Market Commentary | 11.08.

Markets Respond Rapidly to Trump's Victory, Will Spring Come for Ethereum DeFi, Base Backed by Coinbase

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the November 8 edition, we examine Trump's election victory and the subsequent direction of industry developments.

1. Trump's Election Victory and Industrial Developments

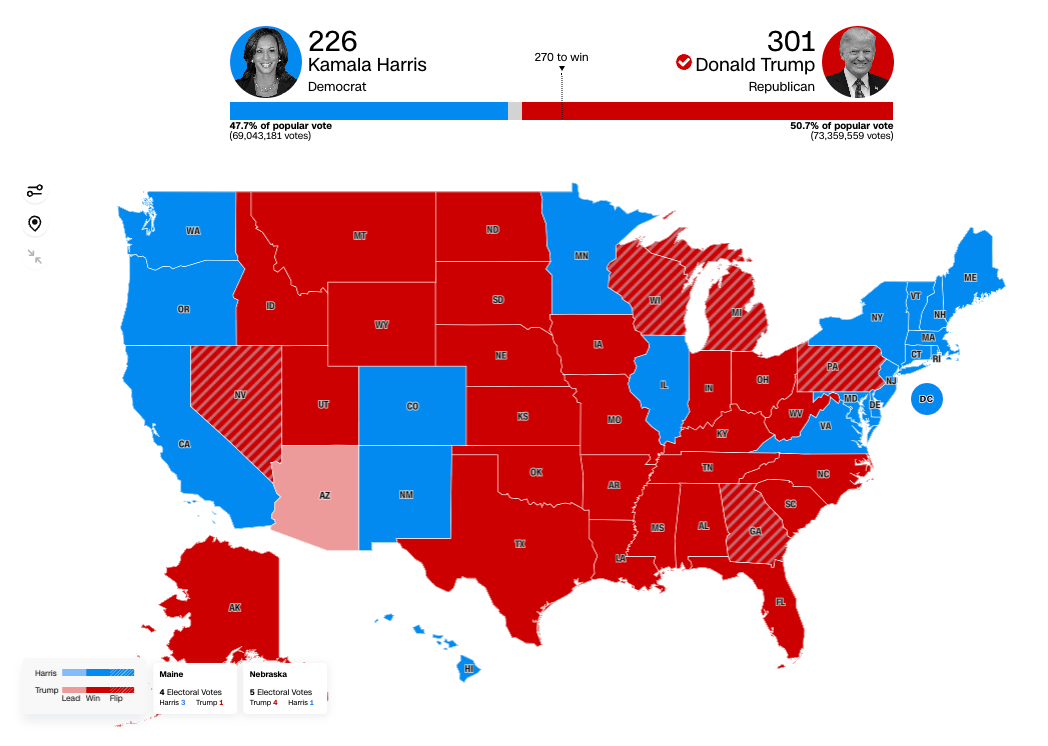

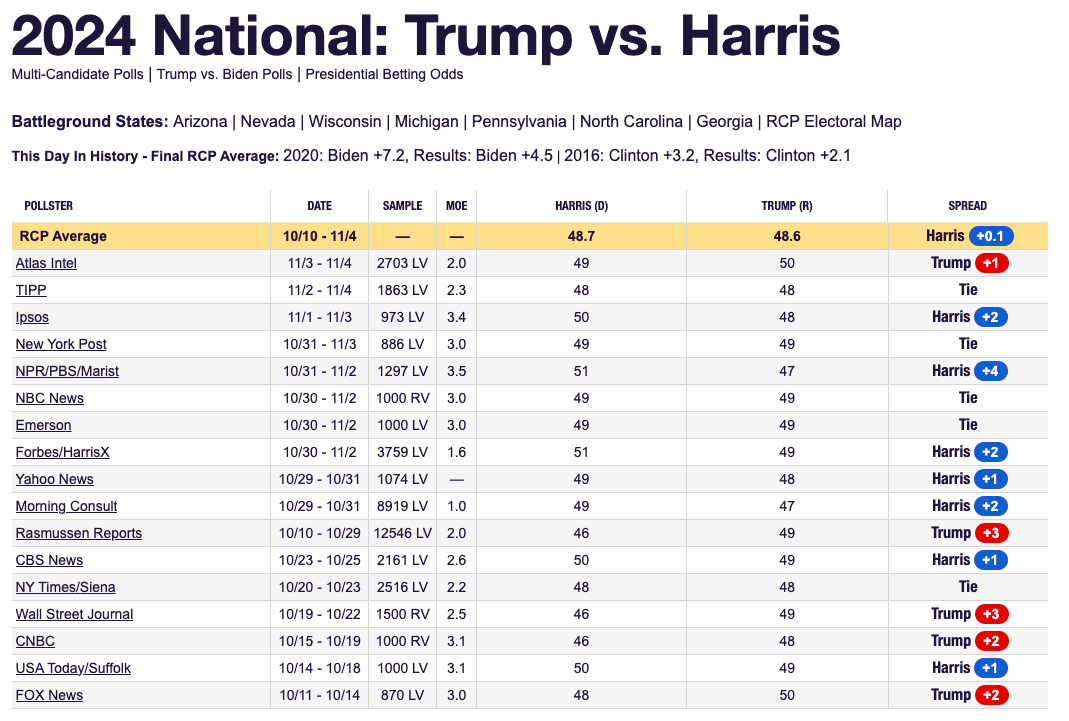

On Wednesday, November 6th, the highly anticipated U.S. presidential election was confirmed with Trump's victory. Trump secured wins in all seven battleground states (Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin) where competition was expected to be fiercest. Of the total 538 electoral votes, Trump is projected to secure 312 electoral votes (as of November 8th, vote counting is largely complete in all states except Arizona). This conclusion to the 2024 U.S. presidential election stands in stark contrast to various polls that had predicted a tight race, instead ending in a decisive victory for Trump.

