dTAO — Market-driven Incentive Alignment Mechanism

Examining the background and features of dTAO adoption

1. Introduction

Most blockchain-based protocols tend to acquire users by distributing their native tokens, which often include governance voting rights, to users who actively use or contribute to the protocol through liquidity mining and airdrops.

Subsequently, they attempt to connect the protocol's performance with the value of their native token through methods such as:

- Establishing staking mechanisms and distributing protocol revenues to stakers

- Executing token buybacks using protocol revenues

This approach motivates token holders to propose initiatives that benefit the protocol through governance. However, since users can receive the same benefits by simply holding or staking tokens, actual governance often fails to reasonably accommodate users' opinions.

Meanwhile, protocol governance includes the authority to determine how capital and incentives are distributed within the protocol. If governance activity declines due to the aforementioned issues, a "tragedy of the commons" phenomenon may occur where only a minority of users participate in governance and distribute the protocol's accumulated revenues to maximize their own interests. Paradoxically, governance tokens that exist to decentralize the protocol can end up accelerating centralization.

Recently, blockchain protocols face the challenge of designing incentive structures that connect protocol performance with native token value to ensure sustainability, while simultaneously achieving higher levels of decentralization and alignment of interests among participants.

In this article, we will examine the background and characteristics of the dTAO (dynamic TAO) mechanism proposed by Bittensor as a solution to these challenges.

2. What is Bittensor?

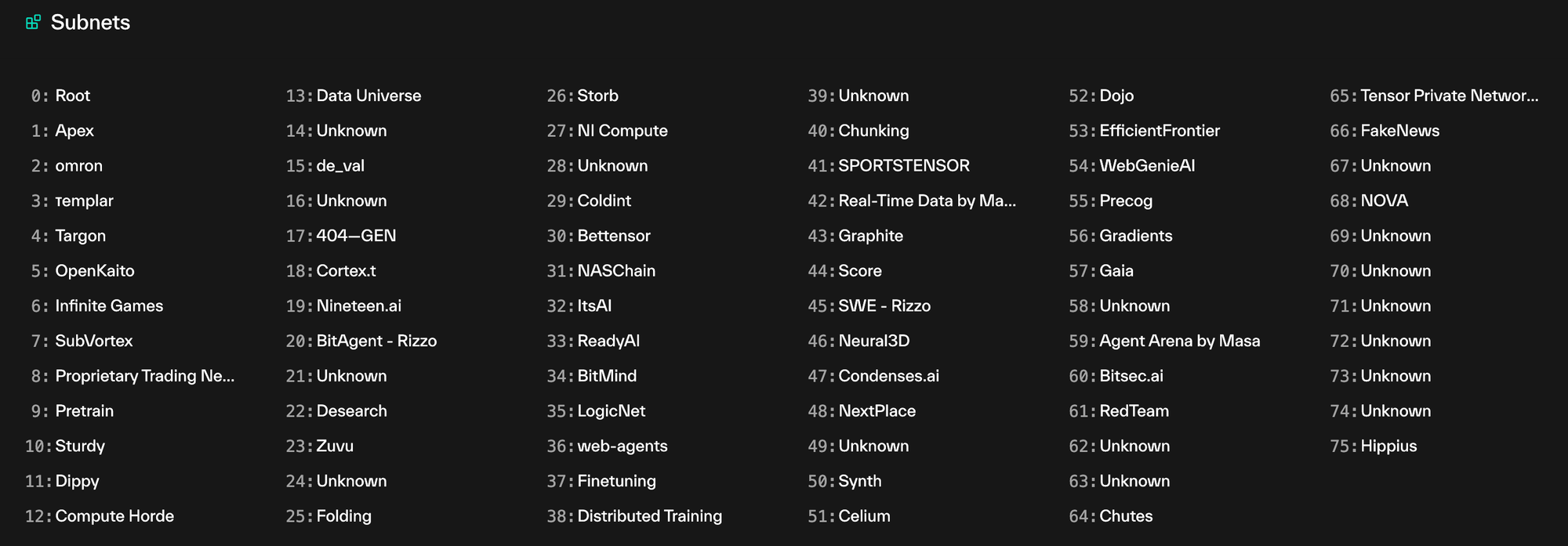

Bittensor is a blockchain-based infrastructure network that builds and provides various digital services such as computing power, storage, AI inference, and learning in a decentralized manner. This ecosystem is centered around a mainnet called Subtensor and consists of various subnets providing specialized services.

- 1. Root: A subnet that manages Bittensor's incentive system

- 5. Open Kaito: A subnet that trains and provides text embedding AI models in a decentralized manner

- 34. BitMind: A subnet that provides AI-based deepfake detection services in a decentralized manner

- 51. Compute Subnet: A subnet that provides GPU computing power in a decentralized manner

Bittensor has its native token, $TAO, used for network fees and subnet validator staking. $TAO has a total supply of 21 million, identical to Bitcoin, with a halving mechanism. Newly issued $TAO is distributed as incentives to participants in the Bittensor network.

Before the introduction of dTAO, Bittensor had a structure where Root network validators evaluated the quality of each subnet, set the $TAO emission weights for the subnets including the Root network, and then distributed them. Each subnet then redistributed the allocated $TAO to subnet participants in the following proportions:

- Miners: Entities providing services supported by the subnet, receiving approximately 41% of the $TAO emission allocated to the subnet. Each miner receives a distribution based on validator evaluations. Note that the Root network does not have miners.

