1. Introduction

Currently, on top of capital gain, as crypto market participants, there are the top-three ways to use the DeFi platform to generate additional REAL YIELD in a sustainable way.

1.1. Staking

A common method is staking, for example, $ETH to earn revenue as a reward for contributing to the Ethereum chain. Alternatively, there is the method of receiving interest income from a borrower of the assets by depositing the assets held in a lending protocol such as AAVE or Euler Finance.

1.2. Liquidity Provisions

This method allows for earning fee-based income through market making by depositing asset pairs on a decentralized exchange based on AMM. A real return can be achieved because the trading consumer pays the liquidity provider a portion of the traded asset as a fee.

1.3. Selling options

With this method, an option premium from the option buyer and a real return can be attained by selling options using one’s assets as collateral. However, since the crypto options market itself is still small to date, it is not possible to earn profits like this for assets that are not supported by option exchanges or the DeFi option vault protocol.

Staking is by far the most passive and low-risk way to earn alpha (excess) returns. Obviously, high-risk-tolerant market participants readily use liquidity provision or option selling as a means to earn more by being more active or taking higher risks.

Using Uniswap V3, one can proactively seek profits, while taking short option positions on a wide array of asset pairs by forming a liquidity pool.

2. Uniswap LP basics

In a nutshell, liquidity provision can be described as an analogy to having the assets placed in an order book. For example, in the $ETH-$USDC pool, sell orders for $ETH are placed at the top the order book, and buy orders for $ETH are placed at the bottom of the order book.

And market makers wishing to form pools need to decide to what extent they want to place their assets.

There’s no need to buy or sell $ETH with $USDC.

The unit of the $ETH price may be different, but the rest is the same, for example, 1 ETH can be bought with x BTC just as 1 ETH can be bought with 2,000 USDC.

So, you can imagine an orderbook quoted by $BTC to buy $ETH. Currently, the trading pair has a cluster of bid and ask quotes in the price range of 0.05 to 0.1 BTC for 1 ETH, as shown in the photo above.

Therefore, if the pool provider injects liquidity in the same range as above, when 0.05 BTC equals 1 ETH, the bid price is settled and $ETH is purchased by paying the full $BTC. (All $ETH Bought)

Conversely, if the price of $ETH rises to 0.1 BTC per 1 ETH, the sell order will be settled and only assets in $BTC will remain. (All $ETH Sold)

As in the example above, a shortcut to avoid getting confused is to decide which of the two liquidity pool assets should be placed as either the base asset ($ETH) or the quote asset ($USDC or $wBTC) in advance. Notably, setting the quote asset as $BTC is relatively easy to understand intuitively as it is well-known as the so-called Satoshi chart like ETH/BTC, SOL/BTC but any other asset can also be a quote asset.

And by making this clear ahead of time, pool providers can take a position with a clear “intent” as in the example below.

1. Leverage for transaction fee

“Since the price of $ETH against $BTC is unlikely to diverge greatly, it is inefficient to place the liquidity over the entire range. If I provide the liquidity at an extreme value, the transaction will not be settled and a transaction fee will not be received. So, I’ll concentrate the liquidity in the range of -25% to 50% of the current price to acquire a high stake in the same value (leverage)”

2. Mean Reversion

“If the correlation between the two assets temporarily breaks the range and the price rises below -25% or above 50%, I will hold 100% of solely $ETH or $BTC. This is desirable because the diverging price will recover back to its intrinsic level (Mean Reversion)”

3. Dollar Cost Averaging

“(If the correlation between these assets is not intended) If the price of the base asset rises against the quote asset, the base asset will be sold for dollar cost averaging out to reap a profit and I think that is fair. On the other hand, if the price of the base asset falls, I’m willing to buy more for dollar cost averaging”

The position of liquidity provision under those scenarios can be expressed as basically passive liquidity provision.

3. Passive liquidity provision (Deposit and Forget)

Without taking up a position trading as a full-time investor or professional portfolio manager, it is impossible for a retail investor with a separate main job to constantly monitor their portfolio and respond in real-time as needed. This inevitably leads to convergence to a “Deposit and Forget” strategy, but the problem is that when the range is out of bounds, an asset pair is no longer provided and a transaction fee will not be received.

Essentially, the most important source of creating alpha (excess) returns beyond a simple “Buy and Forget” strategy through liquidity provision is transaction fees. The value of the pool + transaction fees should be greater than holding the two assets individually.

