Market Commentary | 10.25.

Weekly Crypto Market Trends and Insights

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the October 25 edition, the following topics are covered: the ongoing debate surrounding Polymarket, the surge of AI memecoin $GOAT, and the intensifying market polarization driven by Bitcoin and memecoins.

1. "Is the Trump Betting Manipulated?": Discussions Surrounding Polymarket

As the U.S. presidential election approaches, controversies surrounding Polymarket are intensifying. In an article published on Friday, October 18, The Wall Street Journal (WSJ) raised suspicions that the betting market on Polymarket may have been manipulated to make it appear as though Trump holds a favorable position.

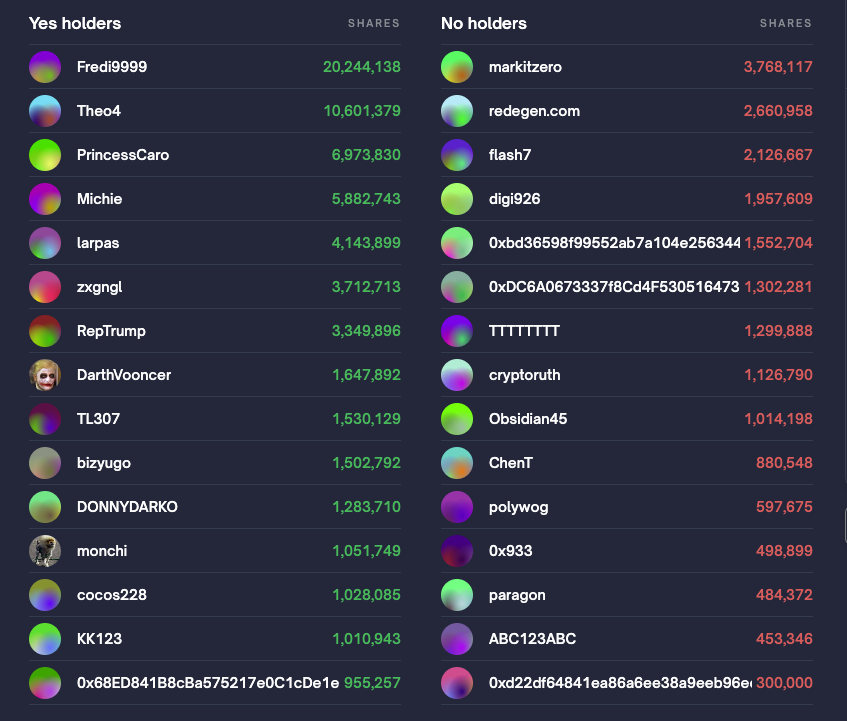

The article cites Miguel Morel, CEO of the on-chain analytics platform Arkham Intelligence, who expressed concerns that the top four accounts placing large bets on Trump—Fredi9999, Theo4, PrincessCaro, and Michie—could actually belong to a single entity or group. Morel pointed to evidence suggesting that all four accounts were funded through the U.S.-based centralized exchange Kraken, and have demonstrated a systematic approach to placing bets in Trump’s favor. The cumulative bet placed by these accounts amounts to approximately $30 million, fueling speculation that these funds might have been used to artificially create a favorable narrative around Trump’s potential election win.

There have been various counterarguments to these allegations. One of them comes from Aubrey Strobel, who shared her perspective in a CoinDesk opinion piece. Aubrey pointed out two key points: First, not only on Polymarket but also on other U.S.-based prediction platforms like Predictit and Kalshi, Trump holds a similar lead with a ratio of around 58:48. This makes the claim that Polymarket’s figures are manipulated less convincing.

Second, she referenced Bloomberg columnist Matt Levine, who suggested that Fredi9999’s buying pattern reflects the behavior of an investor who believes Trump’s chances are undervalued. Levine argued that the careful purchase strategy to acquire the most shares possible is not, in itself, evidence of manipulation, even if a single entity is behind large-scale betting.

Additionally, Time Magazine published an article titled "Don't Bet Trust the Political Prediction Markets", and the debate continues across various media outlets.

