Digital Asset Treasury: From Premium to Multiple

Strategies and Challenges Toward a Sustainable Industry Model

1. Introduction — What Are Digital Asset Treasury (DAT) Companies?

Since the early 2020s, digital assets have steadily moved beyond the realm of individual investors to become a core component of institutional financial strategy. One of the most prominent examples is Strategy (formerly MicroStrategy), which redefined itself as a “Bitcoin-holding company” after converting excess corporate cash into Bitcoin in 2020 and subsequently raising capital to significantly expand its holdings.

Following in its footsteps, a range of emerging players such as Metaplanet have begun employing diverse funding mechanisms to acquire digital assets. Moreover, new entrants like DeFi Development Corp. are pioneering a different model—using digital assets not only as treasury reserves but as core productive assets and revenue-generating vehicles. This report defines such entities as Digital Asset Treasury (DAT) companies.

DAT companies are publicly traded firms that structure their balance sheets around digital assets and leverage these holdings for capital formation, revenue generation, and strategic market positioning. Unlike traditional financial institutions or asset managers, DAT firms directly hold digital assets, operating under the fundamental premise that “digital assets are strategy.”

This report aims to analyze global DAT cases such as Strategy and Metaplanet, and provide answers and strategic recommendations to the following key questions:

- What are the structural drivers behind the formation of a NAV premium for DAT firms?

- What types of risks are embedded in the DAT model, and what are their implications?

- What kind of business model is required to internalize the premium and ensure sustainability?

- What policy considerations must be addressed to support the long-term viability of the DAT framework?

2. Understanding the Strategy Model — The Structure of NAV Premium

2.1. Strategy Inc.: The Archetype of a DAT Firm

Strategy Inc. (NASDAQ: MSTR) was originally a publicly listed enterprise software company. However, beginning in August 2020, it initiated large-scale Bitcoin acquisitions as part of a strategic asset allocation shift. This transformation marked its evolution from a conventional tech company to the prototypical DAT firm. As of July 10, 2025, Strategy holds approximately 600,000 BTC. Its market capitalization stands at around $111 billion—reflecting a 68% premium over the net asset value (NAV) of its Bitcoin holdings.

Strategy’s approach is far more sophisticated than merely investing in Bitcoin. Its model operates as a financial flywheel: Bitcoin holdings → NAV premium creation → equity issuance at elevated valuation → further BTC acquisition → asset base expansion → premium maintenance. This self-reinforcing structure enables exponential growth in enterprise value. It is a form of financial engineering that leverages not just Bitcoin’s appreciation but also capital market dynamics to scale assets.

2.2. The Drivers of NAV Premium: Liquidity and Volatility

The NAV premium of Strategy stock is primarily sustained by two factors: a liquidity-based accessibility premium and a volatility-based trading premium.

- Accessibility Premium — “Bitcoin You Can Buy Like a Stock”

As a large-cap Nasdaq-listed U.S. tech firm, Strategy’s stock is highly accessible to both retail and institutional investors. This accessibility provides distinct utility to investors who are constrained from directly acquiring digital assets, particularly Bitcoin:

- Connectivity to traditional finance: MSTR can be purchased through standard brokerage accounts without requiring custody wallets, private key management, or KYC procedures. This is especially valuable for institutional investors—such as insurers, pension funds, or family offices—that are either prohibited or heavily restricted from holding digital assets directly. In such cases, Strategy’s stock serves as a compliant and auditable proxy.

- ETF substitute in restricted markets: In jurisdictions where spot Bitcoin ETFs are either unapproved or limited, the DAT model operates as a de facto ETF alternative. Since Strategy directly holds a large quantity of BTC and its equity price reflects underlying asset value, it provides an ETF-like trading experience.

- Collateral flexibility: MSTR, being a security, can be used in margin lending or pledged as collateral—capabilities that Bitcoin lacks in most traditional finance settings. This enhances capital efficiency and enables more flexible treasury operations compared to direct BTC holdings.

- Volatility Premium — Derivatives-Driven Demand

Strategy stock exhibits significantly higher implied volatility (IV) than Bitcoin itself. This elevated IV acts as another pillar of its NAV premium.

- Extreme volatility episodes: In November 2024, when BTC surged above $95,000 and Strategy issued $2.1 billion in ATM equity to purchase 27,200 BTC, its 30-day option IV spiked to 225%. In contrast, Bitcoin’s IV during the same period remained between 55–60%, indicating that the market priced Strategy with more than 4x the expected volatility.

- Derivatives market inflow: The high IV attracts volatility traders, including those deploying gamma trading and long/short vol strategies. This inflow of speculative capital boosts liquidity and reinforces upward pressure on the stock price, thereby supporting the NAV premium. In many cases, MSTR’s IV reacts even faster than BTC’s during short-dated option cycles (7–30 days).

- A composite trading premium: The NAV premium thus reflects more than just the fair value of Bitcoin holdings. It also embeds a liquidity premium stemming from MSTR’s high tradability and its role as a volatility product—making it attractive to a wide spectrum of capital market participants.

“We are a voluntary volatility engine. If managed wisely, it becomes a power plant.”

— Michael Saylor, Executive Chairman of Strategy Inc., April 2025

As of July 2025, Strategy’s official dashboard reports a 30-day implied volatility of approximately 56% for MSTR, compared to 28% for BTC. This confirms that MSTR continues to trade with more than twice the market-expected volatility of Bitcoin, sustaining derivatives demand and the high-IV premium mechanism.

2.3. Capitalizing the Premium: Convertible Notes and ATM Issuance Strategy

Strategy actively monetizes its NAV premium through various financial engineering tools, with convertible bonds, ATM (At-The-Market) equity issuance, and perpetual preferred shares forming the core toolkit.

- Convertible Notes — Leveraging the Premium

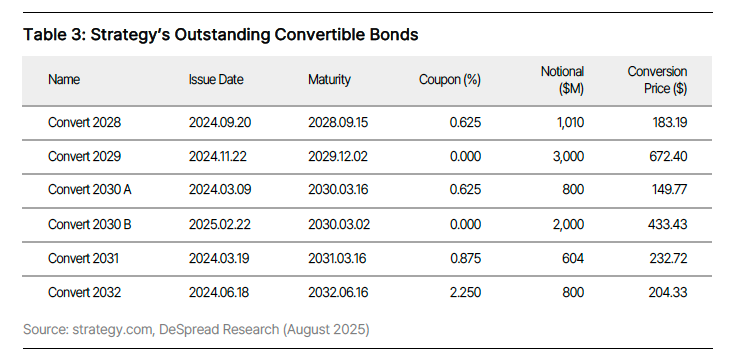

- Since 2020, Strategy has issued over eight rounds of convertible debt, typically at 0% or very low coupon rates (e.g., 0.625%).

- Conversion prices are generally set at 30–50% above the stock price at issuance, reducing dilution risk for the company while lowering default risk for bondholders.

- This asymmetric structure means: if the notes are not converted, they remain as debt; if converted, they become equity priced well above NAV—turning the premium into a capital formation tool without immediate dilution.

- It effectively transforms market optimism into non-dilutive liquidity used to acquire more BTC.

- ATM Equity Issuance — Instant Monetization of the Premium

- Strategy utilizes ATM issuance opportunistically when NAV premiums widen.

- The ATM structure involves selling small amounts of stock at market prices within a pre-registered issuance window, minimizing the need for large discounts or share price impacts.

- Notably, from October to December 2024, Strategy raised $2.1 billion via ATM sales, enabling the acquisition of 27,200 BTC at an average price of $74,463.

- Despite aggressive issuance, NAV premium remained in the 30–50% range, allowing the firm to “sell high and buy low”—issuing expensive stock to acquire cheaper BTC.

- Perpetual Preferred Stock — Fixed-Income Capital Without Dilution

- In 2025, Strategy began issuing perpetual preferred shares under tickers STRF and STRD.

- These instruments pay fixed dividends with no maturity and no conversion rights—enabling long-term capital formation without common equity dilution.

- During March–June 2025, when NAV premiums narrowed and ATM issuance paused, preferred shares offered a flexible alternative for capital raising.

- While providing strategic liquidity, these instruments introduce cash flow obligations and uncertainty around investor appetite. Their success depends on market demand for yield-based products, making them a complementary tool rather than a replacement for convertibles or ATM sales.

2.4. BTC Yield: Accounting for BTC Per Share Growth

Strategy does not frame its approach as merely “holding Bitcoin.” Instead, it presents its performance through a proprietary metric—BTC Yield, defined as Bitcoin held per share (BPS). This accounting construct is central to its shareholder narrative.

When new shares are issued at a sufficient premium to NAV, the proceeds can purchase more BTC than the dilutive effect of share issuance—resulting in a net increase in BPS. This structure not only benefits existing shareholders but also reinforces market trust in the firm’s capital strategy, enabling continued access to funding.

Through this approach, Strategy has cultivated a compelling narrative: a Bitcoin accumulation algorithm powered by capital markets. It secures outside capital to acquire BTC, maintains a premium, and recycles capital to grow its holdings—forming a self-sustaining financial flywheel.

However, it is critical to note that this model relies heavily on sustained market confidence and premium preservation. Should the NAV premium collapse, the flywheel would break down. BTC Yield, after all, is a balance-sheet metric—not a measure of operational profitability. Misinterpreting it as a form of yield or cash flow could lead to overvaluation and heightened investment risk.