However, the longer the “Forget” period gets, the higher the probability that the prospects of transaction fees may get uncertain from the volatility of the asset. So, depending on the volatility of the two assets, a situation such as the holding value of the two assets > pool value + transaction fee may occur. Impermanent losses are realized from going outside the supply range, and the longer transaction fees are not received, the less likely alpha (excess) returns can be gained from pooling.

Therefore, liquidity can be provided across the entire range (-100% to 100%) to avoid a situation of not receiving transaction fees when the range gets out of bounds. However, the wider the range gets, the more assets become idle and transactions go unsettled at both extremes, which reduces capital efficiency. Furthermore, the risk-free rate of return (e.g. staking) that can be obtained from simply holding assets individually is to be deducted as an opportunity cost, the liquidity provision positions even may not reach breakeven regardless of the range.

Therefore, passive LP strategy requires some ingenuity, as shown in the example below.

3.1. Maximize the expected transaction fees

Indeed, as long as the fee is high, all the problems that make one worried can be solved. Also, it should be the standard that passive returns are based on making a choice that maximizes the risk-return profile and just sitting back.

There are two approaches as to the amount of fee collection.

- Privode liquidity to the chain with the most transactions.

Currently, Uniswap supports swaps on multiple chains such as Ethereum, Polygon, Optimism, and Arbitrum. If a random pool is provided to the Ethereum chain, but a transaction occurs on the Optimism chain, the fee cannot be received. For example, BTC-ETH pools are everywhere. The higher the trading volume and the lower the TVL within the range one wishes to set, the higher the total fees one can reap.

The trading volume and TVL for the Uniswap pool can be easily viewed at the link below.

2. Discover asset pairs that exist in only one chain and can supply a 1% fee pool due to low liquidity.

For example, there are always tokens that exist only on the Ethereum chain or predominantly only on the Ethereum chain. So there is no need to worry about losing one’s transaction fees to other chains. Even for these tokens, the 1% fee pool probably constitutes the dominant asset pair due to the lack of liquidity itself. If the token concerned is one of these, a lot of fees can be collected by providing liquidity with the $ETH pair.

4. Active liquidity provision (Active market making)

If there’s an intent to actively adopt a liquidity provision strategy, the analogy to a short put option is useful.

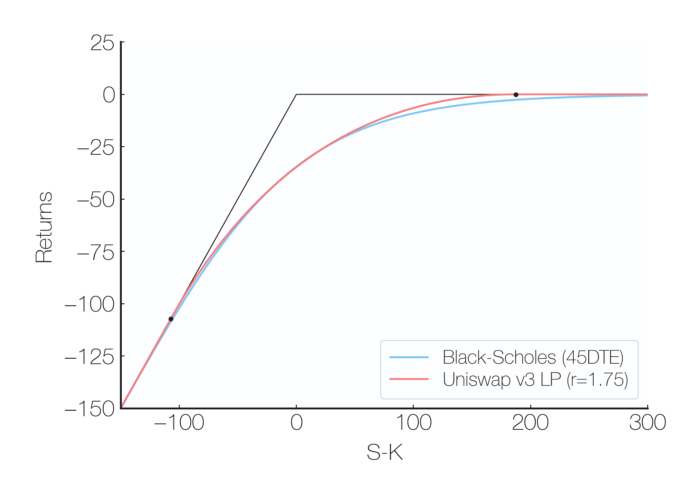

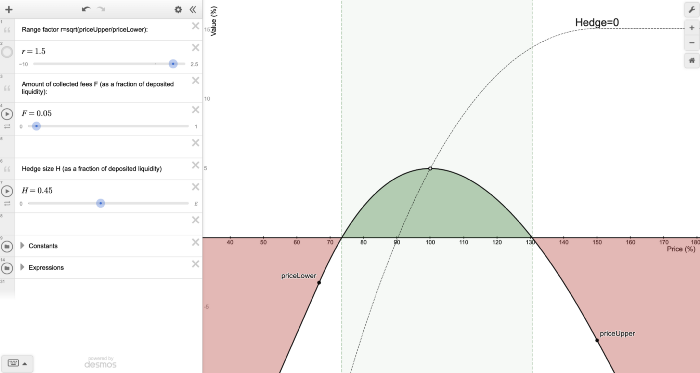

Looking closely at the P&L graph at the bottom left of the picture above, you can see what is similar to a put option short position. And since the graph takes the form of a curve, unexpired short put positions are constantly being held. That is, if a put option is sold with $ETH as the underlying asset, the collateral for the position becomes $wBTC (= BTC secured put).

