2024 DeSpread Partners Recap

Looking back at the year 2024 for DeSpread partners and forecasting 2025

DeSpread, established in 2019, is a Web3 Go-to-Market (GTM) consulting firm that has collaborated with over 90 partners over the past five years, leveraging unparalleled expertise and market insights. This article revisits the major events of 2024 for DeSpread's partners, who exhibit sustainable and high growth potential, and highlights key aspects to watch for in each project in 2025.

1. Berachain

Berachain is a next-generation Layer 1 project that has garnered significant attention for its Proof of Liquidity (PoL) mechanism, which aligns the interests of validators, ecosystem protocols, and liquidity providers, as well as for its loyal community.

Originally launched as an NFT project in 2022, Berachain has made impressive strides, attracting over 200 ecosystem applications during its testnet phase following the testnet launch in 2024, highlighting its strong appeal in the market.

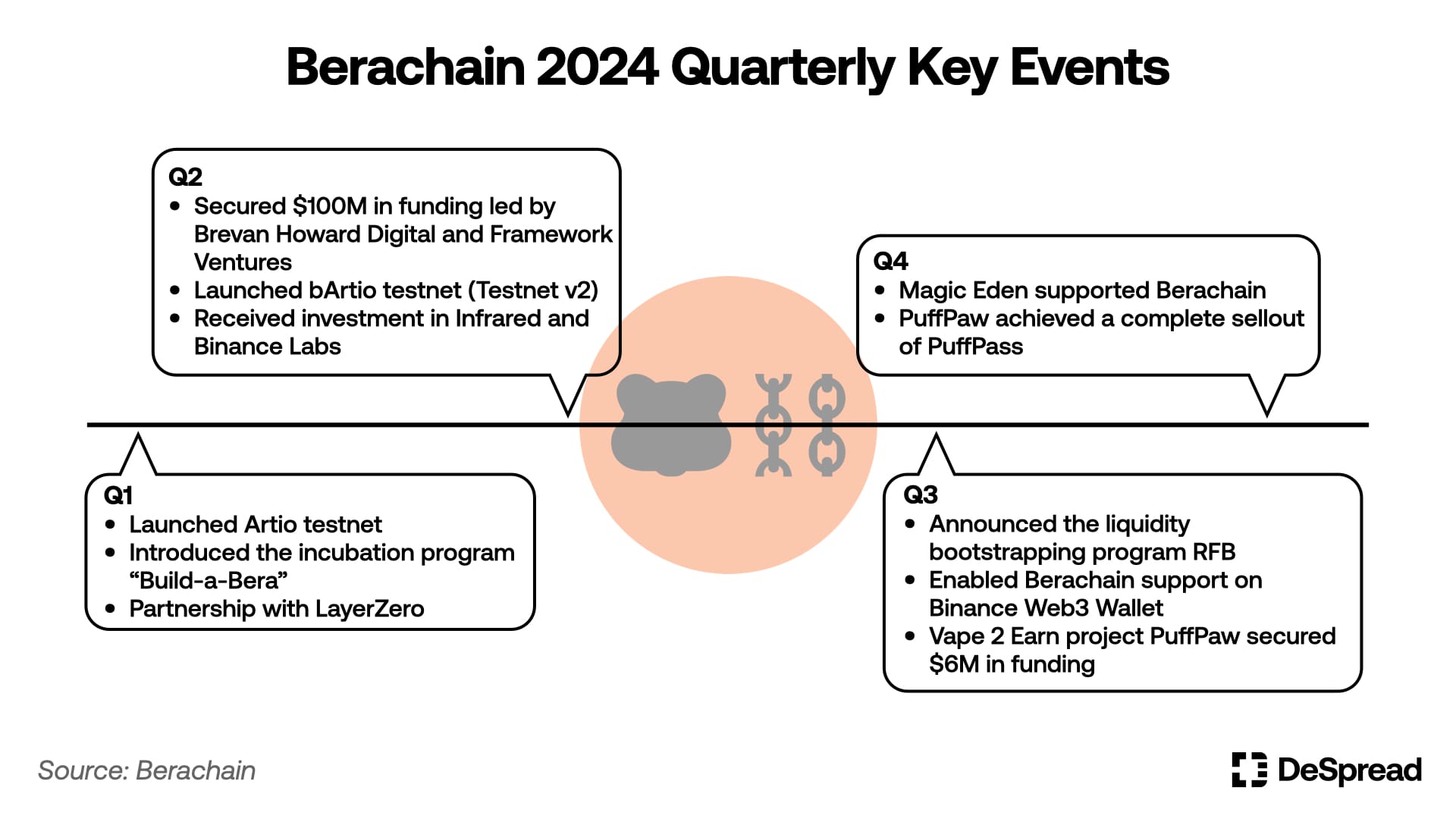

1.1. 2024 Quarterly Key Events

- June 10: Successfully launched the bArtio Testnet with the introduction of Beaconkit, a framework fully compatible with EVM.

- September 5: Vape-to-Earn project Puffpaw, built on the Berachain ecosystem, raised $6 million in funding and recorded a sell-out of 10,000 PuffPass project access tickets on December 14.

- As of December 16: The total number of verified contracts on the bArtio Testnet surpassed 3,700.

- As of December 16: The bArtio Testnet reached a cumulative total of 214 million active wallets, with more than 5 million daily active wallets.

1.2. Key Points to Watch in 2025

From the testnet phase, Berachain has already established a dense ecosystem and active user participation, making its mainnet launch one of the most significant network launches in recent history. The launch is expected to attract substantial user activity and liquidity to the network as many aim to secure $BGT, the core token of the PoL mechanism. This could lead to a different trajectory compared to other networks, which often see a decline in TVL following their mainnet launch and TGE.

However, Berachain faces two key challenges. First, sustaining $BGT’s inflation solely through external liquidity inflow may prove difficult. Second, there is a risk of centralization as a few entities holding large amounts of $BGT could dominate the network. To address these issues, the emergence of user-friendly protocols that can attract new users and stimulate active transactions will be essential. Additionally, it will be critical to ensure that protocols contributing positively to the ecosystem receive adequate liquidity support. Observing whether ecosystem participants can establish consensus with sustainability in mind will be key to Berachain’s long-term success.

2. Monad

Monad is a high-performance, EVM-compatible Layer 1 blockchain designed to achieve the scalability required to handle transaction volumes akin to those in traditional finance. Led by CEO Keone, a former Jump Trading executive, Monad ensures full compatibility with the Ethereum ecosystem through its complete EVM support. Leveraging its proprietary consensus algorithm, MonadBFT, and advanced parallel processing technology, the network achieved a processing speed of 10,000 TPS during its devnet phase.

Notably, even before the launch of its testnet, Monad garnered industry attention with its innovative community engagement strategies. By actively incorporating memecoin culture into its marketing efforts, Monad has introduced a fresh paradigm to the Web3 space, showcasing how creative approaches can redefine community building.

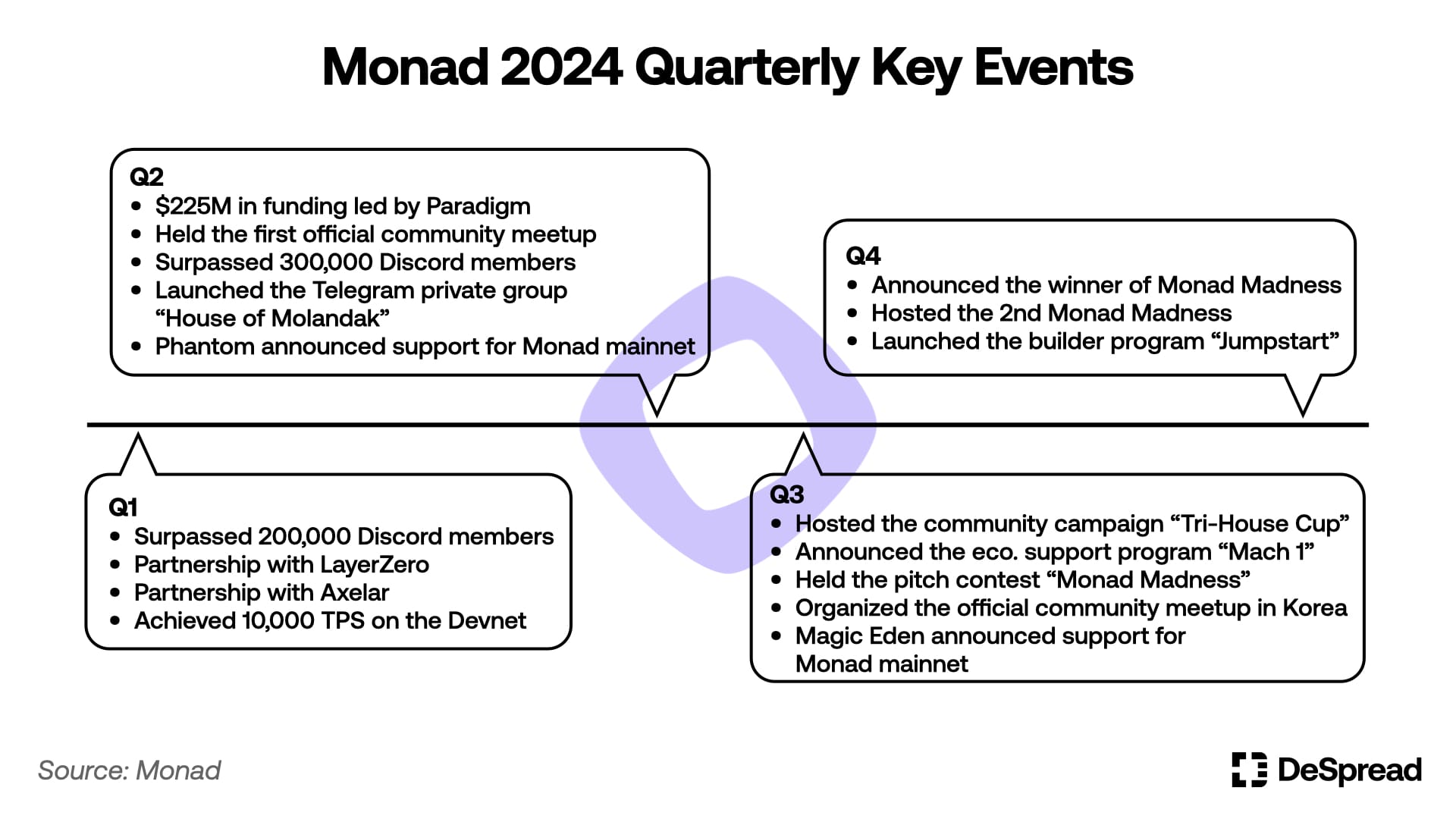

2.1. 2024 Quarterly Key Events

- March 15: Achieved 10,000 TPS on the devnet.

- April 9: Announced a $225 million funding round led by prominent VCs, including Paradigm, Coinbase Ventures, and Electric Capital.

- October and November: Successfully hosted the ecosystem pitch contest “Monad Madness” in New York and Bangkok, featuring a total prize pool of $1 million. The event involved 20 regional teams and facilitated over $60 million in funding connections from more than 60 VCs.

- As of December: Held community meetups across 10+ regions, including Thailand, Vietnam, Korea, Malaysia, Japan, Hong Kong, China, Singapore, Indonesia, and the United States.

