Arkadiko — Laying the Foundation for Bitcoin DeFi

Focusing on the Background and Purpose of the Arkadiko 2.0 Update

1. Introduction

On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETF applications submitted by a total of 11 institutions. This led to an influx of significant capital from traditional financial institutions into the Bitcoin market, resulting in a new all-time high for Bitcoin's price.

The SEC's ETF approval brought substantial capital into Bitcoin and increased the demand for utilizing Bitcoin. This aligns with the growing interest in Bitcoin Layer 2 solutions, which support Bitcoin-based decentralized applications (dApps) while maintaining Bitcoin's core values of decentralization and stability. Among these projects, Stacks has long aimed to apply smart contracts to the Bitcoin network and has built a Bitcoin dApp ecosystem, thus garnering considerable attention as a Bitcoin Layer 2 project.

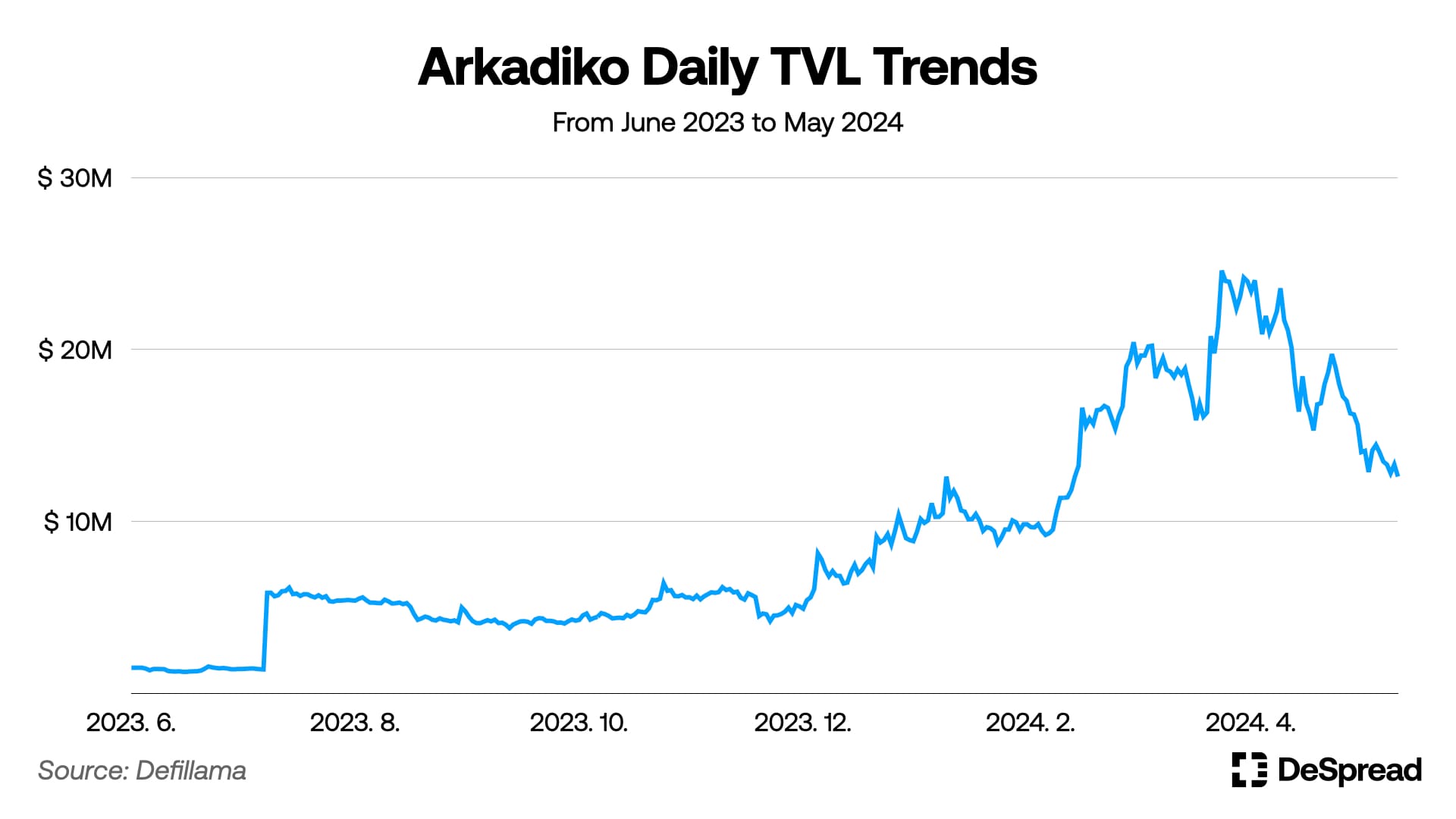

Arkadiko Finance is one of the most crucial dApps within the Stacks ecosystem, enabling users to issue stablecoins using native assets of the Stacks ecosystem as collateral. As a DeFi (Decentralized Finance) project, Arkadiko has significantly benefited from the Bitcoin narrative and has seen its Total Value Locked (TVL) increase more than 19 times from June last year to March this year.

This article will detail Arkadiko's role within the rapidly growing Stacks ecosystem and examine how the newly launched Arkadiko 2.0 will impact the development of the Bitcoin DeFi ecosystem.

