Journey Towards Sustainable Yield Farming

Background behind DeFi's adoption of centralized elements in the evolution of yield farming models

1. Introduction

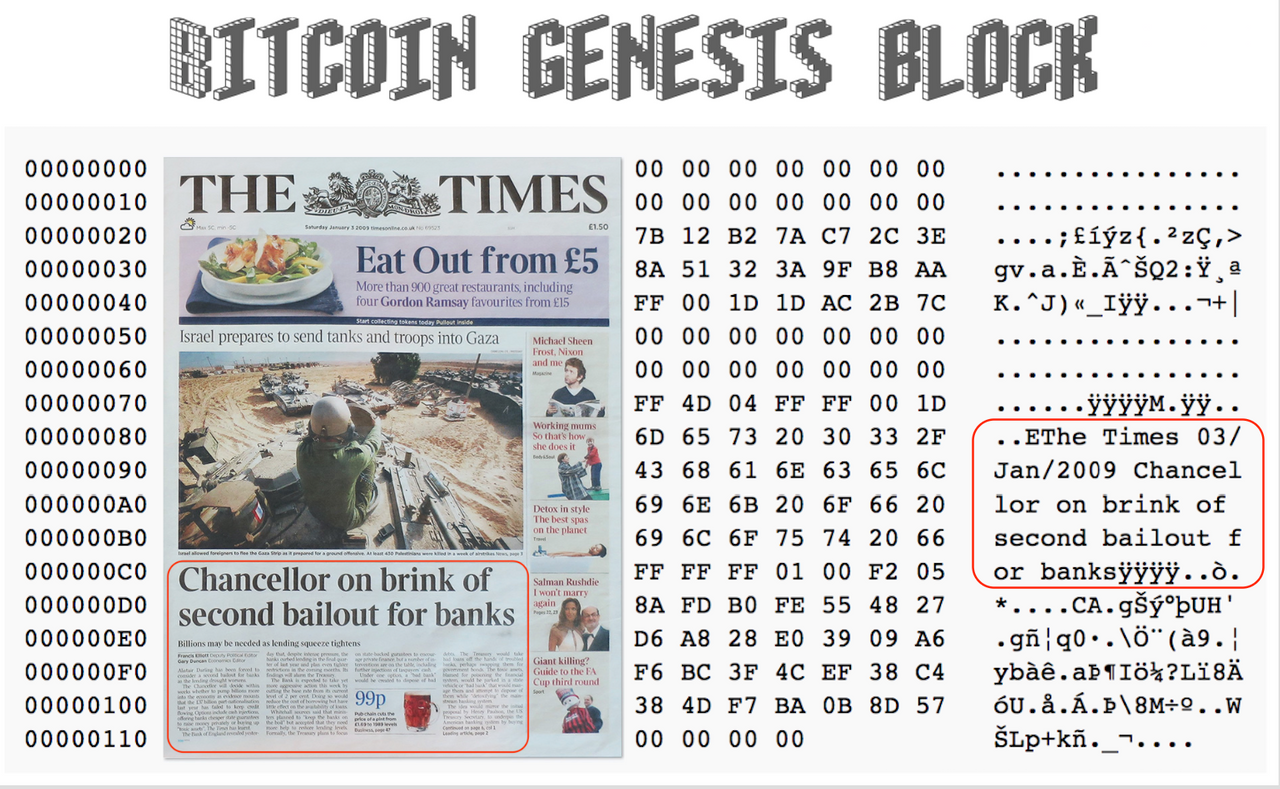

Decentralized Finance (DeFi) is a new form of financial sector that aims to innovate the existing financial system by implementing a trustless trading environment through blockchain and smart contracts without intermediaries, increasing access to financial services even in regions lacking financial infrastructure, and providing transparency and efficiency. The origin of DeFi can be traced back to Bitcoin, developed by Satoshi Nakamoto.

During the 2008 global financial crisis, Satoshi was concerned about the successive bankruptcies of banks and the government's bailout for them. He pointed out the fundamental problems of the centralized financial system, such as excessive reliance on trusted institutions, lack of transparency, and inefficiency. To address these issues, he developed Bitcoin, which provides a value transfer and payment system in a decentralized environment. In the genesis block of Bitcoin, Satoshi included the message "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" to emphasize the problems Bitcoin aimed to solve and the need for decentralized finance.

Later, with the advent of Ethereum in 2015 and the introduction of smart contracts, various DeFi protocols emerged that provided financial services such as token swaps and lending without intermediaries. Based on the ideology proposed by Satoshi Nakamoto, they developed and evolved around various attempts and research to realize 'decentralized finance'. These protocols formed a huge ecosystem through the money lego characteristics of being combined and connected with each other. By enabling various financial transactions beyond the functions Bitcoin provided in a decentralized form, they suggested the possibility that blockchain could replace the role of trusted institutions in the existing financial system.

However, it can be said that the reason why the current DeFi market has grown rapidly and attracted a lot of liquidity is largely due to the high yields provided by the protocols to liquidity providers, rather than ideological factors such as decentralization or financial system innovation. In particular, the various incentive functions called Yield Farming, which are provided to users through the protocol's revenue and tokenomics, offered attractive profit opportunities compared to existing financial products, attracting the interest of many users and playing a significant role in accelerating the inflow of liquidity into the DeFi market.

As users' attention increasingly focused on high yields, the revenue models of DeFi protocols, which were initially designed and provided in a way that aligned with DeFi's core value of 'providing financial services without intermediaries', have changed according to market conditions to provide continuous and high interest rates to liquidity providers. Recently, protocols that borrow centralized elements, such as using real assets as collateral or executing transactions through centralized exchanges, have also emerged to generate revenue and distribute it to users.

In this article, we will examine the development process and various mechanisms of DeFi yields, and explore the types and specific examples of DeFi protocols that have emerged to overcome limitations faced during this evolution by utilizing centralized elements.

2. Liquidity Mining and DeFi Summer

In the early days, DeFi protocols that appeared on the Ethereum network focused on implementing the traditional financial system on the blockchain. Therefore, early DeFi protocols brought about changes in the trading environment where service providers were excluded using blockchain, and anyone could become a liquidity provider, but structurally, they were not significantly different from the existing traditional finance in terms of revenue generation.

- Decentralized Exchange (DEX): Generates revenue through trading fees, similar to money changers or stock exchanges. A certain percentage of fees is charged each time a user swaps tokens, and these fees are distributed to liquidity providers.

- Lending Protocols: Generates revenue through the interest rate difference between depositors and borrowers, similar to banks. Depositors provide their assets to the protocol and receive interest, while borrowers provide collateral and receive loans, paying interest.

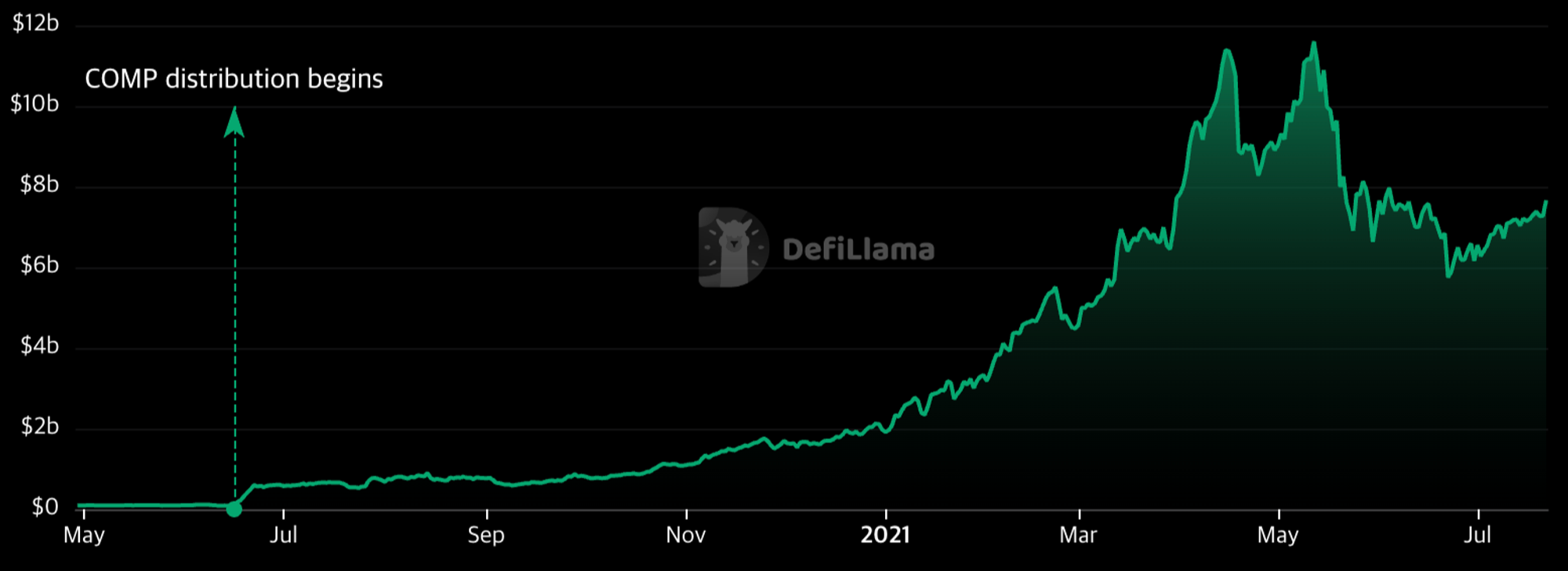

Then, in June 2020, Compound, one of the representative early lending protocols, issued its governance token $COMP and distributed it to liquidity providers and borrowers through a Liquidity Mining campaign to attract liquidity concentrated in the market around the Bitcoin halving event. As a result, a large amount of liquidity and lending demand began to pour into Compound.

The trend of DeFi protocols honestly distributing protocol revenue to liquidity providers began to change through this attempt by Compound. Early DeFi projects like Aave and Uniswap also provided additional yield through their own tokens in addition to the yield provided through revenue distribution. As a result, many users and liquidity flowed into the DeFi ecosystem as a whole, and the Ethereum network ushered in the "DeFi Summer".

3. Limitations of Liquidity Mining and Tokenomics Improvements

Liquidity mining provided a strong motivation for both service providers and users to use the service, which significantly increased the liquidity of DeFi protocols and played a major role in expanding the user base. However, the additional yield generated through early liquidity mining had the following limitations:

- The utility of the issued tokens was limited to governance, resulting in a lack of buying factors.

- The decrease in liquidity mining interest rates due to the decline in token prices.