2.2. Key Points to Watch in 2025

Monad has garnered significant attention by implementing unprecedented systems, such as private Telegram chatrooms, promotion and demotion mechanisms, and collaborative meetups organized jointly by the team and the community across various countries. While these strategies have drawn praise for their innovation, they have also faced criticism for increasing the burden on community members and reducing the proportion of meaningful activities. Nonetheless, Monad has undoubtedly highlighted the importance of community in the blockchain industry and introduced a new paradigm.

In 2025, Monad faces two critical challenges: maintaining its current level of enthusiastic community engagement after the TGE and replicating its testnet performance of 10,000 TPS on the mainnet. With partnerships established with standout projects in the crypto industry, Monad has become one of the most promising new projects. It remains to be seen whether it can sustain its popularity in the coming year.

3. Arbitrum

Arbitrum, developed by Offchain Labs, is an Ethereum Layer 2 solution utilizing optimistic rollup technology. Commonly referred to as the "Arbitrum Network," Arbitrum One serves as its primary rollup solution and has established itself as one of the leading Ethereum Layer 2 platforms in terms of onboarded dApps and TVL.

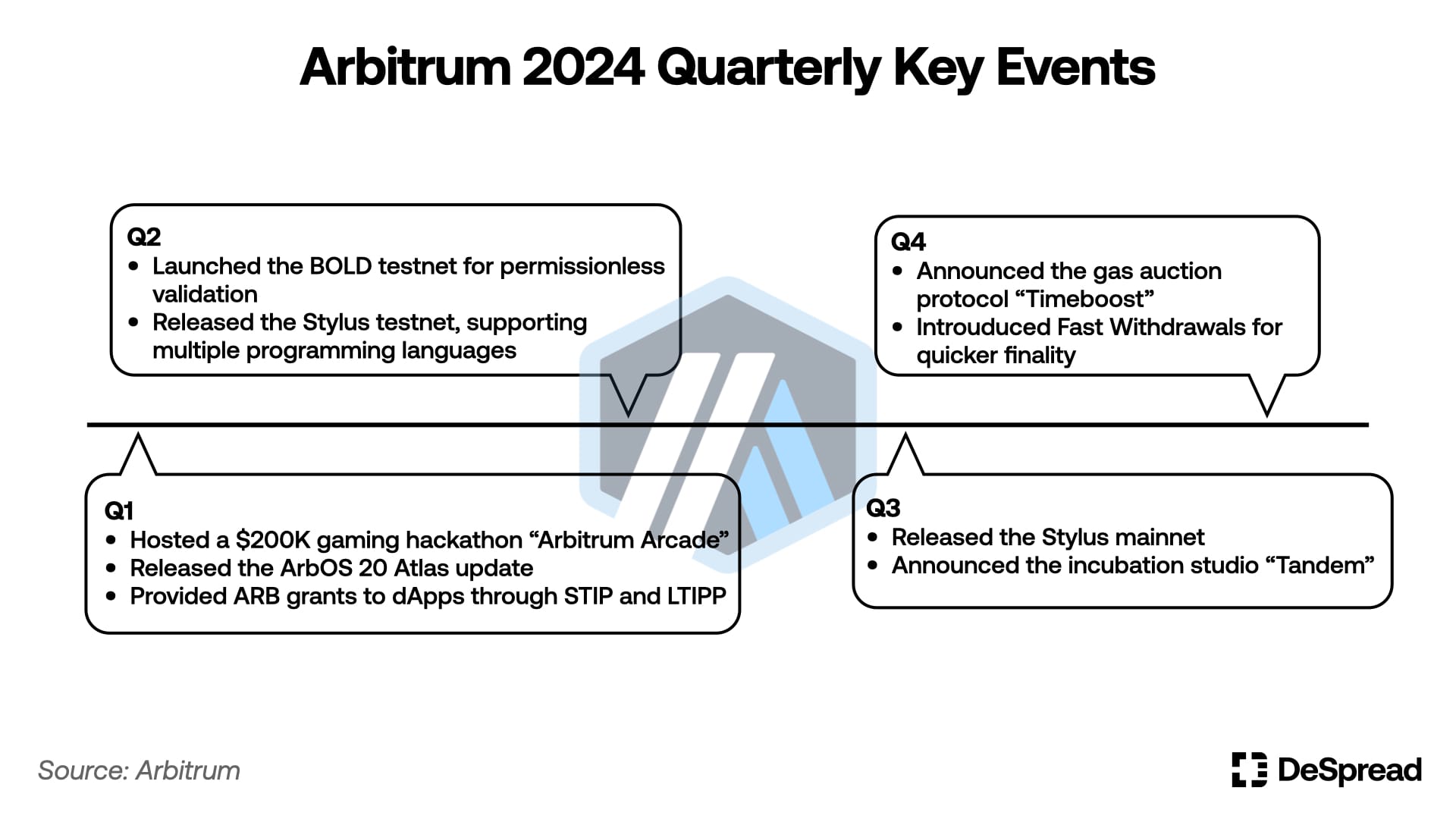

3.1. 2024 Quarterly Key Events

- March 14: Batch submission costs in April decreased by 98.5% compared to the previous level (2,080 ETH → 31.65 ETH) following the application of the ArbOS 20 Atlas update.

- September 3: The introduction of Arbitrum Stylus to the mainnet enabled the support for a MultiVM environment, allowing development in diverse programming languages such as Rust, C, and C++.

- October 24: Over 50 networks, including Geist and ApeChain, were launched based on the permissionless rollup framework, Arbitrum Orbit.

- As of November 11: A total of 100 million $ARB in grants has been distributed to ecosystem dApps through the STIP (Short Term Incentive Program), Backfund STIP, and LTIPP (Long Term Incentive Pilot Program).

3.2. Key Points to Watch in 2025

Arbitrum's 2025 roadmap focuses on three main areas: decentralization, interoperability and horizontal scaling, and performance and efficiency improvements.

To achieve decentralization, Arbitrum plans to move away from the current centralized sequencer system by implementing a decentralized sequencer framework. This transition aims to reduce the risk of censorship attacks and enhance the reliability of the network.

For interoperability and horizontal scaling, Arbitrum aims to introduce Chain Clusters, which will connect the ecosystems and infrastructure of networks built on Arbitrum Orbit. This initiative is expected to significantly reduce the time required for inter-network interactions, bringing it down from minutes to near-instantaneous levels.

In terms of performance and efficiency improvements, Arbitrum plans to support various clients, including Reth 1.0, Erigon 3.0, and Nethermind, to lower the hardware costs for node operators. Furthermore, the implementation of Adaptive Pricing will allow for dynamic gas limits to be set based on the actual resource usage of individual smart contracts.

As 2025 approaches, it will be important to observe whether Arbitrum can achieve ecosystem expansion and decentralization through these three focus areas. The successful implementation of a decentralized sequencer and efficient cross-chain communication through chain clusters is expected to be critical in determining the success of this roadmap.

4. Zeus Network

Zeus Network is a permissionless communication layer that connects Solana and Bitcoin, built on its proprietary programming framework, the Zeus Program Library (ZPL). Leveraging Solana's scalability and Bitcoin's robust security, Zeus Network aims to introduce various Bitcoin assets, such as native Bitcoin, Runes, and Ordinals, into the Solana ecosystem in a fully decentralized manner.

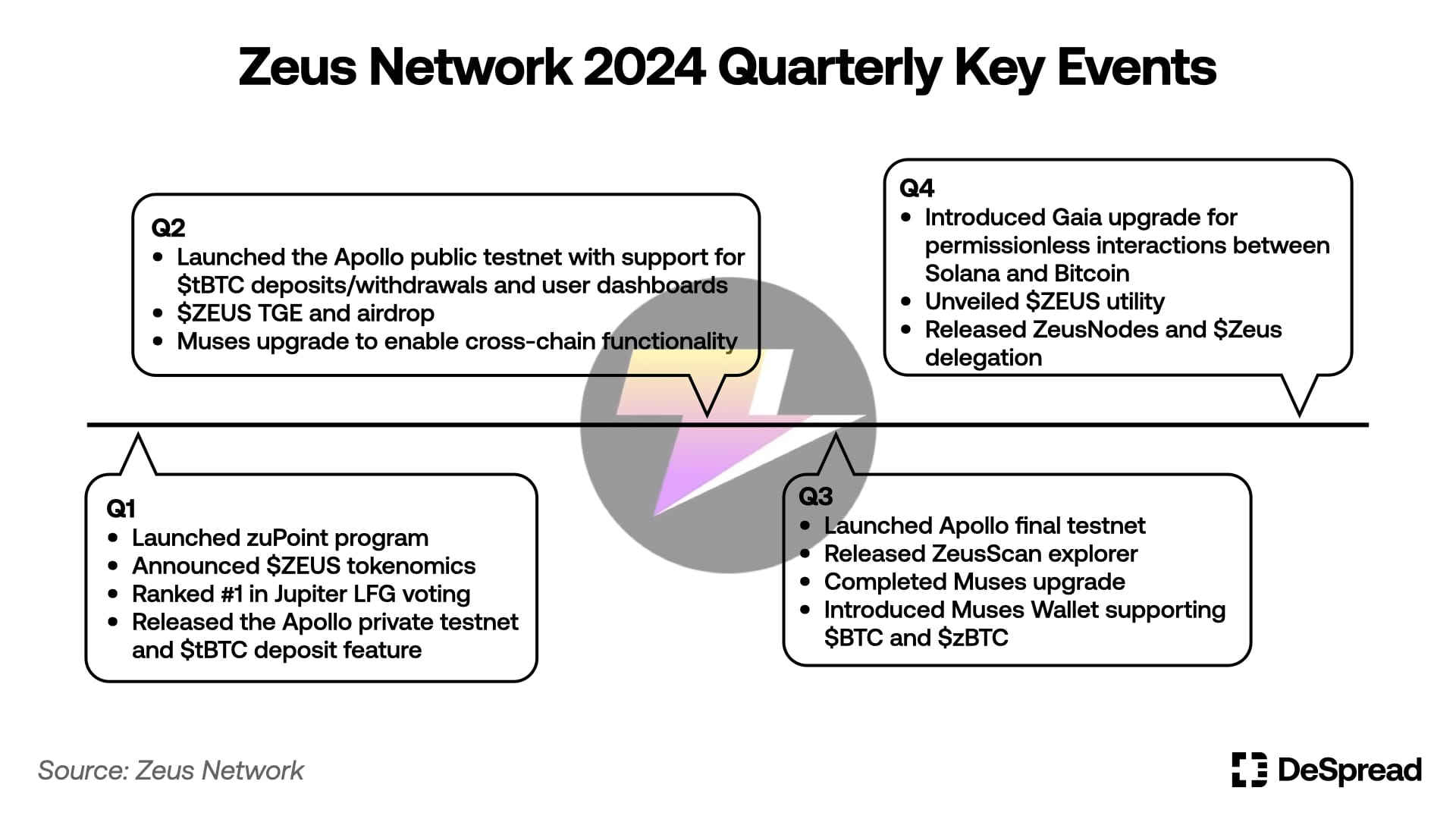

4.1. 2024 Quarterly Key Events

- February 11: Apollo private testnet saw participation from over 3,500 users.

- April 4: Apollo public testnet achieved 46,000 unique wallets.

- October 7: Apollo final testnet reached 60,000 unique wallets.

- December 5: Following the launch of the Zeus Node's $ZEUS delegation feature, the Epoch 1 milestone of 500,000 $ZEUS was achieved in just 17 minutes.

4.2. Key Points to Watch in 2025

In 2024, Zeus garnered significant attention after securing first place in the Jupiter Launchpad LFG vote and successfully completing its TGE and airdrop. Despite facing technical challenges in connecting Bitcoin (Script) and Solana (Rust)—two systems based on different programming languages—which caused delays to its early roadmap, Zeus made rapid progress in the fourth quarter. This includes the launch of ZeusNode, the core of network operations, and the successful validation of the first Bitcoin transaction on the Solana network.