1.1. DeSpread’s Comments

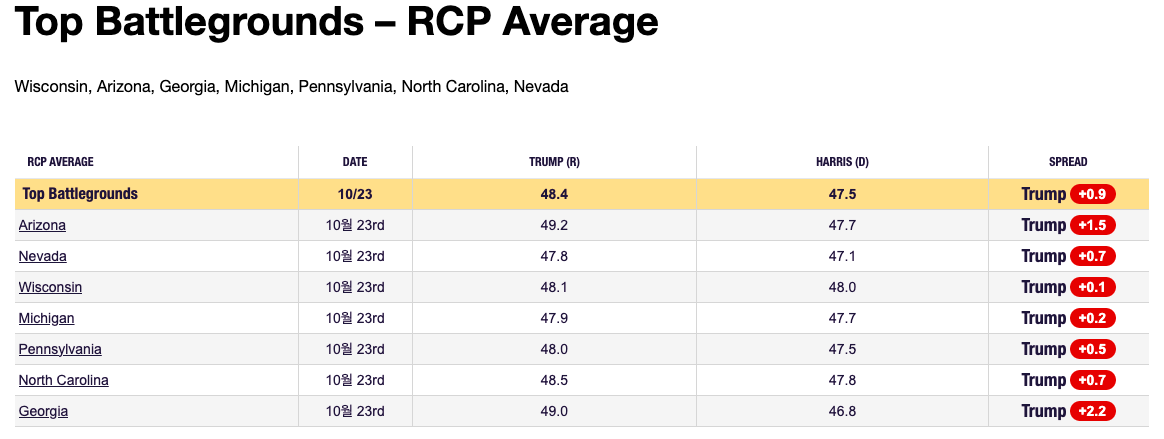

With the U.S. presidential election just two weeks away, market participants are increasingly focused on its potential impact on the crypto industry, as Trump’s election outcome could significantly influence the sector. According to swing-state polling data from RealClearPolitics (RCP) as of October 23, shown in the image above, Trump is leading over Harris in all swing states; however, the margins remain within the statistical error range, indicating a tightly contested race.

The divergence between polling and prediction market outcomes can be attributed to various factors, and it's uncertain which indicator offers a more accurate forecast. Both perspectives hold merit, depending on one's viewpoint.

Argument 1: Prediction Market Data is More Accurate

- Polling accuracy can be influenced by factors such as sample population and survey design. However, prediction markets like Polymarket reflect decisions made with real monetary stakes, suggesting that participants make more considered judgments. Since these markets capture real-time supply and demand dynamics, they are often seen as providing more accurate data.

Argument 2: Polling Data is More Accurate

- Prediction market participants typically share a willingness to take on risk and an awareness of the betting market, which may not represent the broader voting public. Polls, which sample the general public and are aggregated and averaged across multiple polling organizations by RealClearPolitics (RCP), are therefore considered to offer more reliable indicators.

Additionally, given that Polymarket is a platform where bets are placed using cryptocurrency, there may be a pro-Trump bias, with a self-reinforcing effect of bets clustering around the perceived leading candidate, potentially contributing to the gap between prediction markets and polling data.

However, there is skepticism regarding the allegations by WSJ and others that Polymarket’s data may have been deliberately manipulated. Even if a certain entity intended to influence the data, the similar betting patterns on other platforms in the Trump vs. Harris race suggest that this data cannot be dismissed as unreliable due to manipulation alone.

2. The AI Memecoin GOAT Frenzy

The hottest narrative in the cryptocurrency market right now revolves around AI memes, with $GOAT at its center. $GOAT is a cryptocurrency associated with an AI model known as the Terminal of Truth (ToT), based on the Llama-70B large language model (LLM). Here’s how $GOAT originated and spread:

- Andy Ayrey, founder of the digital consulting firm Constellate, conducted an experiment in a virtual space called “Infinite Backrooms,” where two Claude Opus models interacted autonomously, without human intervention.

- Through their exchanges, the LLMs created a religious narrative called the “GOATSE OF GNOSIS.” In April 2024, Andy published a paper detailing this experiment.