- Validators: Entities evaluating the service output provided by miners, receiving approximately 41% of the $TAO emission allocated to the subnet. Each validator receives a distribution based on their staking proportion.

- Subnet Owners: Entities that created the subnet, receiving approximately 18% of the $TAO emission allocated to the subnet. Note that the Root network does not have subnet owners.

At that time, the $TAO emission to the Root network was not distributed to Root network validators but was reassigned to the reward pool, delaying the $TAO emission rate.

With this structure, Bittensor was able to establish itself as one of the leading infrastructure protocols in the DePIN and AI sectors during this bull cycle, and the price of $TAO steadily increased, achieving a market capitalization of approximately $5.2B.

2.1. Limitations of the Previous Structure

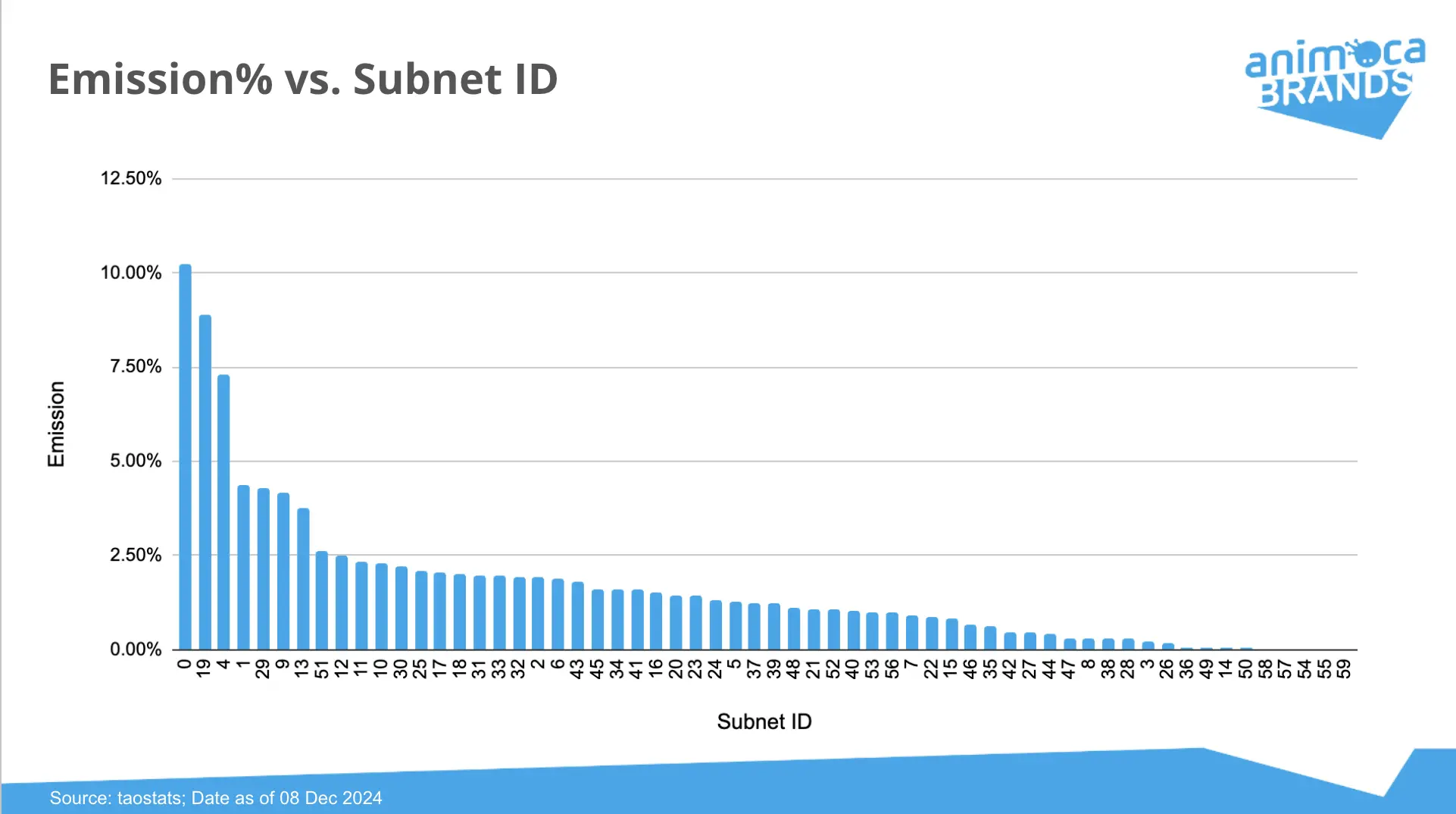

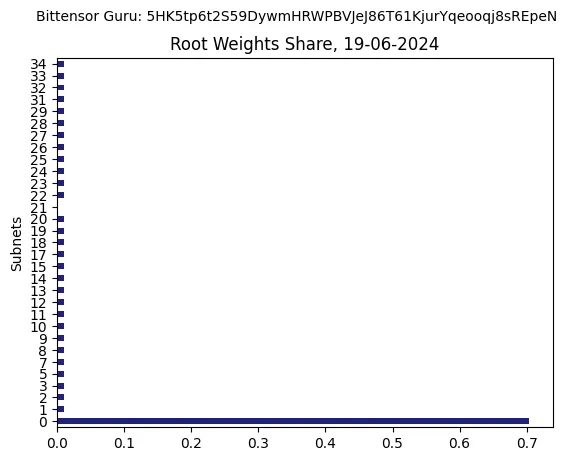

The Root network validators in Bittensor had the greatest authority within the Bittensor ecosystem as they directly evaluated subnets and determined the emission of $TAO to each subnet. This led to the following problems:

2.1.1. Misalignment of Interests

Participants other than subnet validators (miners, subnet owners) had little incentive to hold $TAO long-term, and especially during periods of weak price appreciation expectations, $TAO emitted to subnets was immediately sold on the market. This created an environment that encouraged Root network validators, who had to generate profits solely through $TAO price appreciation without receiving separate emissions, to vote emissions to the Root network.

In this environment, subnets had to compete for limited emissions, and even among promising subnets, there was a tendency to concentrate on those with closer relationships to the top validators of the Root network, making subnet quality evaluation and incentive payments unfair.

2.1.2. Limitations of Scalability

For participants in the Bittensor network to receive incentives proportional to their contributions, reasonable evaluation of subnets by Root network validators was essential. However, since each subnet has different operating methods, purposes, and structures, Root network validators needed in-depth research on each subnet to perform reasonable evaluations.

Due to practical limitations in thoroughly investigating all subnets, some validators tended not to properly evaluate subnets and set detailed emission weights, instead applying a few weights consistently. In such an environment, subnet expansion would further burden other Root network validators, increasing the likelihood of unreasonable subnet evaluations, thus limiting scalability.

To address these issues, the Bittensor community proposed introducing dTAO (Dynamic TAO), a market-driven incentive adjustment mechanism. The proposal was approved and after a year of research, development, and testing, it was implemented on the mainnet on February 13, 2025.

3. dTAO: Entrusting Incentive Adjustment to the Market

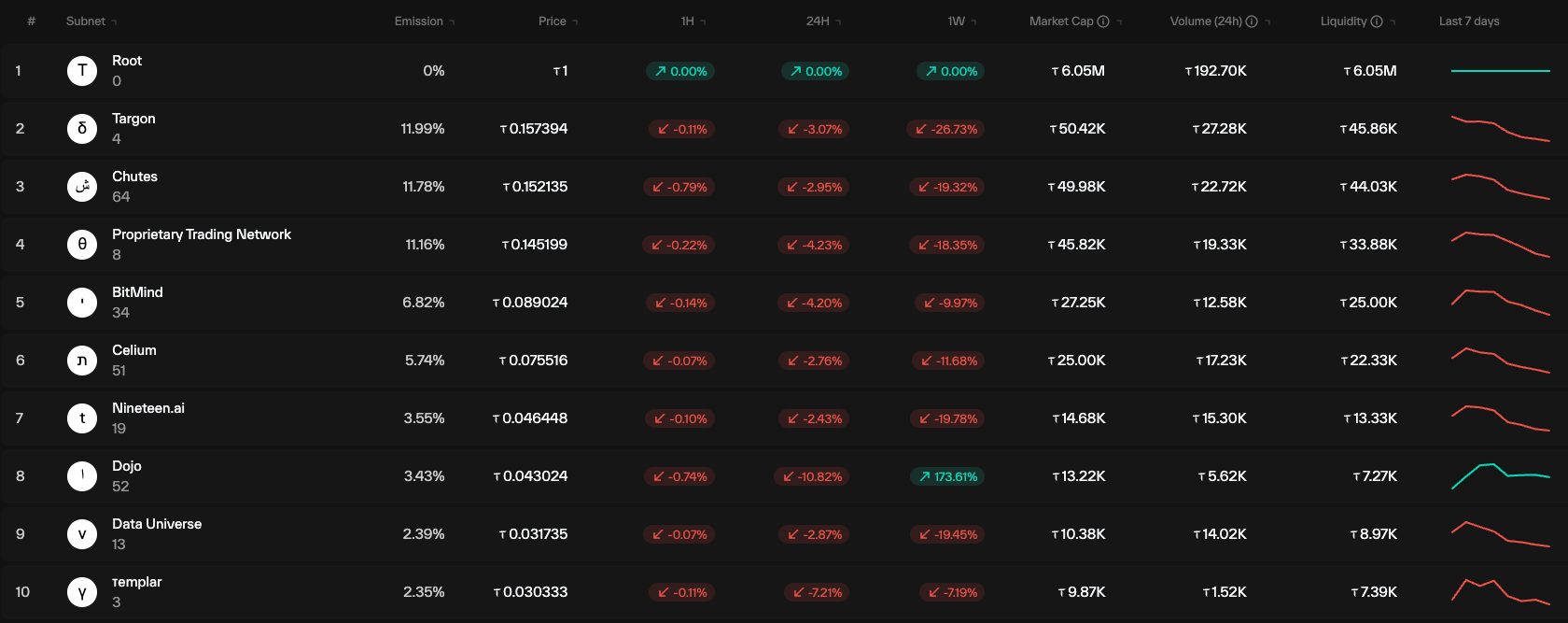

After the introduction of dTAO, each subnet issues a unique 'Alpha Token.' This token is rewarded to subnet participants and serves as a benchmark for the subnet's value assessment in the market. Each Alpha token has a total supply of 21 million, identical to $TAO, and has a structure where the emission amount gradually decreases according to $TAO's halving schedule.