Looking ahead to 2025, the key metric for success will be channeling Bitcoin's abundant liquidity into the Zeus ecosystem, building on this year’s technical advancements. It will be critical to monitor how much $zBTC flows into the ecosystem compared to existing Solana DeFi assets like $wBTC and $cbBTC. Additionally, the success of onboarding non-Bitcoin assets via the ZPL and the mainnet launch of Apollo, the ecosystem's flagship dApp, will be essential indicators of progress.

5. Aptos

Aptos is a Delegated Proof of Stake (DPoS) Layer 1 blockchain developed by former engineers from Meta's blockchain-based payment network, Diem. Launched on its mainnet in October 2022, Aptos stands out as a non-EVM network utilizing the Move programming language. It is characterized by its unique consensus mechanism and high scalability achieved through parallel processing. Additionally, Aptos has garnered significant global attention due to its active partnerships with major corporations such as Microsoft, Alibaba Cloud, and BlackRock.

5.1. 2024 Quarterly Key Events

- March 27, The price of $APT surpassed $18, reaching its highest level since January 2023.

- November 27, The network achieved a record-breaking 1.2 million daily active addresses.

- December 1: TVL on Aptos exceeded $1 billion for the first time, marking a year-over-year increase of approximately 1,834%.

- December 17: According to DefiLlama, the market capitalization of stablecoins within the Aptos network had risen by 705% compared to the beginning of the year.

5.2. Key Points to Watch in 2025

The year 2024 can be seen as a foundational period for Aptos, as it solidified its position as an institution-focused blockchain network through active partnerships with global corporations. Notably, by supporting BlackRock’s tokenized treasury fund, BUIDL, Aptos has positioned itself to lead the industry in 2025, a year anticipated to bring relaxed cryptocurrency regulations and significant institutional capital inflows, especially following Trump’s election victory.

In addition to its positioning as a gateway for institutional funds, if Aptos actively enhances its communication with the community—an area that has been relatively neglected—it could stand out in both B2B and B2C sectors in the coming year.

6. Stacks

Stacks is a network that aims to enhance the scalability of the Bitcoin network by inheriting its decentralization and security while adding smart contract functionality. Following the successful completion of the Nakamoto Update in October and the launch of $sBTC in December, Stacks has firmly established itself as a leading Bitcoin Layer 2 solution.

6.1. 2024 Quarterly Key Events

- April 1: $STX reached an all-time high of $3.72.

- May 15: The ecosystem’s flagship DEX, Alex, suffered a hacking incident resulting in the theft of 13.7 million $STX.

- October 29: Nakamoto Upgrade was successfully completed, enabling full Bitcoin finality and faster transaction processing.

- December 18: $sBTC was introduced, providing a trustless bridge for native Bitcoin.

6.2. Key Points to Watch in 2025

In 2024, Stacks emerged as one of the biggest beneficiaries of the growing Bitcoin ecosystem, attracting significant attention from market participants. However, the ecosystem faced challenges, including a hacking incident at its flagship DEX, Alex, and repeated delays to the highly anticipated Nakamoto Upgrade.

On December 18, Stacks successfully completed the introduction of $sBTC, marking the fulfillment of its final goal for the year and fully preparing itself to function as a true Bitcoin Layer 2. In 2025, the key focus will be on how much Bitcoin liquidity can be channeled into the Stacks ecosystem using $sBTC. Notably, it will be crucial to monitor whether projects dubbed the second generation of Stacks dApps—such as StackingDAO, Zest Protocol, Bitflow, and Hermetica—can capitalize on the heightened interest in the Stacks ecosystem following the completion of the Nakamoto Upgrade and $sBTC launch, translating it into successful TGEs and increased user adoption.

7. Movement

Movement is a rollup network designed to connect the EVM ecosystem with the Move ecosystem, leveraging the Move programming language. Its core components include the Move Executor, which supports both MoveVM and EVM; the Staked Settlement Module, providing high finality and economic security within the network; and the M1 decentralized shared sequencer, which enables customizable transaction ordering. Additionally, Movement offers a proprietary Software Development Kit (SDK) and rollup framework, providing the technical foundation for various entities to onboard into the Movement ecosystem.

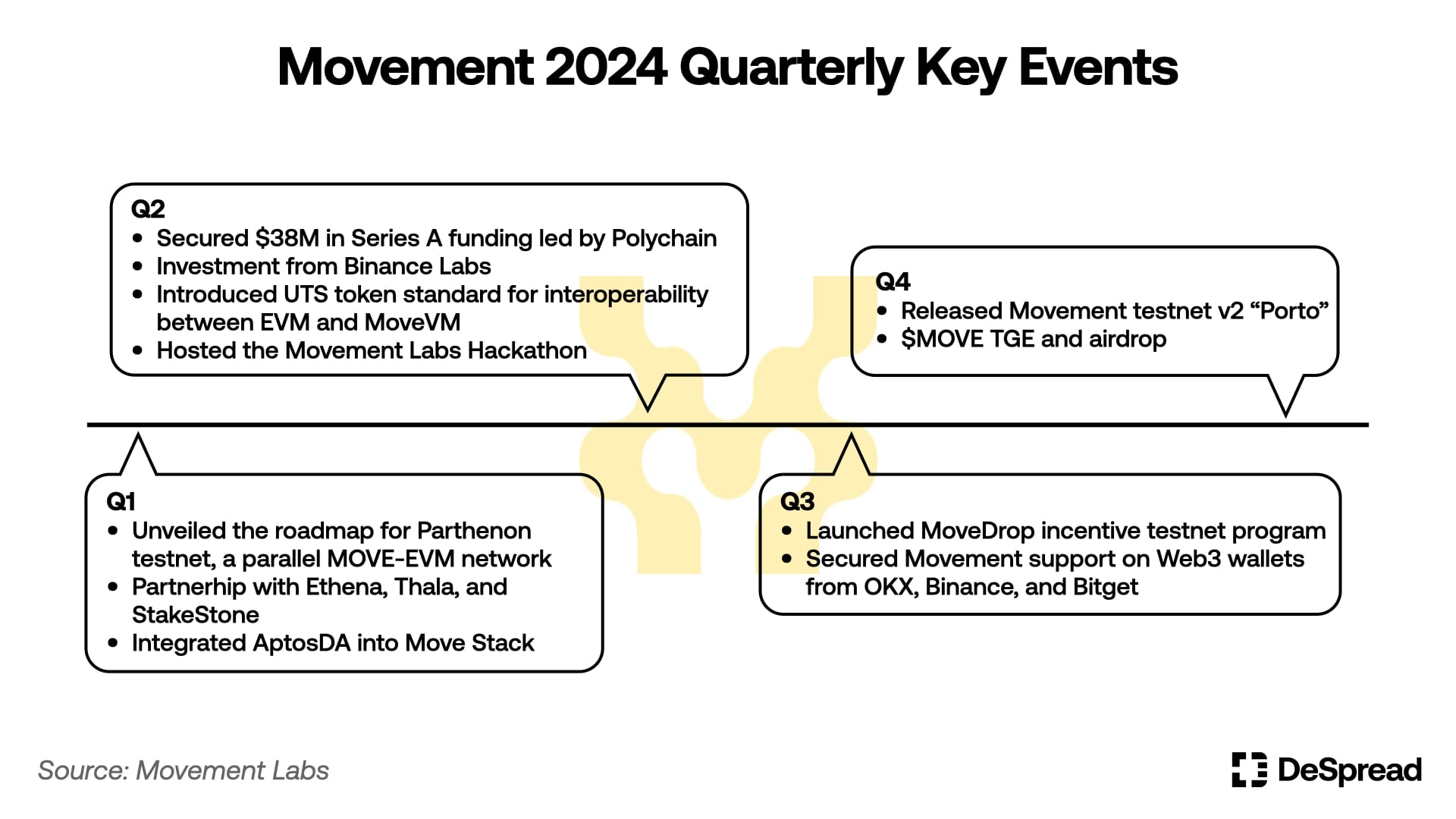

7.1. 2024 Quarterly Key Events

- November 23: Following the launch of its public testnet, Movement achieved a total of 681 million transactions, 158 million active addresses, and the deployment of 63 dApps.

- December 11: Just two days after its TGE, Movement surpassed $8.5 billion in trading volume according to CoinMarketCap.

7.2. Key Points to Watch in 2025

The Parthenon testnet campaign of Movement showcased the potential of the Movement ecosystem, achieving nearly 700 million cumulative transactions and over 150 million active addresses. This demonstrated the performance and stability of the Movement network.

Among the three mainnets planned by Movement—Aptos Move, Sui Move, and Move EVM (MEVM)—Aptos Move has advanced to the private mainnet phase following its testnet program, while the other two networks remain in the devnet stage. In 2025, a key challenge for Movement Labs will be how effectively it can integrate the Move-based ecosystem with the EVM ecosystem after launching its mainnets. Additionally, it will be crucial to observe how much convenience the network can deliver to users of Move-based Layer 1 platforms such as Aptos and Sui, further solidifying its position as a Move-based Layer 2 network.

8. Soneium

Soneium is an Ethereum Layer 2 network launched by Sony Block Solutions Labs, the blockchain-focused subsidiary of Sony, in collaboration with Startale, the developer of Astar. Even before its launch, Soneium garnered significant attention as a key player poised to lead Japan's Web3 ecosystem, thanks to the partnership between Sony, a major Japanese conglomerate, and the blockchain network Astar. Notably, Sony's extensive intellectual property (IP) portfolio is expected to play a pivotal role in onboarding a large number of Web2 users into the Web3 ecosystem.