2. Features and Limitations of Arkadiko

2.1. Operating Mechanism: Loans and Liquidation

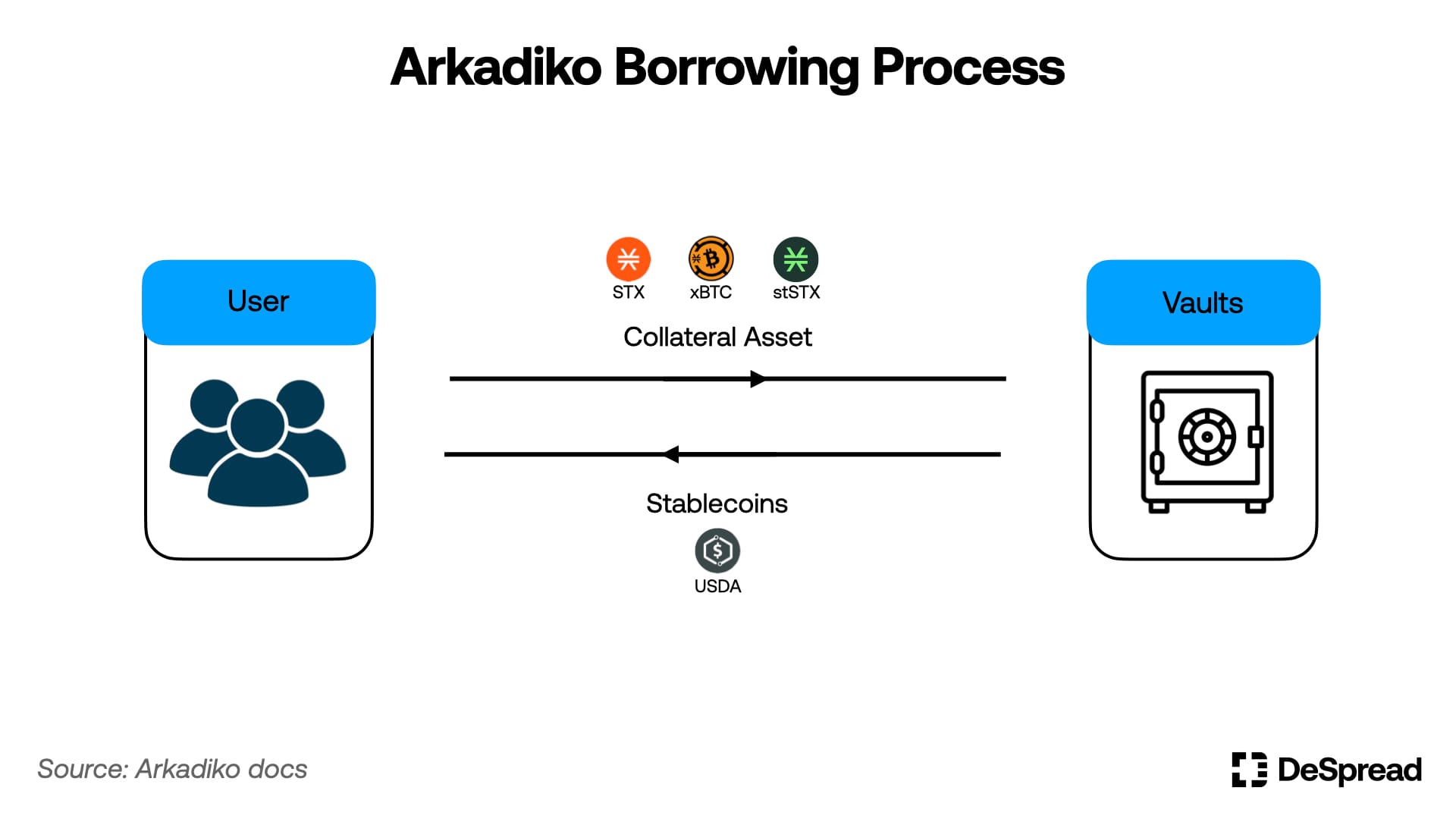

Arkadiko issues a stablecoin, USDA (USD Arkadiko), valued at $1, using Stacks-based assets like STX and stSTX as collateral. This project is based on a Collateralized Debt Position (CDP) system, allowing users to leverage their asset positions while gaining additional asset utilization opportunities. This process is similar to securing bank loans with assets like homes or cars in traditional markets, with the lending and repayment procedures conducted in a decentralized environment via smart contracts.

In Arkadiko, the value of the collateralized assets must always exceed the value of the issued stablecoins, utilizing an over-collateralization system to ensure stable repayment. If the collateral value drops below a certain threshold due to market fluctuations, it triggers a forced liquidation where the collateral is auctioned at a 10% discount. This results in a 10% loss for the collateral provider, who must provide additional collateral or repay the USDA early to avoid forced liquidation.

In the event of forced liquidation, the collateral assets used to issue USDA are auctioned off, and the loaned assets are repaid. The collateral is sold at a 10% discount, allowing the buyer to gain a 10% profit margin.

Arkadiko's liquidation pool facilitates forced liquidation through the following steps:

- Users deposit their USDA into the liquidation pool for a specified lock-up period.

- When the collateral asset value falls below the liquidation ratio, forced liquidation occurs.

- The collateral asset is automatically swapped with the USDA in the liquidation pool at a 10% discount, with the swapped assets distributed to users based on their contribution to the pool.

The USDA used in the liquidation process exits the pool for vault repayment, and users who deposited USDA in the liquidation pool receive the discounted collateral assets according to their contribution ratio. Additionally, USDA liquidation pool participants receive DIKO, Arkadiko's governance token, as a reward (10% of the ecosystem rewards allocated to the liquidation pool).