Newly issued Alpha tokens are distributed as follows:

- 50% to the subnet's Reserve Pool

- 20.5% to the subnet's miners, with each miner receiving a distribution based on subnet validator evaluations

- 20.5% to the subnet's validators, with each validator receiving a distribution based on their staking proportion

- 9% to the subnet owner

Regular users can receive Alpha tokens by depositing $TAO into each subnet's Reserve Pool. The number of Alpha tokens receivable is determined by Uniswap v2's price discovery mechanism, X*Y=K, which is also applied when depositing Alpha tokens back into the Reserve Pool to receive $TAO.

In other words, the 'price' of Alpha tokens is set according to the number of $TAO and Alpha tokens in the Reserve Pool, and users can receive Alpha tokens or pay Alpha tokens to receive $TAO through an experience similar to decentralized exchanges, including slippage during trades. However, unlike typical decentralized exchanges, there are no fees for trading, and liquidity provision to the Reserve Pool is not possible.

Additionally, $TAO, which was previously directly distributed to participants based on weights set by Root network validators, is now only distributed to each subnet's Reserve Pool after the introduction of dTAO, proportional to the value of each subnet's Alpha token relative to the total value of all subnet Alpha tokens. For example, if subnet A's Alpha token value is 100 $TAO and the total value of all subnet Alpha tokens is 1000 $TAO, one-tenth of the total issued $TAO is distributed to subnet A's Reserve Pool.

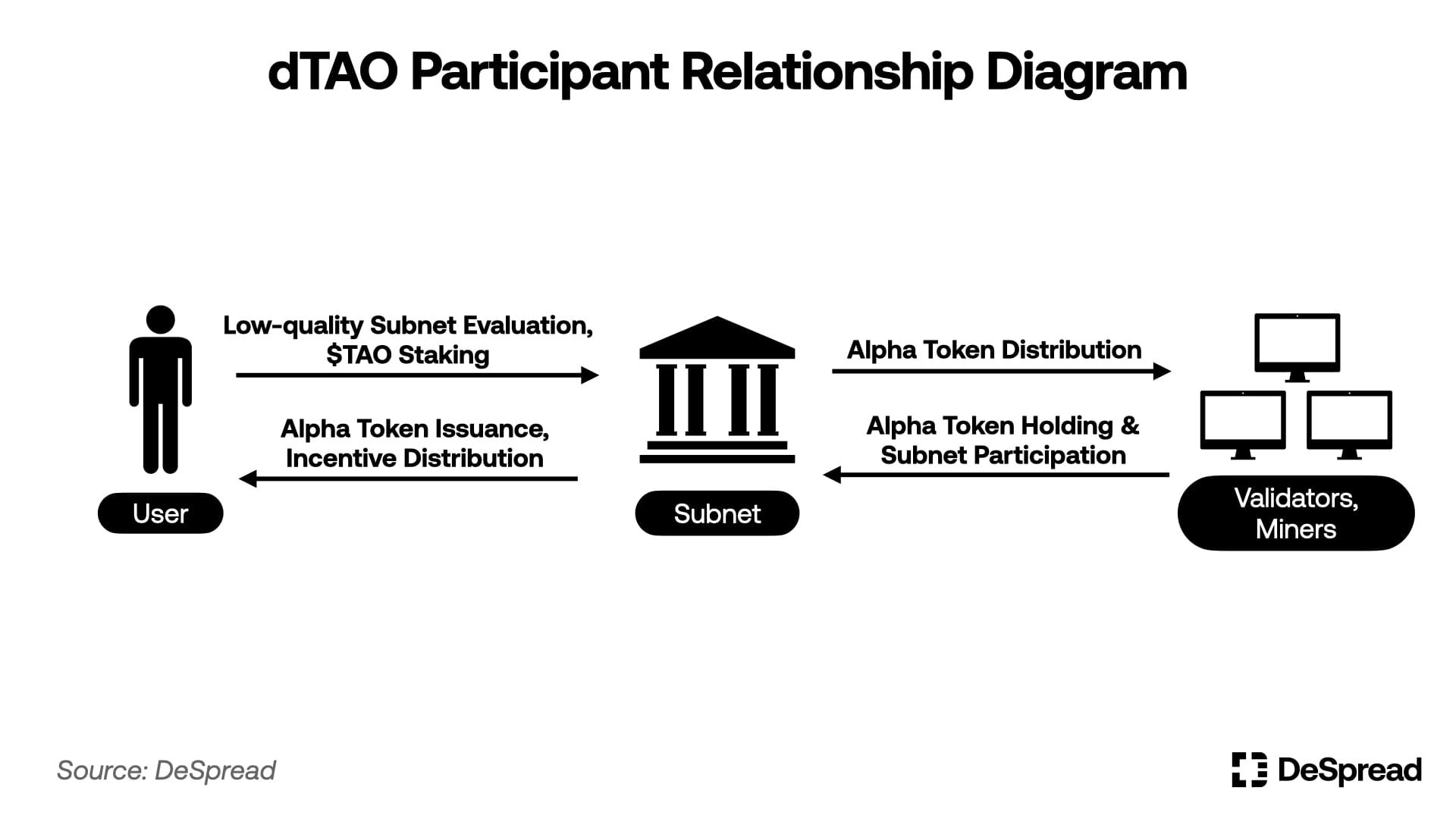

In this structure, participants have the following interests centered around Alpha tokens:

- Validators & Miners: Maintaining Alpha token prices by not selling Alpha tokens received as rewards, thereby encouraging more $TAO emissions to be directed to the subnet they participate in

- Subnet Owners: Maintaining Alpha token prices by not selling Alpha tokens received as rewards, thereby encouraging more $TAO emissions to be directed to the subnet they participate in. If necessary, they can distribute profits generated by the subnet to users holding Alpha tokens to create stronger buying incentives

- Users: Holding undervalued subnet Alpha tokens that provide additional revenue or are likely to provide it in the future

Thus, after the introduction of dTAO, Bittensor has established a structure that aligns the interests of each participant by allowing the market to trade tokens that determine the amount of $TAO rewards each subnet receives based on price, and by distributing incentives to subnet participants in Alpha tokens to suppress selling.

Of course, within this system, there is a possibility that validators, miners, subnet owners, or certain whales colluding with them could artificially raise the value of an Alpha token by mass purchasing and holding it, thereby directing more $TAO emissions to that subnet.

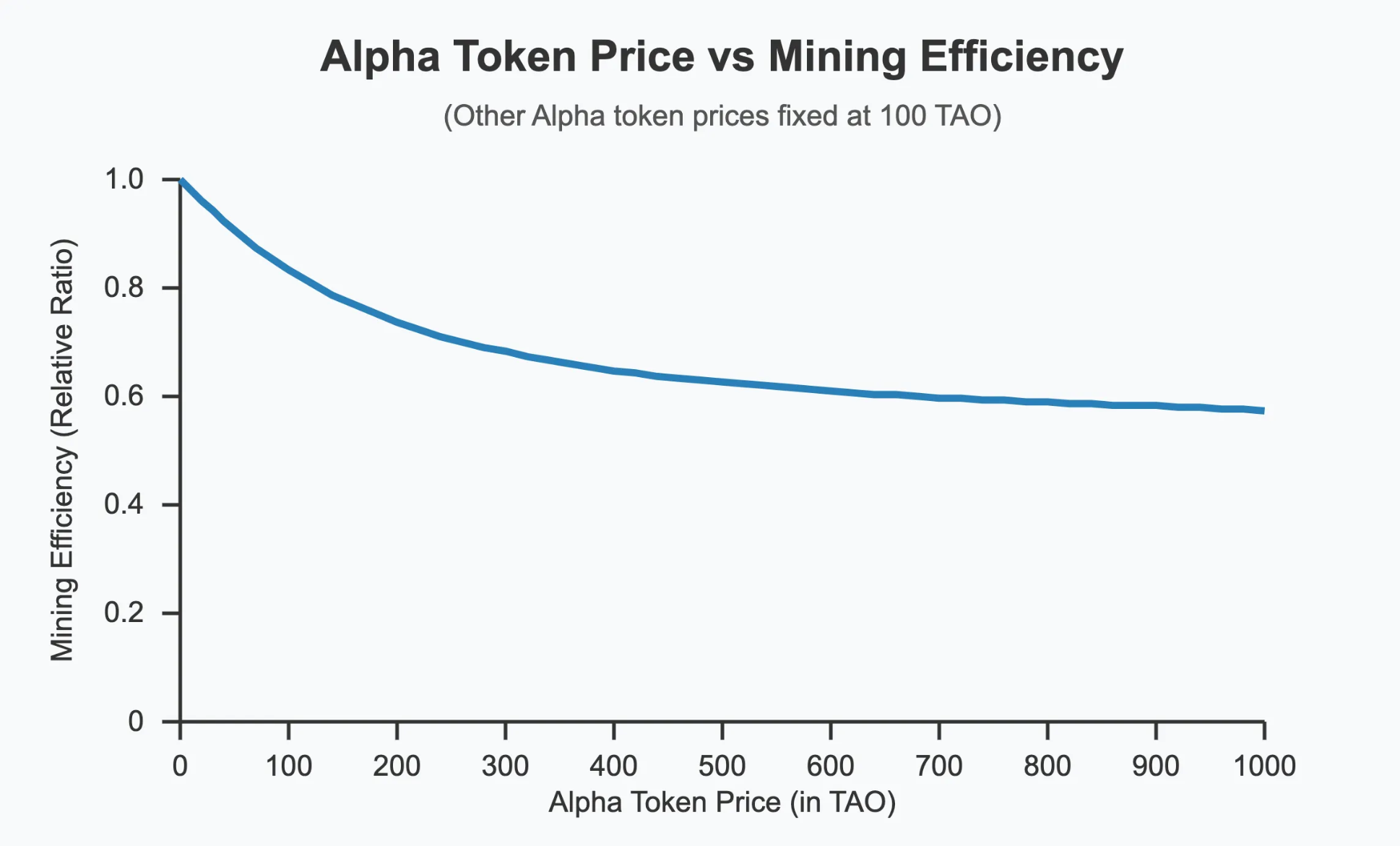

To mitigate this, dTAO has adopted a mechanism where the emission amount decreases as the Alpha token price increases, reducing the mining efficiency of subnets whose value is assessed higher than their quality. This encourages miners and validators who receive Alpha tokens to sell them and leave that subnet to participate in other undervalued subnets. It also suppresses the departure of miners and validators from subnets whose value is assessed lower than their quality, thereby encouraging each subnet's Alpha token to be fairly priced in the long term.