3. The Expansion of DATs — Beyond Strategy

3.1. Japan’s Bitcoin DAT — Metaplanet

Between 2024 and 2025, Metaplanet (TSE: 3350), a small-cap company listed on the Tokyo Stock Exchange, undertook a radical transformation—abandoning its legacy businesses in CD publishing and hotel operations to embrace Bitcoin as the core of its corporate treasury strategy. Often dubbed “Japan’s Strategy Inc.” by the media, Metaplanet’s trajectory shares surface-level similarities with Strategy, but the structural logic and strategic motivations are fundamentally distinct.

3.1.1. Strategic Shift Driven by Structural Concern Over Yen-Denominated Assets

Metaplanet cites three key macroeconomic risks in Japan since 2020 as the impetus behind its strategic pivot:

- Chronic low interest rates and fiscal imbalances: The Bank of Japan’s prolonged monetary easing has weakened confidence in the long-term stability of the yen.

- Persistent U.S.-Japan interest rate differential: While the U.S. retained monetary tightening capacity, Japan remained locked into zero or near-zero rates, prolonging a structural yen depreciation.

- World’s highest debt-to-GDP ratio: Despite domestic absorption of JGBs, foreign asset holders have grown increasingly skeptical about the long-term sustainability of yen-denominated instruments.

In response, Metaplanet positioned Bitcoin as a global store of value that operates independently of the yen. This move reflects more than simple asset diversification—it constitutes a strategic hedge against systemic vulnerabilities in Japan’s financial system. In this context, Metaplanet emerges as the second global DAT firm with a legitimate macro-driven rationale, following Strategy Inc.

3.1.2. Execution Engine: External Strategic Partner EVO Fund

Unlike Strategy, which relied on retained earnings and capital markets, Metaplanet adopted an externally-funded model from inception. The key to this approach is its partnership with EVO Fund, a global investment vehicle with a specialized focus on PIPE (Private Investment in Public Equity) transactions involving small- and mid-cap Japanese firms.

EVO Fund has a track record of structuring complex financial instruments—such as MS warrants and zero-coupon convertibles—with sophisticated risk-return profiles. In the Metaplanet case, EVO did not merely act as a capital provider but served as a strategic architect of the entire financing structure.

By rapidly executing a series of private warrant placements, EVO became both the lead financier and the largest shareholder, publicly endorsing Metaplanet’s Bitcoin-centric vision. The company’s execution capabilities, therefore, owe less to internal conviction and more to the presence of this financial engineering partner.

3.1.3. Funding Mechanism: MS Warrants

Metaplanet’s rapid BTC accumulation strategy diverges from Strategy’s convertible debt and ATM issuance playbook. At its core is the use of Moving Strike Warrants (MS Warrants), exclusively underwritten by EVO Fund.

These warrants are structured so that their exercise price adjusts upward as the stock price rises. This enables a self-reinforcing flywheel:

Bitcoin price increases → Metaplanet share price rises → higher capital inflow via warrants → further BTC acquisitions.

All MS Warrants are privately placed with EVO, ensuring swift capital execution independent of broader market sentiment.

This structure grants Metaplanet a clear edge in terms of speed and consistency of capital deployment. Particularly in volatile Bitcoin environments, the ability to raise billions of yen within days offers a decisive advantage over peers.

However, the closed nature of these deals—conducted outside public markets—raises transparency and governance concerns. The lack of external scrutiny could expose the firm to risks related to asset acquisition transparency, insider trading allegations, and dilution mismanagement.

Even so, Metaplanet’s bold declaration of intent—targeting 210,000 BTC by 2027—signals a prioritization of execution and capital strategy sustainability over short-term market optics. Compared to Strategy, Metaplanet’s model is even more aggressive and speculative, representing a high-risk, high-reward capital markets strategy.

3.1.4. Speed and Outcomes of Strategic Execution

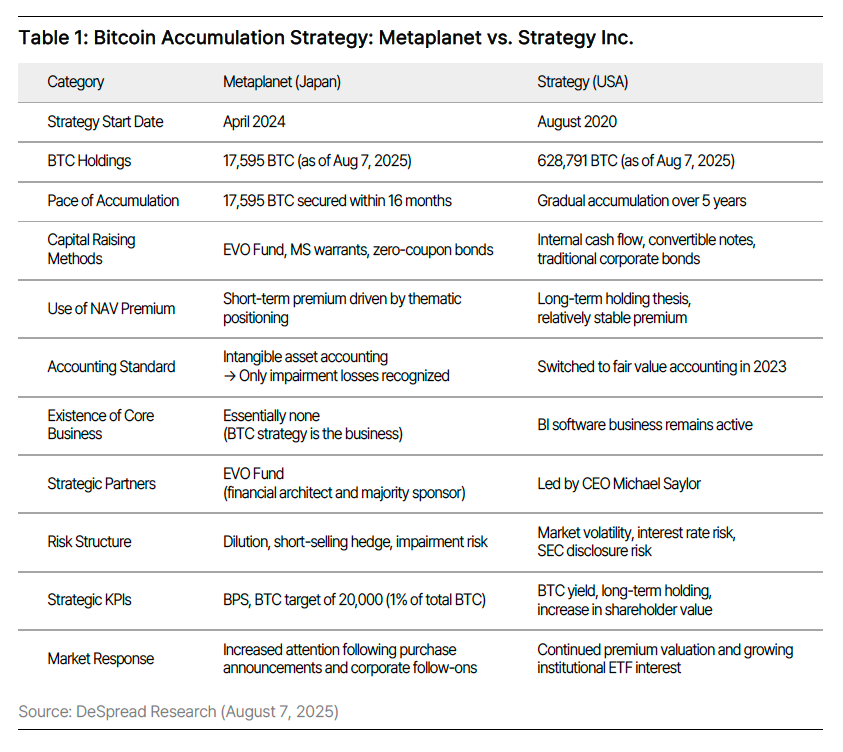

Since officially launching its Bitcoin acquisition strategy in April 2024, Metaplanet has accumulated 15,555 BTC within just 15 months. As of July 10, 2025, this amounts to over $1.7 billion in assets—an extraordinarily aggressive pace when compared to Strategy Inc., which achieved a similar scale over a five-year period.

During this time, Metaplanet’s share price surged from approximately ¥20 in early 2024 to a peak of ¥1,930, marking a 96.5x increase. As of July 10, 2025, the stock trades in the ¥1,500 range, with a market capitalization of roughly ¥92.37 billion (~$641 million USD), having reached a peak of ¥1.16 trillion. This valuation implies a 4x NAV premium, signaling strong market anticipation tied to its Bitcoin holdings.

Metaplanet is now widely referred to as the “Japanese MSTR” and ranks as the fifth-largest corporate Bitcoin holder globally. More than just a treasury strategy, Metaplanet’s positioning represents a broader ambition: to become a central hub in Japan’s expanding Bitcoin ecosystem. The company aims to parlay its BTC-focused model into a leadership role within Japan’s digital asset economy—extending its influence beyond asset accumulation to ecosystem development.

- Through its “555 Million Plan,” Metaplanet aims to raise $5.4 billion in capital and acquire 210,000 BTC—equivalent to 1% of Bitcoin’s total supply—by 2027.

- In parallel with its aggressive treasury strategy, the company is pursuing business diversification by operating media platforms such as Bitcoin Magazine Japan and offering BTC adoption consulting services to enterprises.

- Meanwhile, EVO Fund is actively replicating this strategy across other Japanese small-cap firms, including Mac House and Remixpoint. As a result, the EVO-led DAT model is beginning to take shape as a recognizable capital market pattern in Japan.

3.1.5. Structural Risk: Comparing Risk Architectures of Strategy and Metaplanet

While Metaplanet has executed its Bitcoin strategy at a much faster pace than Strategy Inc., delivering dramatic short-term results, this success has been built atop a high-risk, externally funded structure. Despite surface-level strategic similarities—centered on transitioning corporate finance to a Bitcoin-centric model—the underlying risk mechanics, sustainability profile, and defensive capabilities between the two companies differ significantly.

First, Metaplanet lacks any operating cash flow of its own and relies entirely on external capital instruments such as MS Warrants, designed and underwritten by EVO Fund. In a rising market, this enables a positive feedback loop of higher share prices → higher warrant conversion prices → increased capital inflow → further BTC purchases. However, in a bear market, the structure can invert into an automatic death spiral: falling stock price → lower warrant strike prices → increased share issuance → intensified dilution → further price declines.

Compounding this vulnerability is the short-selling hedge mechanism often employed by EVO Fund prior to warrant conversion. This creates dual sell-side pressure on the stock: one from pre-hedging activity and the other from subsequent equity issuance—exacerbating volatility and undermining shareholder confidence.

Accounting risks also loom large. Under conventional Japanese GAAP (or equivalent accounting standards), Metaplanet classifies BTC as an intangible asset. This results in asymmetric treatment: price increases are not recognized as earnings, but price declines must be marked as impairment losses, directly impacting the P&L. Even if Bitcoin trades well above acquisition cost, the gains remain unrealized on financial statements, while any price drawdown is immediately recorded as a loss. This accounting asymmetry can damage the firm's perceived financial health and erode credibility—despite no actual cash outflows.

