Astar — A Journey Toward Sustainability

Structuring a Sustainable Multi-Layer Ecosystem Centered on $ASTR

1. Introduction

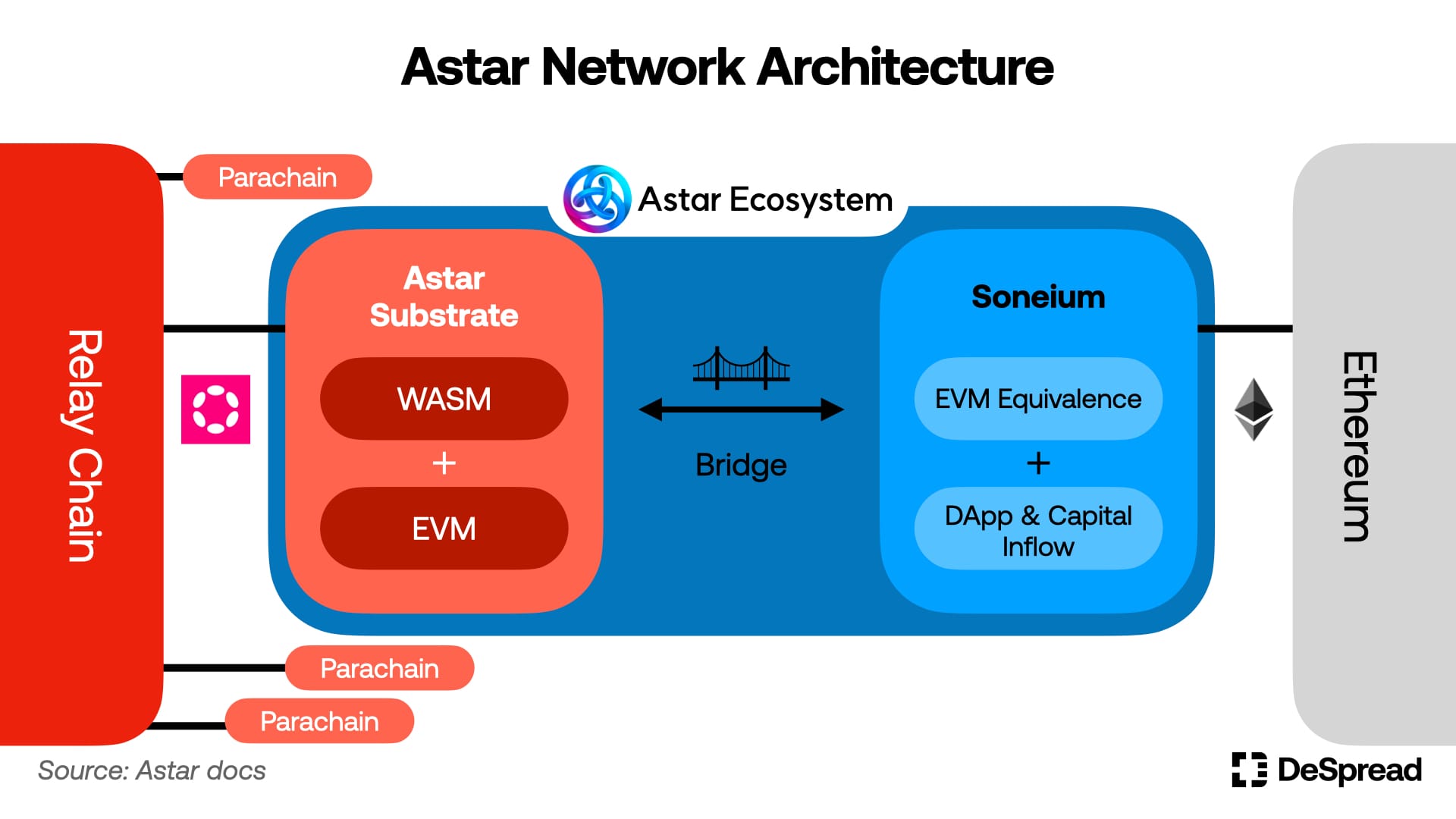

1.1. Astar Network Architecture

Astar is a multichain smart contract platform built on the Polkadot ecosystem. It successfully launched its mainnet in December 2021 after securing third place in Polkadot’s parachain slot auction. By leveraging the Substrate framework, Astar inherits the shared security of the Polkadot Relay Chain while delivering high throughput and interoperability, enabling a flexible and efficient development environment for both enterprises and builders. The network currently supports both EVM and WASM environments, establishing itself as a multi-VM infrastructure with broad language and tooling compatibility.