As mentioned above, a pool can be created for all assets supported by Uniswap, so it can be formed in infinite combinations, such as short put positions with the base asset ($GEL) as the underlying asset and the quote asset ($WETH) as collateral. To construct a cash-secured put that tracks the existing dollar P&L shape, select the quote asset as $USDC.

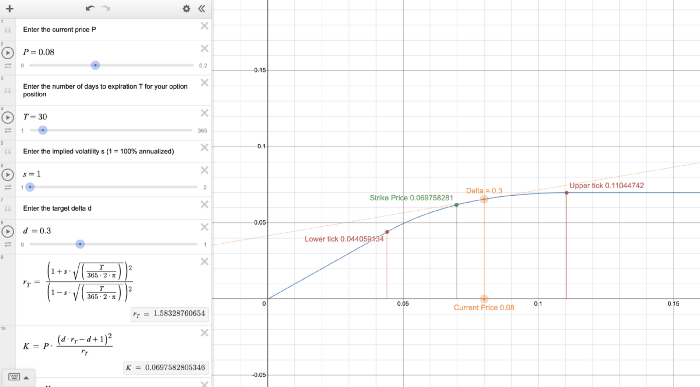

As shown in the picture, there is an amazing tool, so-called perpetual Uniswap V3 option creation machine. By entering the current price (P) of an asset pair, and setting the expiration (T) of the option to be held, assumed implied volatility (s), and target delta (d), the corresponding asset price range will be given.

In addition to being able to set the option’s delta to the desired value, considering that the shorter the option’s expiration, the larger the gamma is, a bet is made on gamma with an expiration of 1 day (instead, frequent rebalancing is required because the target delta fluctuates), or the expiration date can be set longer to avoid gamma risk.

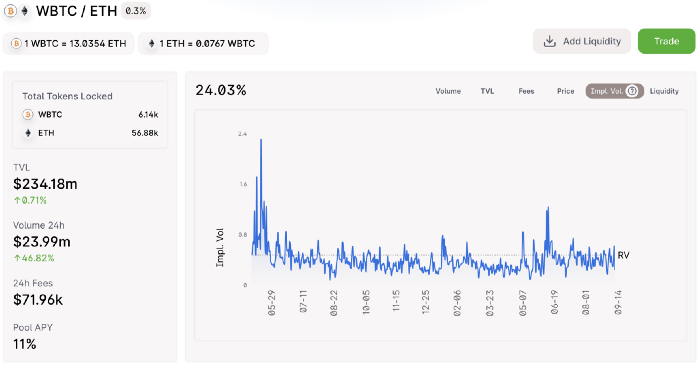

However, as shown in the picture, the price change of the pool value according to the movement of the asset price is similar to the payoff of the short put option, but the option premium and trading fee payment are not the same. With options, an short option premium is received based on the Black-Scholes options model and volatility skew, but in liquidity provision, it is proportional to the volume traded and TVL per tick made and % fee. Therefore, one should find a pool that has a high fee return relative to one’s expected implied volatility and create one’s preferred position.

For information on how the IV per pool is calculated, refer to the link below.

As shown above, it shows various indicators to determine if you are receiving an appropriate fee amount for exposing the payoff on a short-put position that provides a pool to Uniswap.

Of course, it is still debatable whether fee-based compensation through LP provision can justify a short volatility position. As a development that is anticipated, for now, the argument would be different if there were a platform that deposits & lends assets wrapped in tokens while retaining LP tokens in Uniswap as is and receiving fee-based compensation. This is because there is definitely demand to take a long volatility position by borrowing the related wrapped token and short selling it. Even Uniswap LP tokens can be created by using all tokens supported by Uniswap, generating unlimited volatility in buying demand. This will allow for short seller to pay for long volatility and token depositors to receive a more fair value for short volatility positions.

4.1. Various positions according to the hedge ratio(%)

If an asset is borrowed from a lending protocol such as AAVE, Compound, or Euler Finance and used as a base asset to provide a liquidity pool, a variety of options P&L graphs as well as short put positions can be created.

For example, if $GEL is borrowed, with $GEL being set as a base asset and $ETH as a quote asset, the graph moves by the borrowing ratio of $GEL.

If originally held base and quote assets are provided without borrowing, this constitutes the short put position we have already looked at.

The greater the portion that $GEL is borrowed in around 50%, the closer it becomes to the short straddle positions. The borrowed base asset + the originally held quote asset create this position.

The 100% hedge position borrows the base asset and creates a pool using only the borrowed assets and deposits it. This creates a graph similar to the short call option position shown above. Notably, if a large amount of dumping is detected, such as a release of token lockup in the near future, with the expected price drop marked by high trading volume, a position like this can be taken, acquiring a large amount of fees.