By introducing this mechanism, Arkadiko enhances the profitability of USDA depositors while strengthening USDA's stability.

2.2. Governance

Arkadiko's governance token, DIKO, and its staking token, stDIKO, grant token holders the authority to participate in key platform policy decisions. Governance token holders can submit Arkadiko Improvement Proposals (AIPs) to optimize protocol growth according to market conditions. These AIPs are subject to thorough community discussion and a vote to determine implementation. Recent AIPs include:

- AIP-19: Proposal to remove stDIKO cooldown period

- AIP-20: Proposal to adjust DIKO reward ratio

- AIP-21: Proposal to adjust interest rates and issuance fees for USDA loans

AIP-19, which proposed removing the stDIKO cooldown period, was approved by a governance vote on June 6, 2024. Originally, stDIKO was used in Arkadiko's security module to ensure protocol safety during hacks or exploits, requiring a 10-day cooldown period upon withdrawal. This measure prevented sudden bank runs by ensuring capital deployed in the security module could protect the protocol.

However, discussions revealed that stDIKO did not function effectively as a security module and instead hindered DIKO's growth. Given the emergence of various DeFi protocols within the Stacks ecosystem, utilizing DIKO and stDIKO for collateral loans in other protocols became crucial for Arkadiko's growth. Consequently, AIP-19 was proposed to allow users to use Arkadiko more freely without the burden of a cooldown period.

Arkadiko's governance adapts to changing environments, maximizing growth potential through community-driven proposals and decisions, ensuring the platform's continuous development.

2.3. Utilizing Stacks' PoX Algorithm

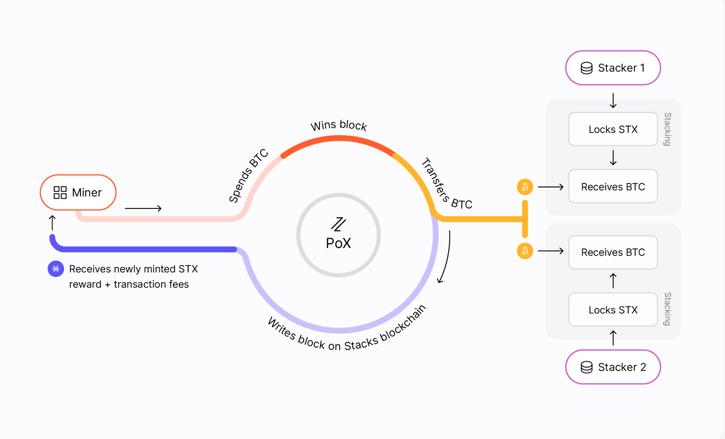

Stacks' PoX (Proof of Transfer) consensus algorithm involves miners creating blocks on the Stacks chain and stackers contributing to network security by stacking STX. Stacks miners bid BTC to create blocks in sync with Bitcoin's block generation cycle, with higher bids increasing the probability of block creation. Successful miners receive STX as block rewards, and the BTC used in bidding is distributed to stackers.

Arkadiko leverages the PoX algorithm to build a system for repaying collateral loan interest. Arkadiko participates in stacking using the STX collateral provided by users, generating BTC revenue. This revenue is distributed to users who initiated collateral loans, allowing them to receive PoX rewards without additional procedures and use the distributed revenue to repay loan interest, maximizing capital efficiency.

2.4. Limitations

2.4.1. Pegging Mechanism and Arbitrage Environment

Stablecoins, excluding dollar-based ones, typically guarantee a $1 value within their platform, enabling seamless arbitrage to maintain the $1 peg. CDP stablecoins undergo the following arbitrage processes:

- Case 1) Stablecoin > $1

- Arbitrageurs issue stablecoins on the CDP platform and sell them at higher prices in the market.

- As the CDP platform treats stablecoins as $1, the demand for stablecoin repayment decreases.

- Increased supply and selling pressure in the market cause the stablecoin price to drop.

- Case 2) Stablecoin < $1

- As stablecoins can be bought cheaply in the market, the demand for stablecoin repayment increases.

- Higher costs of borrowing stablecoins compared to the market reduce borrowing demand.

- Reduced supply and increased buying pressure in the market raise the stablecoin price.

However, merely having these processes does not ensure the easy maintenance of the peg for CDP stablecoins. Both scenarios require additional capital for arbitrage, making seamless arbitrage difficult, necessitating supplementary mechanisms.

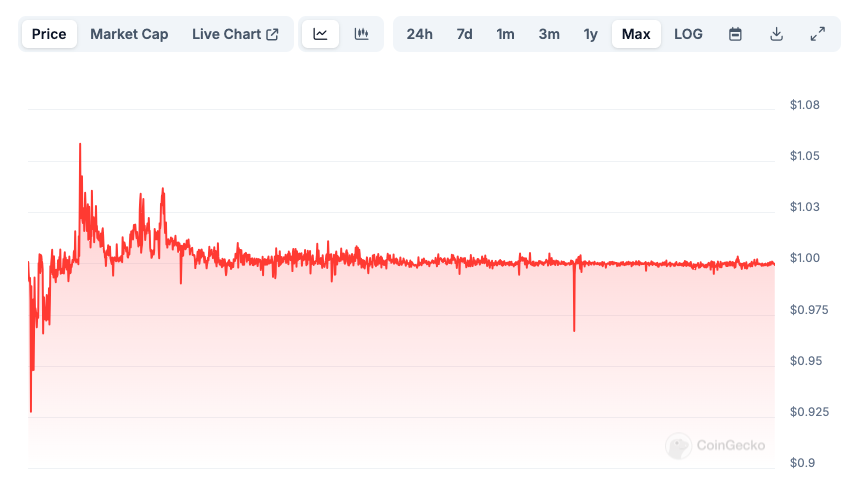

Ethereum's prominent CDP project, MakerDAO, which issues DAI, initially struggled to maintain a $1 peg. However, supplementary mechanisms such as Curve Finance's stable swap, backed by abundant dollar-based stablecoin liquidity, and the Peg Stabilization Module (PSM) guaranteeing 1:1 USDC to DAI exchanges, helped stabilize the $1 peg from late 2020 onwards.