Due to these limitations, DeFi protocols faced difficulties in maintaining the liquidity and user traffic attracted through liquidity mining for a long time. Subsequent DeFi protocols aimed to provide additional yields to liquidity providers in addition to protocol revenue while building a tokenomics model to maintain the liquidity inflow into the protocol for an extended period. To achieve this, they strived to link the value of their issued tokens to the protocol's revenue and provide continuous incentives to token holders, thereby increasing the stability and sustainability of the protocol.

Representative examples that well illustrate these characteristics include Curve Finance and Olympus DAO.

3.1. Curve Finance

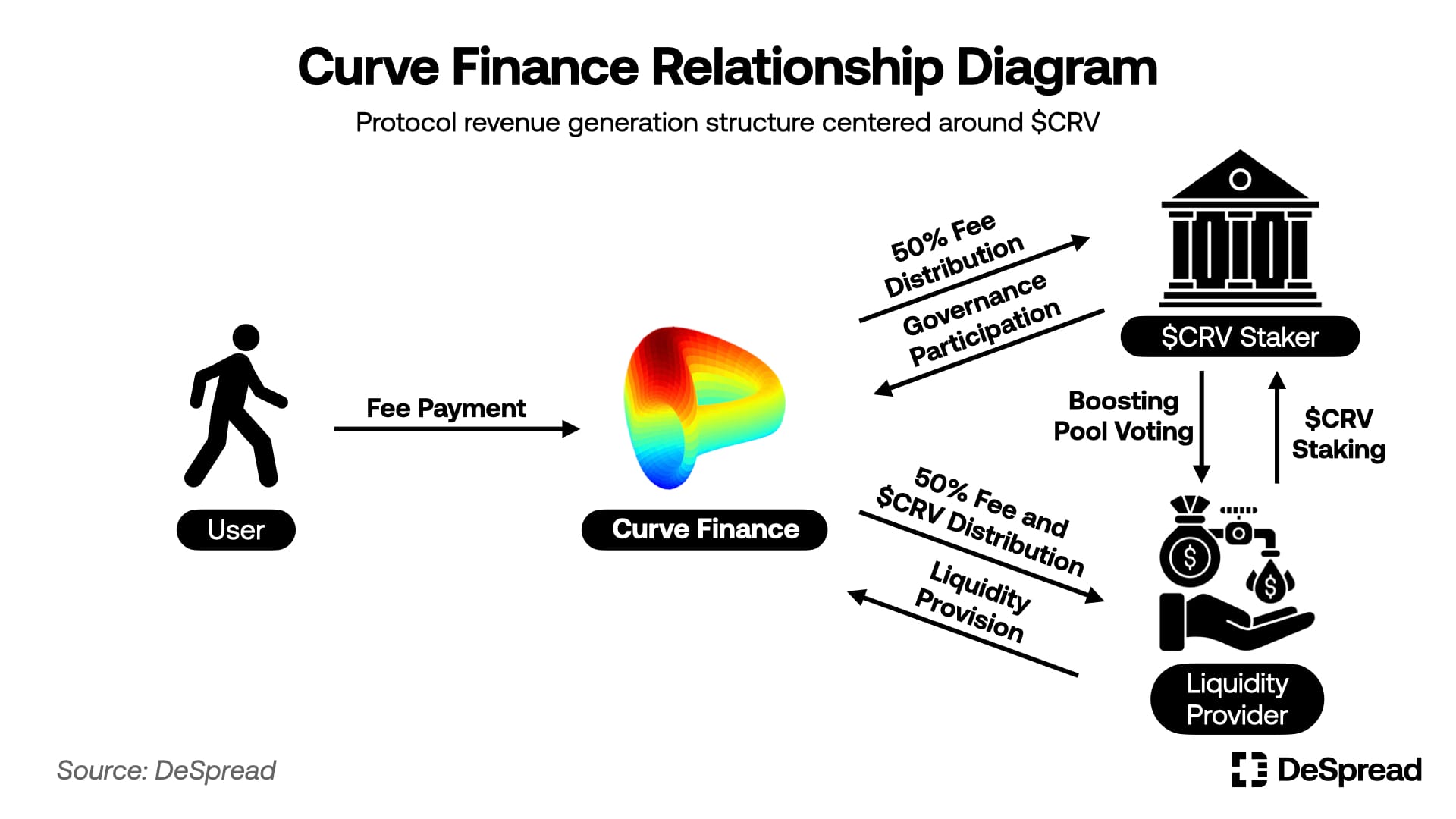

Curve Finance is a DEX specialized in exchanging stablecoins based on low slippage. Curve provides liquidity providers with revenue generated from pool trading fees along with its own token $CRV as a liquidity mining reward. However, Curve Finance aimed to improve the sustainability of liquidity mining through a system called veTokenomics.

veTokenomics Details

- Liquidity providers receive only 50% of the trading fees and, instead of selling the $CRV received as liquidity mining on the market, deposit it into Curve Finance for a set period (up to 4 years) and receive $veCRV.

- $veCRV holders receive 50% of the trading fees generated in Curve Finance and can boost the liquidity mining rewards generated from liquidity provision. They can also participate in voting to additionally boost liquidity mining rewards for specific liquidity pools.

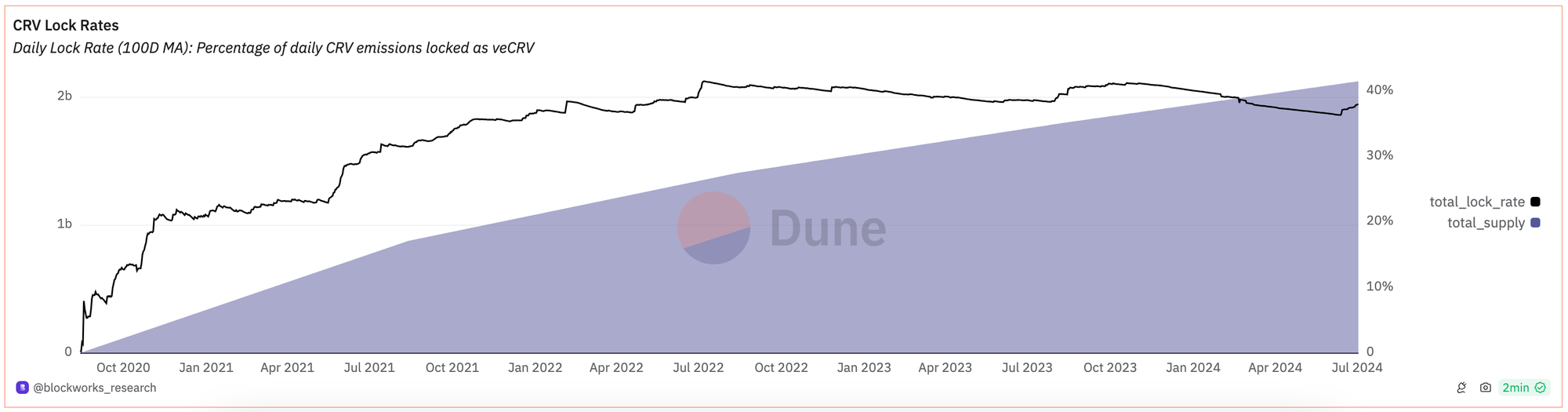

Through the above tokenomics, Curve Finance was able to induce liquidity providers to lock up the $CRV tokens paid to them for a long period, thereby mitigating selling pressure. Furthermore, by introducing a boosting voting right for liquidity mining in specific pools, it encouraged projects that wanted to supply abundant liquidity to Curve Finance to buy and stake $CRV in the market.

Thanks to these effects, the ratio of locked-up $CRV to circulation quickly increased, reaching 40% within a year and a half, and has maintained that ratio to this day.

Curve Finance's approach is considered a good attempt that goes beyond simply providing high yields to secure liquidity in the short term, but closely links its own tokens and the protocol's operating mechanism to pursue sustainability, setting an example for the tokenomics models of many DeFi protocols that emerged later.

3.2. Olympus DAO

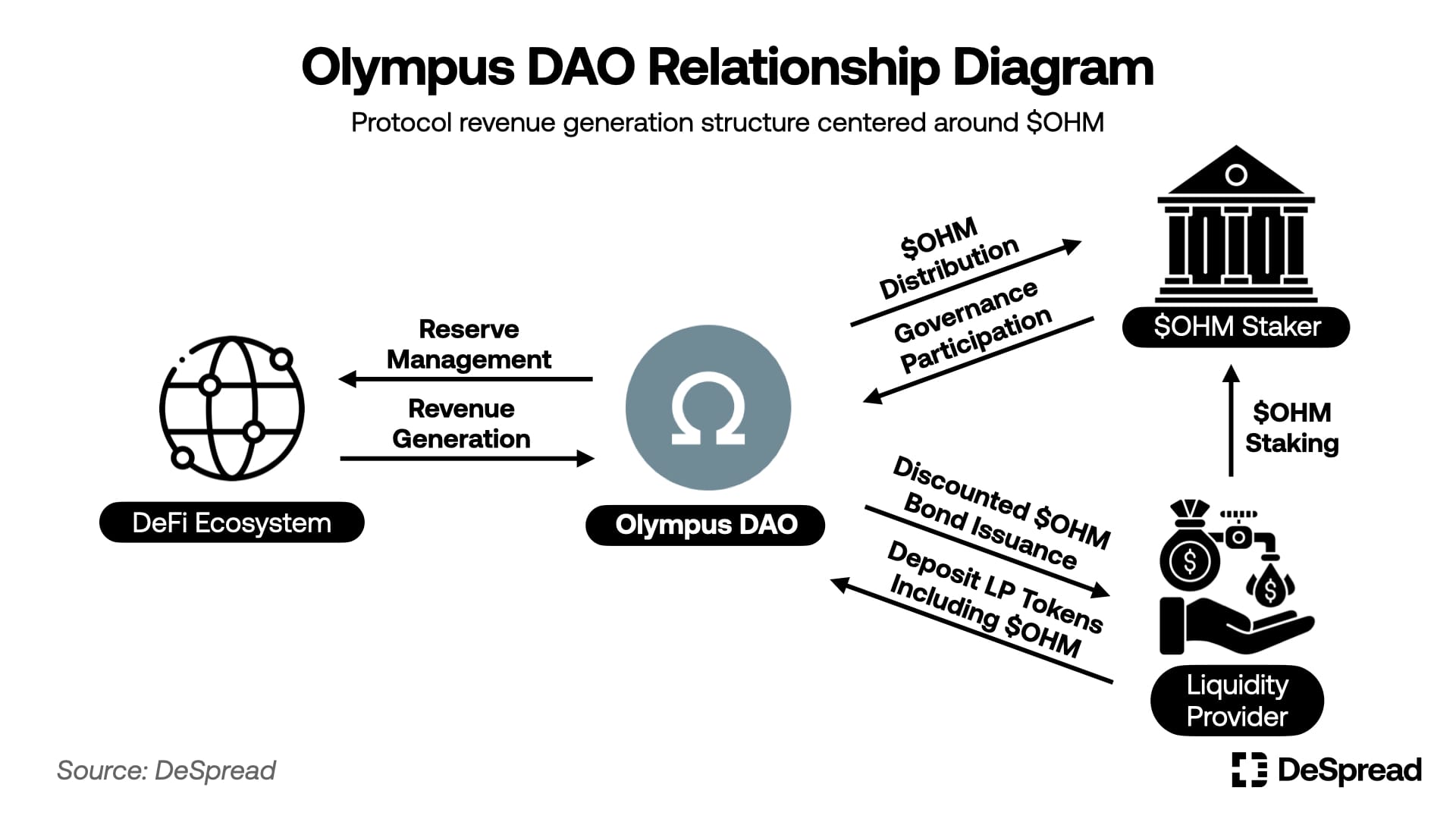

Olympus DAO is a protocol that started with the goal of creating a token that serves as a reserve currency on-chain. Olympus DAO builds and operates reserves by receiving liquidity deposits from users and issues its own protocol token $OHM in proportion to the reserves. In the process of issuing $OHM, Olympus DAO introduced a unique mechanism called 'bonding', where it receives LP tokens containing $OHM and issues bonds for $OHM.