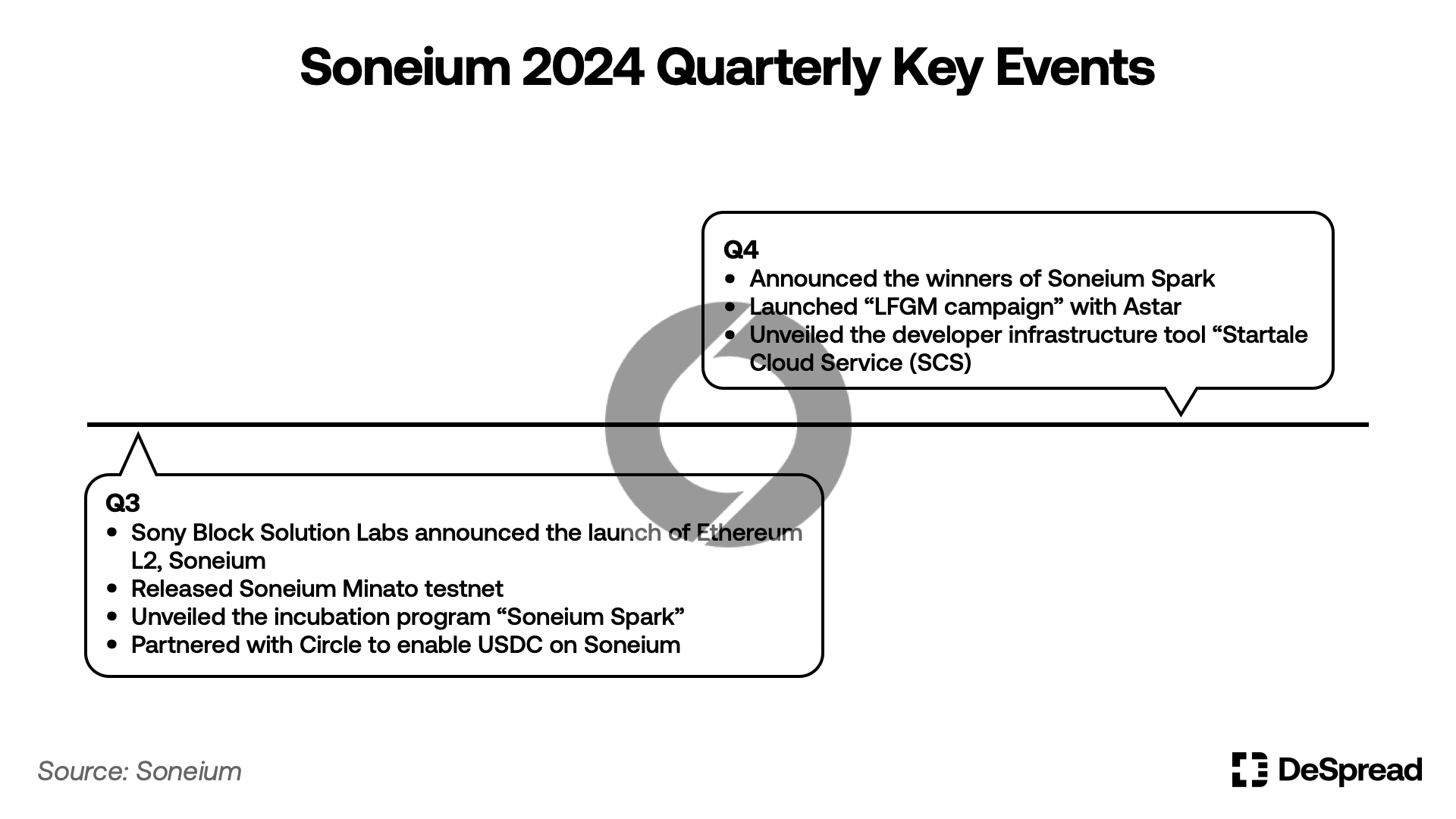

8.1. 2024 Quarterly Key Events

- October 14: The winners of the Soneium Spark incubation program were announced, with grants of up to $100,000 awarded.

- October 22: Minato testnet surpassed 12 million transactions, 1.81 million unique addresses, and 820,000 smart contract deployments.

- December 18: In collaboration with Astar, Soneium hosted Astar Surge, a program that allows staking $ASTR to support Soneium Spark-winning dApps, enabling participants to earn the respective dApps' tokens.

8.2. Key Points to Watch in 2025

Soneium, unveiled in August 2024, is an early-stage project currently focused on testnet operations and ecosystem dApp incubation. True to its catchphrase, "Go Mainstream," Soneium has set its top priority for 2025 as onboarding both Web2 and Web3 users, leveraging the reputation and resources of Sony, one of Japan's leading conglomerates.

The emergence of killer dApps that utilize Sony's exceptional entertainment content and intellectual property will be critical to attracting Web2 users. Soneium has already expressed ambitions to explore collaborations with various Sony services and subsidiaries, as mentioned in its initial vision statement. Efforts to integrate blockchain technology with flagship Sony products, such as PlayStation, are likely to play a pivotal role in achieving this goal. Additionally, initiatives like yen-backed stablecoins through Sony Bank and enabling USDC payments via a partnership with Circle could further facilitate onboarding Sony's vast global user base into the Soneium ecosystem.

9. Axlear

Axelar is a cross-chain messaging protocol designed to overcome the limitations of existing solutions that are often tied to specific ecosystems, offering high interoperability and flexibility. Currently supporting cross-chain messaging across 69 networks, Axelar enables seamless token management across multiple networks through its Interchain Token Service (ITS) and simplifies the process of connecting other networks to Axelar via its Amplifier. These services are part of the Mobius Development Stack (MDS), which provides developers with a streamlined and efficient environment for building cross-chain applications.

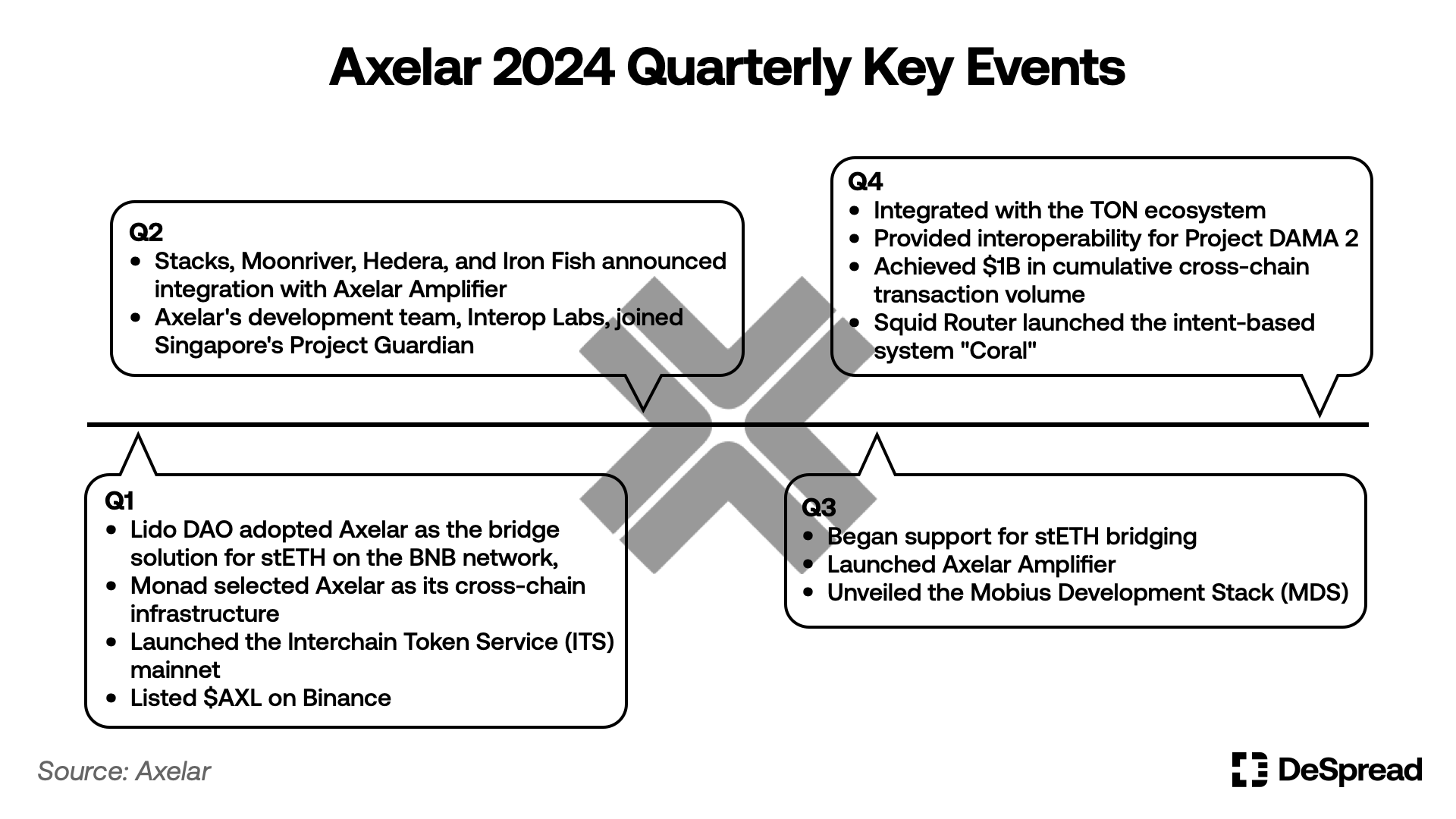

9.1. 2024 Quarterly Key Events

- February 6: Launched the mainnet for its interchain token management solution, Interchain Token Service (ITS).

- As of June: Achieved $1 million in cumulative transaction volume through the Squid Router.

- August: Launched Amplifier mainnet, the permissionless network integration solution.

- November: Provided interoperability support for Project Guardian, a pilot initiative for multi-chain asset services (DAMA2) in collaboration with Deutsche Bank.

- As of December 16: Recorded approximately 2.7 million cumulative cross-chain transactions and achieved a total transaction volume of $10 billion.

9.2. Key Points to Watch in 2025

The Mobius Development Stack (MDS), announced by Axelar in Q3, includes the features mentioned earlier, along with a mechanism that burns $AXL token fees generated from cross-chain messaging. This approach is expected to address the previously unchecked inflation of $AXL tokenomics by redistributing these fees as incentives to validators. As the number of integrated networks and overall usage grows, this mechanism is anticipated to not only curb inflation but also potentially create a deflationary structure. Consequently, rapid integration with prominent and growing networks like Solana and Sui, which are expanding their ecosystems, is expected to become increasingly critical.

Additionally, unlike other interoperability infrastructures, Axelar maintains close relationships not only with blockchain projects but also with major financial corporations such as JP Morgan, Microsoft, Deutsche Bank, and Mastercard. Observing Axelar's role in the blockchain adoption processes of these financial giants will be essential in understanding its broader impact and strategic positioning in the evolving blockchain ecosystem.

10. Pyth Network

Pyth Network is an oracle solution built on the Solana network, designed to reliably provide specific on-chain and off-chain data to applications that require it. Pyth Network stands out as a highly efficient and scalable oracle solution, offering a Pull Oracle feature that allows users to request data only when needed, optimizing resource usage and enhancing flexibility.