2.4.2. Limitations of USDA Pegging Mechanism

The Ethereum ecosystem, with its large-scale DeFi ecosystem, has a significant distribution of USDC and USDT, creating an environment conducive to the emergence of supplementary mechanisms that aid stablecoin pegging. This positively impacts the maintenance of robust pegs for CDP stablecoins.

In contrast, the Stacks ecosystem faces challenges in introducing and distributing dollar-based stablecoins like USDC and USDT. This has hindered the development of mechanisms like Curve Finance's stable swap and MakerDAO's PSM, which aid stablecoin pegging.

As a result, USDA has struggled to maintain a $1 peg due to the lack of sufficient trading environments and arbitrage opportunities necessary for maintaining the peg since its launch.

3. Arkadiko 2.0: Restoring Pegging and Enhancing Protocol Stability

In December 2023, Arkadiko announced its 2024 roadmap, revealing plans for a significant protocol upgrade dubbed Arkadiko 2.0.

"Much of these fixes have to do with our peg, which has been less than stable in the past year. Initially, we assumed a native stablecoin like USDC and USDT would be present on-chain while we’ve only seen wrapped version of them up until now. Our initial plan of building deep liquidity in a StableSwap pool and catching outflows with sufficient DIKO incentives has failed.

…

We’ve missed our chance at keeping things stable and need a stronger method to restore dips in USDA price." — “Arkadiko 2024 Roadmap”