Tokenomics Details

- Users can deposit single assets such as Ethereum or stablecoins, or LP tokens composed of $OHM-asset pairs and receive discounted $OHM bonds in return. Olympus DAO generates revenue by operating the assets acquired in this way through governance.

- $OHM holders receive part of the increase in the protocol's reserves in the form of $OHM tokens by staking $OHM in Olympus DAO.

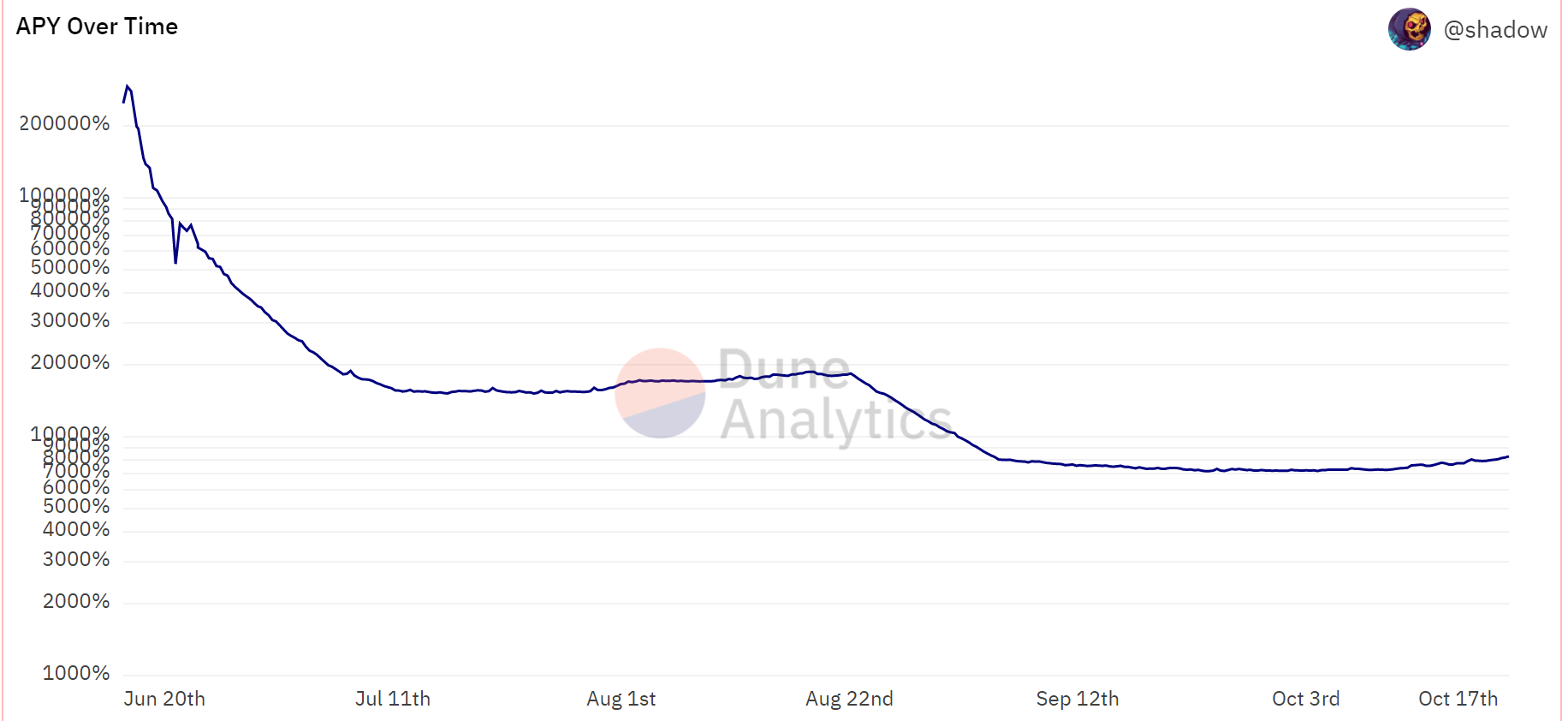

Through the above mechanism, Olympus DAO was able to abundantly supply its own token $OHM to the market while directly owning the LP tokens that represent the ownership of the liquidity supply, preventing the problem of liquidity providers easily leaving liquidity in pursuit of short-term profits. Especially in the early stages of the protocol's launch, as a lot of liquidity flowed in, reserves increased, and additional $OHM was issued and paid to stakers, it maintained an APY of over 7,000% for about 6 months.

Such high APY served as a driving force that continuously encouraged users to deposit assets into Olympus DAO's treasury, issue $OHM, and accelerate liquidity inflow. In 2021, many DeFi protocols emerged that borrowed the Olympus DAO mechanism and launched.

4. DeFi Bear Market and the Rise of Real Yield

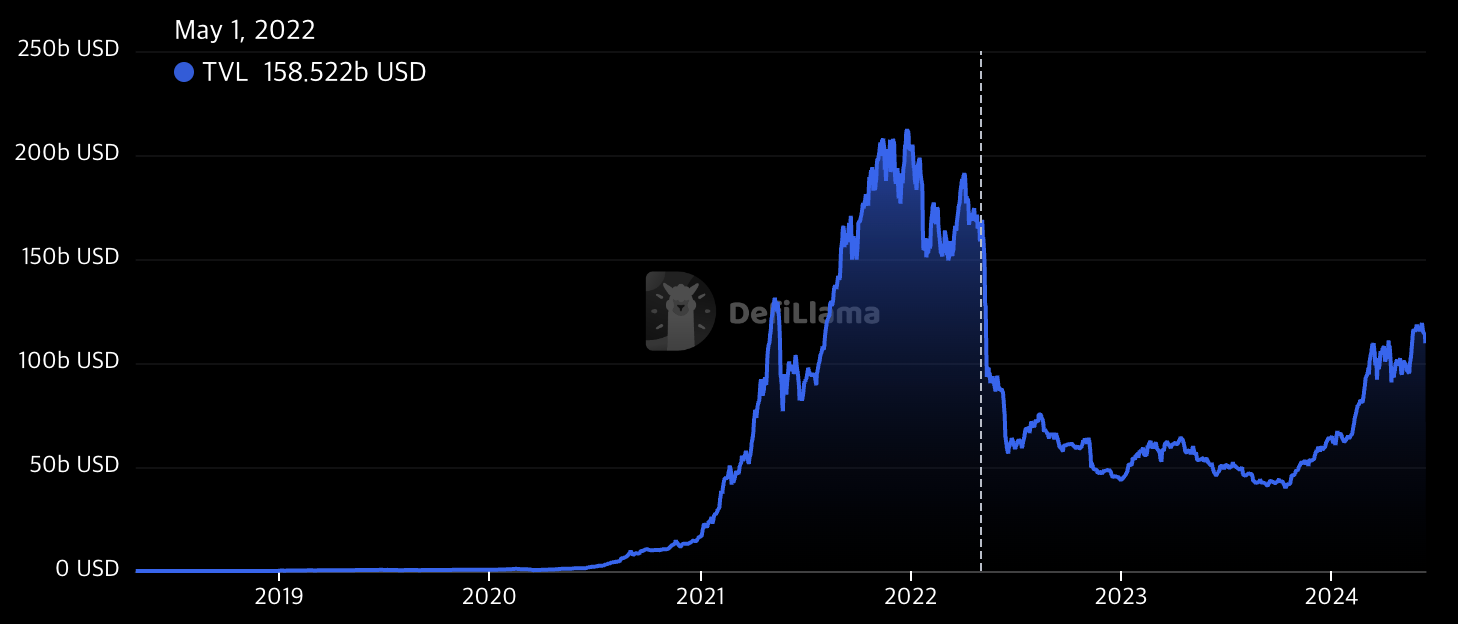

In November 2021, the DeFi market reached its peak, recording an unprecedented growth trend. However, the market then entered a correction phase, and in May 2022, a full-fledged bear market arrived due to the collapse of the Terra-Luna ecosystem. As a result, liquidity across the market decreased, and investment sentiment contracted, significantly impacting not only early DeFi protocols but also 2nd generation DeFi protocols like Curve Finance and Olympus DAO.

Although the tokenomics model introduced by these protocols could overcome the limitations of early DeFi protocols, such as the lack of utility of their own tokens to some extent, the point where the value of their own tokens affects the interest rate of liquidity providers remained the same. They showed structural limitations in sustaining the inflation rate of tokens that are continuously generated to provide higher interest rates than the yield generated by the protocol in a situation where market conditions change and investment sentiment contracts.

As a result, the outflow of assets deposited in the protocols accelerated due to the lowered token value and protocol revenue, leading to a vicious cycle where protocols found it difficult to generate stable revenue and provide attractive interest rates to users. In this situation, Real Yield DeFi protocols began to attract attention. These protocols aim to minimize the inflation rate of their own tokens while appropriately distributing the revenue actually generated by the protocol to liquidity providers and their own token stakers.