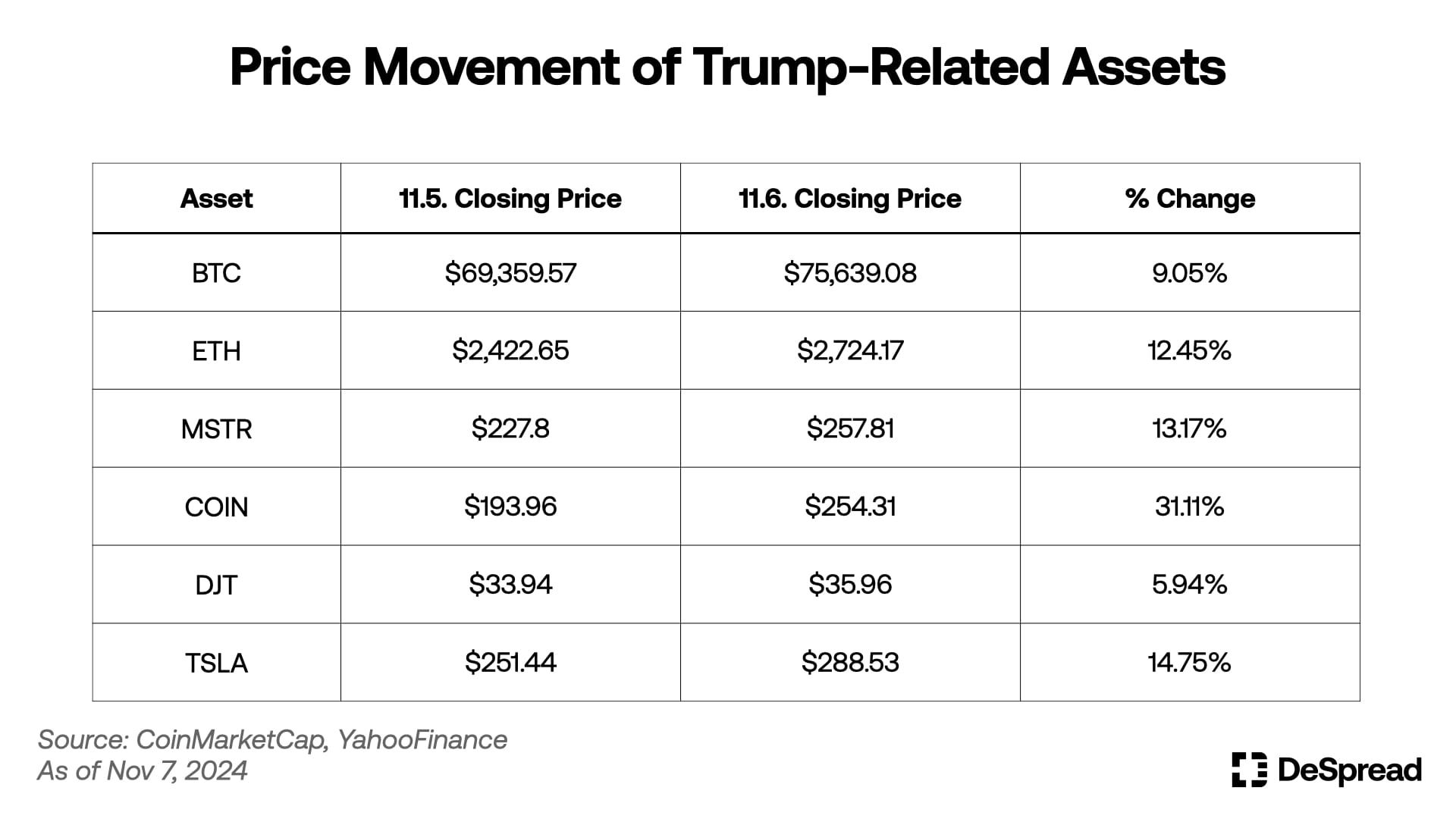

In response, both the cryptocurrency market and U.S. stock market showed sharp increases, with assets previously associated with Trump displaying particularly high rates of growth. According to one article, global investment bank Goldman Sachs predicted continued market growth post-election due to 1) reduced political uncertainty 2) subsequent reallocation of investors' stock portfolios 3) increased M&A and IPO activities under the Trump administration. The bank also noted that historically, the S&P index has recorded a median return of 4% between election day and year-end. As Trump's campaign promises largely centered on America First policies and demonstrated a strong commitment to economic stimulus, risk asset markets are responding rapidly to these developments.

Meanwhile, Trump has expressed his intention to depart from the Biden administration's anti-cryptocurrency policies and transform America into a cryptocurrency leader through pro-Bitcoin policies. He previously stated on his social media platform Truth Social that he "hopes all remaining Bitcoin will be mined in America," and has repeatedly expressed his position to establish a presidential advisory committee on Bitcoin and cryptocurrencies within his first 100 days in office, while building a crypto-friendly regulatory environment. His campaign promises regarding cryptocurrencies in this election include:

- Dismissal of SEC Chairman Gary Gensler, who has shown anti-crypto tendencies

- 100% retention of U.S. government-held Bitcoin and treating Bitcoin as a strategic reserve asset

