Market Commentary | 02.07.

What are the Sources of Market Instability?

Market Commentary provides a recap of the week's key events and offers insights from DeSpread Research on future points of interest. In the February 7th edition of Market Commentary, we will cover Sources of Market Instability

1. What are the Sources of Market Instability?

Since Trump's inauguration, the virtual asset market has shown continuous high volatility. On January 27th, Bitcoin fell by up to 7% due to the DeepSeek incident, and after a rebound, it fell again by up to 12% on February 6th when President Trump announced tariff policies against Canada, Mexico, and China. Although it showed a temporary rebound afterward, it is currently showing a gradual downward trend.

The virtual asset market is now more influenced by macroeconomic conditions than ever before. Events that cause major ripples in the market occur daily, and investors are experiencing turbulent market conditions as a result. Rather than examining individual events and evaluating their impact like traditional market commentary, this article aims to analyze the fundamental factors that make the current market situation inevitably highly volatile without any particular direction.

However, please note that this contains somewhat subjective viewpoints.

1.1. Constraints in Liquidity Environment

As briefly mentioned in "Market Commentary | 01.10.", here's a more detailed description of the current U.S. liquidity environment:

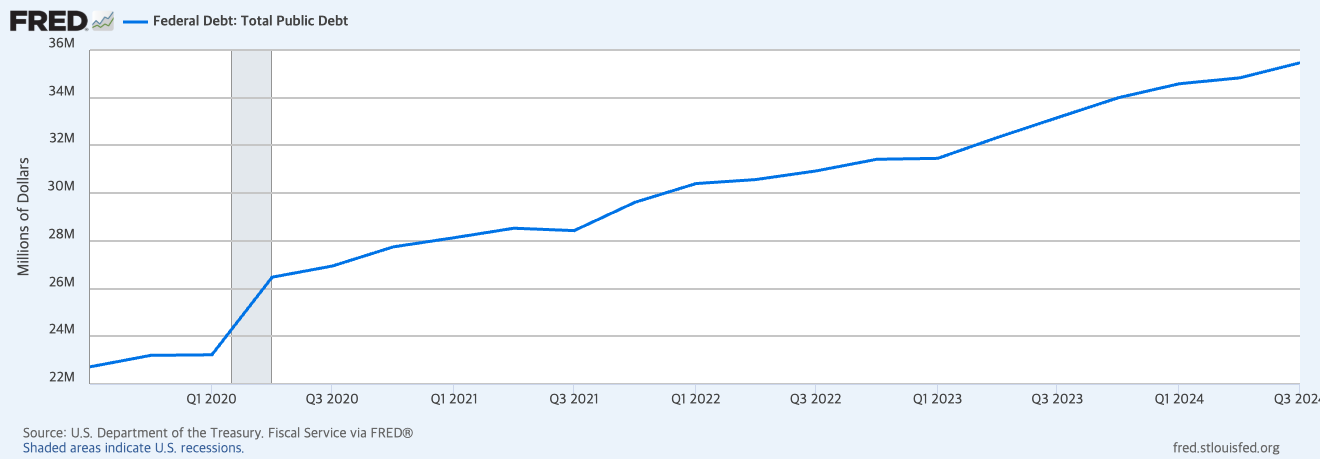

- U.S. national debt has rapidly increased since the 2020 COVID crisis.

- Particularly since early 2023, the asset market stimulus has been implemented by absorbing market idle liquidity through massive short-term debt supply and redistributing it back to the market.