4.1. GMX

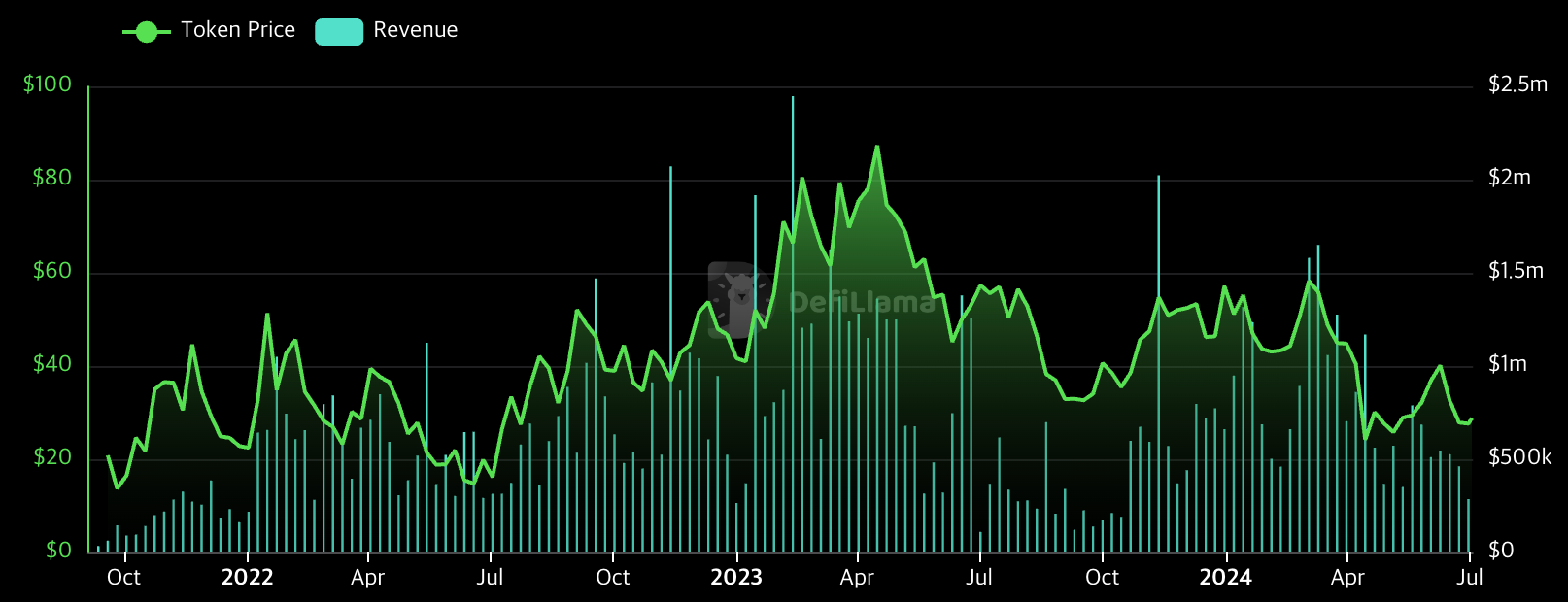

A representative DeFi protocol that advocates real yield is GMX protocol, a decentralized perpetual futures exchange based on the Arbitrum and Avalanche networks.

There are two types of tokens in GMX protocol, $GLP and $GMX, and it has the following operating mechanism:

- Liquidity providers deposit assets such as $ETH, $BTC, $USDC, and $USDT into GMX and receive the liquidity deposit certificate token $GLP. $GLP holders receive 70% of the revenue generated by GMX.

- $GMX stakers, the governance token of GMX protocol, receive discounted trading fees on GMX and linearly receive 30% of the revenue generated by GMX over 1 year.

Instead of providing additional incentives through token inflation, GMX protocol adopted a method of distributing a portion of the revenue generated by the protocol to its own token holders. This approach provided a clear motivation for users to buy and hold $GMX without exposing token holders to value depreciation due to inflation in a bearish market where they simply sell tokens for profit.

Looking at the revenue trend of GMX protocol and the change in $GMX token price, we can see that the value of $GMX token also rises and falls similarly according to the increase and decrease in revenue generated by GMX protocol.

However, this structure is somewhat disadvantageous to liquidity providers as it distributes a portion of the fees that should be paid to liquidity providers to governance token holders, and it is not suitable for attracting initial liquidity. Furthermore, in the process of distributing the governance token $GMX, GMX protocol focused on promoting GMX protocol to potential users by conducting $GMX airdrops targeting Arbitrum and Avalanche DeFi users, rather than quickly securing liquidity through liquidity mining campaigns.

Despite these structural disadvantages, GMX protocol is currently achieving the No. 1 TVL (Total Value Locked) among derivatives DeFi protocols and has consistently maintained its TVL compared to other protocols, despite the bearish trend that continued after the Luna-Terra incident.

The reasons why GMX protocol was able to achieve good results despite having a structure that is somewhat disadvantageous to liquidity providers compared to other DeFi protocols are as follows:

- As a perpetual futures exchange that emerged during the heyday of the Arbitrum network, it preoccupied the liquidity and user traffic within Arbitrum.

- After the FTX bankruptcy incident in December 2022, trust in CEX exchanges declined, and trading demand for on-chain futures exchanges increased.

GMX protocol was able to offset structural disadvantages and succeed in bootstrapping based on these external factors. Therefore, subsequent DeFi protocols found it very difficult to design protocols and attract liquidity and users by directly borrowing GMX protocol's structure.

On the other hand, Uniswap, a DEX that appeared early in the DeFi market, is discussing the introduction of a Fee Switch that shares protocol revenue with the $UNI token it previously distributed to liquidity providers through liquidity mining. This can be seen as part of Uniswap's efforts to transition to a real yield DeFi protocol. However, such discussions are possible because Uniswap has already secured sufficient liquidity and trading volume.

As can be seen from the cases of GMX protocol and Uniswap, the adoption of the real yield model, which distributes a portion of protocol revenue to its own token holders, should be carefully considered according to the maturity and market position of the protocol. Therefore, the real yield structure was not widely adopted by early projects where securing liquidity is the most important task.

5. RWA: An Attempt to Merge Traditional Financial Products into DeFi

Amid the ongoing bear market, DeFi protocols still faced the dilemma of simultaneously achieving the two goals of securing liquidity through tokenomics and providing sustainable yields, and they were engaged in a zero-sum game to secure limited liquidity.

Furthermore, after Ethereum's update called The Merge in September 2022, which transitioned Ethereum from Proof of Work (PoW) to Proof of Stake (PoS), liquidity staking protocols emerged that allowed anyone to participate in Ethereum staking and receive interest. As a result, it became possible to obtain a basic interest rate of about 3% or more using Ethereum, leading to a situation where newly emerging DeFi protocols had to provide higher and more sustainable yields to attract liquidity.

In this context, RWA (Real World Assets) model protocols that distribute revenue generated within the DeFi ecosystem to liquidity providers or create additional revenue by linking traditional financial products and blockchain began to be spotlighted as an alternative for sustainable revenue generation in the DeFi ecosystem.

RWA refers to all areas that tokenize real-world assets other than virtual assets or enable the use of traditional financial products such as credit-guaranteed unsecured token lending as on-chain assets. Traditional finance can gain the following benefits through linking with blockchain:

- Record asset ownership and transaction history more transparently than existing systems

- Increase the inclusiveness of financial services as there are fewer restrictions based on region, identity, etc.

- Provide a flexible and efficient trading environment through fractionalization and integration with DeFi protocols

Due to these advantages, various RWA cases are currently emerging, including bonds, stocks, real estate, and unsecured credit loans. Among them, the field of tokenizing U.S. Treasury bills is receiving the most attention because it can increase demand for U.S. Treasury bills using DeFi while meeting the needs of investors seeking stable value and yields.

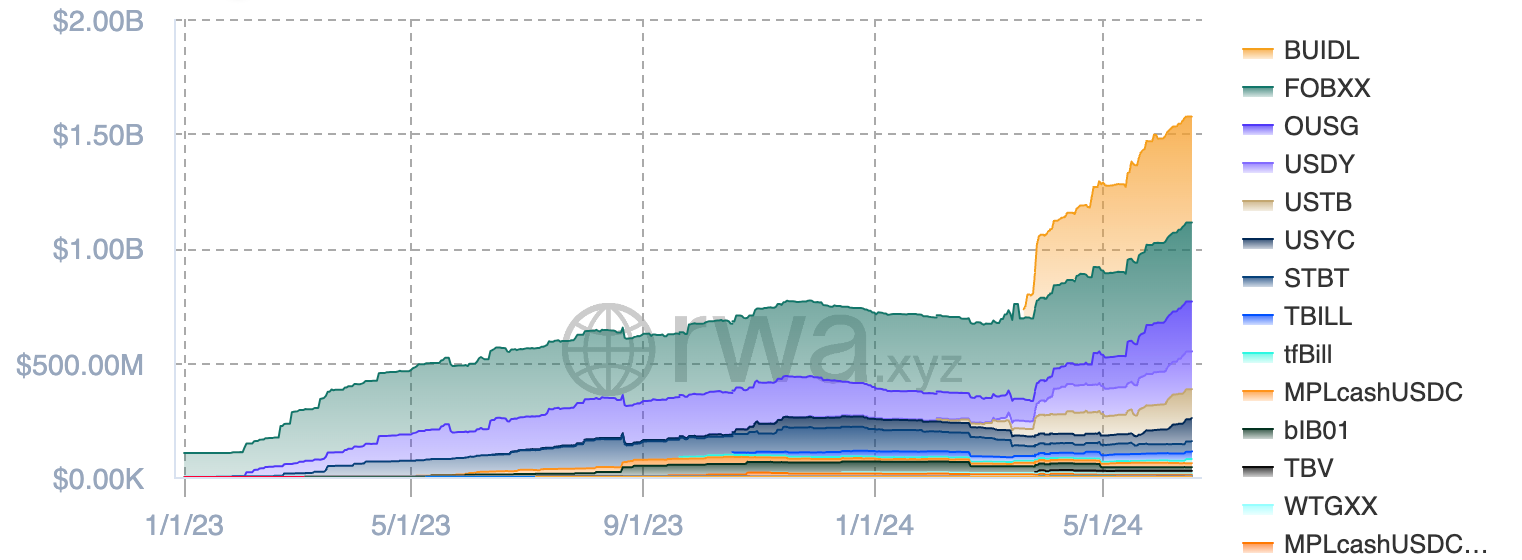

Currently, approximately $1.57 billion worth of tokenized Treasury assets exist on-chain, and global asset management firms such as BlackRock and Franklin Templeton are also entering the field, making RWA a major narrative in the DeFi market.

Next, let's take a closer look at the examples of DeFi protocols that have adopted the RWA model and are providing yields to users.

5.1. Goldfinch

Goldfinch is a project that has preemptively attempted to harmonize DeFi and traditional financial products since July 2020. It is a lending protocol that provides unsecured cryptocurrency loans to real-world businesses around the world based on its own credit rating system. Loans are mainly executed to borrowers in developing countries in Asia, Africa, and South America, and currently, approximately $76 million in capital is being lent and operated.