By contrast, Strategy Inc. retains a legacy BI software business that continues to generate over $100 million in annual operating cash flow, providing a foundational buffer. The company initially deployed retained earnings and later relied on long-term convertible debt to finance its BTC accumulation. In this structure, even if Bitcoin prices collapse or the NAV premium evaporates, the firm avoids automatic dilution or strategic breakdown. Dilution is not mechanically linked to stock performance; instead, conversions are conditional, subject to market dynamics, issuer discretion, and investor choice.

On the accounting front, Strategy initially followed GAAP impairment-based accounting similar to IFRS. However, by 2023 it transitioned to fair value accounting, allowing unrealized BTC gains to be recognized on the balance sheet.

3.1.6. Bitcoin Accumulation Strategy: Metaplanet vs. Strategy Inc.

3.2. Solana-Based DATs — Sol Strategies and DeFi Development Corp.

Beyond the examples of Strategy Inc. and Metaplanet, a new generation of DAT strategies is emerging—centered not around Bitcoin or Ethereum, but alternative L1 assets. Among them, Solana stands out as a promising foundation for DAT models thanks to its high throughput, low transaction costs, native staking yields, and DeFi integration. These characteristics make Solana not only suitable for asset holding but also for a broader range of on-chain operational strategies. The most notable examples of this evolution include Sol Strategies (CSE: HODL, OTCQB: CYFRF) and DeFi Development Corp. (NASDAQ: DFDV), both of which are publicly listed firms pioneering operational DAT models built on Solana.

3.2.1. Significance of the Solana-Based DAT Model: From “Holding” to “Operating”

Solana-based DATs seek to move beyond passive token holding by exploring new avenues for yield generation, including:

- Validator rewards: Participating in Solana’s proof-of-stake consensus to earn predictable block rewards.

- Structured yield: Creating proprietary financial products using native assets and distributing them on-chain.

This marks a departure from the Bitcoin-centered DAT model, which relies solely on price appreciation and NAV premium. The Solana-based approach signals a possible evolution toward “operational DATs” or “financial infrastructure DATs”—firms that generate sustainable cash flows through on-chain activity.

3.2.2. Sol Strategies — Earning Validator Revenue via Infrastructure Ownership

Sol Strategies, a Solana-focused digital asset firm listed on the Canadian Securities Exchange (CSE), operates as more than just a token holder. It has built its own validator infrastructure, avoiding reliance on third parties, and actively stakes its SOL to earn block rewards and delegation fees—forming a base layer of predictable, on-chain income.

This model differentiates Sol Strategies as a validator-revenue DAT, combining blockchain infrastructure operations with asset management. While the company has yet to pursue aggressive capital markets strategies akin to Strategy Inc., it is steadily positioning itself as a core institutional access point within the Solana ecosystem, emphasizing risk-managed growth and validator-backed earnings over speculative valuation premiums.

3.2.3. DeFi Development Corp. — Validator Yields + DeFi Asset Origination

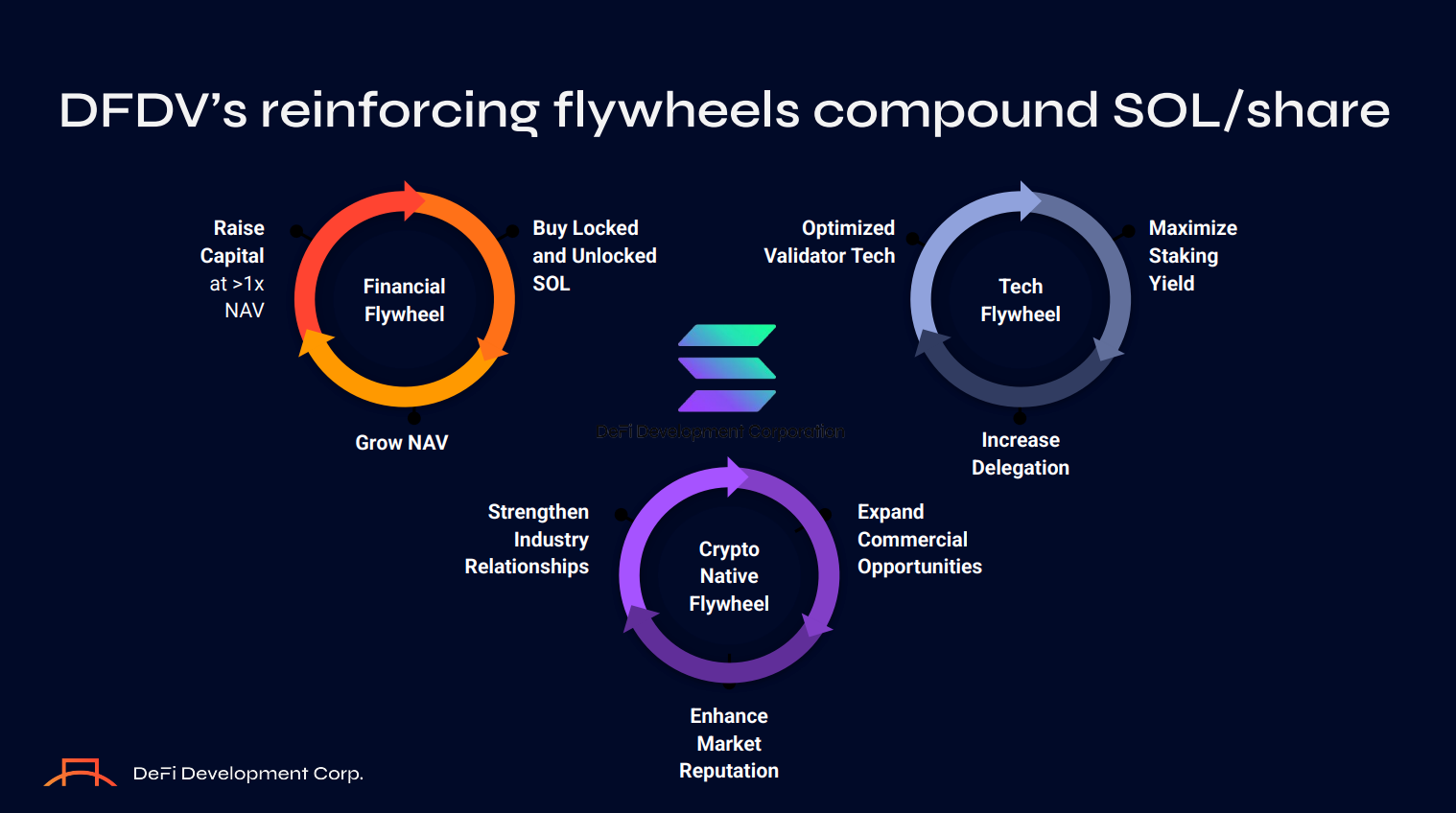

DeFi Development Corp. (DFDV) takes the Solana-based DAT model one step further by not only operating a validator node but also structuring and distributing financial assets built on top of its staked SOL. The firm raises capital to acquire SOL, delegates the tokens to its own validator infrastructure to earn staking rewards, and then issues a derivative asset, dfdvSOL, backed by these holdings.

dfdvSOL is a liquid staking derivative—a tokenized representation of staked SOL within DeFi Development’s validator node. Users delegate their SOL to the company and receive a 1:1 minted amount of dfdvSOL in return, allowing them to retain staking rewards while unlocking liquidity for on-chain use.

Importantly, dfdvSOL is integrated across a wide range of Solana DeFi protocols including Orca, Kamino, Drift, Exponent, and RateX. This enables users to use dfdvSOL as collateral for loans and to provide it as liquidity in yield-generating pools. This model transforms DAT firms from a passive staker into a core infrastructure player within the DeFi ecosystem.

The company is also fostering platform-based network effects:

As demand for dfdvSOL utility grows across DeFi, more users delegate SOL to DeFi Development’s validator, increasing its stake and rewards. This self-reinforcing cycle expands revenue beyond staking yields to include various types of revenues such as structured product fees and protocol integration incentives.

Ultimately, DeFi Development Corp. represents a new class of financial infrastructure DATs—not only holding and validating assets, but structuring, distributing, and monetizing on-chain asset flows. This approach sets a precedent for DAT evolution: shifting away from dependency on long-term asset holding or short-term NAV premiums, toward real, on-chain utility and platform-based revenue multiples.