If one’s pool is deposited in Uniswap, Euler Finance is the best lending protocol to use for hedging. Euler uses Uniswap as an asset price oracle, and in theory, any asset supported by Uniswap could be onboarded onto Euler. That is, it is most convenient to build a liquidity pool position hedged on Uniswap by borrowing the desired asset.

5. Leverage the active liquidity management (ALM) protocol

If there’s not enough time to implement active liquidity provision, and taking optimal passive positions on one’s own is too difficult, there’s the option of leveraging the ALM protocol to automatically manage one’s Uniswap liquidity provision positions.

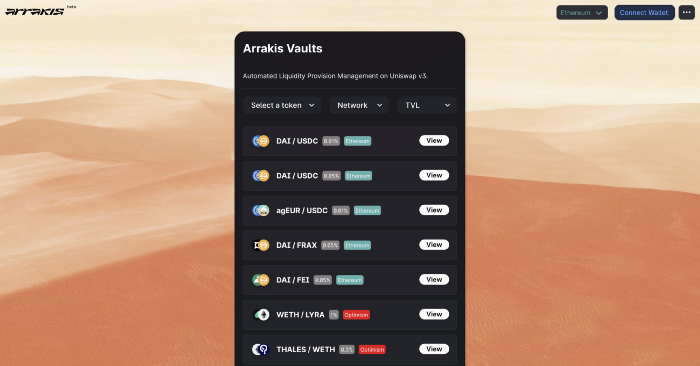

Currently, Arrakis Finance (formerly G-UNI) is the prime example.

Arrakis uses a Monte Carlo Simulation based on an asset’s past movement and provides liquidity to ensure that the asset’s price does not go out of bounds with a 95% probability over at least the next few months. The simulation runs weekly and rebalancing is done if needed.

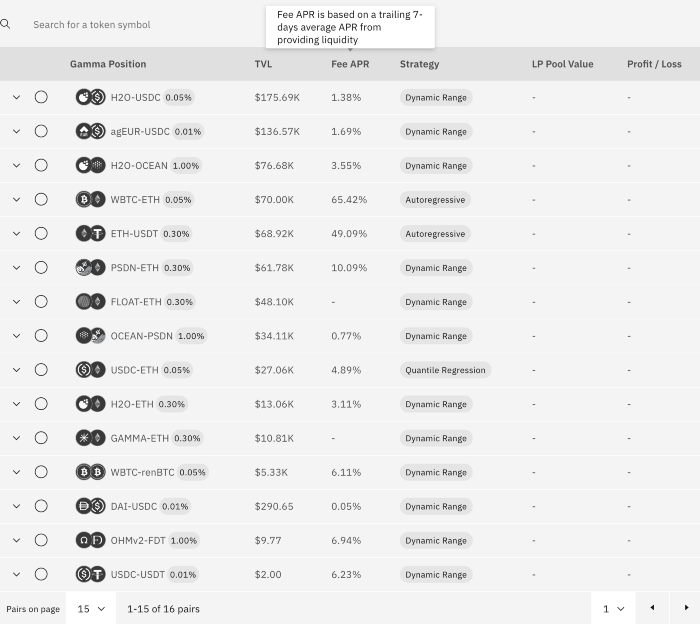

There is also the Gamma protocol. In the past, it garnered attention as a well-known ALM protocol, but it is far behind Arrakis by TVL standards.

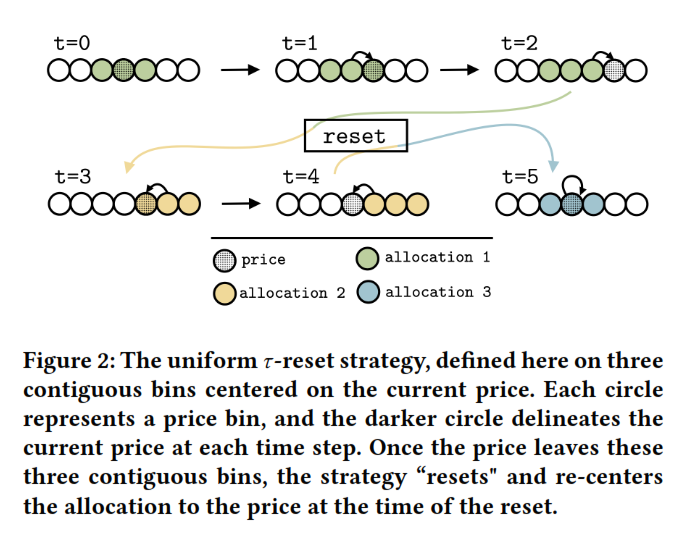

According to Gamma Docs, liquidity is provided to an optimized range using a strategy called “expected price range strategy” that predicts price movements in the near future based on past price movements introduced in the paper “Strategic Liquidity Provision in Uniswap v3”. And as the price moves, it constantly reallocates liquidity ranges to maintain an optimized liquidity supply.