Goldfinch has the following two types of lending pools:

- Junior Pool: Created when borrowers apply for loans and pass audits. It is a pool where professional investment institutions and credit analysts, verified entities, deposit funds to lend to the borrower. In the event of default, the funds in the Junior Pool bear the loss first.

- Senior Pool: A single pool that is diversified across all Junior Pools. It receives principal protection first, but is paid a lower yield than the Junior Pool.

After completing the KYC process, users can deposit $USDC into the Senior Pool to receive a share of the revenue generated by Goldfinch through credit-collateralized lending and receive the $FIDU token as a certificate of liquidity provision. If users want to withdraw, they can deposit $FIDU and receive $USDC in return only when there is idle capital in the Senior Pool. However, even if there is no idle capital, users can achieve the same effect as withdrawing assets by selling $FIDU on a DEX. Conversely, even if users do not perform KYC, they can buy $FIDU tokens on a DEX to receive the yield generated by Goldfinch.

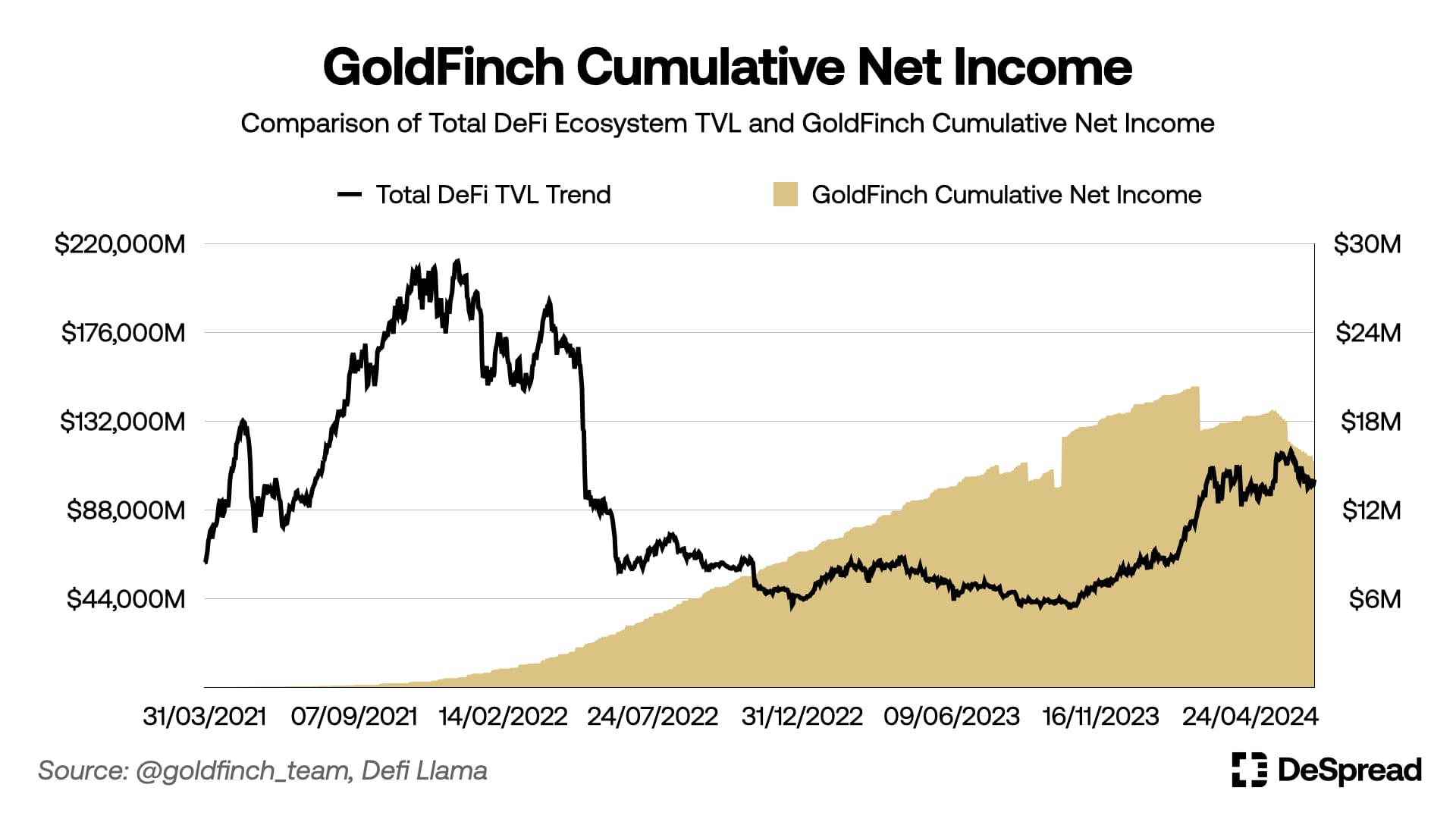

Goldfinch was able to attract a large amount of liquidity through liquidity mining that distributed its governance token $GFI in the early stages of its launch. Even after the end of the liquidity mining campaign and the market's downward trend following the Luna-Terra incident, Goldfinch was able to generate stable net income from outside sources regardless of these situations and provide liquidity providers with a consistent expected interest rate of around 8%.

However, from August 2023 to the present, Goldfinch has experienced three instances of default, revealing problems such as poor credit ratings and lack of loan information updates, raising questions about the sustainability of the protocol. As a result, liquidity providers began selling $FIDU tokens on the market. Despite the revenue generation, the value of $FIDU, which should have risen in price, continuously declined from $1 and remains at around $0.6 as of June 2024.

5.2. MakerDAO

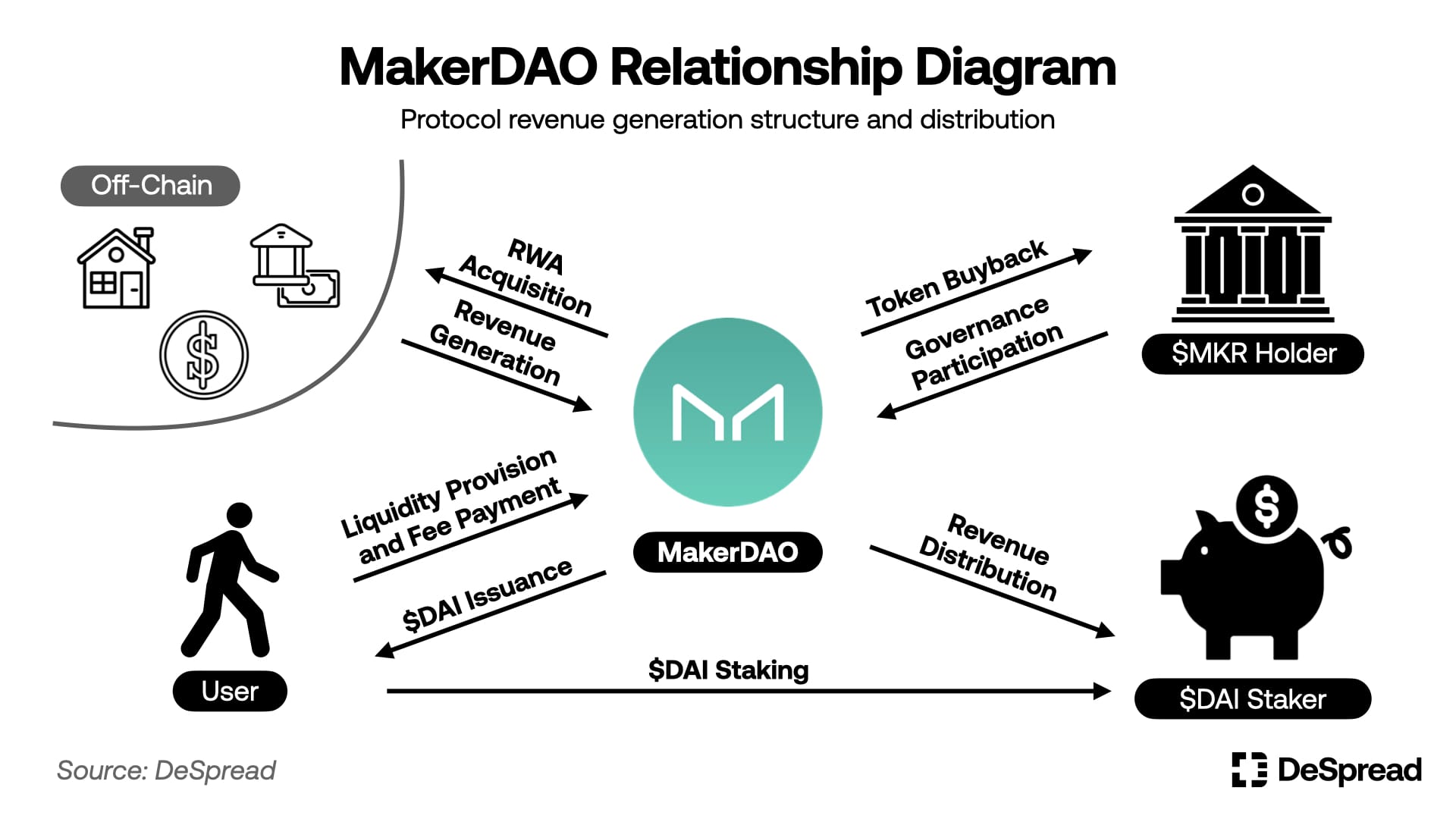

MakerDAO is a CDP (Collateralized Debt Position) protocol that appeared early in the Ethereum DeFi ecosystem. It aims to issue and provide users with a stablecoin that has stable value in response to the high volatility of the crypto market.

Users can provide virtual assets such as Ethereum to MakerDAO as collateral and receive the issued $DAI in proportion to it. At this time, MakerDAO continuously monitors the value fluctuation of collateral assets to measure the collateral ratio and maintains a stable reserve through mechanisms such as liquidating collateral assets if this ratio falls below a certain level.

MakerDAO has two main types of revenue generation structures:

- Stability Fee: A fee paid by users who deposit collateral, issue $DAI, and borrow it

- Liquidation Fee: A fee charged when the collateral value of the $DAI issuer falls below a certain level and liquidation is executed

MakerDAO pays the fees collected in this way as interest to depositors who have deposited $DAI in MakerDAO's deposit system called the DSR contract. With the remaining surplus capital, it buys back and burns the governance token $MKR to ensure that incentives also reach $MKR holders.

5.2.1. Endgame and RWA Introduction

In May 2022, Rune Christensen, co-founder of MakerDAO, proposed the 'Endgame' plan, a long-term vision for true decentralization of MakerDAO's governance and operating units and securing the stability of DAI.