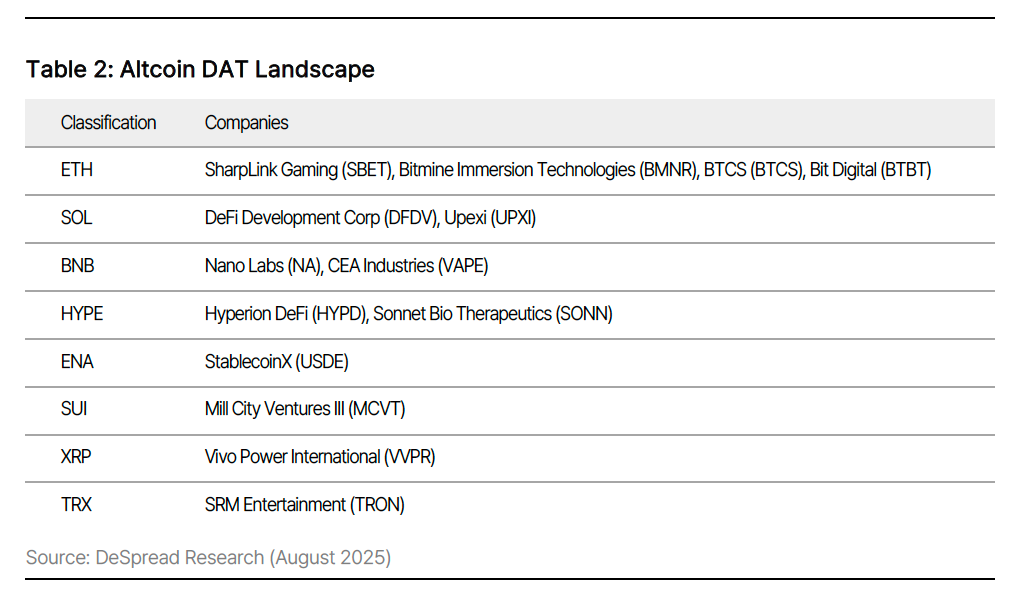

3.3. Other Emerging DAT Models — ETH, XRP, TRX, HYPE, BNB and Beyond

Beyond Solana-based DATs, a growing number of publicly listed companies are adopting treasury and operational strategies centered on a diverse range of digital assets—including Ethereum (ETH), XRP, TRON (TRX), HYPE, and Binance Coin (BNB). These firms vary significantly in structure and strategy, reflecting the unique characteristics of each asset and its surrounding ecosystem.

4. Risk Analysis of the DAT Model — Innovation or an Unsustainable Structure?

The DAT business model—pioneered by Strategy Inc.—has captured immense attention and liquidity across both crypto markets and traditional securities exchanges. New companies are entering the space almost daily, announcing pivots to the DAT model alongside capital raises often in the hundreds of millions. Each time a firm discloses its intent to accumulate digital assets, its stock price often surges dramatically.

A striking example came on June 30, when BitMine Immersion Technologies (NYSE: BMNR) announced an ETH-focused DAT strategy, triggering a 40x share price increase within just four days. Such cases reflect both the speculative euphoria and the outsized market attention currently granted to nascent DAT firms.

However, the party cannot last forever. Criticism that Strategy Inc.’s model is structurally unsustainable has long circulated in financial circles. Its flywheel relies heavily on a single variable: the price of Bitcoin. That dependency introduces inherent fragility—particularly if asset prices reverse. This chapter analyzes the risks embedded in the DAT model, with Strategy as a reference point, to assess whether current market behavior signals innovation or excessive overheating. It also offers a practical checklist for surviving the ongoing DAT boom.

4.1. Structural Risk — The Dynamics of the Premium

At the heart of the DAT model lies the Net Asset Value (NAV) premium. DAT firms use this premium to raise capital—via ATM issuances, PIPE deals, or Equity Lines of Credit (ELOC)—and deploy the proceeds to accumulate digital assets. This, in turn, increases the Unit Per Share (UPS) metric, driving perceived shareholder value. The NAV premium is the alpha and omega of the DAT flywheel, enabling a self-reinforcing loop of capital inflows and asset accumulation.

The core belief sustaining this model is that as long as the premium persists, UPS will continue to rise, justifying both the company’s valuation and ongoing fundraising efforts. In a bull market, this logic fuels a beautiful upward spiral. However, the same mechanism can quickly reverse in a downturn. If optimism evaporates, the very foundation of the DAT tower—built atop premiums—can collapse with alarming speed.

NAV Premium Collapse Scenario:

Decline in digital asset prices → Fall in DAT firms’ NAV and share prices → Shrinking or negative NAV premium → Capital raising becomes difficult or impossible → Increased pressure to repay existing debt → Forced liquidation of digital assets → Further price declines across the market

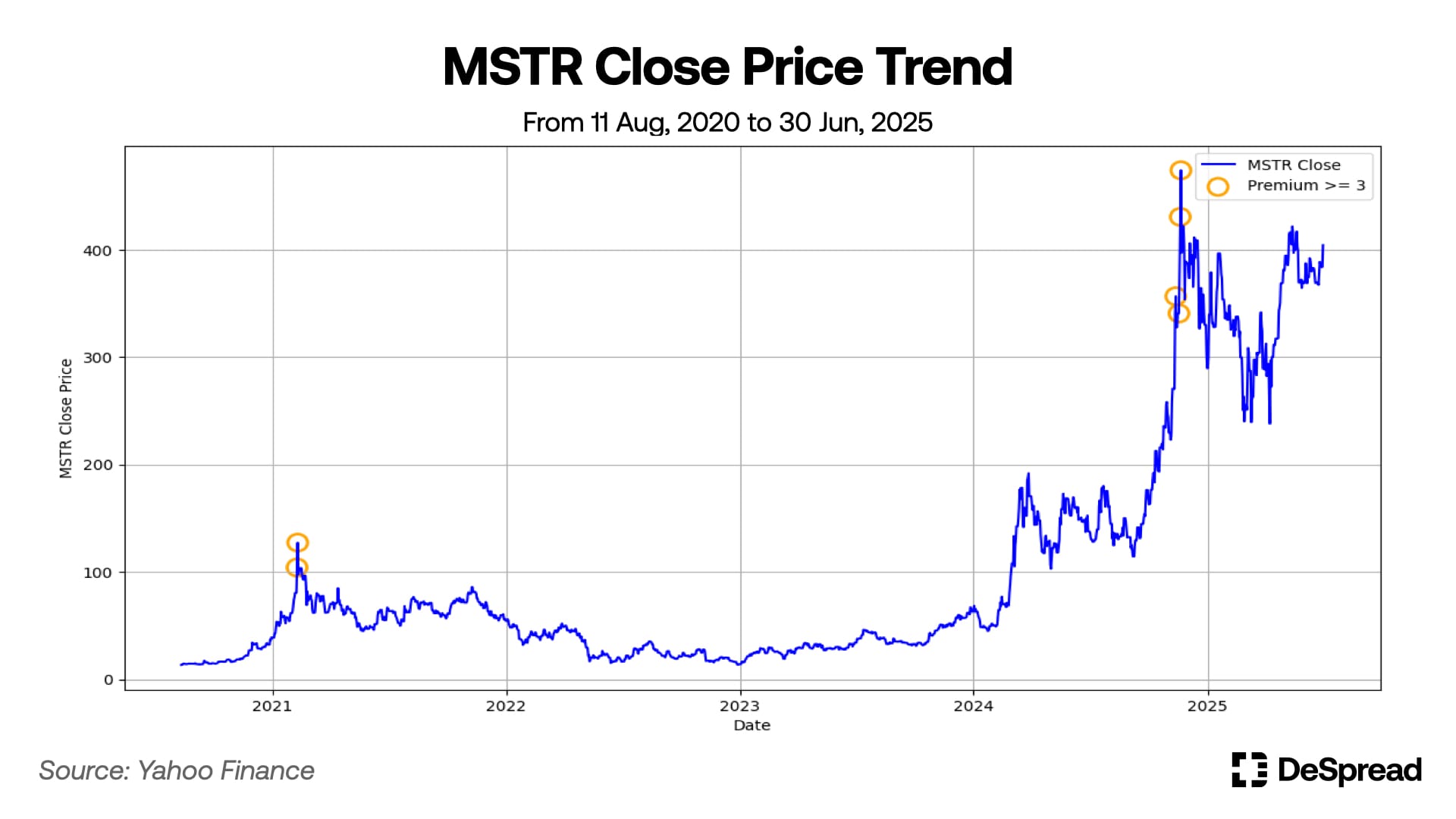

The chart above illustrates the NAV premium trajectory of Strategy Inc. from January 11, 2024, when it began its latest Bitcoin accumulation phase, through June 30, 2025. Over this 548-day period, Strategy maintained a premium above 1.5x NAV on 480 days, with an average premium of 1.879 and a peak of 3.407—a remarkably elevated level.

Even more striking is the behavior of newer DAT entrants such as Metaplanet, DeFi Development Corp., and Sharplink Gaming, which have recorded NAV premiums ranging from 300% to over 500% following the launch of their respective strategies. It is worth noting that Strategy itself experienced a similar phenomenon in September 2020, when its NAV premium spiked as high as 535% shortly after initiating its original Bitcoin acquisition plan.

Business models like DAT, which have emerged recently, continue to maintain relatively high premiums as the market acknowledges their innovation and growth potential. However, it is clear that once the premium rises beyond a certain threshold, the DAT model is no exception to the risk of a bubble collapse. The chart above shows the closing price of $MSTR from August 11, 2020, to June 30, 2025, with orange dots indicating the dates on which Strategy’s premium exceeded 3.

Strategy has recorded a premium above 3 on six occasions: February 8–9, 2021, and November 12, 17, 19, and 20, 2024. These dates closely align with local tops in MSTR’s price. On February 9, 2021, MSTR reached a peak of $131.5, after which it declined steadily for nearly two years, losing approximately 90% of its value. Similarly, on November 19, 2024, Strategy’s premium exceeded 3.4, and two days later, MSTR hit a new all-time high of $543. However, over the following four months, the stock trended downward, eventually experiencing a drop of more than 57%.