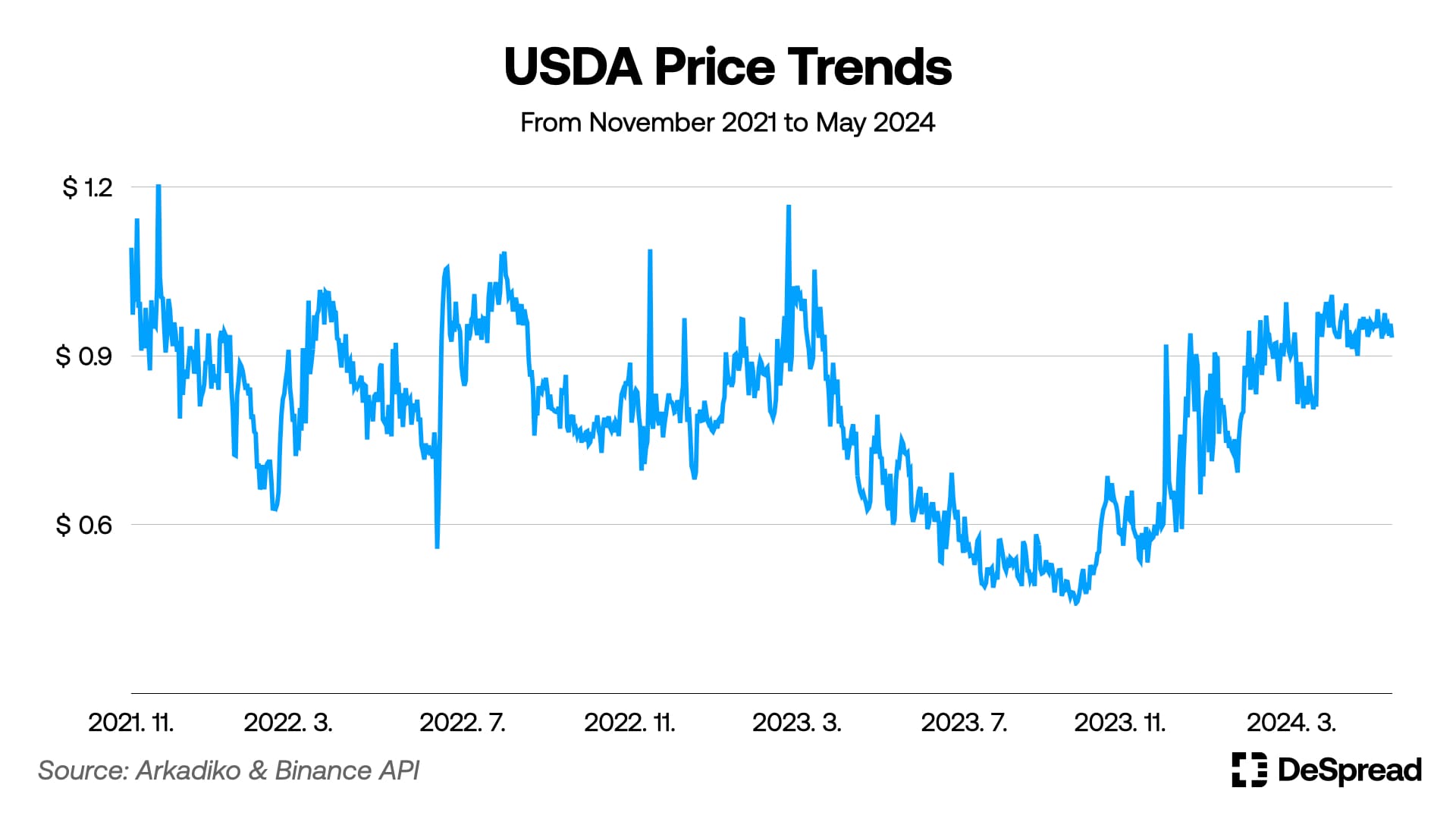

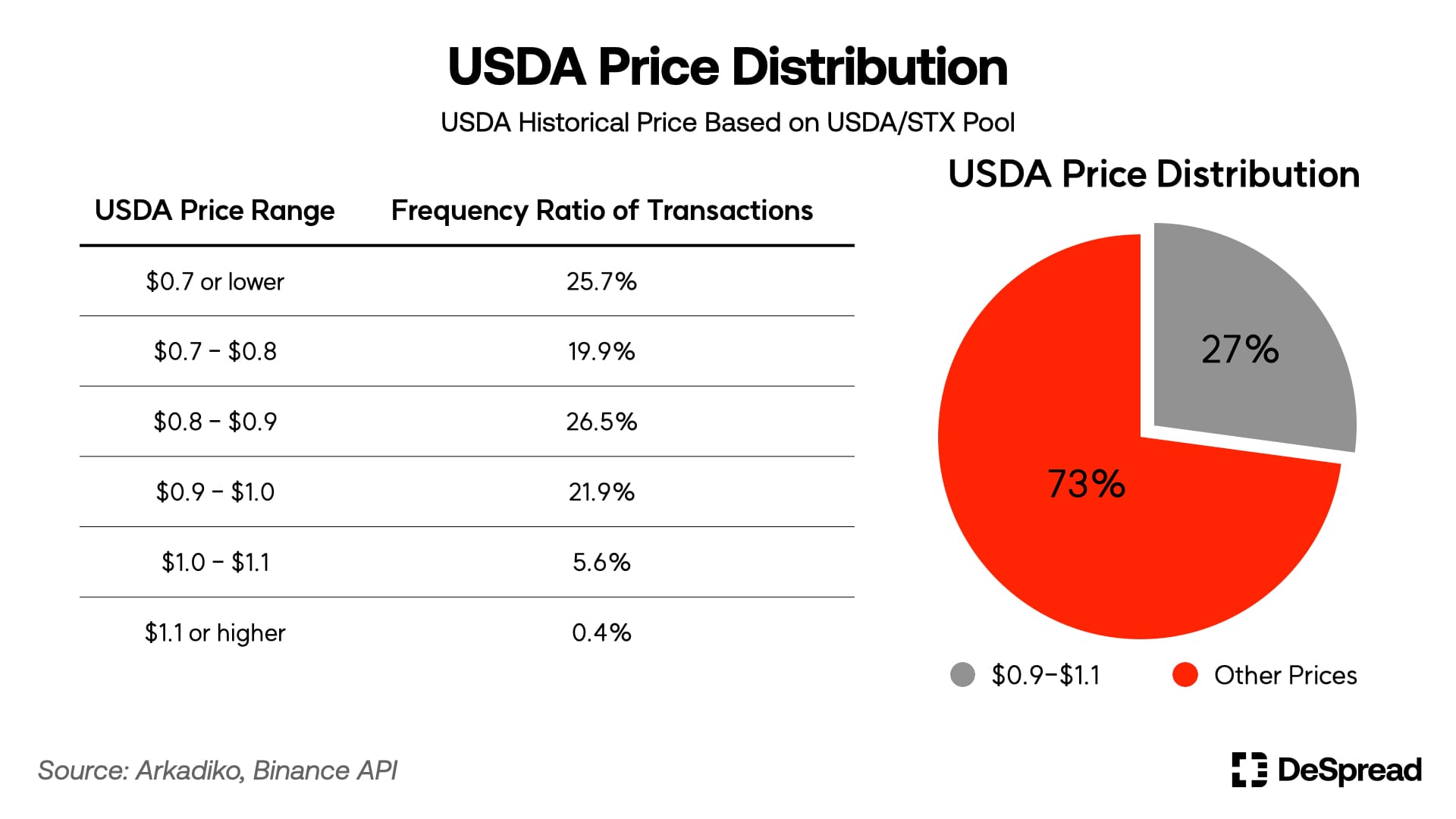

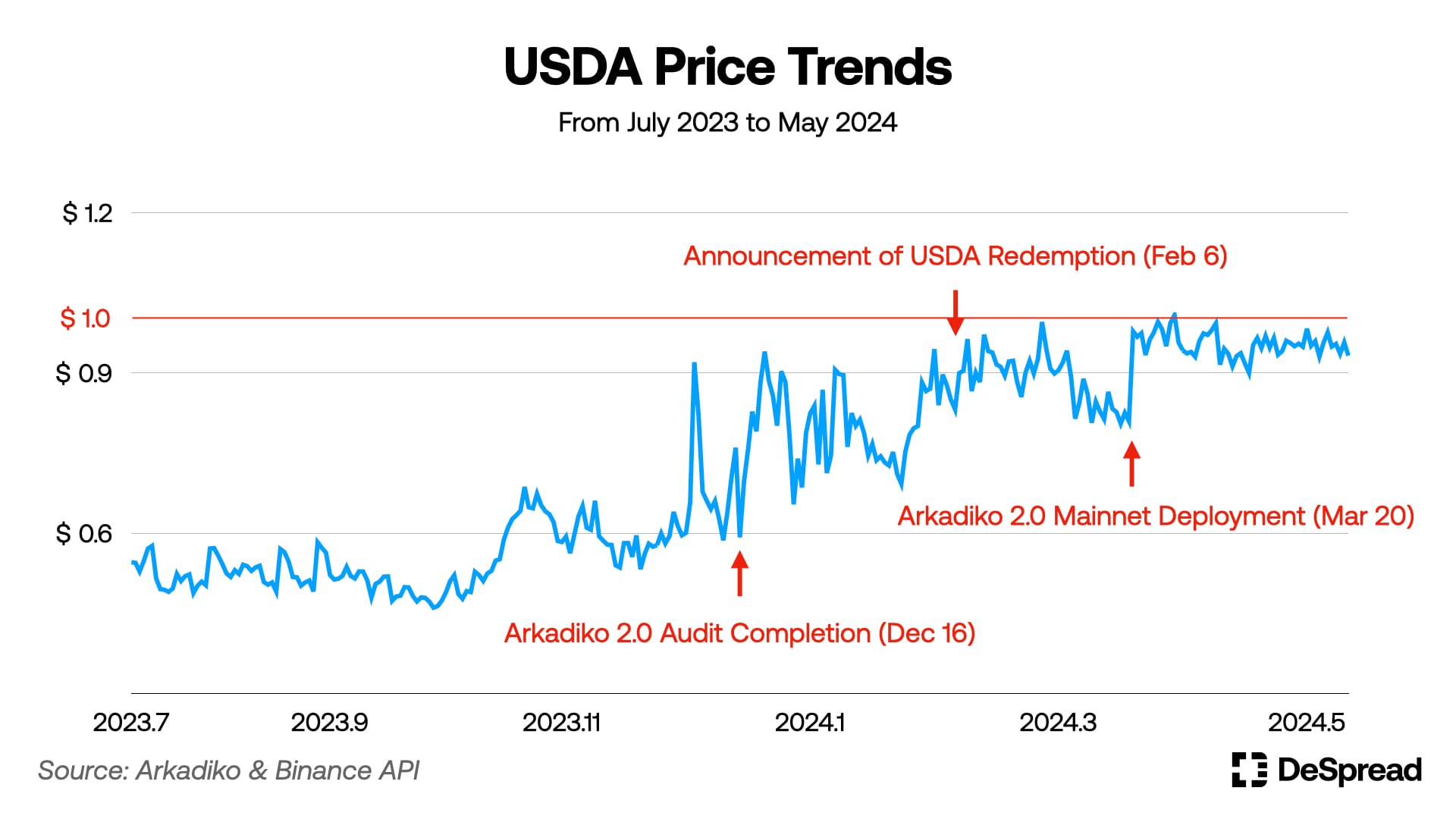

As illustrated in the Arkadiko roadmap, the primary reason for the Arkadiko 2.0 upgrade was the unstable pegging of USDA. Reviewing the USDA/STX pool transactions since Arkadiko's launch shows that over 70% of trades valued USDA below $0.9.

For Arkadiko, a CDP-based stablecoin project, the pegging issue was a vulnerability and a limitation in protocol operations. To address this problem, Arkadiko implemented the Redemption feature as the core of its Arkadiko 2.0 upgrade in March 2024.