For more details on Endgame, please refer to the Endgame Series.

One of the key tasks mentioned in Endgame for securing the stability of $DAI is diversifying the collateral assets that were focused on $ETH. To achieve this, MakerDAO aimed to introduce RWA (Real World Assets) as collateral assets and gain the following benefits:

- RWA shows different price fluctuation characteristics from crypto assets, thus achieving a portfolio diversification effect.

- RWA based on real assets helps reduce friction with regulators and gain the trust of institutional investors.

- By strengthening the link between the MakerDAO protocol and the real economy through RWA, it can secure the long-term stability and growth momentum of $DAI, not limited to the on-chain environment.

The MakerDAO relationship diagram after the passage of the Endgame proposal is as follows:

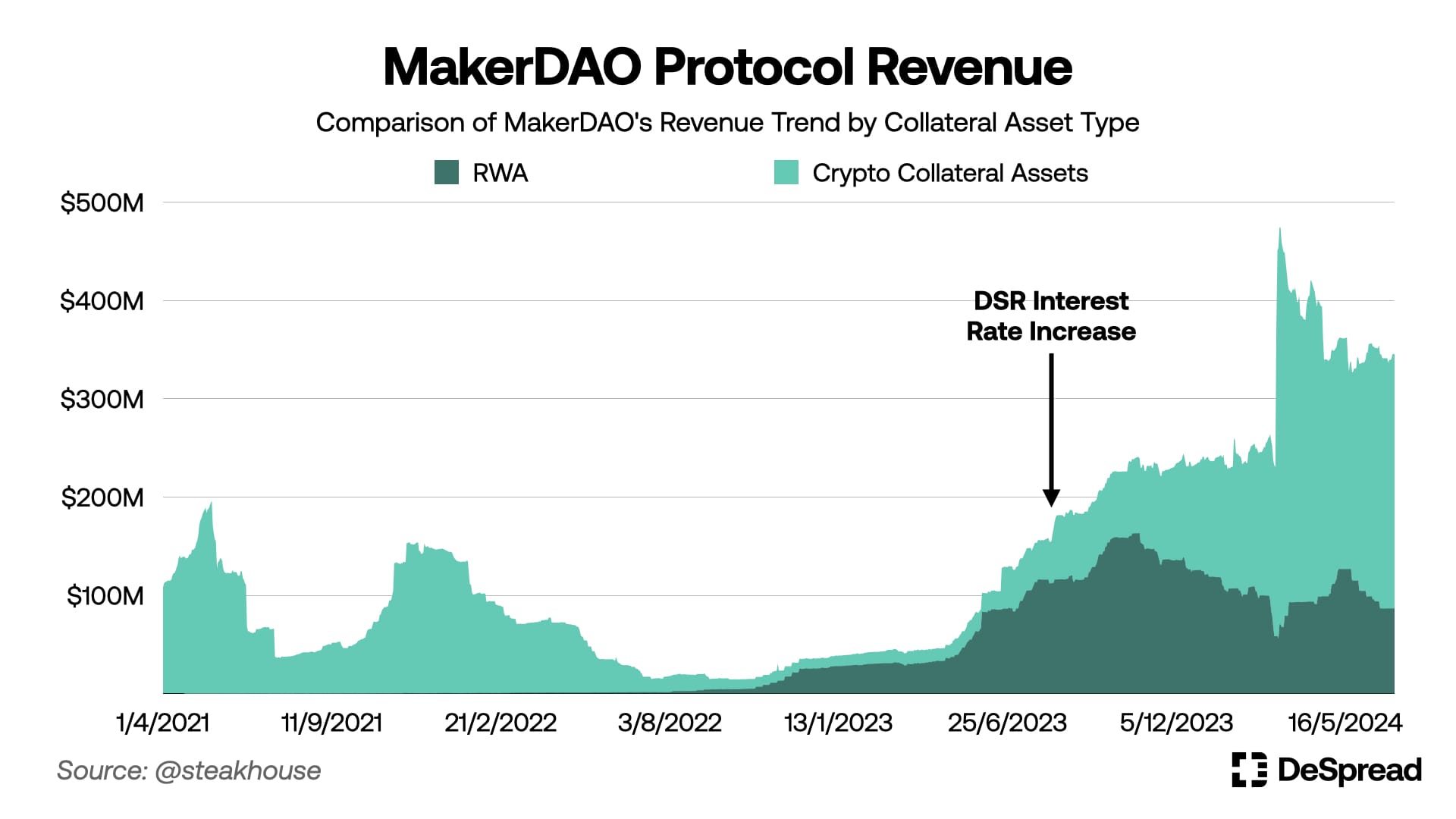

After the passage of the Endgame proposal, MakerDAO diversified its portfolio by introducing various forms of RWA, including U.S. short-term Treasury bills, real estate-backed loans, tokenized real estate, and credit-collateralized assets. The stability fee applied to RWA is determined by external factors such as Treasury yields or off-chain lending interest rates. Therefore, through the introduction of RWA, MakerDAO was able to generate stable revenue while being less affected by the volatility of the crypto market.

Even during the period when the overall DeFi ecosystem was experiencing a bearish trend in 2023, MakerDAO's RWA collateral assets generated stable revenue of approximately 70% of the total protocol revenue. Based on this revenue, MakerDAO was able to raise and maintain the DSR interest rate from 1% to 5%, which contributed effectively to supporting the demand for $DAI.

In this way, MakerDAO started as an on-chain asset collateral stablecoin issuance protocol and was able to diversify its revenue sources and strengthen its link with the real economy by accommodating the point of contact with real finance. MakerDAO, which has secured sustainability and long-term growth momentum through this, is positioning itself as a leading RWA protocol that presents a new direction for integrating traditional finance and DeFi.

6. Basis Trading: An Attempt to Utilize CEX Liquidity

In Q4 2023, external liquidity began to flow into the market, which had been stagnant for about two years due to expectations of Bitcoin ETF approval. This allowed the DeFi ecosystem to break away from the existing passive operation structure and move toward bootstrapping initial liquidity by offering high interest rates utilizing the incoming liquidity and incentives from its own tokens.

However, instead of liquidity mining used by early DeFi protocols, attempts are being made to accumulate points for liquidity providers and conduct airdrops based on them, extending the term between liquidity bootstrapping and incentive distribution, and allowing the protocol team to more effectively manage the circulation of its own tokens.

In addition, protocols with a restaking model that generate additional revenue by providing staked tokens as collateral to other protocols, layering risks, are emerging in the market and quickly attracting liquidity by incorporating the above airdrop campaigns.

Based on these movements, a favorable wind is blowing again in the crypto market after the Luna-Terra incident. However, due to the low user accessibility of the on-chain environment, the overall liquidity and user traffic of the crypto market are concentrated in CEX rather than DeFi protocols.

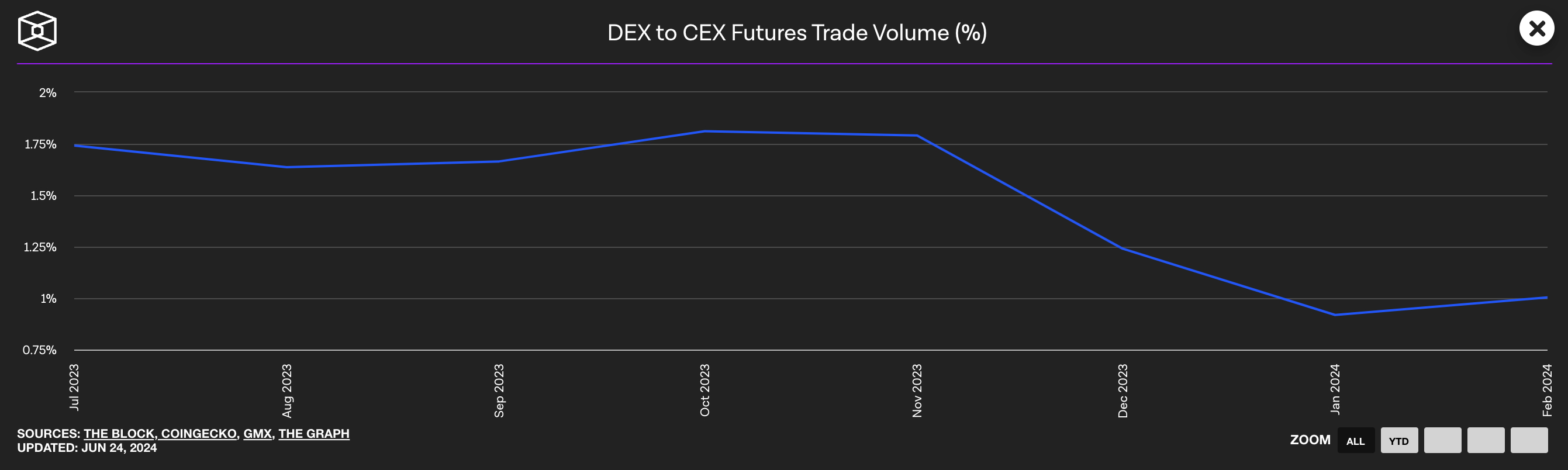

Especially as many users flock to the convenient CEX futures trading environment, the trading volume of on-chain futures exchanges has decreased to 1/100th of the CEX futures trading volume. This environment leads to the emergence of Basis Trading model protocols that generate additional revenue by utilizing CEX trading volume and traffic.

The basis trading model refers to a structure in which users' deposited assets are used to capture price discrepancies between spot and futures or between futures of the same asset on a CEX to create positions and generate additional revenue, which is then distributed to liquidity providers. Compared to the RWA model that directly links with traditional finance to generate revenue, this model is less subject to regulations, allowing for the construction of more flexible protocol structures and the adoption of various aggressive market entry strategies.

In the past, virtual asset custody and management institutions such as Celsius and BlockFi also used a method of generating and distributing revenue by utilizing user-deposited assets on CEX. However, due to the lack of transparency in fund management and excessive leverage investment, Celsius went bankrupt after the market collapse in 2022, and the custody and management model that arbitrarily operates deposited assets lost trust in the market and is gradually disappearing.

In response, The basis trading model protocols that have recently emerged are striving to operate protocols more transparently than existing custody and management institutions and to establish various mechanisms to supplement reliability and stability.

Next, let's take a closer look at specific protocols that have adopted the basis trading model to generate revenue and provide yields to users.