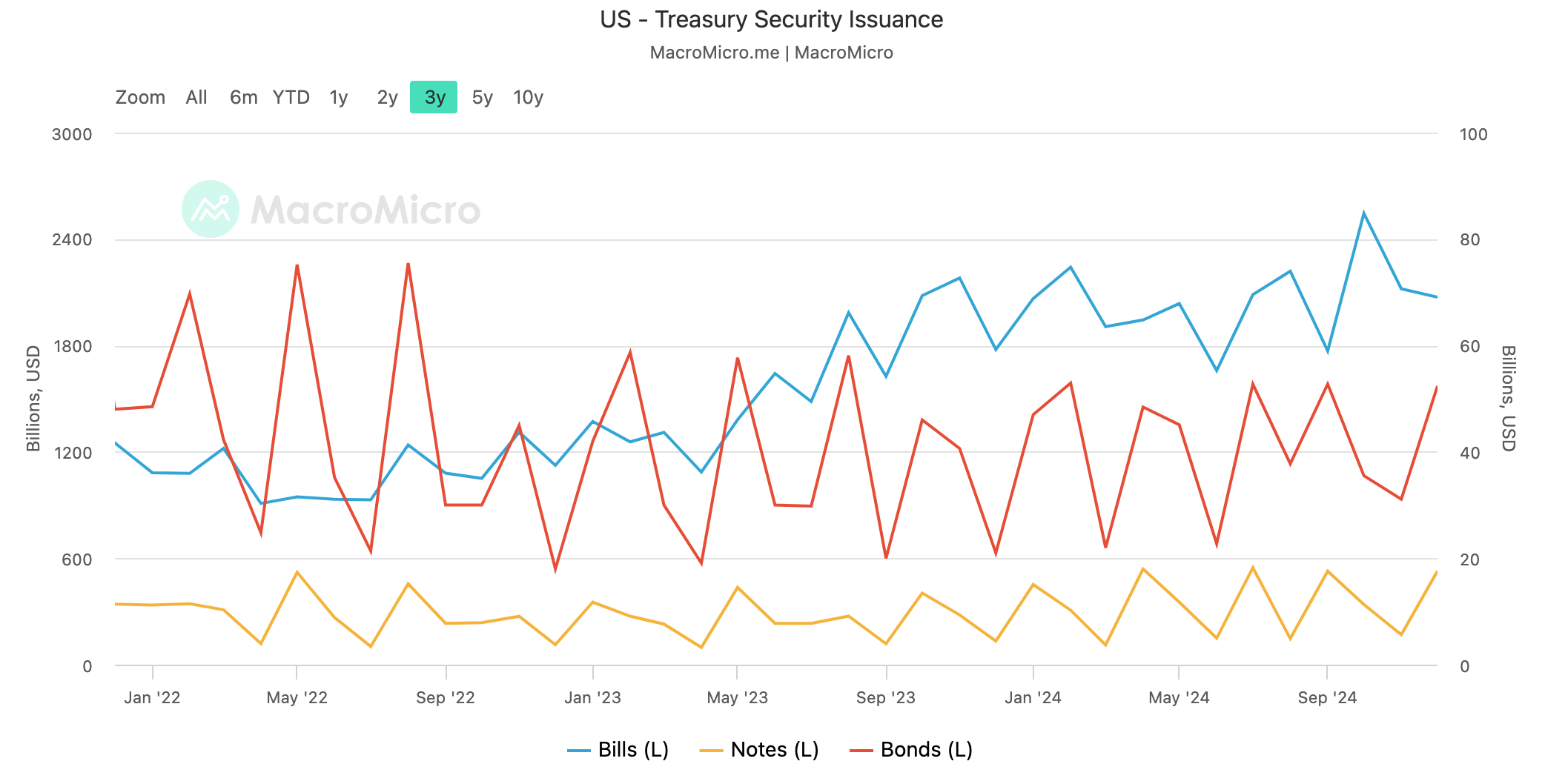

- The image below shows the issuance volume by type of U.S. Treasury securities. Since early 2023, the issuance of Bills (Treasury securities with maturities less than 1 year) has significantly exceeded that of other long-term securities (Notes - securities with maturities between 1 and 10 years, Bonds - securities with maturities longer than 10 years).