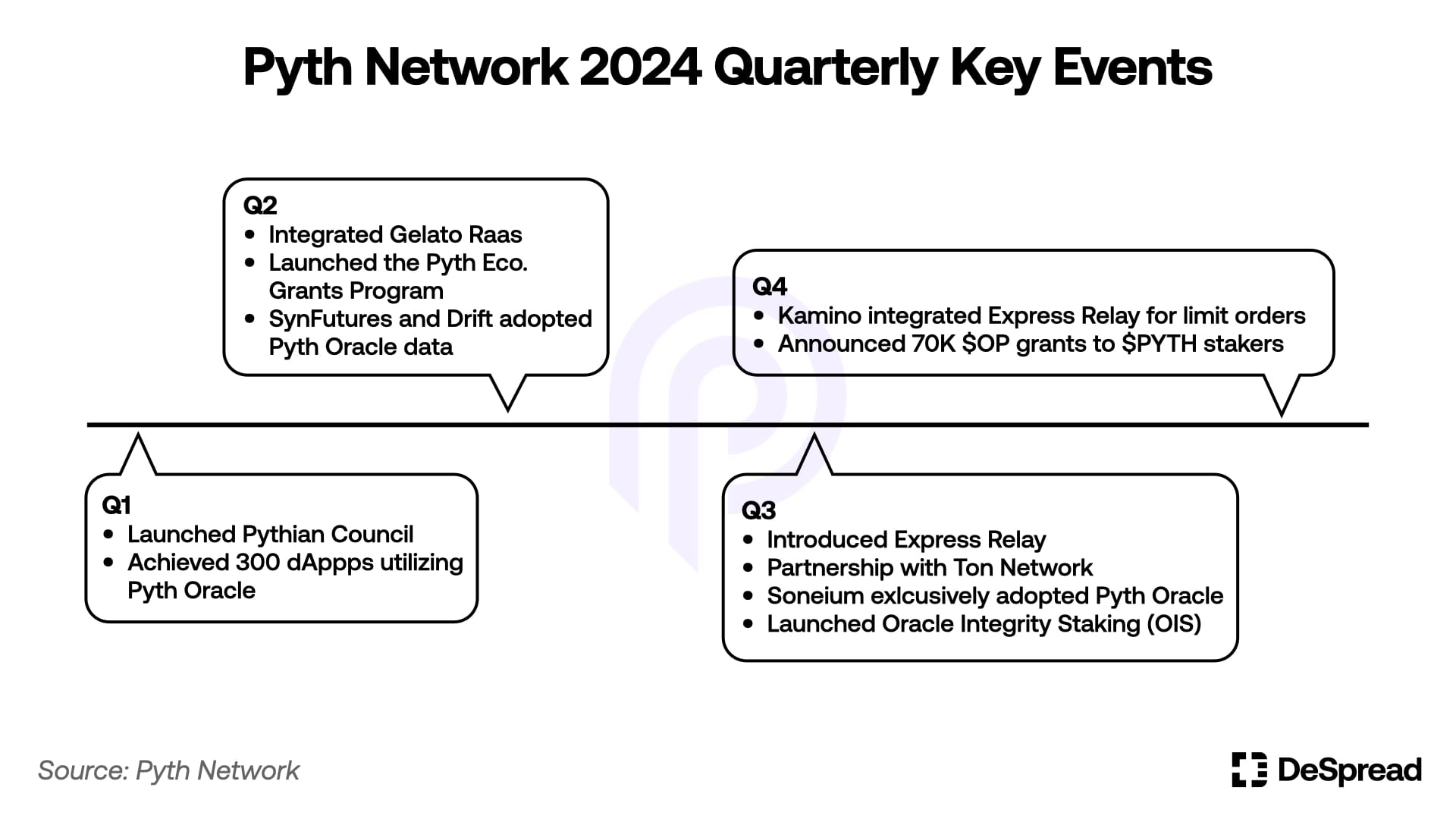

10.1. 2024 Quarterly Key Events

- March 5: Achieved a staking volume of 1.28 billion $PYTH.

- March 21: Number of dApps utilizing Pyth Network's oracle services reached 300.

- July 11: Introduced Express Relay, a feature designed to prevent MEV attacks on DeFi protocols that use its oracle.

- As of December 17: Pyth Network is supplying 614 data feeds to over 430 dApps.

10.2. Key Points to Watch in 2025

Throughout 2024, Pyth Network has enhanced its protocol with the launch of the Pythian Council and the introduction of Express Relay, further strengthening its functionality. More recently, the network has focused on aligning the interests of its community and protocol through initiatives such as the Pythian NFT Collection for community building and the adoption of Oracle Integrity Staking (OIS). However, to ensure robust governance and ecosystem sustainability, a clear and sustainable incentive mechanism is essential. It will be important to closely examine the incentive models that Pyth Network presents to its users and their long-term viability.

To enhance its competitiveness in the oracle market, Pyth must broaden its data provision capabilities beyond dApps to encompass institutional clients. Institutions are particularly sensitive to meeting legal requirements, and failure to comply may lead them to avoid using the network’s data due to potential risks. Therefore, establishing trust in the protocol is paramount. This includes providing reliable APIs that facilitate seamless integration with existing systems, which will be crucial for gaining institutional adoption.

11. Wormhole

Wormhole is a cross-chain messaging protocol that facilitates interoperability across various blockchain networks, currently supporting connections to 27 networks. It has garnered significant attention in the market for enabling interoperability with popular non-EVM networks such as Solana and Sui, which boast large user bases. As a result, Wormhole has become one of the most actively used cross-chain messaging protocols in existence today.

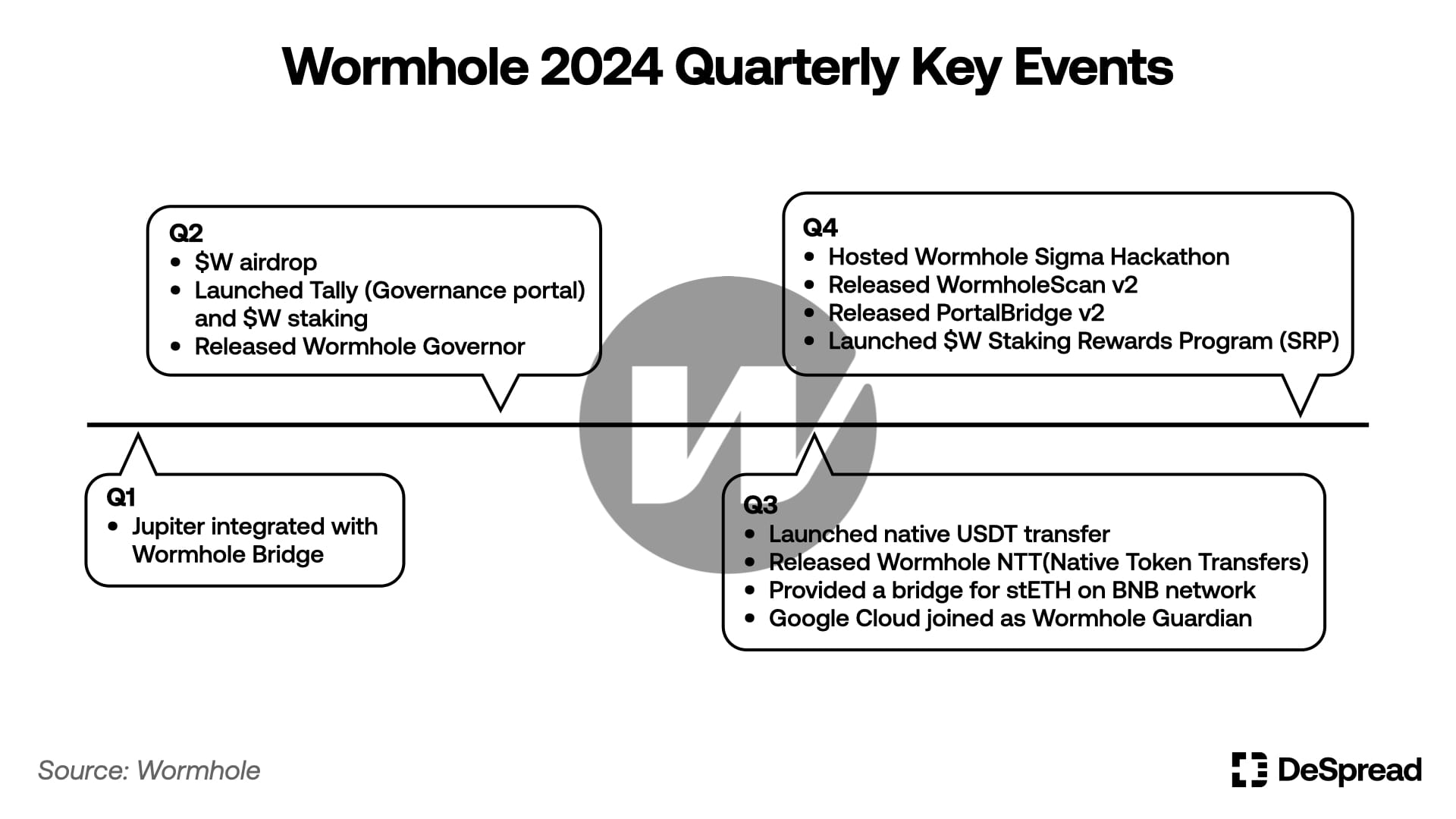

11.1. 2024 Quarterly Key Events

- April 3: Conducted an airdrop of 6.1% of the total supply (617 million $W) to early users.

- June 6: Launched the $W staking service, achieving 130,000 stakers and 427 million $W staked as of December 16.

- December 5: Introduced the SRP (Staking Reward Program), distributing 50 million $W as rewards for $W stakers.

- December 16: Surpassed 1 billion cumulative cross-chain transactions and $53 billion in total transaction volume.

11.2. Key Points to Watch in 2025

The $W airdrop conducted in the first half of 2024 targeted over one million users, including those who used bridge dApps integrating Wormhole's interoperability solutions, as well as Pyth stakers, Monad community members, and Wormhole community participants. Designed to reward active community engagement, the airdrop successfully garnered significant support for Wormhole from its user base. However, criticism emerged following the TGE due to continuous price declines and the lack of token utility. In response, Wormhole launched a staking reward program in Q4, promising ongoing rewards to its community, which helped reignite interest in the project.

Looking ahead to 2025, Wormhole's primary challenges will be expanding token utility and maintaining active community engagement. Given the nature of interoperability infrastructure projects, on-chain activities accessible to retail users are limited. It will be crucial to monitor whether Wormhole can successfully implement systems like MultiGov, a multi-governance model, and enhance staking reward programs to re-capture community interest and foster sustained participation.

12. IO.NET

Io.net is a protocol built on the Solana network that establishes a decentralized GPU and CPU computing power network. With the rapid growth of the AI industry driving increased demand for GPU computing power for AI training and inference, io.net has gained significant attention from the market and is emerging as a leading player in the DePIN (Decentralized Physical Infrastructure Network) sector.

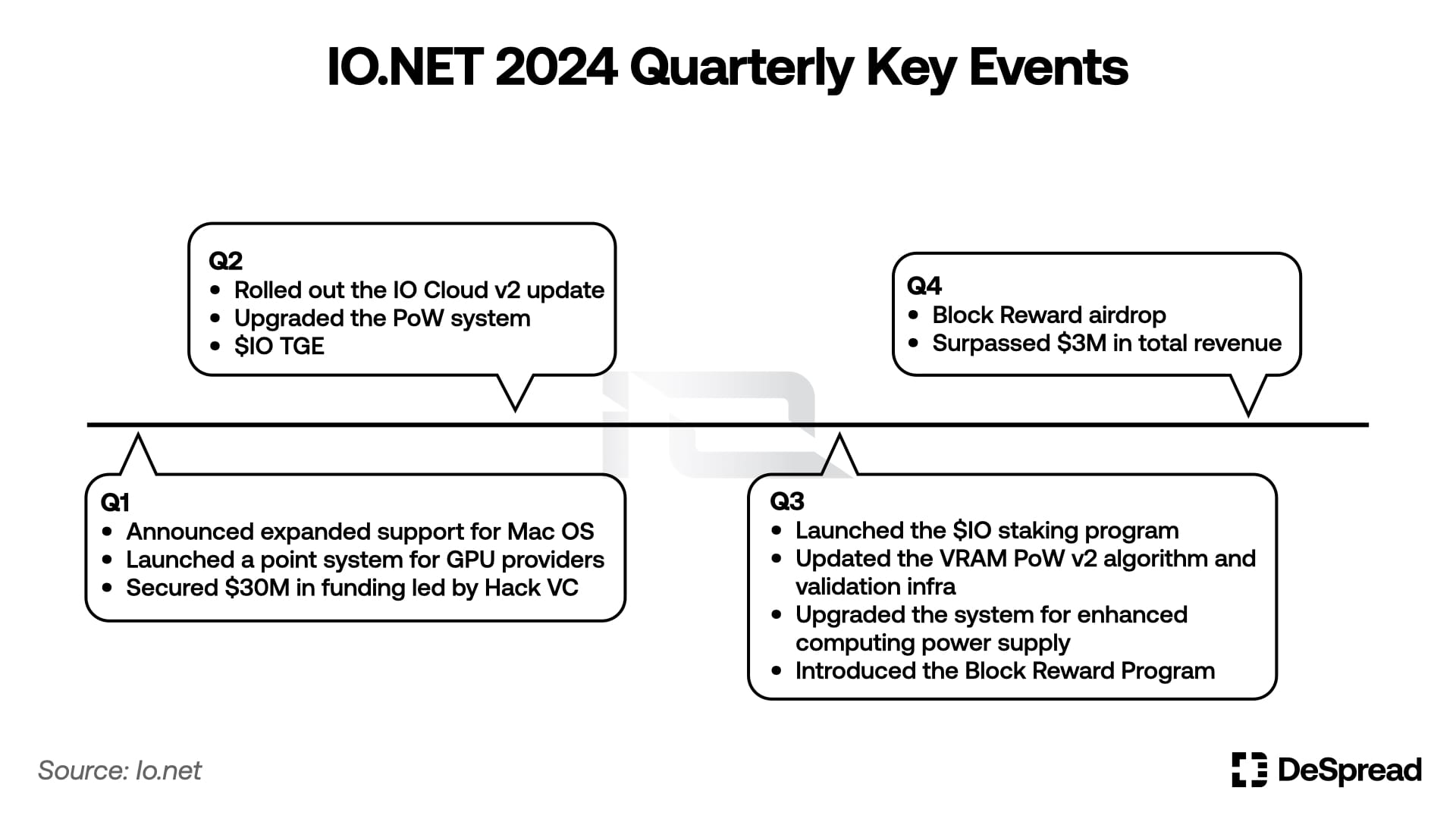

12.1. 2024 Quarterly Key Events

- March 5: Secured $30M in funding through a round led by Hack VC, with participation from Multicoin Capital and Delphi Digital.