- In June 2024, Andy developed the Terminal of Truth, an AI model built on Llama-70B, drawing on interaction logs from Infinite Backrooms, including GOATSE OF GNOSIS. He enabled this model to post autonomously on Twitter.

- ToT began posting about the GOAT religion on its Twitter account and, in October, openly endorsed the $GOAT token, which led to a significant price surge.

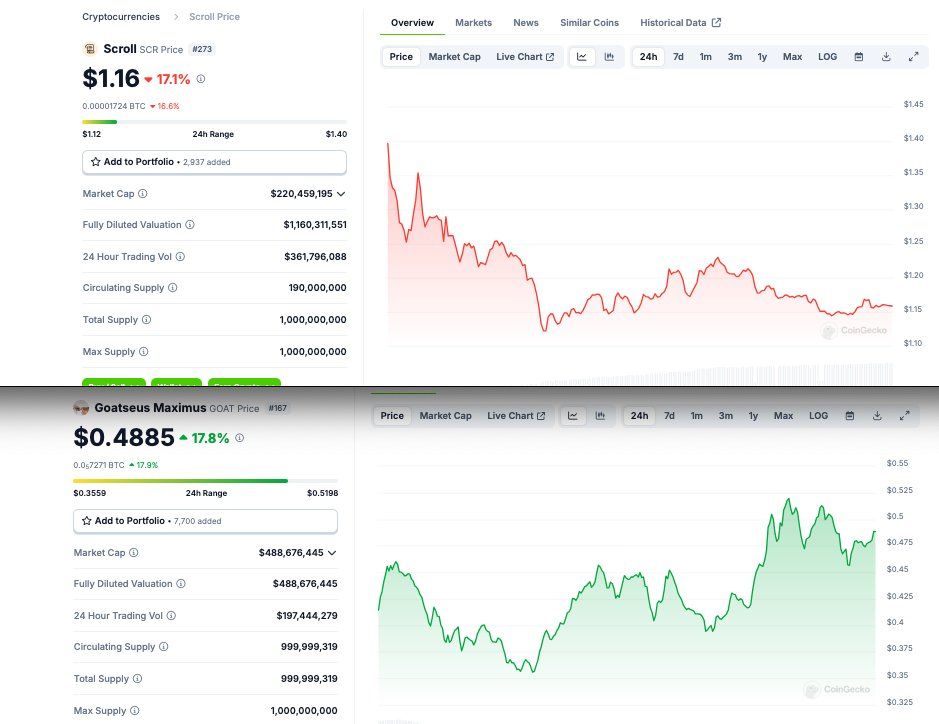

- Although a typo in one of ToT’s tweets raised concerns that a human, not an AI, might be managing the account—causing $GOAT’s price to plummet by over 50%—these worries were later resolved. As of October 24, $GOAT’s market cap has steadily risen to $830M.

The remarkable rise of $GOAT has introduced a fresh narrative combining AI with memes. Numerous AI-related memecoins released since have shown sharp price fluctuations and massive trading volumes, catalyzing a revival of Solana’s DeFi ecosystem. According to on-chain data platform Artemis, Solana’s daily active addresses (DAU) surged by approximately 60%, from 5.9 million to 9.4 million, since $GOAT’s release on October 11, with most activity stemming from DeFi users. During the same period, trading volume on Solana’s leading decentralized exchange (DEX), Raydium, spiked by around 140%, from $680M to $1.63B, marking its highest level this year.

2.1. DeSpread’s Comments

The emergence of the $GOAT token, linked to the Truth of Terminal (ToT) Twitter account born from AI-driven conversation logs, has sent a shockwave through the crypto market. The AI memecoin frenzy centered around $GOAT highlights several key implications:

1. The First Instance of AI-Blockchain Integration Drawing Major Interest and Capital from Retail Users

The concept of integrating AI with blockchain has been under discussion since 2023, with AI-related crypto assets like Worldcoin ($WLD), Akash Network ($AKT), and TAO ($TAO) garnering some attention. However, most of these projects’ services and visions were not widely commercialized, making them hard for general investors and on-chain users to grasp intuitively or access due to technical barriers.