- Reference - Lee Ji-heon, “새해 美국채 만기도래 3조달러…단기채 비중 커 채권시장 경보음”, Yonhap News

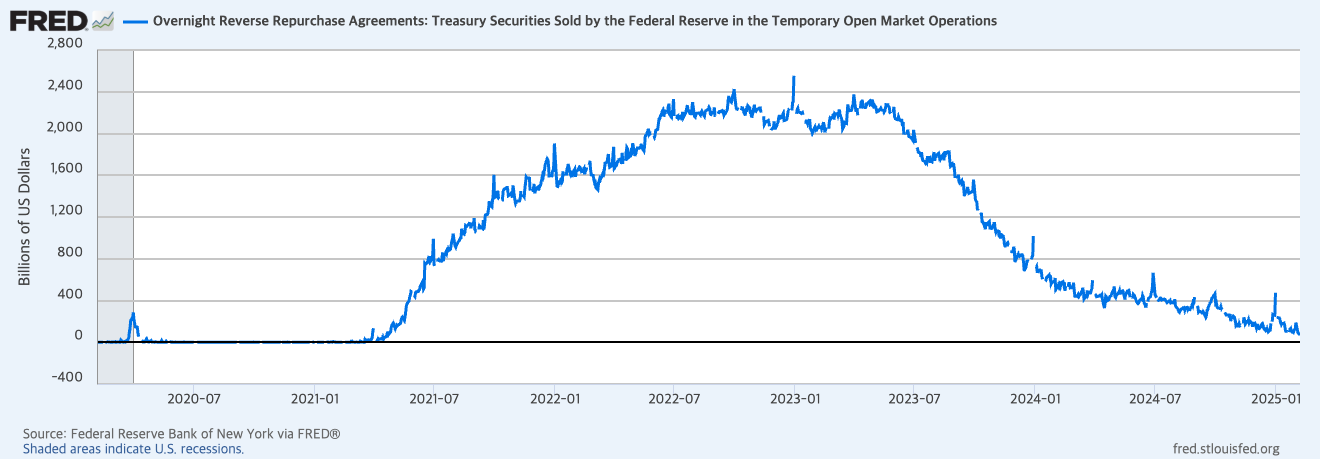

- The market's idle liquidity was mainly held in the Fed's reverse repo account, and as a result of maintaining this liquidity supply method, the reverse repo account is now nearly depleted.

Meanwhile, the U.S. debt ceiling has reached its limit, and debt ceiling negotiations need to be successfully concluded in the near future.

- Former Treasury Secretary Yellen warned that a default could occur if U.S. debt ceiling negotiations are not successfully concluded by June. (Reference - “Market Commentary | 01.03.”)