- Elimination of Bitcoin capital gains tax

- Support for Bitcoin mining industry expansion

The current cryptocurrency market trends reflect positive future expectations based on Trump's stance, and it remains to be seen whether this momentum will continue.

1.1. Will Spring Come for Ethereum DeFi?

Which sectors of the industry should we focus on if Trump's pro-cryptocurrency promises are fulfilled after his inauguration? The DeSpread Research Team believes the following four areas and narratives deserve attention:

- Bitcoin ecosystem based on Trump's Bitcoin-friendly policies

- Ethereum ecosystem due to Gary Gensler's dismissal and changes in SEC's stance toward the industry

- Resurgence of Solana ecosystem with renewed discussions about Solana spot ETF that previously faced securities concerns

- Memecoin sector that maintained steady interest even before the election event

Among these four narratives, this article will focus on the Ethereum ecosystem, particularly the Ethereum DeFi ecosystem, which requires a longer-term perspective due to its close relationship with regulatory reform.

The SEC and Gary Gensler have taken legal action against numerous cryptocurrency exchanges and projects under the pretext of unregistered securities, while showing insufficient progress in establishing clear regulations. The industry urgently needed regulatory clarity, especially regarding securities classification, which explains the anticipation for Trump's somewhat radical promise to dismiss SEC Chairman Gary Gensler (on his first day) and the expected industry-friendly approach from the SEC.