- November: Achieved an average daily network revenue of $32,000.

- December 19: Verified pool stake includes 6,950 GPUs and 1,181 CPUs actively supplying computing power.

12.2. Key Points to Watch in 2025

Following Ethereum's The Merge update, most of the PoW mining market collapsed, leaving many idle GPUs without purpose. A significant number of these GPUs transitioned to participate in io.net's computing power supply. This influx enabled io.net to secure sufficient computing power for AI training, establishing its position as a pioneer in decentralized computing power networks for AI. As the AI industry continues to grow and attract attention, demand for io.net’s computing power network is expected to increase steadily over time.

However, io.net still faces the challenge of generating enough demand for computing power to offset the inflation of its $IO tokens offered to power suppliers. While io.net focused on securing a robust supply of GPUs in 2024 under the concept of blockchain-powered decentralized computing, the critical question for 2025 will be whether it can attract enterprise-scale demand to fully utilize the vast GPU resources it has gathered.

13. Avail

Avail is a modular blockchain solution designed to optimize data availability. Its architecture centers around the Avail Data Availability (DA) layer, which provides essential data availability services, alongside the Nexus layer, which acts as a hub within and beyond the ecosystem, and the Fusion Security layer, which enhances the security of the Avail network. Currently, only the Avail DA layer is operational on the mainnet.

With the growing trend of applications adopting modular designs tailored for specific functionalities, Avail has garnered significant market attention for offering reliable and cost-effective data availability solutions.

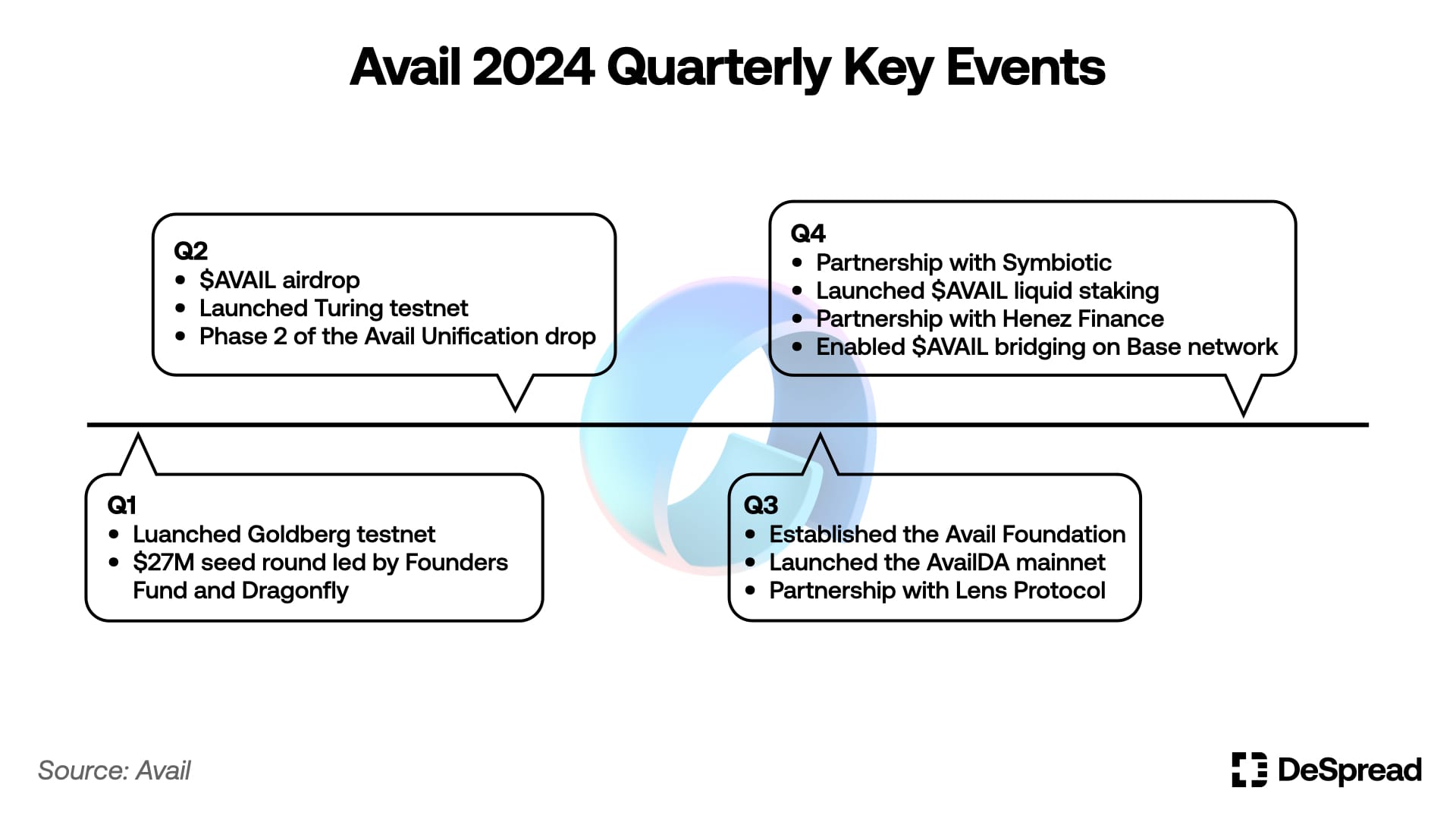

13.1. 2024 Quarterly Key Events

- April 22: Conducted an airdrop of 6% of the total supply (600 million $AVAIL) targeting developers, educators, and stakers.

- July 23: Successfully launched the mainnet of Avail DA (Data Availability), optimized for ZK technology with validity proofs.

- July: Introduced $AVAIL liquid staking services via Deq.fi, achieving a TVL of $5.1M as of December 16.

- December: Initiated $AVAIL support for the Base network bridge and Aerodrome liquidity pools, with the USDC/AVAIL liquidity pool reaching a TVL of $2.8M as of December 16.

13.2. Key Points to Watch in 2025

To gain an edge over prominent data availability solutions like EigenDA and Celestia, Avail must go beyond simply attracting partnerships that utilize its DA layer. Building its own robust ecosystem and generating network effects will be crucial for long-term success.

From this perspective, the successful launch of the yet-to-be-released Nexus layer and Fusion Security layer will be critical milestones to watch. If these layers are deployed seamlessly, they are expected to enable smooth interoperability within the Avail ecosystem. This interoperability, combined with the network effects created by a fully developed ecosystem, could position Avail to achieve a competitive advantage over other data availability solutions.

14. Galxe

Galxe is a decentralized identity verification protocol that helps individuals build and securely manage their digital identities in the Web3 environment, based on their on-chain and off-chain activities. It has garnered significant attention as many newly launched blockchain protocols are leveraging Galxe to conduct airdrops based on users' identities and quest completion statuses established through the platform.

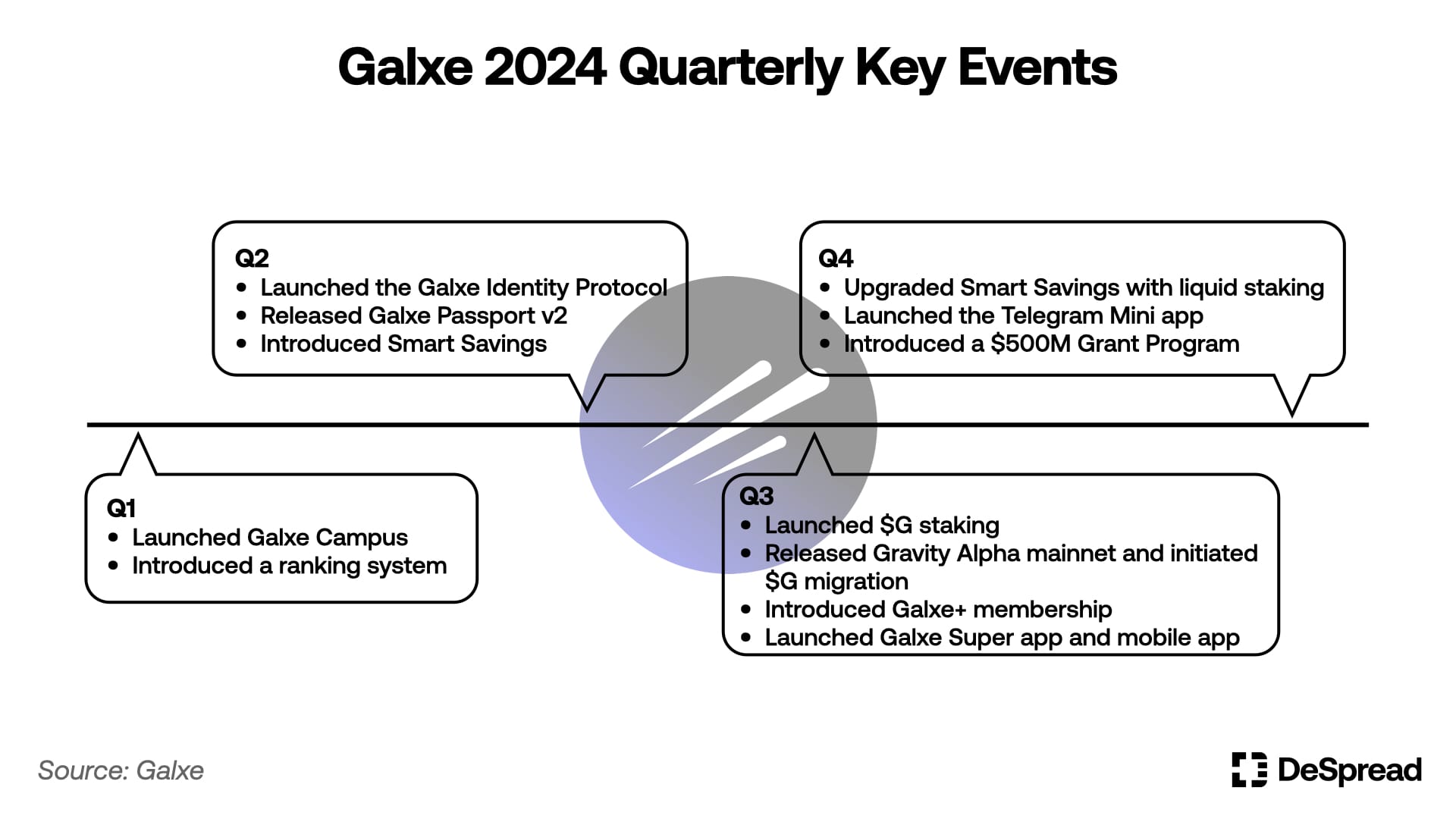

14.1. 2024 Quarterly Key Events

- September: Surpassed 100 million cumulative transactions on the Gravity Network.