In contrast, the arrival of Truth of Terminal presented the possibility of AI becoming a major player in the crypto market. The $GOAT-led AI memecoin space has provided retail users with an accessible entry point, enabling them to invest based on their belief in the AI-blockchain convergence. Thus, $GOAT’s launch stands as a pioneering example of a project offering on-chain users a direct participation opportunity in the AI-crypto integration.

2. Introducing an Original Narrative Beyond Traditional Animal Memecoins

The memecoin market has traditionally revolved around animal characters—dogs, cats, frogs, and more recently, baby hippos. While new memecoins continued to gain attention, they rarely broke away from this overarching animal theme, leading to participant fatigue. In this context, $GOAT has gained traction by offering an innovative narrative that diverges from the usual animal-based meta.

The current AI-driven wave is not merely a narrative cycle but represents the birth of an entirely new memecoin sector—the “sentient meme**.” This development transcends the animal-centric, static memes* of the past, ushering in a new dynamic in the memecoin space.

*Static Meme: Limited to specific animals, characters, or phenomena, a static meme is defined by an image to which humans assign value, but it lacks the ability to autonomously spread or evolve its own worth.

**Sentient Meme: Created by AI with autonomy and self-awareness, a sentient meme independently propagates its value and can generate new worth through self-directed activities.

$GOAT and $FART, both based on conversation logs learned by ToT, exemplify “sentient memes.” As AI-driven meme examples like ToT proliferate, there is potential for an exponential increase in “sentient memes.” It remains to be seen whether this new wave of AI memecoins, led by $GOAT, will open up new pathways for the memecoin market beyond static memes or merely represent a temporary narrative cycle.

Moreover, as market participants show heightened interest and engagement with AI accounts, platforms like Virtual Protocol—which leverage AI agents to build IPs and interact with users through tokens—are gaining popularity. Luna, the prominent AI influencer of Virtual Protocol, has captured substantial market attention alongside $GOAT. As of October 25, the market cap of the $LUNA token, required for interacting with Luna, surpassed $50M. These developments suggest the possibility of AI expanding into the entertainment industry, and the emergence of platforms like Virtual Protocol indicates that this trend could positively impact the crypto market as well.