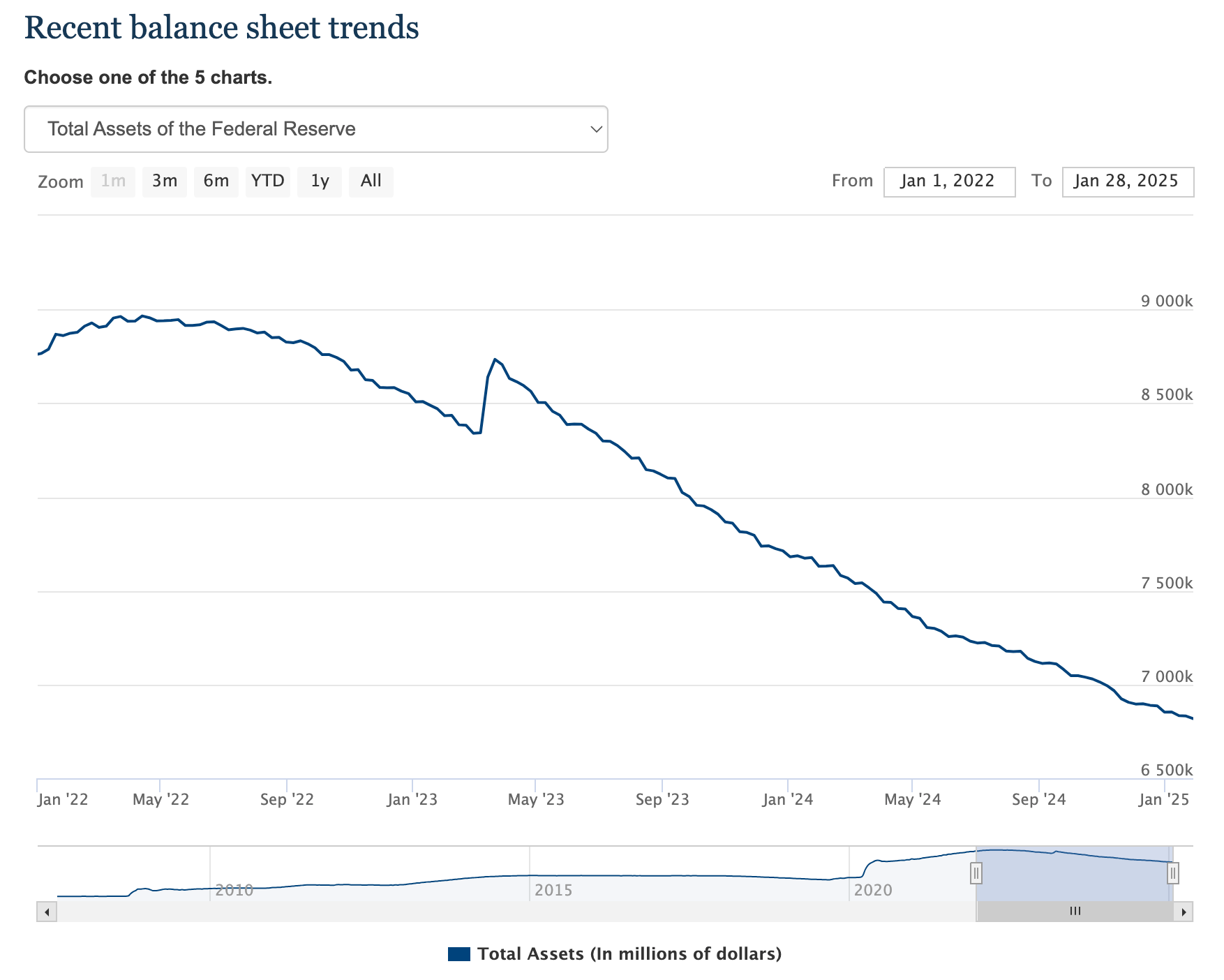

The Fed's Quantitative Tightening (QT), which began in June 2022, is still ongoing. Although the possibility of early termination was mentioned at the beginning of this year, Chairman Powell recently stated that "there is room to continue QT," and the market expects the QT end point to be at least June this year.

- Reference - William Watts, “Powell says bank reserves abundant, room to keep shrinking balance sheet”, MarketWatch

As a result, the current U.S. asset market liquidity is in a very limited situation, which is becoming a major obstacle to driving the overall asset market upward. The virtual asset market, in particular, is sensitive to liquidity changes, making these constraints even more prominent.

1.2. U.S. Economic Conditions and Trump's Policy Direction

- Consumption and employment indicators showing U.S. economic conditions continue to demonstrate robustness.

- As mentioned in "Market Commentary | 01.10.", the U.S. economy being in an expansion phase acts as a trigger for inflation concerns