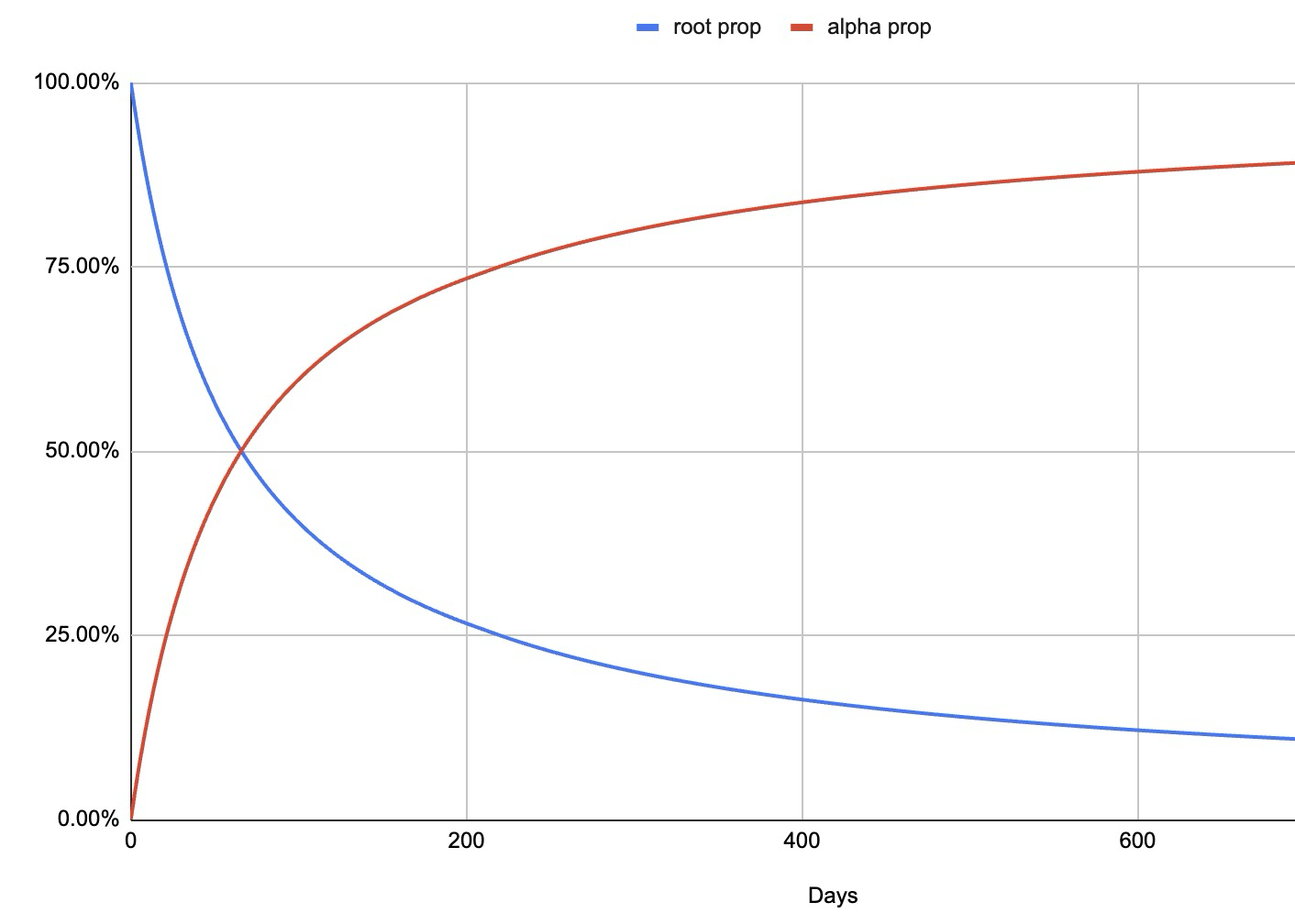

Furthermore, to maintain protocol stability and smoothly transition from the existing structure to dTAO, Bittensor introduced a structure where Alpha token incentives paid to subnet validators are initially distributed to Root network validators and gradually increase.

At this time, Alpha token rewards that should be distributed to Root network validators are exchanged from each subnet's Reserve Pool and paid in $TAO. Therefore, currently, less than two months after the introduction of dTAO, more incentives are being distributed to Root network validators, putting selling pressure on all Alpha tokens. This phenomenon will gradually ease as incentives emitted to the Root network decrease, and after sufficient time, it is expected to achieve more objective subnet evaluation compared to the previous structure while reducing the research burden previously borne by a few, resulting in higher scalability.

However, newly launched subnets have insufficient quantities of $TAO and Alpha tokens in their Reserve Pools, creating a limitation where even high-quality subnets launched later provide inefficient Alpha token trading environments compared to those launched earlier.