- October: Achieved over 30 million registered users on Galxe.

- December 19: Reached 5.5 million $G staked across 55,000 staking wallet addresses.

14.2. Key Points to Watch in 2025

In 2024, Galxe focused on strengthening its position as an identity verification protocol by launching the Identity Protocol and Passport v2 features, while also successfully rolling out the Gravity mainnet. Building on these advancements, Galxe is expected to evolve into a comprehensive Web3 platform catering to all user levels—from beginners to experts. Its future plans include providing foundational Web3 education, AI-driven project analysis and research support, and fostering its own ecosystem through the interoperability of the Gravity Chain.

However, as the Gravity Network is still in its early stages, its ecosystem remains relatively small compared to other interoperability solutions. It will be critical to monitor how effectively Galxe leverages its established recognition and user base as an identity protocol to build a more expansive and inclusive ecosystem on the Gravity Chain, surpassing competing solutions in scope and functionality.

15. Access Protocol

Access Protocol is a Web3 content platform launched in 2022 within the Solana ecosystem, connecting content consumers and creators through its native token, $ACS. Users can stake $ACS to access premium content from their preferred creators, while content creators earn rewards proportional to the amount of $ACS staked by their audience.

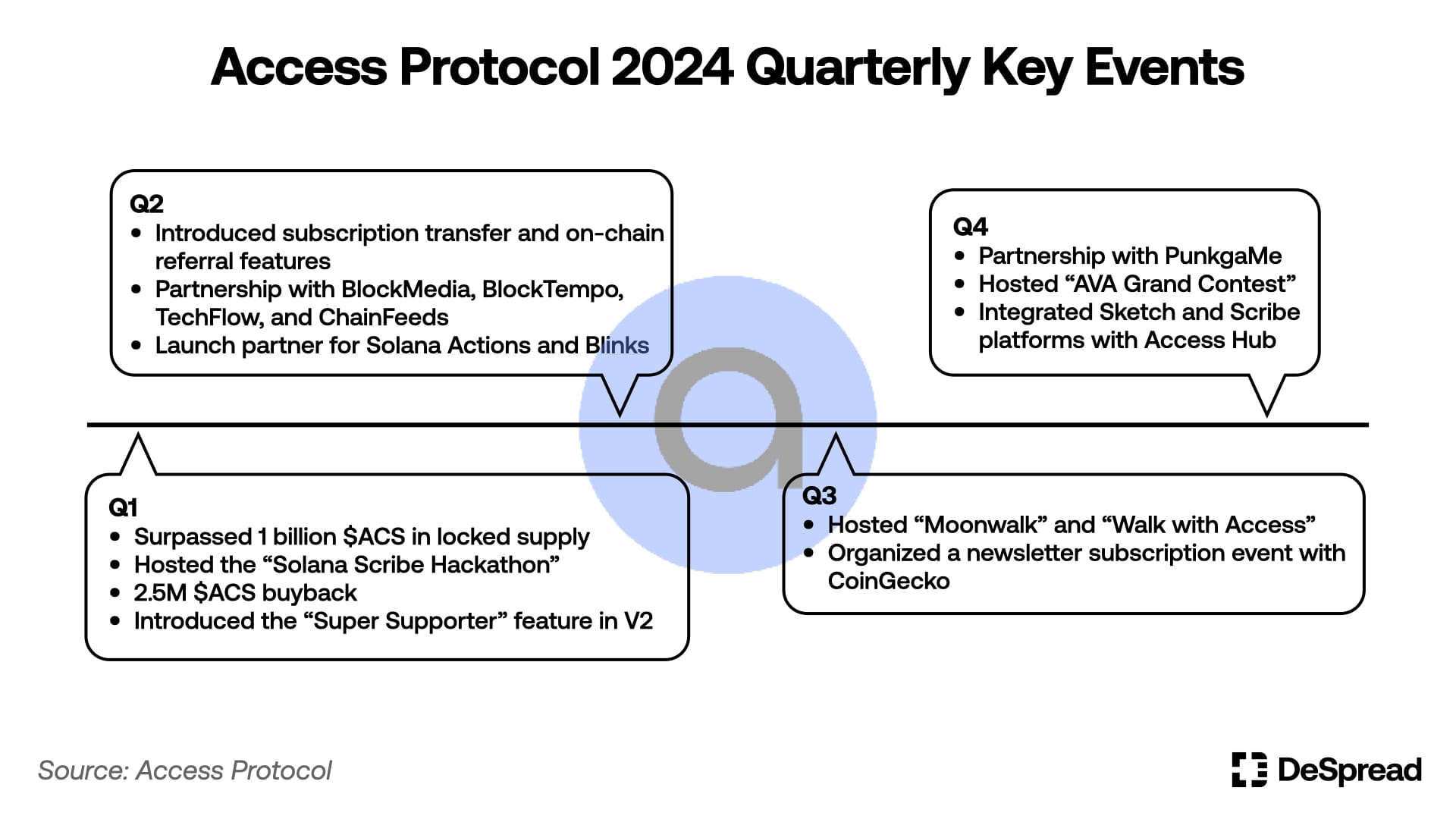

15.1. 2024 Quarterly Key Events

- January: Surpassed 1 billion $ACS in locked tokens.

- February 15: Conducted a buyback of 250 million $ACS tokens that were scheduled for unlocking.

- October: Partnered with manga SocialFi platform PunkgaMe to host a contest for manga artists and illustrators, offering a total prize pool of $6,000.

15.2. Key Points to Watch in 2025

In 2024, Access Protocol achieved significant milestones, including a comprehensive structural overhaul with the V2 upgrade and the establishment of strategic partnerships with major media companies in the APAC region. Building on these achievements, the staking-based subscription model is expected to expand further in 2025, accelerating integrations with global media platforms.

Notably, collaborations with local media companies in Asia are anticipated to enhance the ecosystem and broaden its influence. These efforts will be critical in determining whether more creators can benefit from Access Protocol, discovering new revenue opportunities that surpass the limitations of traditional platforms.

16. Alex

Alex is a flagship DeFi project within the Stacks ecosystem, aiming to establish a comprehensive financial infrastructure layer for Bitcoin. Alex offers a range of features, including swaps, launchpads, and staking. In August, it launched Alex V2, introducing support for a Bitcoin bridge, an integrated DEX combining AMM and order book functionality, and cross-chain trading. With this update, Alex has set its sights on establishing a new standard for Bitcoin DeFi.

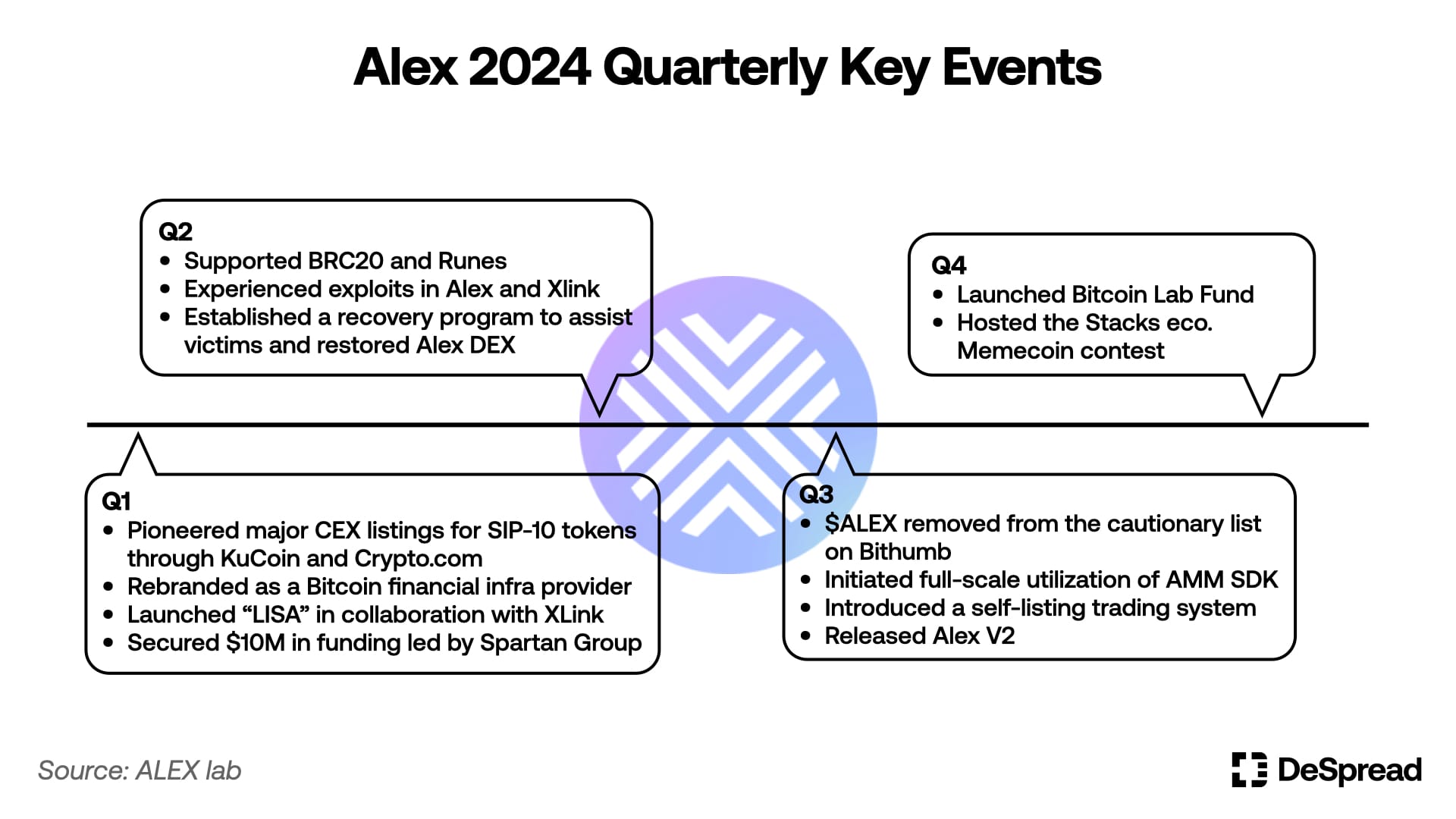

16.1. 2024 Quarterly Key Events

- April 2: $ALEX surpassed $0.5, achieving an ATH, driven by the growth of the Bitcoin and Stacks ecosystems.

- May 15: After a hacking incident that resulted in the theft of 13.7 million $STX, Alex launched a financial support program, allocating 100% of protocol revenue to compensate victims, and shared a roadmap to prevent future incidents.

- July 11: $ALEX was removed from Bithumb's Investment Warning List, following monitoring standards set by the Digital Asset eXchange Alliance (DAXA).