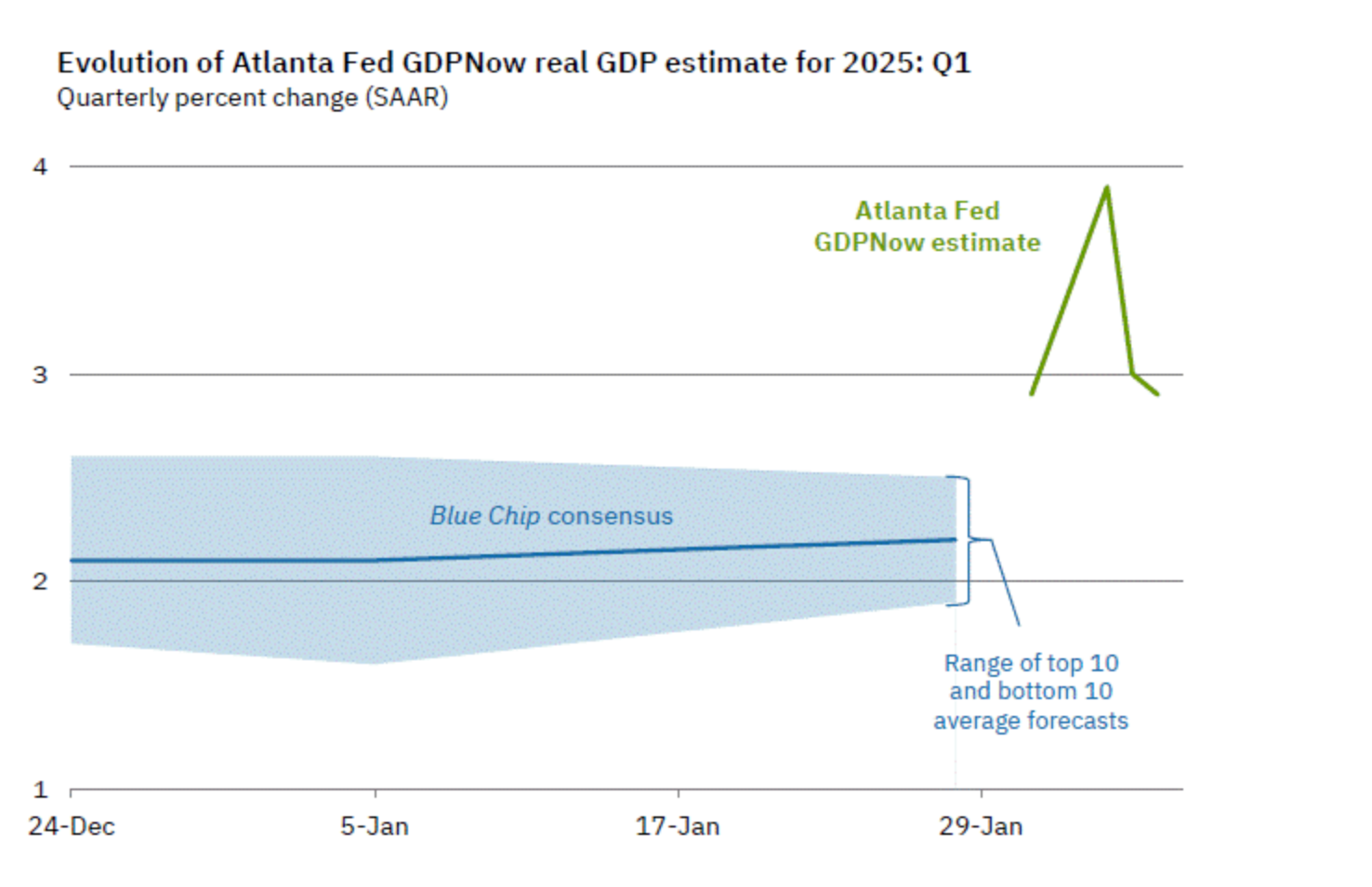

- GDPNow, the GDP growth rate forecast released by the Atlanta Fed, continues to show estimates around 3%, suggesting that the U.S. economy continues its growth trend

Trump administration's policy direction can be summarized in three main points. First, strengthening government efficiency through establishments like D.O.G.E. Second, increasing market efficiency through large-scale tax cuts. Finally, focusing on supplementing insufficient tax revenue through tariffs, and restructuring trade imbalances and global supply chains to increase long-term economic growth rates.

- While these policies may be evaluated as rational in the medium to long term, there are concerns that in the short term, they could worsen liquidity due to reduced fiscal spending, and measures such as tax cuts and tariffs could trigger inflation, increasing market anxiety

On December 19th last year, Fed Chairman Powell, while implementing a hawkish rate cut, mentioned the following (Reference - “Market Commentary | 12.21.”):

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Even then, there were interpretations that Trump's policies after his inauguration could raise inflation concerns, and these concerns seem to be gradually materializing. While President Trump is evaluated as market-friendly and asset markets rose significantly due to expectations of pro-market behavior following his inauguration, concerns about side effects are growing as specific policies announced one by one after his inauguration are being implemented.

1.3. The Question of Adoption

After the Trump administration's launch, the most important narrative in the virtual asset industry has become the 'possibility of large-scale adoption'. While there have been discussions about mass adoption in the past, its importance is now more highlighted than ever before.

The main factors supporting this narrative can currently be summarized in three points:

- Inclusion of Bitcoin and other virtual assets in U.S. strategic reserves

- Large-scale adoption of stablecoins

- Relaxation of virtual asset industry regulations following changes in SEC stance

Since these possibilities are all exogenous variables decided outside the virtual asset industry, innovations occurring within the industry aren't receiving sufficient attention until these factors are confirmed. Moreover, with the rise of memecoin trading due to the launch of pump.fun last year and the emergence of skepticism about VC coins, the persuasiveness of visions presented by new coins, except for major coins, has significantly decreased. Consequently, in a situation where the memecoin market and the narrative of 'trading' itself are overwhelming, I believe the direction of the current virtual asset industry becomes even more ambiguous with insufficient liquidity and market instability.

In this situation, our eyes as participants in the virtual asset market inevitably continue to move outward from the industry. We pay attention to and are influenced by macroeconomic conditions and every move of the Trump administration, which is significantly reflected in market movements. I expect this trend to continue for the time being until new and powerful driving forces that can lead the industry's development and market rise are discovered.

References

- 이지헌, “새해 美국채 만기도래 3조달러…단기채 비중 커 채권시장 경보음”, 연합뉴스

- William Watts, “Powell says bank reserves abundant, room to keep shrinking balance sheet”, MarketWatch