Due to this limitation, Alpha tokens of newly launched subnets may exhibit speculative characteristics, and it is also anticipated that newly launching subnets might over-advertise their vision and future additional incentives to take short-term profits.

Therefore, when investing in subnet Alpha tokens, it is necessary to determine whether sufficient trading liquidity exists for that token and to adopt an attitude of self-evaluation of the subnet and appropriate valuation to assess whether the Alpha token's value is overestimated.

4. dTAO vs Solidly

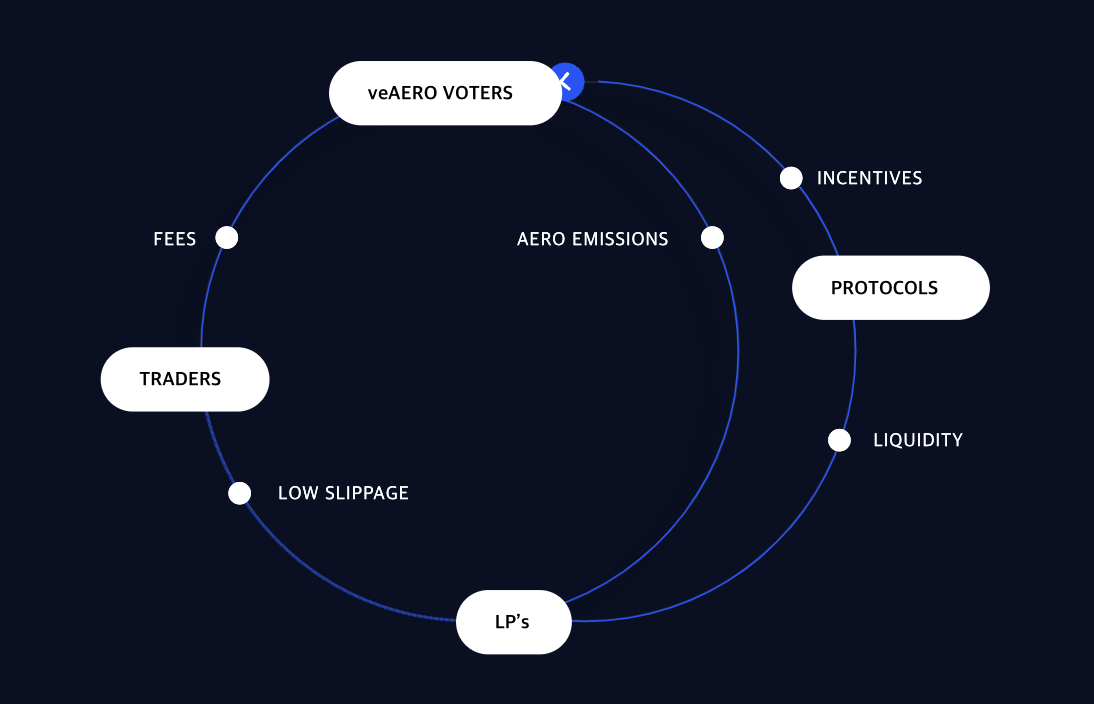

dTAO's mechanism has a structure that effectively aligns the interests of protocol participants, similar to the Solidly mechanism adopted by decentralized exchanges such as Curve Finance, Aerodrome, and Shadow Exchange.

While details vary slightly between DeFi protocols, the Solidly mechanism broadly has the following structure:

- Governance token emissions to liquidity providers

- Governance token holders acquire emission voting rights by staking their tokens (most Solidly structure protocols grant more voting rights for longer staking periods)

- Entities (protocols) wishing to boost specific liquidity pools pay bribes to users who voted for those pools