16.2. Key Points to Watch in 2025

by Jonathan — Senior Consultant

In 2024, Alex underwent a rebranding to position itself as a Bitcoin DeFi infrastructure provider, transitioning beyond its role as a flagship DeFi project in the Stacks ecosystem. Despite facing a challenging period due to a major hacking incident, Alex demonstrated resilience through active communication with its foundation and community, implementing a decentralized governance-driven compensation plan for victims, and quickly restoring its services.

Looking ahead to 2025, Alex aims to address challenges such as poor user experience and liquidity fragmentation through Alex V2, which supports Bitcoin chain abstraction. Key initiatives include the development of the Gaze Network, which facilitates seamless interaction between Bitcoin and other chains, along with the creation of a Bitcoin oracle and an indexer for Bitcoin metadata transactions. Additionally, the XLink bridge, connecting Bitcoin with multiple networks, is expected to play a pivotal role in enhancing interoperability and driving the growth of Bitcoin DeFi.

17. Open Campus

Open Campus is a protocol that leverages blockchain technology to create a decentralized educational environment. It offers teachers the convenience of distributing educational materials while providing new revenue opportunities. For students, Open Campus ensures easy access to educational resources and a transparent system for obtaining verifiable academic records.

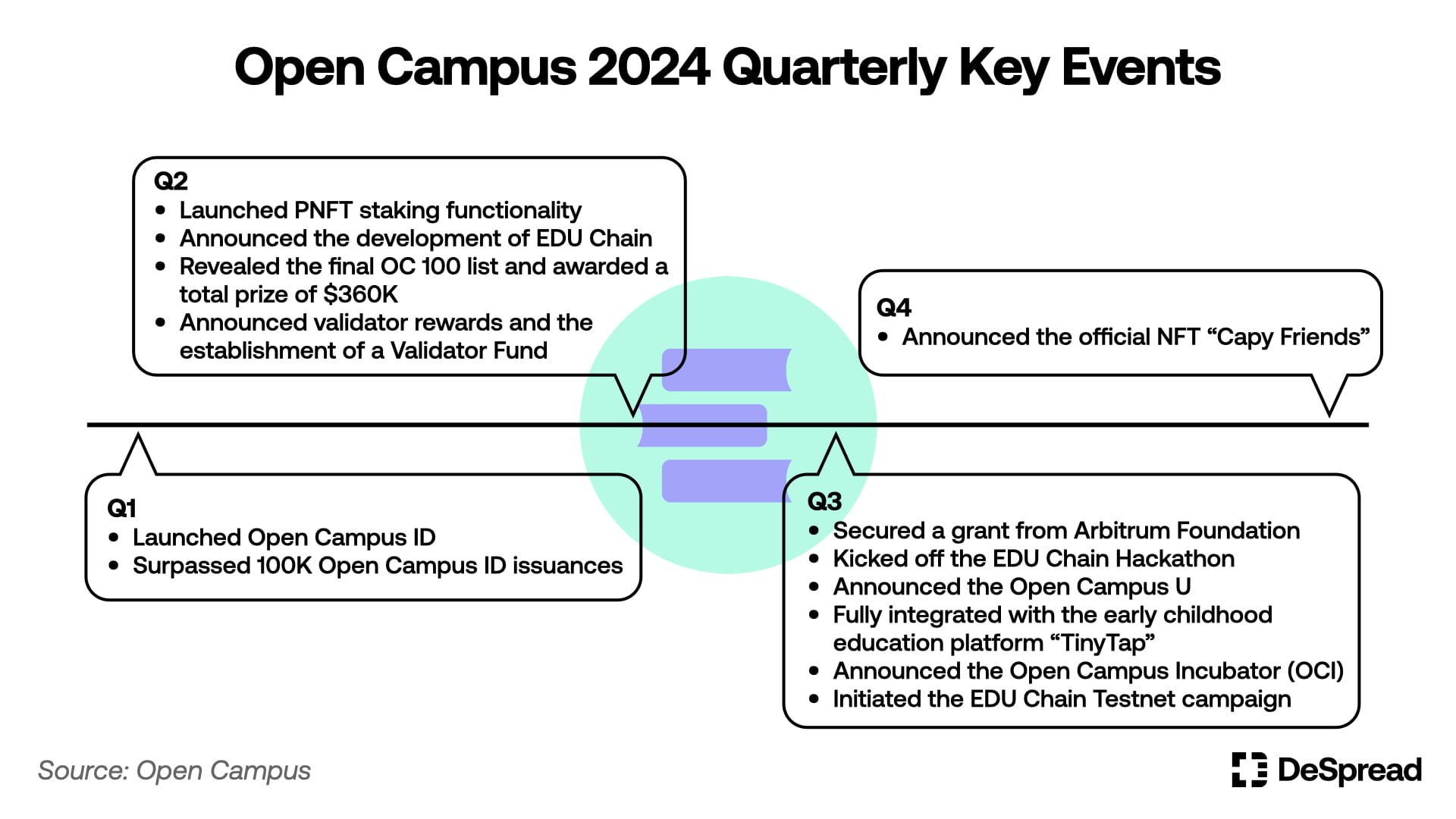

17.1. 2024 Quarterly Key Events

- January: Surpassed 100,000 issued Open Campus IDs within a month of launch.

- July: Hosted the Codex Hackathon for the EDU chain with a $1M prize pool.

- July 31: Announced full integration with TinyTap, an early education platform with 100,000 creators and 11 million users.

17.2. Key Points to Watch in 2025

Throughout 2024, the narrative of "education" did not gain significant traction in the crypto market. However, Open Campus made steady progress toward its vision of future education by launching initiatives such as Open Campus ID, Open Campus University, and the EDU chain. Notably, its integration with TinyTap was a meaningful achievement, exposing existing Web2 users to the Web3 environment.

Now that Open Campus has transitioned to its mainnet, the potential for ecosystem formation, beyond simply offering existing features, sets the stage for greater growth in 2025. Key challenges remain, including onboarding dApps, attracting users, and ensuring liquidity—all common hurdles for emerging chains. It will be important to observe how Open Campus integrates the education narrative into its ecosystem and whether its partnerships with global universities, currently under preparation, can generate significant network effects alongside the mainnet launch.

Additionally, following the mainnet transition, Open Campus is hosting hackathons to onboard dApps. The critical question is whether these events will go beyond being one-off occurrences. With the foundation's support for winning teams, sustained product development on the EDU chain could create a lasting positive impact on the ecosystem. Monitoring these developments in 2025 will be crucial to assessing Open Campus's ability to achieve its ambitious goals.

18.. Filecoin

Filecoin is a decentralized, distributed cloud storage protocol built on IPFS technology. Unlike traditional distributed cloud storage systems, Filecoin incorporates a token incentive mechanism to ensure the sustainability of distributed data storage. The protocol currently serves prominent storage users such as Opensea and UC Berkeley. In 2023, Filecoin introduced the Filecoin Virtual Machine (FVM), positioning itself as a platform for creating decentralized applications where data trust and permanence are critical.

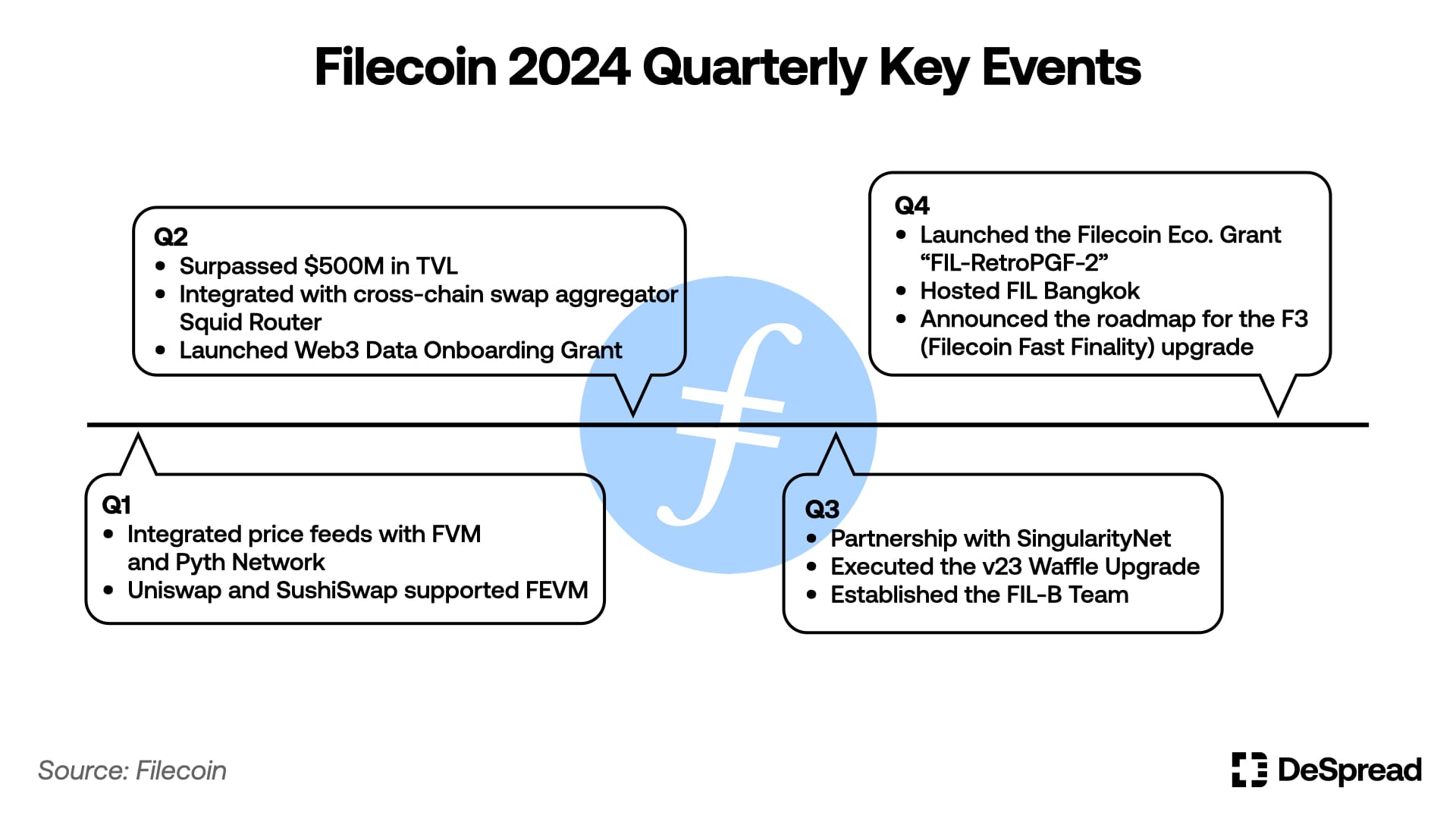

18.1. 2024 Quarterly Key Events

- April: Surpassed $500M in TVL within a year of the FVM launch.

- December 17: 913 service providers collectively storing 1,411 PiB (approximately 1.41 million TB) of data.

18.2. Key Points to Watch in 2025

As the AI industry continues to grow and attract attention, the importance of storage for the rapidly increasing volume of generative content is becoming more pronounced. In particular, the demand for Filecoin’s decentralized storage, which can overcome the limitations of centralized solutions, is expected to rise significantly in the near future.

Internally, Filecoin is set to undergo significant technical improvements with the upcoming F3 update, which will drastically reduce block finality times. Additionally, ecosystem expansion and development are being actively supported through various initiatives, including developer assistance from the FIL-B team, storage provider support from Storacha, and the FIL-RetroPGF program announced by the Filecoin Foundation.

However, it will be crucial to monitor the successful implementation of these updates and whether the recipients of $FIL grants can generate proportional value within the Filecoin ecosystem.