4.2. Market Risk – Excessive Dependence on Bitcoin

The value of DAT companies is heavily influenced by the digital assets they hold. In the case of Strategy, Bitcoin accounts for more than 99% of its total assets, making it reasonable to consider the company’s asset value as essentially equivalent to that of Bitcoin. Furthermore, as previously discussed, the DAT business model and its sustainability are structurally dependent on the price of the digital assets they accumulate. This chapter analyzes MSTR’s correlation with BTC, volatility ratio, and beta to assess how significantly DAT companies are influenced by their underlying digital assets and how much more volatile they are by comparison.

4.2.1. Correlation Coefficient

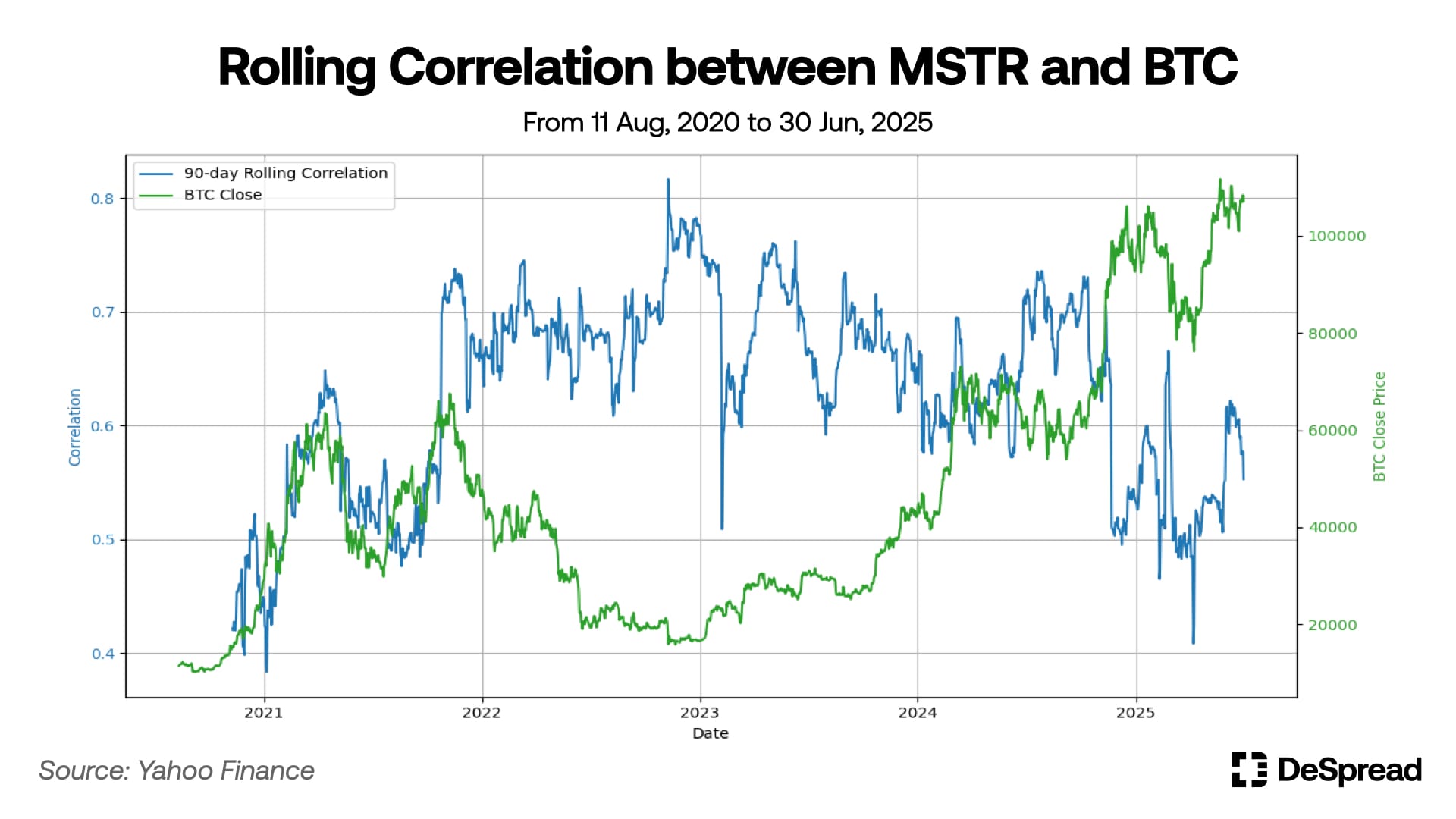

Daily logarithmic returns were used to measure the correlation between the two assets, and the analysis shows that the Pearson correlation coefficient between MSTR and BTC from August 11, 2020, to June 30, 2025, was 0.6012. During the same period, the correlation coefficients of BTC with SPX, IXIC, and COIN were 0.3414, 0.3611, and 0.5573, respectively, indicating that MSTR had one of the strongest linear relationships with Bitcoin among traditional asset classes.

A review of the 90-day rolling correlation between MSTR and BTC shows an average of 0.6286 and a peak of 0.8167, confirming a consistently strong linear relationship between the two assets. Notably, since 2022, the correlation between MSTR and BTC tends to increase more sharply during bear markets than in bull markets. This suggests that while MSTR’s price may exhibit some degree of independence during BTC uptrends—driven by company-specific factors—investor sentiment becomes far more reactive during downturns. In bearish conditions, the structural dependence on Bitcoin and NAV premium amplifies selling pressure, reinforcing price coupling between the two assets.

4.2.2. Beta and Volatility Ratio

While the correlation coefficient reflects the degree of linear co-movement between MSTR and BTC, beta measures the sensitivity of MSTR’s returns to changes in BTC’s returns. Based on the same dataset, MSTR’s beta with respect to BTC is calculated at 0.9555. This indicates that, on average, a 1% change in BTC’s return corresponds to a 0.9555% change in MSTR’s return.

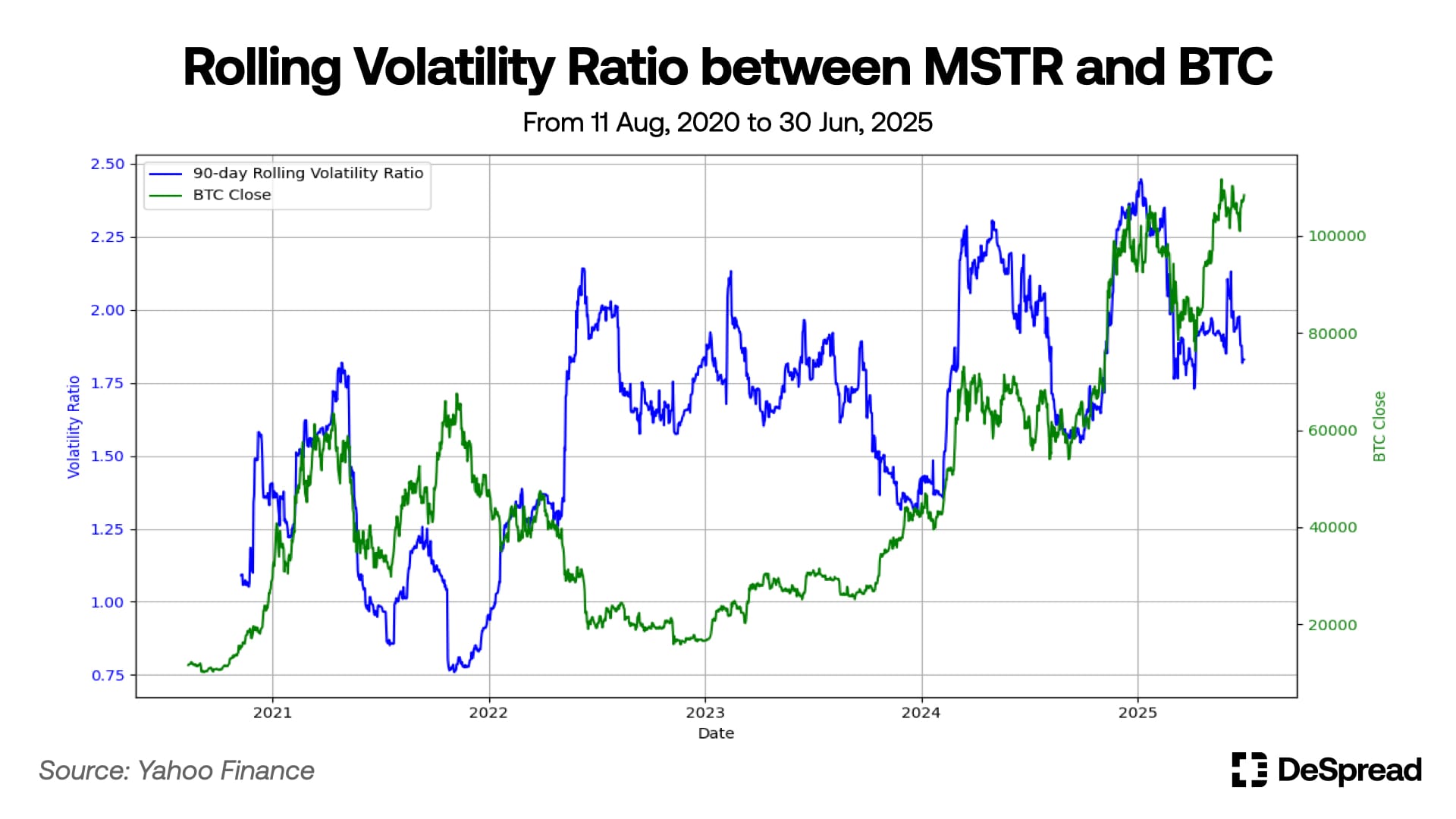

Volatility ratio measures how much more volatile MSTR is compared to BTC. Using daily logarithmic returns, annualized volatility was derived by multiplying daily standard deviation by the square root of 252. The results show BTC’s annualized volatility at 0.4987 and MSTR’s at 0.7926, yielding a volatility ratio of 1.5893 (0.7926/0.4987). This implies that for any given period, if BTC moves by x%, MSTR tends to move by approximately 1.6x% on average.