3.1. Redemption

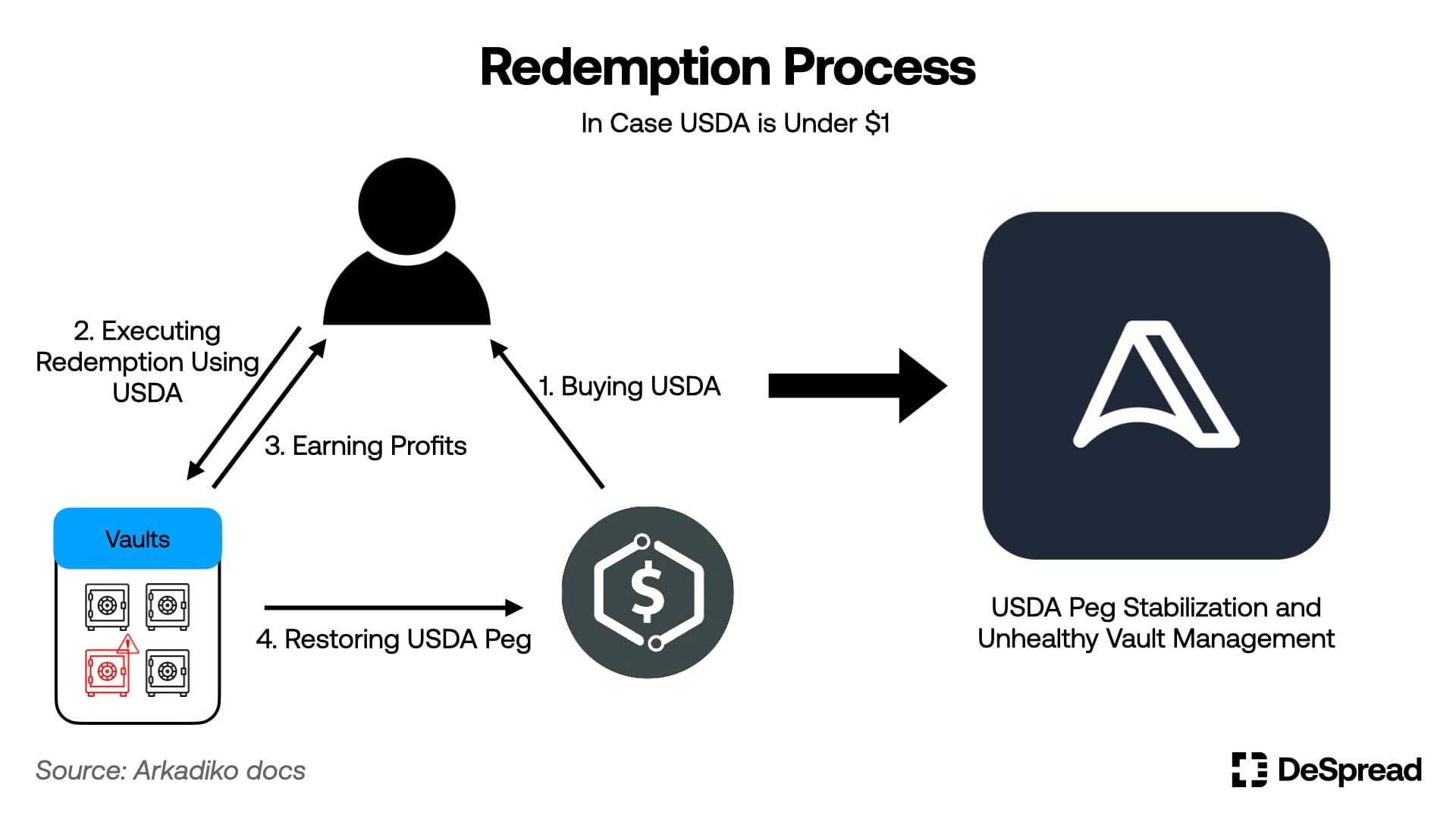

The primary limitation of typical CDP-based stablecoin projects is the relatively restricted arbitrage environment. Particularly when the stablecoin price falls below $1, users must buy the stablecoin in the market and redeem it on the platform to perform arbitrage. However, only users who created vaults can engage in arbitrage, complicating efficient peg recovery.

The redemption feature addresses these limitations and enhances the pegging mechanism with the following characteristics:

- Any user can purchase USDA from the market and repay loans for vaults at risk of liquidation, regardless of whether they created the vault.

- Users can repay loans for vaults at risk of liquidation and receive the collateral (STX, stSTX, xBTC) in those vaults.

- Liquidation risk is determined by the liquidation ratio (Collateral/Debt value), with higher risks closer to the liquidation ratio.

- Dynamic Redemption Fee:

- A base fee of 0.5% is applied to redemptions, increasing gradually with each redemption.

- If no redemptions occur for a set period, the fee gradually returns to the base rate of 0.5%.

- This mechanism prevents protocol instability caused by indiscriminate redemptions.

The redemption feature's introduction allows anyone to repay debt even without actual vault liquidation, fostering a seamless arbitrage environment to strengthen USDA pegging and encouraging vault creators to maintain healthy liquidation ratios.

Following the announcement and mainnet deployment of Arkadiko 2.0 featuring the redemption function, USDA prices have shown signs of stabilizing closer to the $1 peg, indicating some effectiveness of the update. However, the feature currently remains accessible mainly to developers, highlighting some limitations in user accessibility.

3.2. Protocol Updates

3.2.1. Adding stSTX as Collateral

stSTX, issued by StackingDAO as part of Stacks' Liquid Stacking solution, serves as a receipt token for users delegating STX stacking to StackingDAO.

The recent update allows stSTX to be used as collateral in Arkadiko, alongside previously accepted assets like STX and xBTC. This enables users to earn income through STX stacking and leverage stSTX as collateral to issue stablecoins, enhancing capital efficiency.

3.2.2. Upcoming Addition of sBTC as Collateral

Stacks plans to launch sBTC in Q3 2024, enabling trust-minimized transfers of BTC onto the Stacks chain. Unlike Layer 1s like Ethereum or Solana, Stacks can directly read Bitcoin network states, allowing decentralized interaction with BTC through a group of stackers, facilitating free movement of BTC between the Bitcoin and Stacks chains.

Upon sBTC's release, Arkadiko 2.0 will adopt it as collateral, allowing BTC holders to engage with Arkadiko without additional third-party trust.

3.2.3. Creation of a Stable Swap Pool

Similar to how DAI maintains its $1 peg through stable swap mechanisms on Curve Finance, Arkadiko partnered with Bitflow, Stacks' stable swap protocol, and Allbridge to bridge aeUSDC (bridged USDC on Stacks) and USDA. This stable swap pool supports seamless exchanges between USDA and dollar-based stablecoins, promoting a robust arbitrage environment and contributing to a stable $1 peg for USDA.