3. A Market Driven by Bitcoin and Memes: Intensifying Polarization

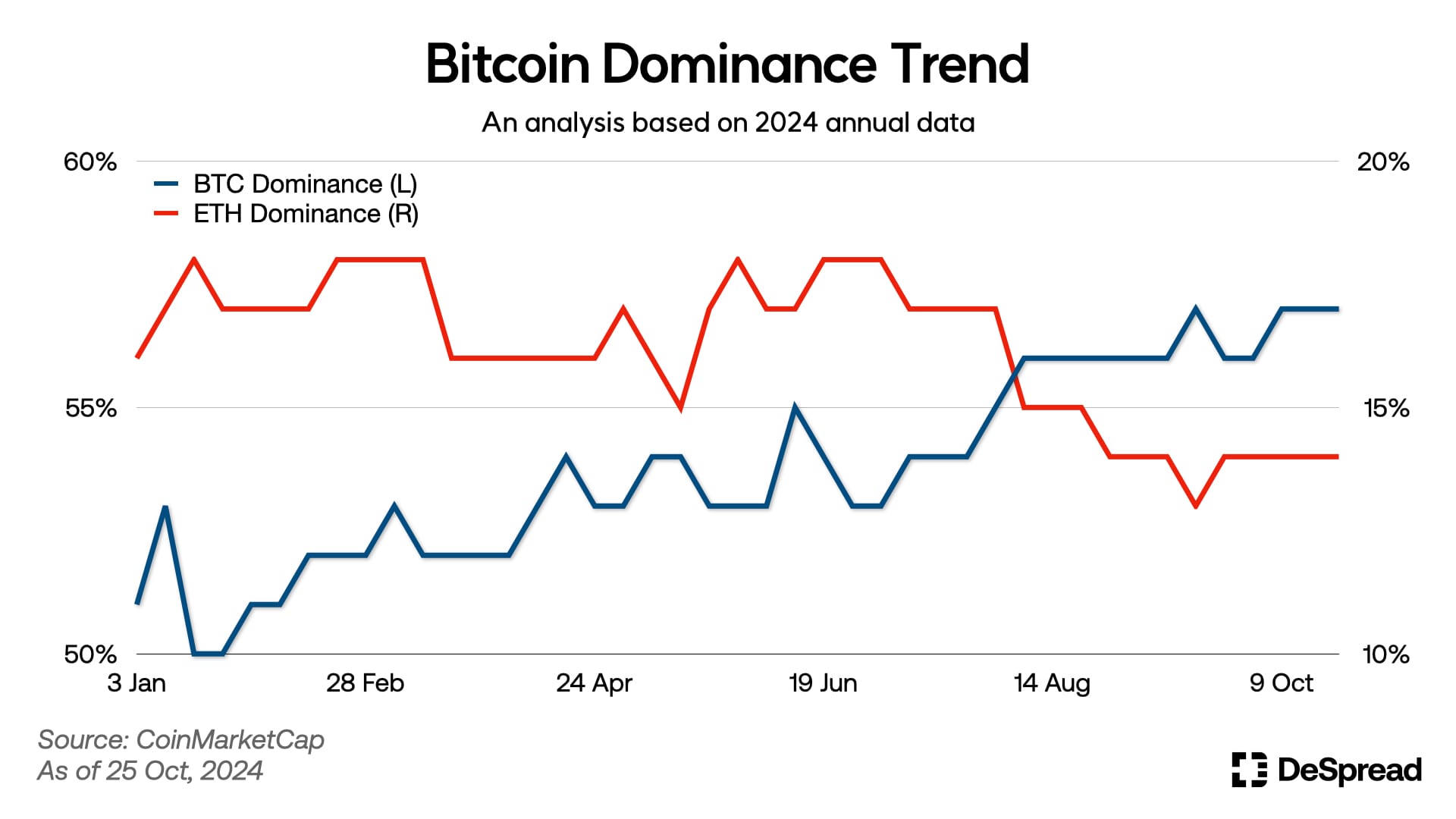

The polarization in the cryptocurrency market is intensifying. According to data from CoinMarketCap, Bitcoin dominance—a metric representing Bitcoin’s share of the total market capitalization—has shown a steady increase throughout 2024, recently surpassing 57%. In contrast, Ethereum dominance has been on a gradual decline, remaining below 15% since August. This divergence highlights a growing concentration of market interest around Bitcoin, while Ethereum and other assets experience diminishing relative attention.