Volatility has become increasingly amplified, indicating that the market views MSTR as a structured Bitcoin leverage product. Notably, on January 6, 2025, the 90-day relative volatility reached an all-time high of 2.447.

What is particularly noteworthy is the shift in volatility patterns. During the bear market of 2022, MSTR’s relative volatility tended to spike during Bitcoin price declines. In contrast, the current pattern shows increased volatility during BTC uptrends. This change is likely due to Strategy’s structural adaptation through ATM and convertible bond issuance, which strengthens its capital-raising capacity in tandem with rising Bitcoin prices.

This shift in volatility dynamics suggests that Strategy has established structural relevance not only in crypto markets but also in traditional financial markets. It further indicates that the firm, as a DAT model, has positioned itself for explosive upside potential during bullish phases.

Taking the three metrics together, we can draw the following conclusions about the relationship between MSTR and BTC, and more broadly between DAT stocks and their underlying digital assets.

- Limited directional correlation

The correlation coefficient between MSTR and BTC stands at 0.6012, demonstrating a statistically significant linear relationship. This value is higher than the correlation between BTC and major traditional equity indices such as the S&P 500 and NASDAQ, as well as crypto-related stocks like Coinbase. However, a coefficient of 0.6 also implies that MSTR is meaningfully affected by other factors—including capital structure, fundraising mechanisms, and stock market liquidity—resulting in a relatively constrained linear relationship with BTC.

- High sensitivity and elevated volatility ratio due to the corporate structure

MSTR’s beta of 0.9555 indicates that the stock responds to changes in BTC prices with nearly one-to-one sensitivity. This reflects not only the firm’s extensive Bitcoin holdings but also the structural dependence of its valuation and revenue model on the value of those holdings. As a result, the market increasingly perceives MSTR as an indirect leverage instrument on BTC. The fact that MSTR’s volatility is approximately 1.6 times higher than BTC’s suggests that the stock is viewed not merely as a BTC tracker, but as a high-volatility structured product that amplifies the expected return profile of Bitcoin.

In sum, MSTR is structurally highly exposed to Bitcoin, yet exhibits even greater volatility due to company-specific risks. It is widely regarded as a “Bitcoin leverage asset within the securities market.” While this DAT model may serve as an attractive alpha-generating vehicle during bull markets, it carries a critical vulnerability: excessive risk concentration during bear cycles.

4.3. Financial Risk – Debt Repayment Pressure

Alongside ATM issuance, convertible bonds have served as one of Strategy’s primary fundraising tools. Between 2020 and 2024, the company issued several billion dollars’ worth of convertible bonds to finance its BTC purchases. These instruments were generally issued with low interest rates around 0.625% and high conversion premiums of 35–50% above the stock price at issuance, allowing bondholders to capture significant upside if BTC prices rose.

In theory, given Strategy’s B– credit rating from S&P as of July 2024, the company should not be able to issue convertibles at sub-1% rates. However, the presence of high conversion premiums and the potential for long/short arbitrage using MSTR’s short interest enabled market participants to view these instruments more as premium-free call options than traditional debt. This perception formed the basis for the atypical low-cost structure and allowed Strategy to access capital under terms far more favorable than its credit rating would suggest.

As a result, convertible bonds have played a dual role in Strategy’s financing strategy, operating alongside ATM issuance as a key vehicle for scaling its Bitcoin treasury.

Between December 2020 and June 2024, Strategy issued convertible bonds on eight separate occasions, totaling approximately $9.78 billion. Among these, the bonds issued in December 2020 and December 2021 were subject to a *soft call clause and were either converted into equity or repaid in cash.

*soft call: the right of the issuer to redeem the bonds early if certain conditions are met, such as the stock price staying above 130% of the conversion price for a defined period.

As of now, Strategy is obligated to repay roughly $8.2 billion in convertible debt by June 2032. This represents a major financial liability over the next several years. While most of the bonds have conversion prices lower than the current stock price ($415), they are not exercisable for at least another two years. A particularly large maturity wall looms between December 2029 and March 2030, when $5.8 billion is set to mature within a three-month window. This figure far exceeds Strategy’s current cash and equivalents, which stood at just $60 million as of July 2025. If MSTR trades below the conversion price at maturity, Strategy will be forced to repay in cash.

In the event that MSTR’s price remains below the conversion threshold at maturity or on the put date, Strategy will face two primary options:

- Sell a portion of its Bitcoin holdings to meet its debt obligations

- Raise new funds in advance through ATM issuance or additional convertible debt

Among the two, the second option appears more likely. Selling Bitcoin to repay debt would not impose a severe financial burden on Strategy. The company currently holds 597,325 BTC, worth around $69.5 billion, and will likely hold even more in two to three years. Assuming it could liquidate BTC smoothly, the $8.2 billion in repayments would not be a major burden.

However, independent of the balance sheet impact, the mere act of selling Bitcoin could have a significant psychological and market impact. Since 2020, Strategy has consistently acquired Bitcoin at scale and publicly committed to never selling a single coin. It has become a central player in the market. In the current environment, even news that Strategy did not buy Bitcoin in a given week can trigger negative headlines. If the company were to sell Bitcoin, it could cause more than just price pressure—it could raise doubts about the sustainability of the entire DAT business model and potentially spark a trust collapse that spirals into a broader selloff.

The second scenario—raising funds through ATM or new convertible issuance before maturity—also comes with risks. Most of Strategy’s existing convertibles have conversion prices set more than 50% above the current stock price. If the stock continues to trade below those levels, redemptions in cash would imply that MSTR's NAV premium has significantly compressed. In such an environment, equity-based fundraising via ATM becomes nearly impossible, forcing the company to rely on convertible bonds or conventional corporate debt.

In this case, it would be difficult to maintain the ultra-low interest rates Strategy previously secured. The company would likely need to offer above-market rates, increasing its interest burden. Moreover, if it becomes known that Strategy is using new debt not to acquire more Bitcoin, but to repay existing obligations, this could damage investor confidence—not just in Strategy, but in the broader financial independence and growth narrative of all DAT companies.

This highlights a structural limitation common across DAT firms: their heavy reliance on digital assets. Many DAT firms are already aware of this issue and are working to establish more stable and scalable revenue models based on their holdings. Firms that hold on-chain assets like ETH, SOL, and HYPE are increasingly turning to staking and DeFi to generate returns. Metaplanet, Japan’s largest corporate Bitcoin holder, has also announced plans to use its BTC as collateral to raise cash, which it will use to acquire cash-generating businesses and expand into financial services.

For DAT firms to be sustainable in the long term, they must move beyond simple digital asset accumulation and diversify structurally into recurring revenue and financial service offerings. The speed and clarity with which they present this evolution will determine whether they can earn the market’s trust as institutional players operating across both Web2 and Web3.

5. The Next Challenge for DAT Firms — From Premium to Multiple

If the business model of a DAT firm is simply to purchase digital assets on behalf of others, it is not difficult to argue that there is no fundamental reason for the premium to persist. Monetizing the premium to gain an advantage in capital raising is not a sustainable business model that produces real yield; rather, it is a short-term tactic that leverages a temporary flywheel event.

However, we do not believe that the consistently high premiums observed in DAT firms over a significant period of time can be dismissed as mere inefficiencies driven by speculative demand. Once we strip away the speculative premium, we can infer that there is a prevailing market expectation for how these firms will generate returns from the digital assets they have accumulated.

In other words, DAT firms today are in the phase of raising capital and accumulating strategic assets necessary for their future business. This suggests that the current premium can be interpreted as a type of “multiple.”

In traditional equity markets, when a company is expected to grow, the market often prices in that growth in advance, forming a multiple. The company then either outperforms or underperforms relative to that valuation. If the company’s growth potential was overestimated, the multiple contracts, and its market value converges to its book value, or in some cases, falls below it.

The same applies to DAT firms. If their business model ends with the mere act of holding digital assets, then their valuations will revert to book value, implying a premium of zero. In fact, given the idiosyncratic risks tied to individual firms, a discount may be more likely. As ETFs emerge and the custody of digital assets becomes increasingly institutionalized, there will be diminishing incentive to hold equity in a DAT firm at all.

Therefore, DAT firms must move beyond simple asset holding and satisfy market expectations for multiples through diverse monetization and commercialization strategies based on their holdings. If they fail to do so, the market will inevitably conclude that the DAT model and its premium were illusory.

This chapter will propose ways in which DAT firms can generate profits from their digital asset holdings, and analyze the structural characteristics and constraints of each approach.