4. Conclusion: Current Status and Outlook

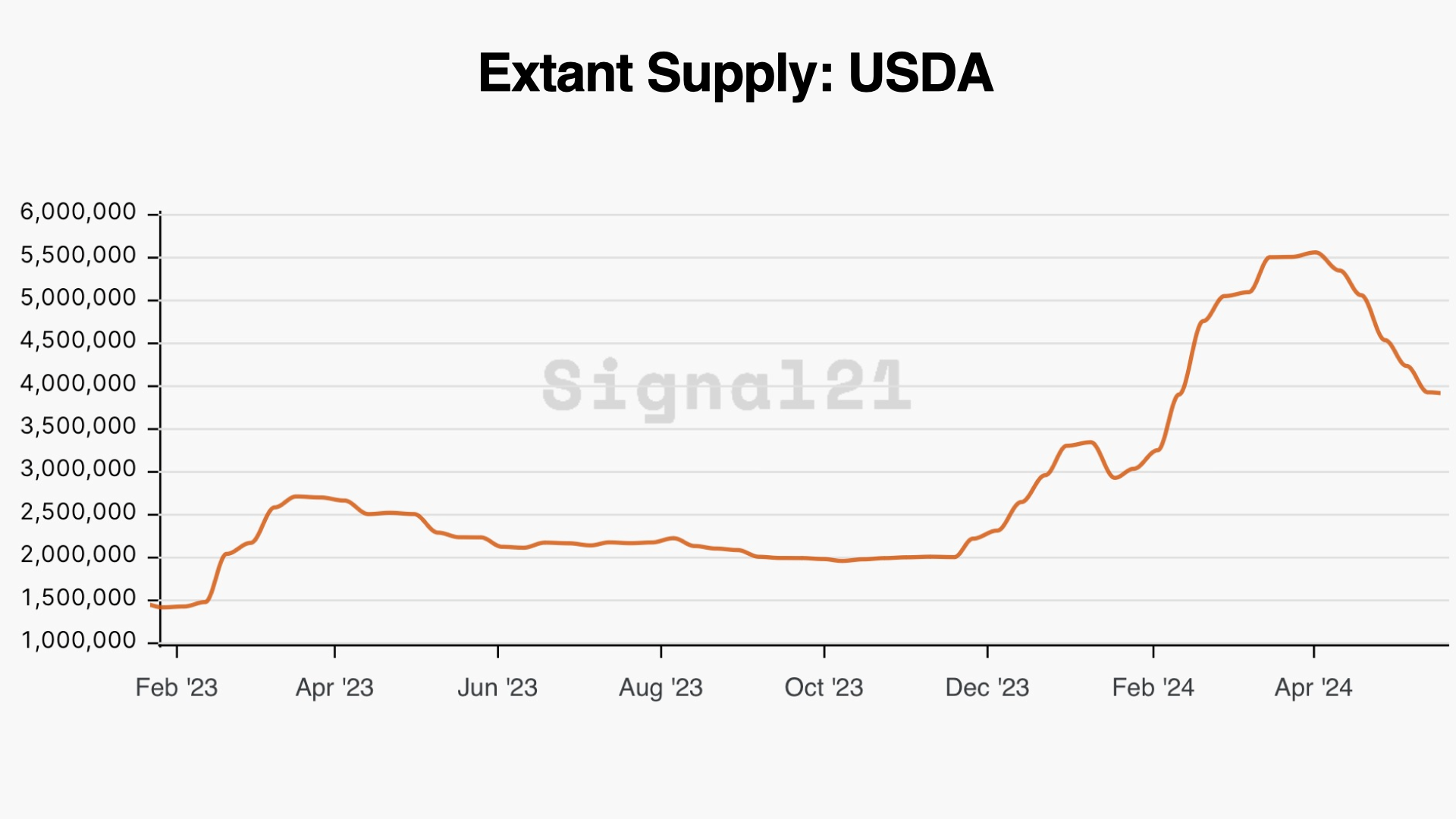

The overall market recovery spurred by the Bitcoin ETF approval became evident from mid-2023, with Bitcoin-related themes receiving significant attention. Arkadiko, a main CDP project within the Stacks ecosystem, benefited from this trend, showing remarkable growth across its protocol. From June 2023 to March 2024, Arkadiko's TVL grew approximately 19 times from $1.25M to $24.6M.

USDA circulation also increased, doubling from $2.1M in June last year to over $5.5M in March this year. Despite this growth, Arkadiko's TVL and stablecoin circulation remain lower than major CDP protocols on other chains like MakerDAO, Thala, and Liquity. However, with significant updates like Nakamoto Release and sBTC launch scheduled for the Stacks chain this year, further growth is anticipated.

In January, the Spartan Group's report 'Bitcoin Layers: Tapestry of a Trustless Financial Era' noted that Bitcoin applications' TVL is currently undervalued compared to Ethereum's market cap to application TVL ratio, suggesting a potential 740-fold growth if Bitcoin applications become mainstream. If Stacks' main updates succeed and BTC assets are widely utilized on the Stacks chain, Arkadiko, as a key CDP project, could emerge as a major beneficiary.

Arkadiko has evolved with Stacks, aiming to be a Bitcoin-based CDP protocol. The recent emergence of Runes Protocol and discussions around OP_CAT suggest the potential for smart contract capabilities on the Bitcoin network itself. Combined with the rise of Bitcoin Layer 2 projects, the environment for Arkadiko's vision is becoming more tangible. Observing how Arkadiko leverages these changes to achieve its vision will be key in the coming years.

References

- Arkadiko docs

- Arkadiko White Paper

- Arkadiko Governance

- Arkadiko, Arkadiko 2024 Roadmap

- Arkadiko, Explaining Arkadiko 2.0: Redemptions

- Arkadiko, Arkadiko Nakamoto Update

- Stacks docs

- sBTC: Design of a Trustless Two-way Peg for Bitcoin

- The Spartan Group, Bitcoin Layers: Tapestry of a Trustless Financial Era

- Signal21, Arkadiko Overview