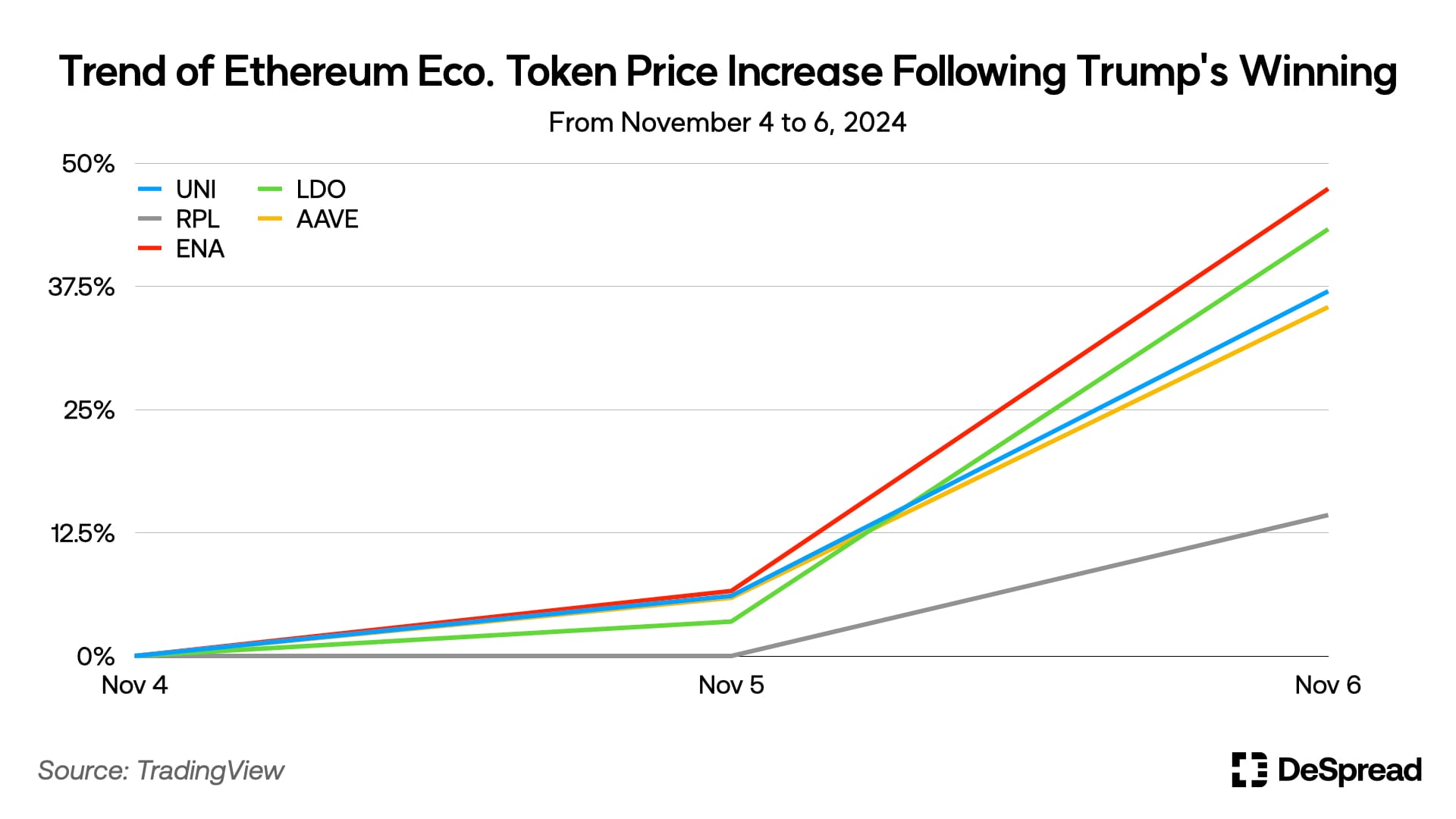

Indeed, $UNI of Uniswap, $LDO of Lido, and $RPL of Rocket Pool, which couldn't escape securities disputes from the SEC, showed price increases of 37%, 43.3%, and 14.3% respectively from November 4th to 6th, confirming actual expectations for regulatory clarity progress due to Trump's victory.