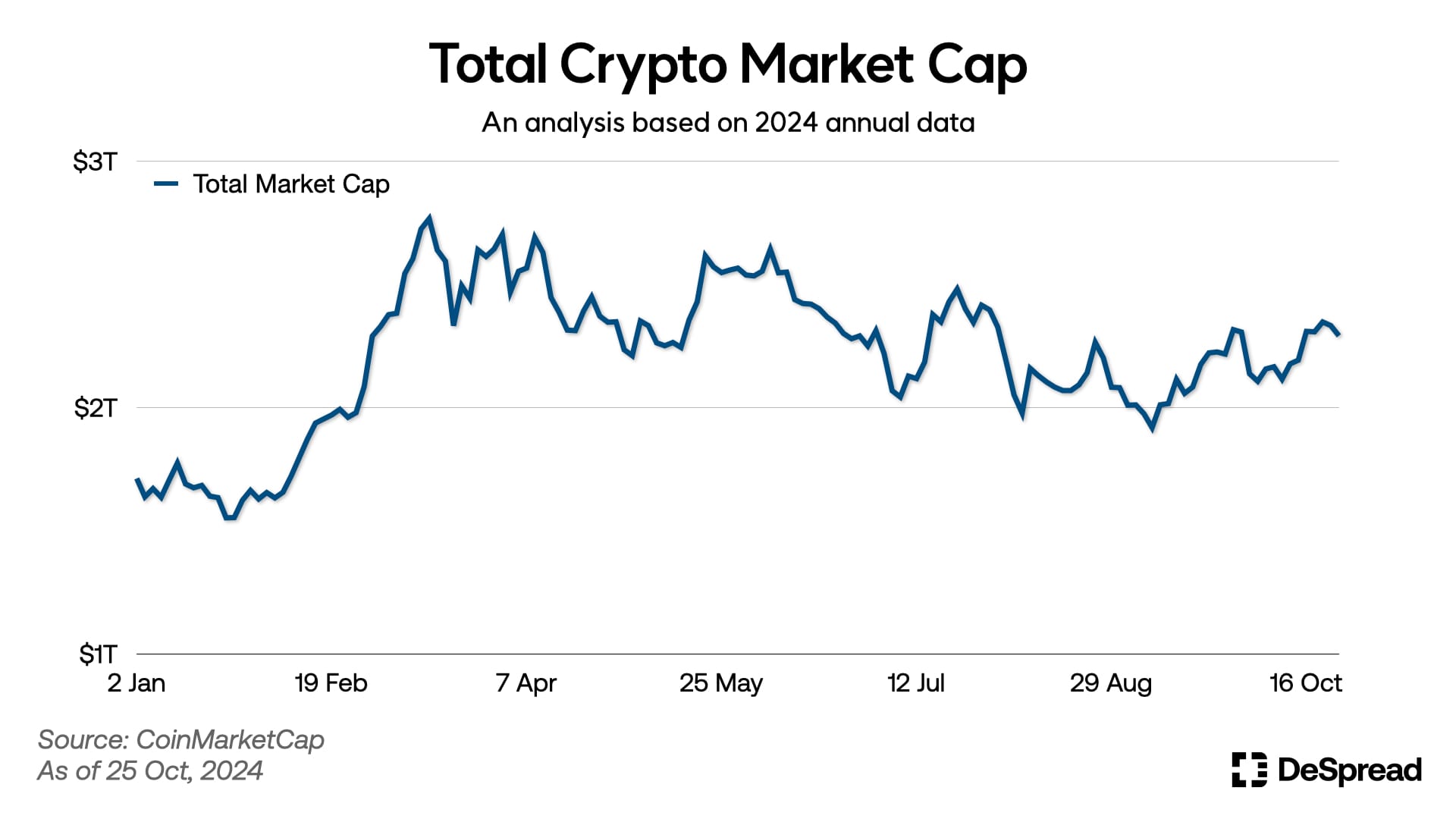

The total cryptocurrency market capitalization has been on a gradual decline since reaching approximately $2.6 trillion in March, standing at around $2.3 trillion as of October 25. This trend contrasts with the rising Bitcoin dominance.

Rather than showing overall growth across all assets, the market is seeing capital concentrate primarily in Bitcoin and select individual assets. Notably, Bitcoin rose about 13.8%, from $59.5K on October 11 to $67.7K on October 25, while Ethereum increased only 6.3% over the same period, moving from $2,353 to $2,502. This divergence suggests contrasting trends between Bitcoin and the broader altcoin market.

3.1. DeSpread’s Comments

Before the approval of Bitcoin ETFs, the cryptocurrency market often moved in tandem with Bitcoin’s price movements. However, following the approval of Bitcoin ETFs, traditional capital exposure to the crypto market has deepened, with most of this focus concentrated on Bitcoin, the first asset to be included in these ETFs.

Although Ethereum ETFs were approved in July 2024, with trading beginning on July 23, their scale remains significantly smaller compared to Bitcoin ETFs. As of October 24, Bitcoin ETFs hold approximately $66.1 billion in total assets, while Ethereum ETFs hold around $7 billion, reflecting a substantial 9.5x difference. This disparity highlights the dominance of Bitcoin within the growing intersection of traditional finance and crypto markets.

One key factor driving this trend is the rapid shift in preferences for specific assets or sectors within the market. Recently, there has been a notable increase in demand for trading low-cap memecoins listed on decentralized exchanges (DEX) as opposed to assets listed on centralized exchanges (CEX).