5.1. Off-Chain Asset Management

5.1.1. Lending

DAT firms can generate interest income by either lending their digital assets directly or using them as collateral. Similar to traditional secured lending, institutional-grade crypto-backed lending is already being offered on platforms such as BitGo Prime, Anchorage, Galaxy, and CoinList.

The key advantage lies in securing relatively stable interest income. Even with highly volatile assets, it is possible to earn predictable yields, and with proper risk management, this can be an efficient and high-return strategy.

However, it is essential to recognize the severe counterparty risk that exists in crypto markets, as evidenced by past incidents involving Genesis, Celsius, and Voyager. For DAT firms, it is crucial to clearly communicate to the market that all lending operations are conducted under institutional-grade custody and compliance frameworks.

5.1.2. Option Selling and Structured Products

DAT firms can also implement derivatives-based strategies using assets like BTC. One example is the covered call strategy, where call options are sold against held spot assets to collect option premium income.

This approach is particularly effective when firms aim to hold assets long-term, and it can provide stable returns during sideways or mildly bullish markets. It is a well-established monetization method in traditional equity markets.

For more advanced structuring, firms can benchmark traditional structured products like ELS. For example, a BTC-based ELS product could be designed as follows:

- Underlying asset: BTC/USD

- Maturity: 6 to 12 months

- Condition: Pays a 12% annualized return if BTC does not fall more than 30% before maturity

- Structure: DAT firm sells call/put options and collects premium income, which is then used to fund the return at maturity

Such structures allow for the creation of cash flow-focused instruments with attractive risk-adjusted yields, providing a potential foundation for institutional partnerships.

Ultimately, DAT firms can package digital assets like BTC into products that resemble fixed-income instruments and offer them to LPs or third-party institutions. This strategy not only diversifies revenue streams but also presents a compelling value proposition for attracting external capital.

5.1.3. Fund of Fund

If a DAT firm lacks in-house asset management capabilities or has access to external partners with specialized strategies, it may consider a Fund of Fund approach—delegating part of its holdings to crypto asset managers, hedge funds, or quant trading firms.

That said, the crypto market is still recovering from trust breakdowns and counterparty risk following incidents like Luna and FTX. The memory of failures such as 3AC and Haru Invest has made outsourced management a sensitive issue.

Therefore, any Fund of Fund strategy must be accompanied by robust due diligence protocols and transparent communication with the market. In some cases, it may be more appropriate to adopt a non-custodial structure, where the DAT firm retains asset custody but outsources only the execution of investment strategies.

5.1.4. Offering Volatility-Based Trading Instruments

Strategy has not only held Bitcoin but also aggressively employed a convertible bond structure that leverages the high volatility of its own stock. This mechanism works by facilitating gamma trading executed by market participants, not by Strategy itself.

Between 2024 and 2025, MSTR’s realized volatility exceeded 100%, and its 30-day implied volatility was up to 2.5 times higher than that of BTC options. This indicates that the embedded call options within MSTR’s convertibles held substantial value, creating an ideal setup for investors engaging in gamma trading.

Gamma trading refers to a strategy in which convertible bond holders buy and sell MSTR stock repeatedly to hedge the delta exposure of the embedded call options. This allows investors to profit regardless of directional movement. It is not a strategy executed by Strategy but rather a trading framework enabled by the issuance of its convertibles. Over multiple rounds of issuance, Strategy effectively established itself as a gamma trading hub.

This structure holds strategic significance for Strategy. By issuing convertible bonds with high NAV premiums, the firm can secure low-cost capital, which it can then use to buy more BTC or expand operations. Designing a structure that offers this kind of opportunity and deploying it repeatedly becomes a strategic financing method.

In summary, gamma trading does not directly generate revenue for DAT firms, but it boosts demand, volume, and volatility for their stocks. This, in turn, fuels the premium → capital raising → BTC purchase or business expansion → enhanced premium flywheel. The entire mechanism functions as a financial engineering-based fundraising strategy.

However, this structure relies heavily on sustained market trust and engagement. Therefore, it is better understood as a premium-defense mechanism based on market structure, rather than as a genuine profit-generation model that justifies the premium.

In the case of Metaplanet, a later entrant, the strategy may appear similar to Strategy’s on the surface—large-scale Bitcoin holdings, DAT positioning, and capital raising via MS warrants. But due to structural differences, gamma trading does not occur organically across the broader market. Instead, it is monopolized by a single player: EVO Fund.

Through a pre-arranged deal with Metaplanet, EVO Fund acquired a significant volume of MS warrants and has the rights and liquidity to implement gamma trading or convertible arbitrage strategies using both the directional movement and volatility of the underlying stock. But this setup is fundamentally different from Strategy’s market-driven “gamma casino.” Metaplanet hasn’t opened a casino—it has reserved a private table for EVO Fund.

As a result, Metaplanet does not benefit from structural volatility driven by widespread trading activity, nor does it enjoy premium support based on market-driven volume. Gamma trading in this context benefits EVO Fund, but does not contribute to the sustainability of Metaplanet’s premium. Furthermore, since it does not create an appealing trading environment for external traders, there are clear limits to building a trust-based flywheel of liquidity and market participation.

5.2. On-Chain Asset Management

5.2.1. Staking – Securing Base Yield Through Network Participation

When a DAT firm holds native tokens based on proof-of-stake, the most fundamental form of on-chain monetization is earning validator rewards by contributing to network security through staking.

There are two ways to stake:

- A passive approach, in which the firm delegates its stake to external validators and receives a portion of the reward

- An active approach, where the DAT firm operates its own validator node, collects rewards directly, and attracts third-party delegations

By becoming a validator, a firm can earn rewards not only from its own stake but also collect additional fees from delegators. Therefore, companies that hold large stakes or can attract them have the potential to secure stable, recurring on-chain income.

In practice, DAT firms such as Sol Strategies, DeFi Development, and Hyperion DeFi are already staking their acquired tokens to earn block rewards. These firms not only operate as validators but also engage in ecosystem contributions—development, marketing, and community support—creating incentives for delegation and maximizing validator fee revenue. The validator role goes beyond mere income generation; it plays a critical part in reputation-building and community influence within the blockchain ecosystem.

However, validation also comes with risks. Network downtime or failures can result in slashed rewards, and actions such as double-signing or violating network rules may lead to forced token burns. These penalties are executed automatically on-chain, unlike traditional asset losses, making infrastructure stability and proactive risk management essential for DAT firms.

Bitcoin is a notable exception. As a proof-of-work network, BTC does not offer staking rewards simply through holding. Participating in block validation requires specialized hardware and significant electricity costs, which impose accounting, environmental, and financial burdens. For a public company, directly running a mining operation is a challenging proposition. Since BTC does not yield staking income natively, DAT firms must pursue alternative operational strategies to generate yield.

5.2.2. On-Chain Finance

For publicly listed DAT firms operating under regulatory compliance, there are two potential pathways for using their assets in on-chain financial transactions.

- CeDeFi – A path to monetizing on-chain finance with regulatory compliance

Centralized DeFi (CeDeFi) leverages the openness and flexibility of public blockchains while meeting the compliance requirements of institutional investors (KYC/AML/CFT, custody, etc.). Positioned between traditional CeFi and DeFi, CeDeFi has emerged as a practical solution for public companies and regulated institutions seeking to participate in on-chain finance.

One leading example is Maple Finance’s Bitcoin yield product. Maple provides BTC-denominated yield to investors by converting validator rewards from the Core Network. The platform works with regulated custodians like BitGo, Copper, and Hex Trust, and restricts participation to users who have completed KYC. This allows institutions to engage in public chain activities while remaining compliant. Several institutional players are already managing their on-chain assets through this structure.

However, the CeDeFi market is still in its early stages, with most products currently centered around dollar-denominated debt financing. But as the market evolves, we can expect the emergence of “onchain-yield-as-a-service” platforms that utilize AMMs, funding rate vaults, and CDPs—elements that are native to blockchain environments—to generate additional yield.

Looking further ahead, the growth of permissioned applications tailored for regulatory compliance may give rise to institutional money markets where DAT firms can deploy their assets in on-chain financial operations.

- DeFi – From Direct Use to Infrastructure Provider

On public blockchains like Ethereum and Solana, anyone can deploy financial services via smart contracts, enabling DAT firms to generate yield from their holdings. While smart contracts eliminate counterparty trust requirements, they introduce new risks related to code vulnerabilities.

Unlike traditional counterparty risks, losses resulting from protocol exploits carry ambiguous legal responsibility. For DAT firms, which operate as public companies bound by fiduciary duties and unlimited accounting liability, this introduces a serious structural risk. In such cases, Conditional VaR could effectively be considered -100%, meaning these risks are fundamentally unmanageable under existing corporate governance frameworks.

The second major consideration is regulatory risk. In a 2023 report, the U.S. Treasury and FinCEN made it clear that DeFi platforms performing financial activities must comply with AML/CFT regulations under the BSA, regardless of whether they operate in a decentralized fashion. The FATF similarly stated that when DeFi protocols are controlled or significantly influenced by a central party, they qualify as VASPs and must implement KYC, Travel Rule, and SAR reporting obligations.

That said, by 2025, the regulatory environment has begun to shift toward a more relaxed and calibrated approach. In April, the U.S. Congress officially withdrew the IRS’s 1099-DA broker rule expansion, exempting DeFi platforms from broker reporting requirements. The SEC announced plans for an “innovation exemption,” and FinCEN signaled a softer stance on decentralization by deferring or relaxing BOI reporting obligations. In May 2025, the SEC issued a formal clarification stating that “direct staking activity does not fall under the Howey Test,” reducing legal uncertainty around participation in public networks.