Additionally, $AAVE of Aave and $ENA of Ethena, while not directly involved in legal disputes with the SEC but discussing the possibility of activating Fee Switch to distribute protocol revenues to token holders, also rose by 35.4% and 47.37% respectively during the same period as securities risks decreased.

However, we believe the Ethereum DeFi sector should be approached from a medium to long-term perspective, watching how the following events unfold:

- Whether Gary Gensler will be dismissed as SEC Chairman and if a crypto-friendly SEC Chairman will be appointed

- SEC's position on whether Ethereum LST constitutes a security

- FIT21 Senate approval and final implementation

1. Appointment of New Crypto-Friendly SEC Chairman After Gensler's Dismissal

Senator Mark Uyeda is considered the most likely candidate for the next SEC Chairman. Uyeda is pro-cryptocurrency, having repeatedly criticized the current SEC's "regulation by enforcement" approach and called for a complete revision of the SEC's policies and approaches to cryptocurrency. For example, at KBW in September, Uyeda advocated for creating a new cryptocurrency-specific S-1 form. S-1 is a mandatory form for registering securities with the SEC, and if a cryptocurrency-specific S-1 form is created as Uyeda suggests, it's expected to provide legal grounds to prevent the SEC's indiscriminate legal actions by establishing clear registration criteria for securities and commodities reflecting cryptocurrency's unique characteristics like smart contracts, token economics, and on-chain governance.

2. Securities Status of Ethereum LST

In June, the SEC charged Consensys, the developer of the widely-known Web3 wallet Metamask, for "being an unregistered securities broker dealing in unregistered securities" regarding their handling of Ethereum LSTs like $stETH and $rETH, with legal proceedings continuing at the Brooklyn court in New York.

Unlike the Texas lawsuit that concluded in September, the Brooklyn case will include a merit hearing on charges of selling unregistered securities through Metamask staking. While the key issue is similar to Uniswap's case - determining whether Metamask is an unregistered securities seller or merely a software interface - the securities status of Ethereum LSTs like $stETH and $rETH is also a major point of contention, potentially providing insight into the SEC's future stance on Ethereum LSTs through the trial's outcome and ruling.

3. FIT21 Senate Approval and Final Implementation

FIT21, a cryptocurrency-related bill introduced in the U.S. House in May, contains provisions to expand CFTC's regulatory authority over cryptocurrencies while limiting SEC's authority. Having passed House deliberation, FIT21 now awaits Senate approval and presidential authorization for final implementation.

If passed, digital assets meeting blockchain's functional and decentralization requirements will be regulated as commodities by the CFTC, while those meeting functional but not decentralization requirements will be regulated as securities by the SEC.

It's important to monitor whether Ethereum LST will be classified as securities or commodities according to FIT21's decentralization requirements. Classification as a commodity could open possibilities for applying staking to Ethereum spot ETFs, potentially leading to more substantial institutional fund inflows into the Ethereum ecosystem.

1.2. Base, Backed by Coinbase

Coinbase's stock, COIN, which was charged by the SEC in 2023 for operating an unregistered securities exchange, surged approximately 31% in just one day following Trump's election victory. This appears to reflect market expectations that Coinbase will be able to expand its cryptocurrency business more aggressively.