For sure, neither individuals nor protocols can predict future asset price movements. Therefore, instead of constructing an optimized pool on one’s own accord and continuously rebalancing and relocating the scope, the ALM protocol is the best option if a suitably optimized liquidity provision strategy is desired while saving on personal labor and fuel costs. However, keep in mind that a management fee is incurred since the services from using the protocol do not come free of charge.

6. Other Applications- Uniswap V3 for Limit Orders

Although a large purchase or sale of assets is planned, it would be very burdensome to trade them due to the market impact in the case of low or ill-liquid assets as above.

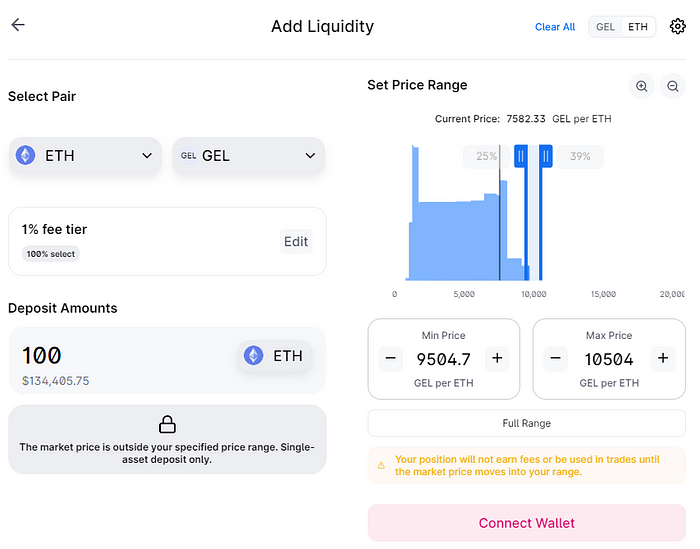

It is possible to deposit only a single asset by setting a target price range in Uniswap. Using the example in the picture above, when the price of $GEL continues to fall and reaches 9,500 GEL per 1 ETH, DCA of $GEL will start, and when it reaches 10,500 GEL per 1 ETH, the purchase is completed.

By adjusting the target price range, the start and end points of DCA can be specified, and the narrower the range, the more like a single limit order it gets. Above all, it is seen as a smart buying method with no slippage and earning the transaction fee as a reward rather than incurring such a fee.

The risk is that a potential opportunity cost may be incurred from not reaching the target price and non-settlement.

7. Conclusion

After a downward trend in 2022, the DeFi platform is gaining traction as a valuable platform that can provide real yields, rather than providing APR to users through simple token issuance.

Nothing in life is earned without effort. As a participant in the DeFi market, individuals must be able to properly make investment decisions across a variety of investment vehicles (vehicles) to earn real returns. Therefore, it is necessary to fully understand the mechanism and risk of each instrument and seek a reasonable expected return for it.

Providing liquidity to AMM can be visualized as creating a market above and below the limit order book(LOB). Accordingly, it is necessary to clearly pinpoint the intent and purpose of liquidity provision, so that both the base and quote assets can be clearly discerned and accepted from the result of the price movement.

A prime example of such an intent/ purpose is to provide passive liquidity or build an active position to receive a transaction fee while drawing the same payoff among various option positions. Alternatively, there is also the option of conveniently gaining transaction fees using the ALM protocol. And always keep in mind the risk of loss and opportunity costs due to an asset’s volatility spike may exceed the transaction fee received, falling below the risk-free rate of return.

Separately, by applying the liquidity provision function to provide only a single asset within the target price range, one can use this function to execute a buy/ sell order without slippage at the desired price by placing a limit order while receiving additional transaction fees.

Based on AMM, Uniswap provides an opportunity for anyone to conveniently engage in market making, even if they are not professional traders. As a first-generation decentralized exchange, it is the protocol with the largest trading volume and liquidity. It’s a no-brainer that having an accurate understanding of the provision of liquidity pools, one of the most accessible alpha real return strategies in the DeFi ecosystem, and the ability to actively execute them when needed can create large alpha returns in the long run.