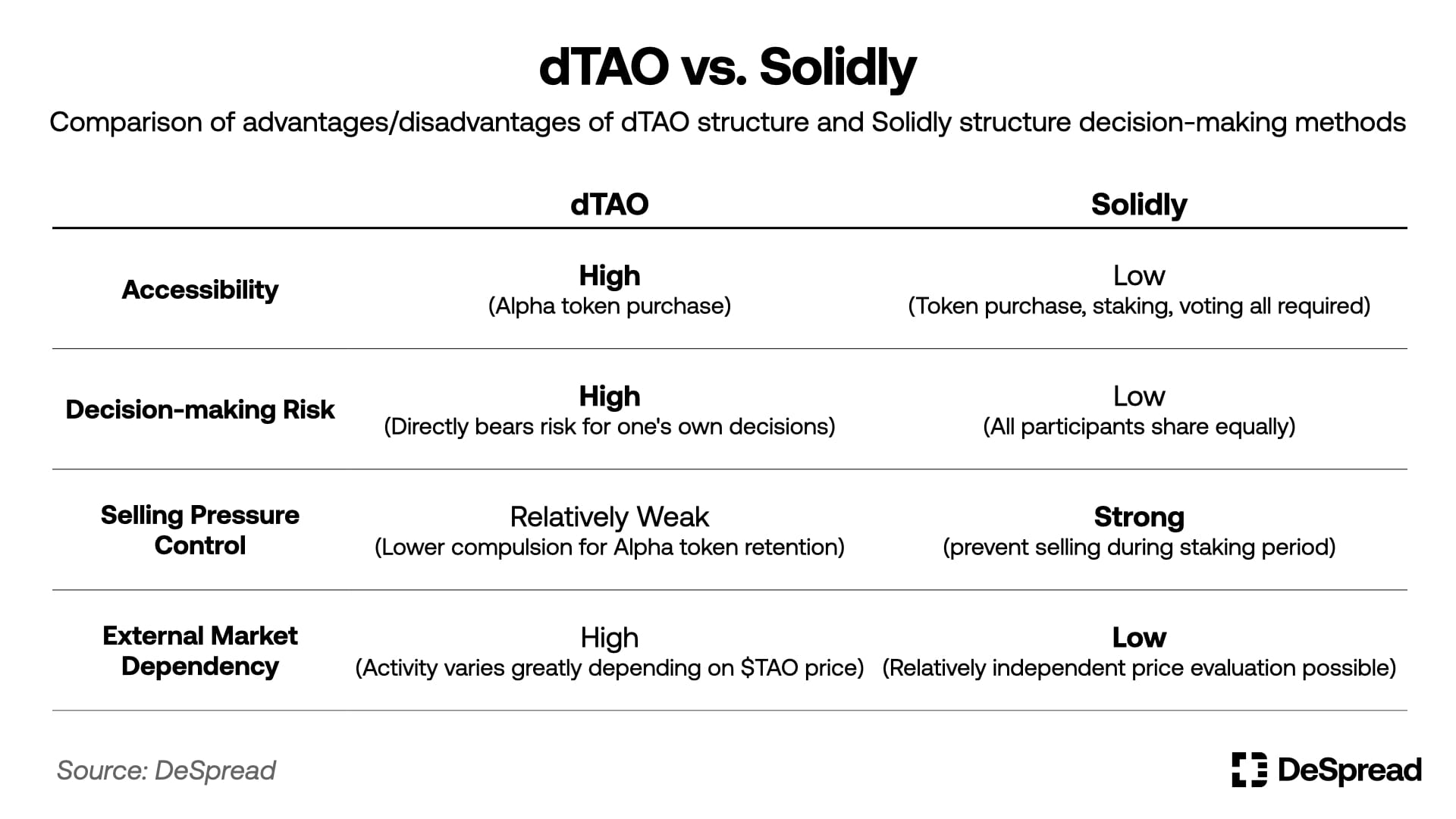

In the Solidly structure, participating in the incentive distribution process requires multiple procedures such as purchasing governance tokens, staking, and voting, whereas in the dTAO structure, unspecified market participants can directly influence incentive distribution simply by purchasing Alpha tokens. Therefore, the dTAO structure promotes decision-making participation by more participants compared to the Solidly structure, potentially creating an environment for more objective and fair incentive distribution.

Moreover, in the Solidly structure, if certain decision-makers execute unreasonable emission votes, the resulting losses are uniformly distributed among all governance token holders through the depreciation of the governance token value. In contrast, in the dTAO structure, the community's negative evaluation of specific incentive distribution decisions directly leads to selling pressure on that subnet's Alpha token. Consequently, Alpha token holders primarily bear the losses, with the impact subsequently spreading to the broader $TAO ecosystem.

In other words, decision-making participants in the dTAO structure bear greater risks than decision-making participants in other protocols, and due to this difference, dTAO decision-making participants perform subnet quality evaluation and Alpha token fair value judgment more carefully and actively.

However, dTAO's structure does not have mechanisms to suppress governance token selling pressure or enforce voting participation like Solidly, and the Alpha token price also immediately fluctuates along with the externally set $TAO price. Therefore, compared to the Solidly structure, decision-making activity is more influenced by price fluctuations due to external demand for $TAO.

In summary, the Solidly structure has strengths in suppressing native token selling and increasing protocol liquidity and transaction volume by forcing long-term participation of users who want strong expression of opinions through staking functions. On the other hand, dTAO has higher participation accessibility but higher decision-making risk, giving it an advantage in executing incentive distribution more decentralized and rationally compared to Solidly.

5. Conclusion

So far, we have examined the operation and characteristics of dTAO and compared its advantages and disadvantages with Solidly, another market-driven incentive distribution mechanism.

The main thrust of dTAO is to map the subnet quality evaluation and $TAO emission weight voting roles previously performed by 64 Root network validators to Alpha token prices, thereby bringing the collective intelligence of unspecified market participants into the decision-making process for incentive distribution.

If Bittensor shows significant growth after the introduction of dTAO, it is expected that market-driven incentive adjustment mechanisms similar to dTAO will be actively adopted by other protocols, particularly in the following situations:

- Network incentive distribution in the form of subnets centered around a mainnet

- Business fund distribution for DAOs with sub-DAOs operating multiple businesses simultaneously

- Grant distribution to ecosystem applications

However, as mentioned earlier, at the current initial stage of dTAO introduction, incentives received by Root network validators are higher than those paid to subnet validators, and as rewards paid to subnet validators gradually increase, it is difficult to diagnose actual efficiency while Alpha tokens are in the process of finding their fair values.

Therefore, when sufficient incentives are paid to subnet validators in the future, it will be necessary to continuously monitor whether the rational incentive distribution system intended by the Bittensor community is actually implemented.

References

- Bittensor Docs

- Taostats

- Taostats Docs

- Mentat Minds, What Root Network weights reveal about Bittensor

- Animoca Brands Research, Comprehensive Analysis of the Decentralized AI Network Bittensor