In short, U.S. regulation around DeFi is gradually moving away from blanket prohibitions and reclassification as financial institutions. Instead, it is transitioning toward risk-based differentiation, laying the groundwork for DAT firms to design indirect yield-generating structures.

A strong example of this is DeFi Development’s issuance and integration of liquid staking derivatives. Rather than seeking returns through active asset management, the company’s primary goal is infrastructure development that supports the ecosystem.

Any on-chain user can delegate SOL to DeFi Development and receive both block rewards and a derivative asset called dfdvSOL. This token is pegged to the underlying SOL and can be reused throughout the Solana ecosystem. Since launching its DAT model, DeFi Development has quickly integrated dfdvSOL into various Solana applications, providing users with compelling reasons to delegate their assets to the firm.

5.3. Establishing New Business Models

DAT firms based on Bitcoin may be particularly well-positioned to explore new business models, given the asset’s relatively strong value foundation and clearer legal standing. Strategy has emerged as a symbolic case of this strategic pivot. The company signed a contract to issue up to $4.2 billion in STRD preferred shares and explicitly stated that the funds would be used not only for additional BTC purchases but also for general corporate purposes, including new business investments, operating capital, and strategic expansion.

One example of such a strategy is Saylor’s publicly stated vision for Bitcoin-backed mortgage products. In conversations with William Pulte, a commissioner of the Federal Housing Finance Agency, Saylor discussed the possibility of institutionalizing BTC-backed mortgages and proposed using Bitcoin collateral to reduce barriers to home ownership and credit market access. At the BTC conference in Prague, Saylor and Blockstream CEO Adam Back presented the idea of BTC-backed bonds offering fixed yields of 6–10%, as well as tokenized stocks and structured credit products—positioning Bitcoin not merely as an investment vehicle, but as a collateral asset capable of integration into the broader financial system.

DAT firms holding native assets from purpose-driven public blockchains may also consider leveraging economies of scale to create new lines of business. For instance, if a firm accumulates a large quantity of Hyperliquid’s HYPE token, it could transition from passive holding to a more institutionalized, commercial use of the token’s utility. Hyperliquid currently offers a HIP-3 standard that allows entities staking one million HYPE to gain the right to open a perpetual futures market, including control over fee structure and operational rights.

This structure opens the door for a HYPE-holding DAT firm to operate directly as a derivatives infrastructure provider. Instead of relying solely on token price appreciation, such a model enables long-term revenue generation by acquiring market operator rights through staking and continuously collecting a share of trading fees. There is also potential to expand into a Derivatives-as-a-Service model, offering tailored instruments for hedging risk. Business models based on such governance-token-linked privileges could represent a broader experimentation ground for DAT firms looking to establish themselves as “on-chain financial infrastructure operators” across various blockchain ecosystems.

Whether these business ventures and asset management strategies will immediately produce meaningful revenue, or allow DAT firms to maintain market attention beyond short-term speculative premiums and toward sustained multiples, will ultimately depend on the capabilities of each firm. Investors must thoroughly analyze each DAT firm’s business roadmap and execution strength and distinguish between speculative premiums and true multiples that reflect the market’s recognition of long-term value.

6. Conclusion and Recommendations — Sustainability and Policy Imperatives of the DAT Model

The concept of the DAT model can no longer be sufficiently explained by describing it simply as a company that holds Bitcoin. These firms have evolved into active financial actors that seek to extract value beyond the assets they hold through interaction with the market. The cases of Strategy, Metaplanet, and DeFi Development show that these are not just investment vehicles, but experimental financial systems that continuously adjust their strategies across asset management, capital markets, technology, and regulatory environments.

6.1. DAT is not a static holding model, but a market experiment

The core of a DAT firm is not simply “holding digital assets.” Asset holding is something anyone can do. What defines a DAT is the ability to build financial structures using those assets—within the framework of a publicly listed company—based on audited disclosures, accounting standards, and engagement with the capital market.

This structure can take many forms: facilitating gamma trading, designing structured products, or connecting assets to the DeFi ecosystem. DAT is not a holding model—it is a utilization model.

6.2. The premium reflects expectations, not just speculation

Many see the DAT model as a speculative premium bubble. But the key is that the market views the premium not as a reflection of asset value alone, but as a forward-looking valuation of potential earnings. This is similar to the concept of a multiple in traditional equities.

- In the case of Strategy, the premium was not just for holding Bitcoin, but because it offered market participants gamma trading opportunities. The firm is now seeking to convert that premium into a multiple by expanding into BTC-based financial products.

- DeFi Development has shown multiple potential not through validator rewards alone, but by creating infrastructure and derivative structures like dfdvSOL.

To sustain a premium, a business model capable of turning that premium into a multiple is essential.

6.3. The premium itself entails structural risk

The DAT model functions as a powerful flywheel in a bull market, but it is also highly exposed during downturns.

Structural risk: If the premium collapses, capital raising ability becomes constrained, and pressure to liquidate holdings can threaten both corporate value and the broader market. The DAT model is a double-edged sword: the same force that drives its virtuous cycle also accelerates its unraveling.

Market risk: DAT firms operate like high-volatility leveraged products on their underlying digital assets. In bull markets, they offer amplified alpha on BTC performance, but in bear markets, they tend to fall faster and harder than BTC itself. Correlation with BTC intensifies during downturns, compounding risk exposure.

Financial risk: Strategy’s convertible bonds, predicated on MSTR’s growth potential, have been a key driver of its expansion. But the looming maturity wall in 2–3 years may trigger repayment pressure that, if not managed, could undermine trust not only in Strategy but in the broader DAT sector.

These risks are not isolated to individual firms—they are embedded in the DAT model’s conditional stability. That is why policy and institutional frameworks are crucial for enabling the transition from premium to multiple.

6.4. Monetization strategies are essential to achieve a multiple

As demonstrated by prior cases, DAT firms must secure at least one of the following three monetization strategies to continue earning market recognition:

- Off-chain strategies: revenue from collateralized lending, structured products, option selling

- On-chain strategies: revenue from staking, CeDeFi integration, or public DeFi protocols

- Platform strategies: operating derivatives markets, issuing structured credit products, or institutionalizing token utility

This is not simply about “generating income,” but about establishing a distribution mechanism that connects the asset to the market. Only if this connection functions effectively will the market view the premium as a legitimate multiple—otherwise, a holding discount becomes inevitable.

6.5. Accounting, disclosure, and regulatory alignment are indispensable

The DAT model is fundamentally about holding digital assets and interacting with markets to create corporate value. Therefore, for DATs to function properly as public companies, alignment with the accounting and disclosure systems of the capital markets is essential. Without it, DATs risk being misunderstood or undervalued, and cannot sustain long-term multiples.

- Fair value accounting: Under impairment accounting, price increases are not reflected in financial statements, while decreases are recorded immediately. This structurally disadvantages DATs, whose models are built on holding digital assets. Fair value accounting is permitted under K-IFRS, but practical application is limited due to unclear definitions of active markets and data reliability.

- Accounting for validator rewards: Rewards earned from staking in PoS networks (e.g., SOL, ETH) are a form of income and asset appreciation without cash inflow. Yet they are often not clearly classified as “other income” or “valuation gain,” resulting in opaque financial statements. For DAT firms aiming to prove real profitability, clearer definitions and disclosure standards for validator rewards, staking yield, and token incentives are needed.

- Accounting for on-chain financial income: Income generated from tokenized derivatives (e.g., dfdvSOL) or DeFi vaults is almost entirely unaddressed in traditional accounting. DAT firms must pioneer new standards that recognize on-chain financial activity within corporate accounting—this is not just an accounting issue but a policy experiment in itself.

6.6. Disclosures must focus on “what the firm is doing”

For market participants, the most critical factor in investment decision-making is not the funding route but how that capital is used and what strategy is being executed. Therefore, DAT disclosure standards should include:

- Real-time asset information: quantities of BTC, SOL, ETH held, average acquisition cost, and monthly changes. This data is essential for NAV calculation and premium assessment. While MSTR provides this via a public dashboard, standardized disclosure is needed.

- Business plan and strategic use of assets: whether the firm intends to hold, tokenize, participate in validation, or operate a platform. These are fundamental to evaluating a DAT firm’s value and should be formal disclosure items beyond traditional IR reports.

- Disclosure of on-chain activity: validator operations, asset structuring, and protocol integrations are the core of DAT revenue and risk. However, current systems lack standardized formats or templates for on-chain reporting. As a result, the market cannot fully understand “what the firm is doing.” It is time to introduce standard disclosures for on-chain activity.

References

- Strategy.com

- BitcoinTreausriesNet

- CryptoTimes

- Maple Docs

- David Krause, Ponzi or Pioneer? Evaluating the Viability of MicroStrategy's Bitcoin-Focused Model

- Emil Sandstedt, Bitcoin Treasury Companies Are Bubbles

- BitMEX, MicroStrategy Bonds – When Liquidation?

- FSA EDINET

- 適時開示情報閲覧サービス

- Emil Sandstedt, All Your Models are Destroyed — The Rise and Future Fall of MicroStrategy