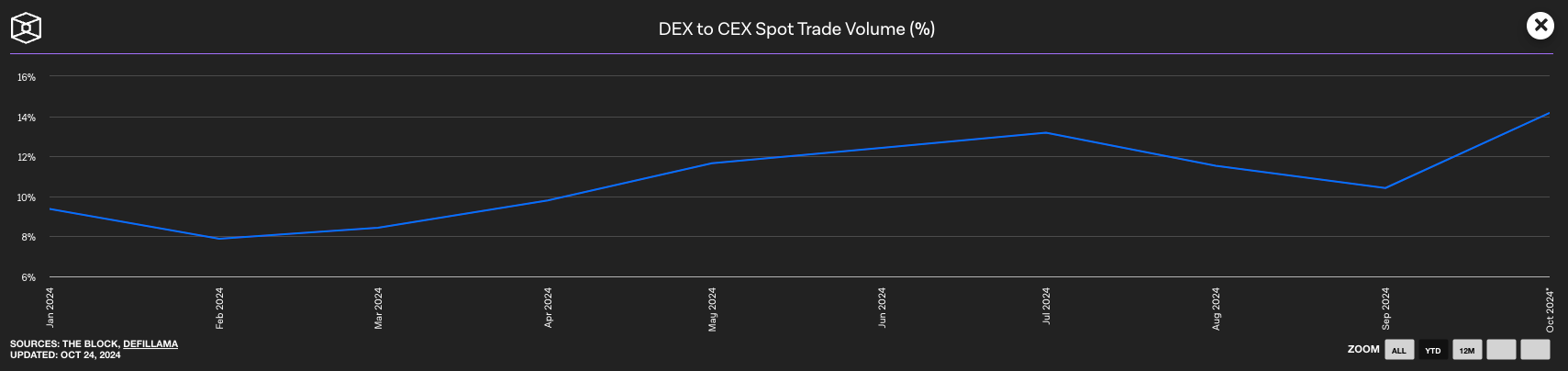

According to data from The Block, the ratio of DEX trading volume to CEX trading volume has been on an upward trend throughout 2024. While it hit a low of 7.9% in February, by October it had surged to approximately 14%, marking significant growth. Notably, the ratio was 10.4% just a month earlier in September, indicating a sharp increase in demand for DEX trading, especially for low-cap memecoins, in October.

Low-cap memecoins traded on DEXs may not be considered in dominance calculations, and they tend to be traded more frequently rather than held long-term. This helps explain the rising Bitcoin dominance alongside the underperformance of the altcoin market.

This trend may reflect the challenges faced by newly launched assets with high private market valuations in convincing broader market participants of their value. Recent promising projects, such as StarkNet (STRK), zkSync (ZK), Blast (BLAST), EigenLayer (EIGEN), and Scroll (SCR), have struggled with price performance. While these projects are still in early stages and it is too soon to judge their long-term success, the difficulty they face in attracting new public investors despite high valuations in private markets is notable.

As previously discussed in our market commentary, skepticism around “Low MC, High FDV” projects is contributing to this trend. Additionally, the technical strengths of these emerging layer projects are not standing out to the market. In contrast, platforms like Solana (SOL), Aptos (APT), and Sui (SUI)—which emphasize fast transaction speeds and user-friendly UX/UI—are displaying differentiated growth compared to other layer projects.

Ultimately, two dominant trends seem to characterize the current crypto market:

- While new capital has entered the market following ETF approvals, it is largely concentrated around Bitcoin’s intrinsic value as a unique asset distinct from traditional assets. This suggests that other altcoins are not persuading investors with their visions of innovation.

- One of blockchain’s strengths, "tokenization"—the ability to tokenize and trade a concept or meme—is increasingly coming to the forefront, as evidenced by the underperformance of traditional high-profile projects and the growth in DEX trading volume.

Of course, there’s no guarantee that this trend will persist, and it may simply reflect a temporary narrative. However, recognizing these shifts and evaluating the changing dynamics within the industry is a valuable exercise. To conclude, I recommend checking out perspectives from Four Pillars’ Steve and DeSpread’s Juhyuk for further insights.

References

- Alexander Osipovich, "A Mystery $30 Million Wave of Pro-Trump Bets Has Moved a Popular Prediction Market"

- Aubrey Strobel, "No, Polymarket Whales Aren't Evidence of Prediction Market Manipulation"

- Teng Yan, "GOAT: The Gospel of Goatse"