6.1. Ethena

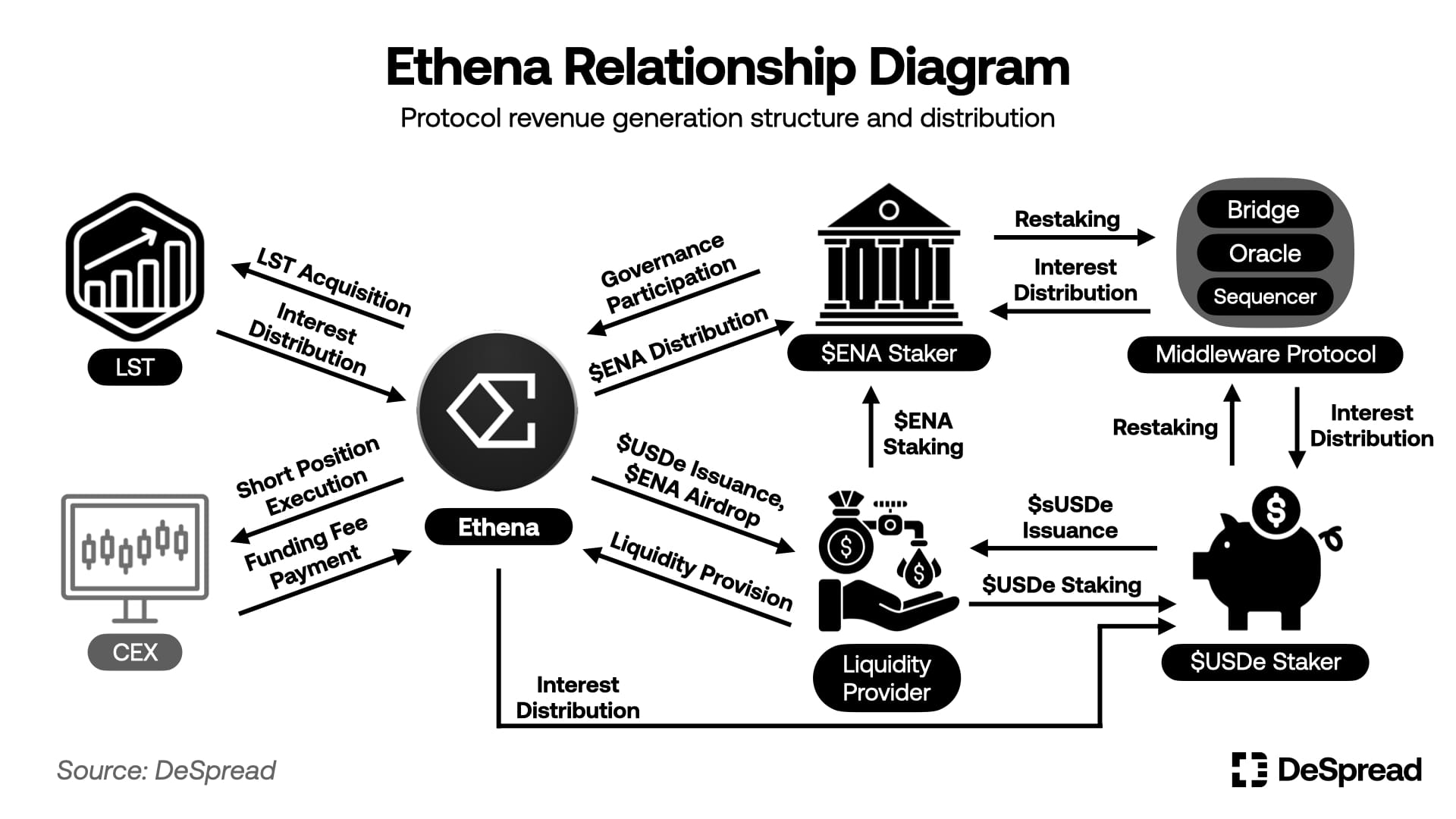

Ethena is a protocol that issues $USDe, a dollar-pegged synthetic asset with a value of 1 dollar. Ethena maintains a delta-neutral state by taking a CEX futures hedge position on the collateral assets it holds to ensure that the collateral ratio does not change according to the fluctuation of the collateral asset value. This allows Ethena to issue $USDe equal to the value of the collateralized assets without being affected by market conditions.

The assets deposited by users to Ethena are distributed to $BTC, $ETH, Ethereum's LST tokens that generate staking interest, and $USDT through companies called OES (Off-Exchange Settlement) providers. Ethena then executes hedging by opening short positions on CEX for the amount of $BTC and $ETH spot collateral it holds, making the protocol's entire collateral assets delta-neutral.

Ethena earns the following two types of revenue in the process of forming USDe's collateral:

- LST Interest: Interest generated from Ethereum validation rewards, consistently maintaining over 3% per year and increasing according to the activity of the Ethereum ecosystem. The revenue generated from this is about 0.4% per year based on the total spot collateral assets.

- Funding Fee: A fee paid by users with overheated positions to users with opposite positions to narrow the price difference between spot and futures on CEX (considering that long positions are at a disadvantage compared to short positions due to the absence of a price ceiling, the default funding fee is set to 0.01% paid by long position users to short position users every 8 hours). Currently, the funding fee revenue of the short futures positions held by Ethena is approximately 8% per year based on the open positions.

Ethena distributes the revenue generated through basis trading to $USDe stakers while conducting a second airdrop campaign for its governance token $ENA. In this process, by allocating more points to $USDe holders than stakers, it induces the protocol's revenue to be concentrated on a small number of stakers. As a result, as of June 20, 2024, a high interest rate of 17% is provided for $USDe staking.

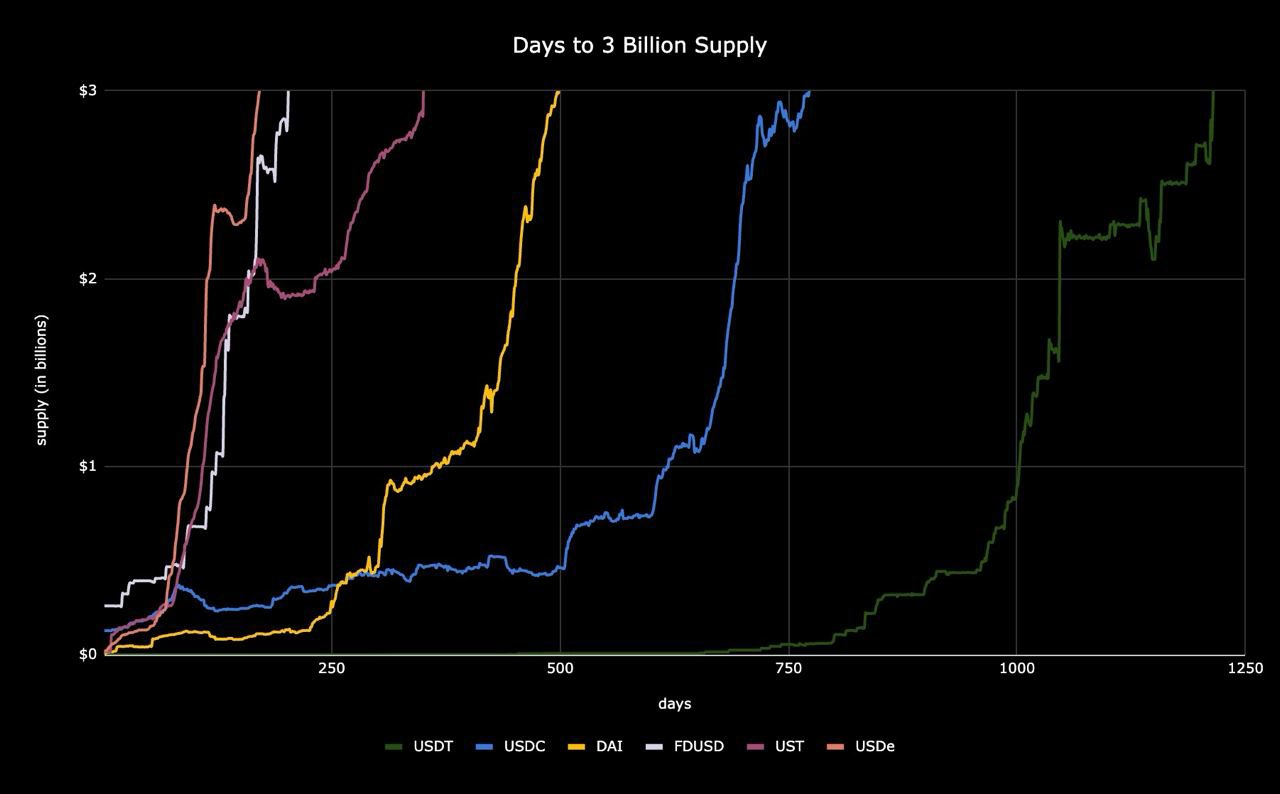

Furthermore, by providing a function to boost future airdrop volume when $ENA is staked in Ethena, it strives to mitigate the selling pressure on $ENA, which is distributed as an incentive for initial liquidity acquisition and liquidity provision. Based on this point farming campaign and high staking interest rate, approximately $3.6 billion worth of $USDe has been issued so far, becoming the stablecoin that achieved a market cap of $3 billion at the fastest pace.

6.1.1. Limitations and Roadmap

While Ethena has shown some success in quickly securing initial liquidity, it carries the following limitations in terms of yield sustainability:

- Staking revenue may decrease due to reduced demand for $USDe when the point farming campaign ends.

- The interest rate generated by funding fees is a floating rate that varies according to market conditions and tends to decrease in a bear market where short positions increase.

- Currently, the only reason to stake $ENA in Ethena is to acquire additional $ENA, so $ENA may face significant selling pressure after the airdrop campaign.

Recently, as the first measure to add utility to the two tokens and prevent liquidity outflow from $USDe and $ENA staking, Ethena announced a partnership with the restaking protocol Symbiotic to generate additional revenue by restaking $USDe and $ENA staked in Ethena to PoS-based middleware protocols that require a security budget.

The Ethena relationship diagram announced so far is as follows:

Ethena transparently discloses the wallet addresses of OES providers that entrust asset management. For the value of positions and assets that are not proven solely by wallet addresses, it issues reports proving the possession of the assets to improve the transparency issues of existing asset custody and management institutions. Furthermore, it plans to introduce tools using ZK technology to enable real-time proof of all assets operated through OES providers, further enhancing transparency.