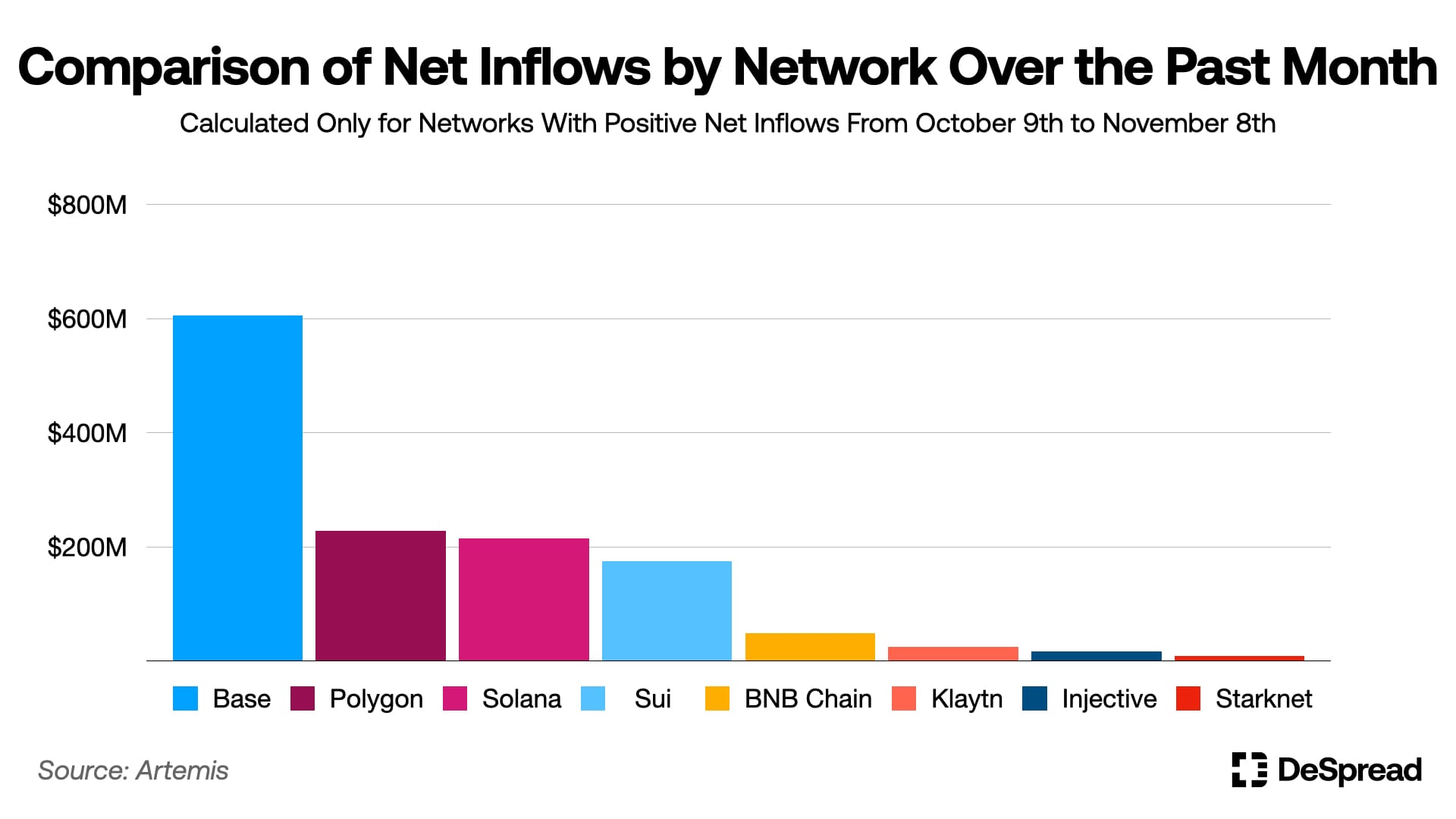

The Base network, launched by Coinbase, has shown remarkable growth even before election day and Trump's victory, recording about $574M in net asset inflows, led by the growth of Aerodrome, Base network's native DEX, and Virtuals Protocol (which we covered in our previous commentary). This occurred during a period when Ethereum L2s were showing poor performance compared to L1s like Solana and Sui. Additionally, market expectations for Coinbase's cryptocurrency business expansion are expected to have an even more positive impact on Base ecosystem protocols going forward.

