legal groundwork with the second amendment, Japan’s STO market had all the ingredients to take off, and the formation of the Japan Security Token Offering Association (JSTOA) signaled the beginning of the prelude.

2.2. Start of Japan Security Token Market

Establishment of JSTOA

JSTOA 설립

JSTOA was established in October 2019 by six core Japanese securities firms, including SBI, Nomura, and Rakuten Securities. It was recognized as a self-regulatory organization by the FSA in accordance with Article 78(1) of the Financial Instruments and Exchange Act upon the implementation of the second amendment in May 2020. Its main duties include investor protection, security token market system development, seller registration management, and communication with organizations related to the financial instruments and exchange business. This organization has been transparently disclosing internal information such as business plans, business reports, and balance sheets every year since 2019, when it began its activities.

JSTOA’s strength is that it is a self-regulatory organization by practitioners. A wide range of legal and accounting firms, including those in the financial industry in their home countries, are included as full, supportive, and sponsoring members. As of February 2023, there are 75 member firms that are making practical regulations for the healthy development of the security token market based on their practical experience in the field. In addition, the CEOs or comparable key figures of each member participate in various committees of the JSTOA(ST Market Revitalization Committee, ST Market Business Committee, ST Taxation Business Committee, etc.) and hold regular consultations to disclose the challenges and progress of the security token market.

In addition to the JSTOA, there are various organizations in Japan that work to develop the token securities market. One such organization is the Japan Security Token Association(JSTA). JSTA is a non-profit organization founded in September 2018 by a group of companies from various fields, including fintech companies, blockchain startups, and real estate companies. The difference between JSTA and the aforementioned JSTOA is that while JSTOA is a self-regulatory organization and focuses on regulatory development and market creation related to the issuance and distribution of security tokens mainly by securities companies, JSTA focuses on the educational aspect, holding various seminars and conducting ecosystem research. However, JSTA and JSTOA are not separated from each other and perform their roles independently; rather, JSTA is a supporting member of JSTOA and JSTOA is a partner of JSTA, and they are working together under the common goal of developing a healthy security token market in their respective countries.

Performance of Securities Firms

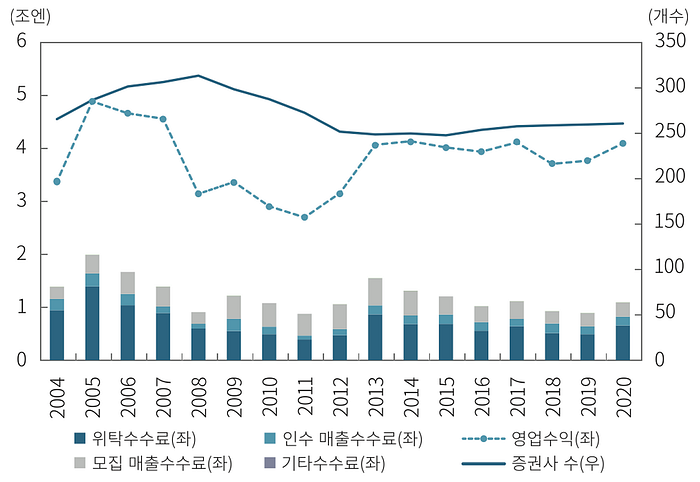

Through 2019, Japan’s securities industry has shown that profitability has not kept pace compared to the rising stock market. The graph below shows that the operating income of Japanese securities firms continued to decline through 2019, and while 2020 saw an upturn in profits, the continuation of the upturn in operating income was not guaranteed due to internal and external risks such as COVID-19 and the US-China trade war.

As a result of this turmoil, the Japanese securities industry felt the need to expand its business scope and improve its profitability, and in response to the regulatory overhaul by various organizations and governments, including the JSTOA and JSTA, and the high capital efficiency and liquidity of STOs using blockchain tokens, cases of actual utilization of STOs in Japan began to emerge in 2020, mainly among securities companies. The first to take the initiative was SBI Securities, which raised funds in October 2020 by issuing 1,000 common shares(approximately 50 million yen) of its subsidiary SBI e-Sports in the form of security tokens through the consortium blockchain platform “ibet”.

Below is a summary of key examples of STO utilization in Japan by year since 2020. You can see that most of these examples involve collaboration with multiple securities firms and fintech companies, rather than individual securities firms acting on their own.

2020

- Mizuho Securities: Conducted a demonstration test to issue bonds as STO for general companies such as Family Mart and Yamada Electric(20.02) — Connects issuers and investors directly, offering points that can be used in stores.

- SBI Securities: Aforementioned(20.10)

In February 2020, Mizuho Bank’s bonds were issued as an STO, but since it was an empirical experiment and investors were limited to employees of the bond issuer, we describe the case of SBI.

2021

- Sumitomo Mitsui Trust Bank (SMTB): Issuing token securities based on credit card receivables using Securitize’s platform(21.03) — The first security token-based derivative to receive an investment grade rating (A-1) from a rating agency.

- SBI Securities: Established ODX(Osaka Digital Exchange), a PTS (Proprietary Trading System) operating company that handles stocks and security tokens, as a joint venture with SMBC, Nomura Securities, and Daiwa Securities(21.04) — Currently supports only equities, but plans to handle security tokens in 2023.

- SBI Securities: Issued its bonds as security tokens through the ibet platform(21.04) — Minimum investment set at 100,000 yen, offering STO services to retail investors beyond institutions.

- Mitsubishi UFJ Trust Bank: Collaborated with SBI Securities and Kenedix(a real estate asset manager) to issue token securities with real estate as the underlying asset(21.07) — utilized its token securities platform “Progmat.”

2022

- Japan Exchange Group(JPX): Announces STO market launch in April 2025(22.04)

- Mitsubishi UFJ Trust Bank and 6 other companies: Announced joint venture in STO platform “Progmat”(22.12) — Transitioned from a subsidiary of Mitsubishi UFJ Trust Bank to a joint venture and aim to establish the company after September next year.

2023

- Ticketme: Working with MountainView to launch an STO with carbon credits as the underlying asset(23.01)

3. Conclusion

So far, we’ve seen how the Japanese security token market has evolved and where it stands today. Feeling the need for regulation after the Mt.Gox incident in 2014, Japan used it as a springboard to quickly establish regulations in various areas related to cryptocurrencies, and as a result, it is now one of the leading countries for STO.

While Japan’s implementation of the first and second amendments has led to counterarguments that strict regulation could have the side effect of stifling innovation, the FSA has focused on protecting investors within the framework of the system weighing in on stability. In fact, even in the FTX debacle that sent tremendous ramifications around the world last November, Japanese market investors were relatively unscathed thanks to the proactive actions of the FSA, which prevented exchanges from arbitrarily selling off assets without protecting customer assets.

With the FSC indicating that it will submit amendments to the Act on Electronic Registration and the Capital Markets Act to the National Assembly in the first half of this year, the example of Japan which has enacted legislation to regulate security tokens starting in 2019, may provide hints for domestic markets looking to start institutionalizing. In the following article, we will compare the Korean security token market with the that of Japan, focusing on the issuance/distribution structure and related laws.

<References>

- NH Investment & Securities, Security Token(STO) Market Is Coming, 2023

- Capital Markets Focus, Status and implications of STOs in Japan, 2021

- FSA, Regulating the crypto assets landscape in Japan, 2022

- National Assembly Legislative Research Center, Strengthening regulations to protect users of virtual assets in Japan, 2020

- everytreeisblue, How does Japan regulate STOs?