6.2. BounceBit

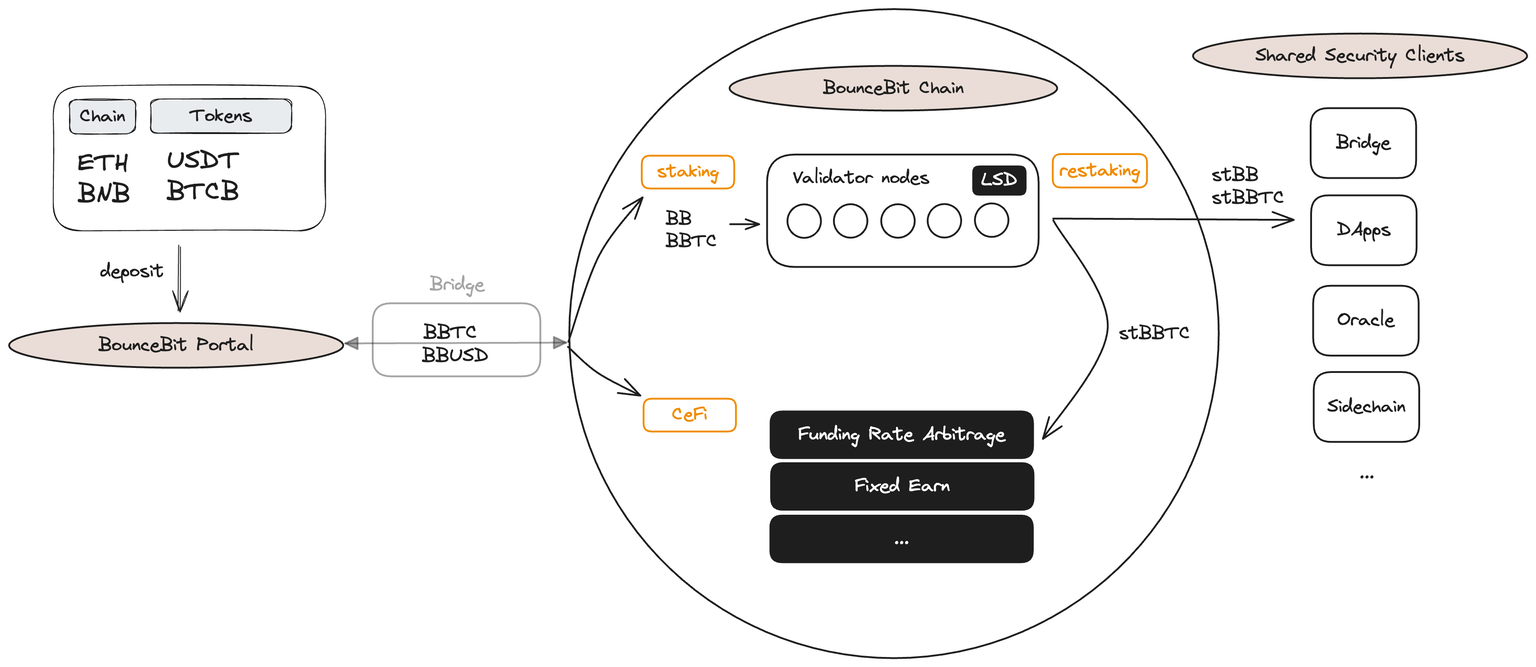

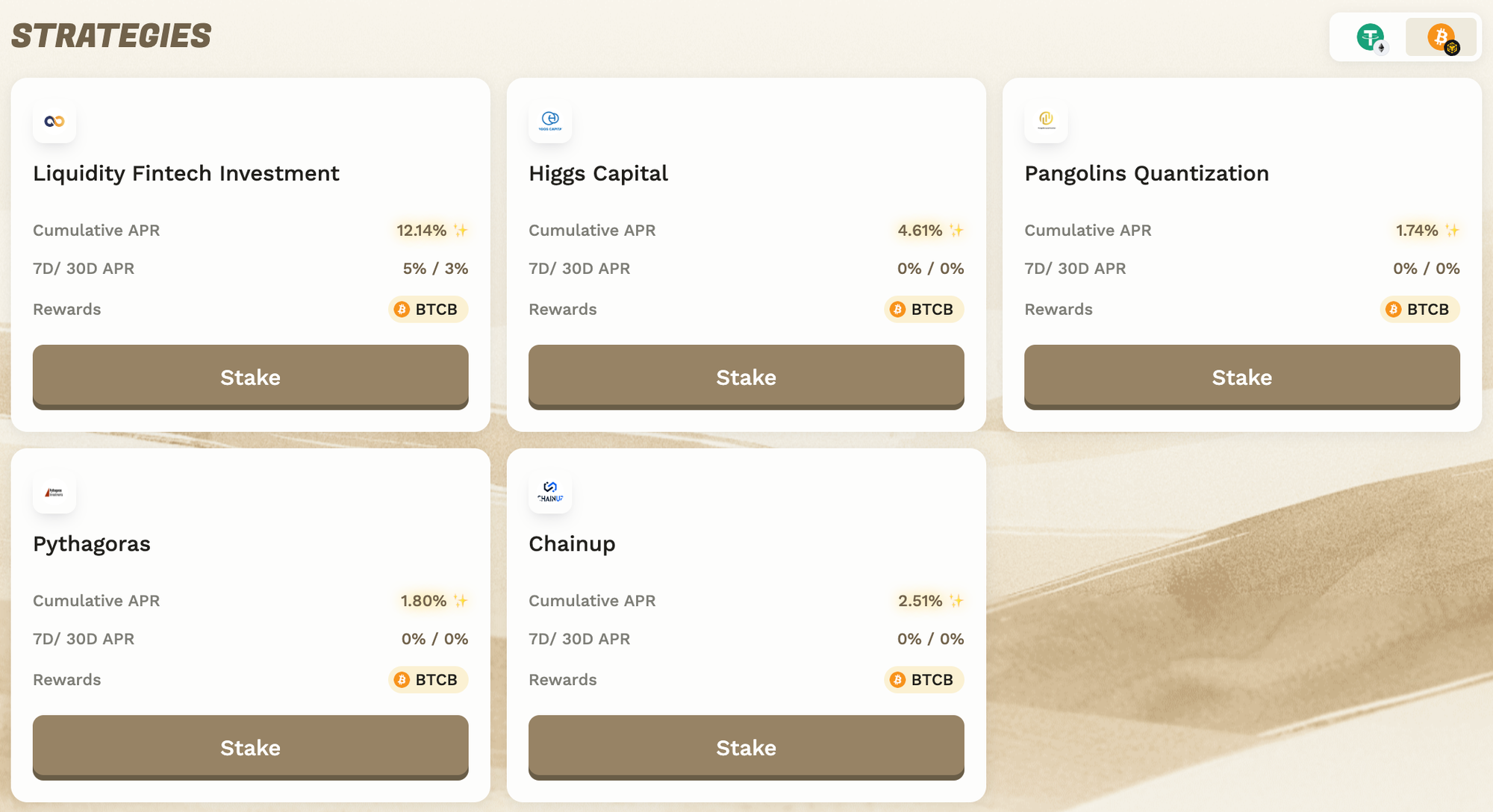

BounceBit is a PoS-based layer 1 network that generates additional revenue by taking delta-neutral positions on centralized exchanges (CEX) using assets bridged by users. As of June 2024, users can bridge two assets, $BTCB and $USDT, to BounceBit from other networks.

The assets bridged by users are utilized for basis trading on CEX through asset management entities. BounceBit issues Liquid Custody Tokens, $BBTC and $BBUSD, which are usable on the network, to users at a 1:1 ratio as a certificate of deposit. Users can use the received $BBTC for staking to validate the network along with BounceBit's native token $BB, and stakers receive staking interest paid in $BB as well as liquidity tokens $stBBTC and $stBB, which are liquidity tokens for the principal tokens staked.

Furthermore, users can restake the received $stBBTC to middleware protocols called SSC (Shared Security Clients) that have partnered with BounceBit to generate additional revenue, or deposit it into premium yield generation vaults to receive yields generated from BounceBit's basis trading. Currently, the function to restake to SSC is not yet open, and additional yields can only be obtained through premium yield generation vaults.

When depositing assets into premium yield generation vaults, users can choose through which of the 5 asset management entities collaborating with BounceBit they want to receive the revenue generated. These asset management entities use the MirrorX function, which allows them to execute trades without actually depositing the assets into CEX when utilizing the assets bridged to BounceBit on CEX. They also periodically issue reports on the status of asset management to ensure the stability and transparency of bridged assets.

Currently, BounceBit's maximum yield is 16%, combining the network staking interest rate of 4% and the premium yield generation vault yield of 12%, which is high among $BTC-based assets. However, the network staking interest rate can fluctuate depending on the $BB price, and the basis trading yield is also subject to market conditions, so the sustainability of this yield needs to be monitored.

As such, basis trading model protocols that have recently emerged are utilizing CEX trading volume and liquidity to generate relatively stable revenue compared to the DeFi ecosystem and making it a key component of the yields provided by the protocols. At the same time, they are aggressively borrowing strategies taken by DeFi protocols, such as enabling the utilization of assets under management in other protocols or providing additional yields to users through their own tokens.

7. Conclusion

So far, we have examined the history of DeFi ecosystem yield evolution and explored various protocol examples that have borrowed centralized elements for sustainable revenue generation and liquidity acquisition, such as the RWA model and basis trading model. Considering that the RWA model and basis trading model are still in their early stages of introduction, their influence in the DeFi ecosystem is expected to grow further in the future.

While the RWA and basis trading models borrowed centralized elements with the common goal of bringing external assets and liquidity into DeFi, in the future, user convenience in utilizing the DeFi ecosystem will be improved through the development of on/off-ramps and interoperability protocols. Protocols that borrow centralized elements and reflect the increased blockchain usage in yields are also expected to emerge and gain attention.

Although borrowing centralized elements and accommodating the problems of traditional finance that Satoshi Nakamoto sought to solve with Bitcoin are becoming the mainstream sector of the DeFi ecosystem, considering that the modern financial system has developed based on capital efficiency, it is a natural process for DeFi, as a form of finance, to undergo such changes.

Moreover, in the process of evolving by accommodating centralized elements, protocols that prioritize decentralization principles over high yields and liquidity acquisition, such as Reflexer, which aims to implement a crypto-native stablecoin with an independent price formation system not pegged to the dollar value, will continue to emerge. These protocols will form a mutually complementary relationship with protocols that adopt centralized elements and maintain balance within the DeFi ecosystem.

Within that, we hope to use a more mature and efficient financial system and need to observe how the current blockchain financial ecosystem, expressed by the term 'DeFi', will change and be defined.

References

- Bitcoin Genesis block & Satoshi's message

- Beyond DeFi 2.0 - What Is Driving DeFi's Current Innovation?

- Activate Uniswap Protocol Governance

- Decentralized Finance Entering the Real World

- MakerDAO Endgame — MakerDAO Dreaming of a Complete Rebranding

- Case Study: The First RWA Distressed Debt Opportunity with Goldfinch's $FIDU Token

- Introduction to futures contracts and basis trading

- Update to $ENA Tokenomics