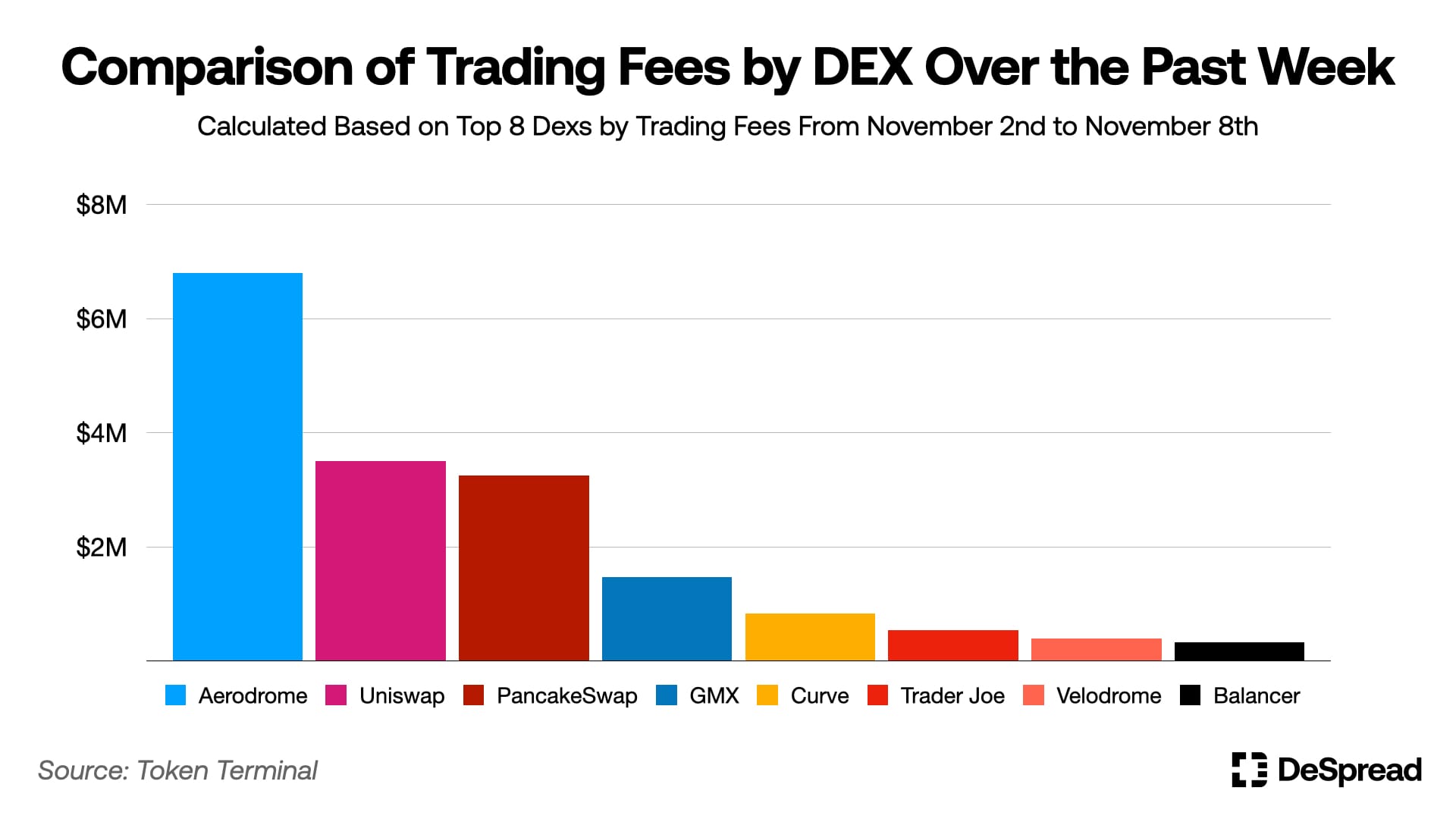

Among these, Aerodrome has been particularly impressive. Aerodrome is a DEX protocol that adopts the "Solidly" mechanism, distributing $AERO tokens to liquidity providers and trading fees to $AERO token stakers. It plays a central role in the ecosystem by recording high trading volumes on the Base network. In fact, during the first week of November, it generated approximately $6.8M in trading fees, showing overwhelming metrics compared to other DEXs, while its native token $AERO also showed a 24% price increase during the same period. The token's price increase can be attributed to both the protocol's high performance and the influx of capital seeking to invest in Coinbase and the Base network flowing into $AERO tokens, given the absence of a native token for the Base network.

However, it should be noted that Aerodrome currently distributes about 9 million new $AERO tokens weekly to liquidity providers, raising concerns about continuous supply increase. Due to the protocol's structure, trading fees generated from the protocol have a relatively larger impact on token demand compared to other DEXs. This creates a structure that necessitates trading fee growth corresponding to newly distributed token supply, requiring continuous and careful monitoring of the aforementioned metrics.

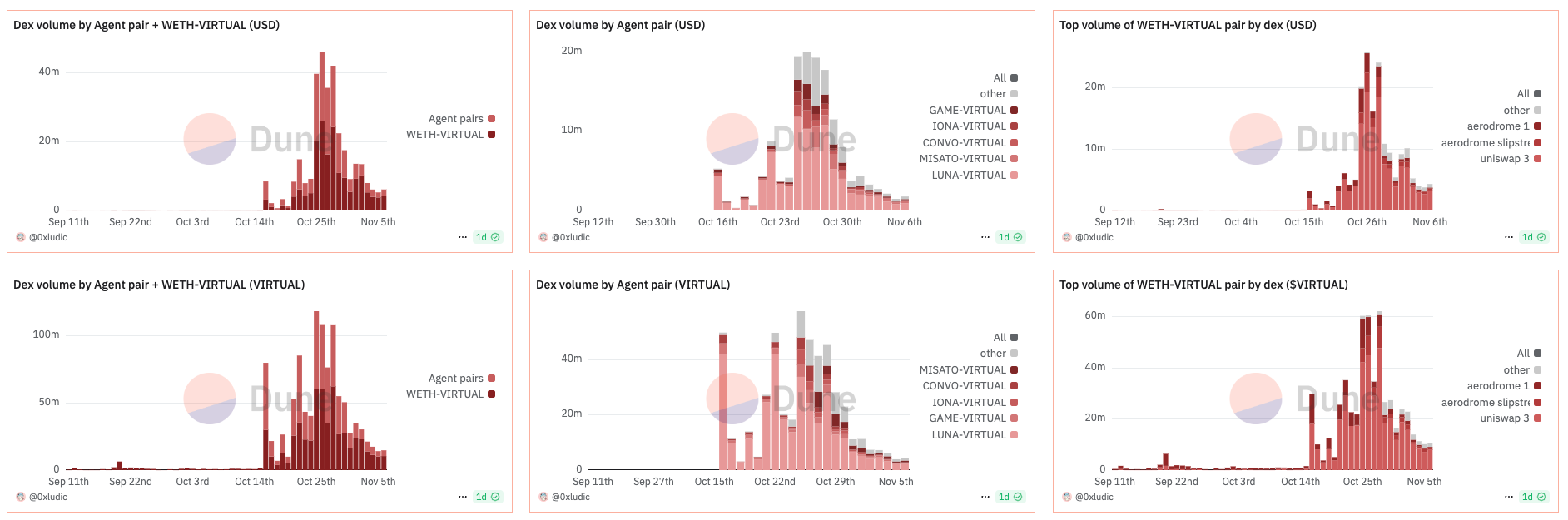

Furthermore, we believe that for the Base ecosystem to expand, additional dApps need to flourish beyond DEXs like Aerodrome to drive network activation. Virtuals Protocol, which was once at the center of the AI meme narrative in October, seems somewhat left out of the excitement about Trump's victory and the expected industry revival. For instance, the trading volume of $VIRTUAL and Virtual Protocol's agent tokens, which once reached approximately $46M, recorded about $6M on November 6th, showing an 87% decrease. Additionally, metrics such as DAU and engagement numbers for Farcaster, which led Base network's surge in early 2024, are also declining, showing somewhat disappointing results in terms of dApp activation.

References

- 신영증권, 이더리움 현물 ETF 승인 전망과 쟁점 분석

- HOR, 2024년 미국 대선과 크립토산업의 미래

- Uniswap Labs, Wells Notice Response

- @0xludic dune dashboard