In March 2024, Astar elevated its technical roadmap by launching Astar zkEVM, a Layer-2 Ethereum solution that achieves not just EVM compatibility but full EVM equivalence. This milestone significantly expanded Astar’s reach within the Ethereum ecosystem. Building on this momentum, Astar announced a major strategic shift in August 2024 by transitioning Astar zkEVM into “Soneium,” a blockchain initiative led by Sony, Astar’s long-standing strategic partner and one of Japan’s most prominent conglomerates. Soneium, an Ethereum L2 built on the Optimism OP Stack, is operated by Sony Blockchain Solutions Labs (SBSL), a joint venture between Sony Group and Startale Labs.

Through this transformation, Astar retained its Polkadot parachain identity while simultaneously establishing a multi-layer ecosystem that spans Polkadot, Ethereum, and Soneium. This transition represents more than just technical expansion—it marks a pivotal step toward the long-term sustainability of both Astar and Soneium, laying the foundation for a broader, more interconnected Astar ecosystem under what is now known as “Astar Evolution Phase 1.”

In a multichain ecosystem like Astar, seamless interoperability between networks is of paramount importance. Astar has secured this capability by partnering with long-established and industry-recognized interoperability protocols such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and LayerZero. Through these integrations, Astar ensures robust interoperability across dozens of networks, including Ethereum Layer 1 and various Layer 2 solutions.

1.2. Investors and Strategic Partners

In December 2021, Astar successfully launched its mainnet by completing a community-driven crowdloan campaign as part of the Polkadot parachain auction. The campaign attracted over 27,000 participants and secured more than 9.47 million DOT (approximately $380 million at the time), establishing a strong foundation of early community support.

Earlier that year, in February 2021, Astar raised $2.4 million in a Series A round from Binance Labs (now YZi Labs) and HashKey Capital, followed by an additional $10 million from investors including Fenbushi Capital and Hypersphere Ventures.

In January 2022, Astar continued its growth trajectory by raising $22 million in a strategic round backed by prominent investors such as Polychain Capital, GSR, and Alameda Research. Most recently, Astar secured both a strategic partnership and investment from Animoca Brands, a leading player in the blockchain gaming sector.

Beyond securing capital from prominent global investors, Astar’s strategic positioning in Japan has become one of its most distinctive competitive advantages. Led by founder Sota Watanabe, the Astar Foundation has actively collaborated with the Japanese government and major corporations, solidifying its status as Japan’s flagship blockchain project. Notably, in 2022, Astar signed a partnership with the city of Fukuoka to provide Web3 education and technical support while jointly exploring blockchain use cases in the public sector, thereby contributing to government-led Web3 industry development in Japan. Additionally, Astar has forged alliances with major Japanese corporations such as Microsoft Japan, SoftBank, and NTT Docomo to cultivate a robust domestic Web3 ecosystem.

Among these partnerships, Astar’s collaboration with Sony stands out as a particularly significant milestone. In June 2023, Sony Network Communications, a subsidiary of Sony Group, made a strategic investment of approximately $3.5 million in Startale Labs, the development company led by Watanabe. This investment led to the establishment of Sony Blockchain Solutions Labs (SBSL), a joint venture headquartered in Singapore. Sony contributed 90% of the capital to SBSL, marking its official entry into the Web3 industry. The outcome of this collaboration is Soneium, the Ethereum Layer 2 network mentioned earlier. Positioned as a gateway to Japan’s Web3 expansion and a vital layer within the Astar ecosystem, Soneium adopts Astar’s native token, $ASTR, as a core asset—broadening its use cases and reinforcing the token’s utility within a sustainable multi-layer framework.

1.3. $ASTR Tokenomics

Astar’s native token, $ASTR, serves as the foundational asset of the Astar ecosystem. It is used for transaction fees, staking rewards, builder incentives, treasury operations, and community funding. The initial total supply of $ASTR was set at 7 billion tokens, with the distribution allocated as follows:

- Users and early supporters: 30%

- Parachain auction participants: 20%

- Early backers: 10%

- Foundation: 10%

- Protocol development: 10%

- Marketing, DAO, team incentives, and parachain auction reserve: 5% each

Since launch, Astar has faced persistent inflationary pressure due to high block rewards, amounting to 253.08 $ASTR per block. With blocks produced every 12 seconds, this translated into an annual inflation rate of approximately 9.5% to 10%. As a result, by June 2025, the total supply of $ASTR had increased by over 1.4 billion tokens from its initial issuance, reaching 8.43 billion.

However, the challenge extended beyond mere supply expansion. Without sufficient utility for the native token and no mechanisms to offset the structural selling pressure, the market value of $ASTR continued to decline. Moreover, the lack of meaningful rewards for users and developers exposed limitations in ecosystem engagement and sustainability.

Recognizing this issue, the Astar team introduced “Tokenomics 2.0” in August 2023, aimed at alleviating inflationary pressure and supporting the ecosystem’s long-term growth. At the core of this upgrade was a shift from fixed block rewards to a dynamic inflation model, where reward issuance would be determined based on factors such as the network’s staking ratio and overall participation levels.

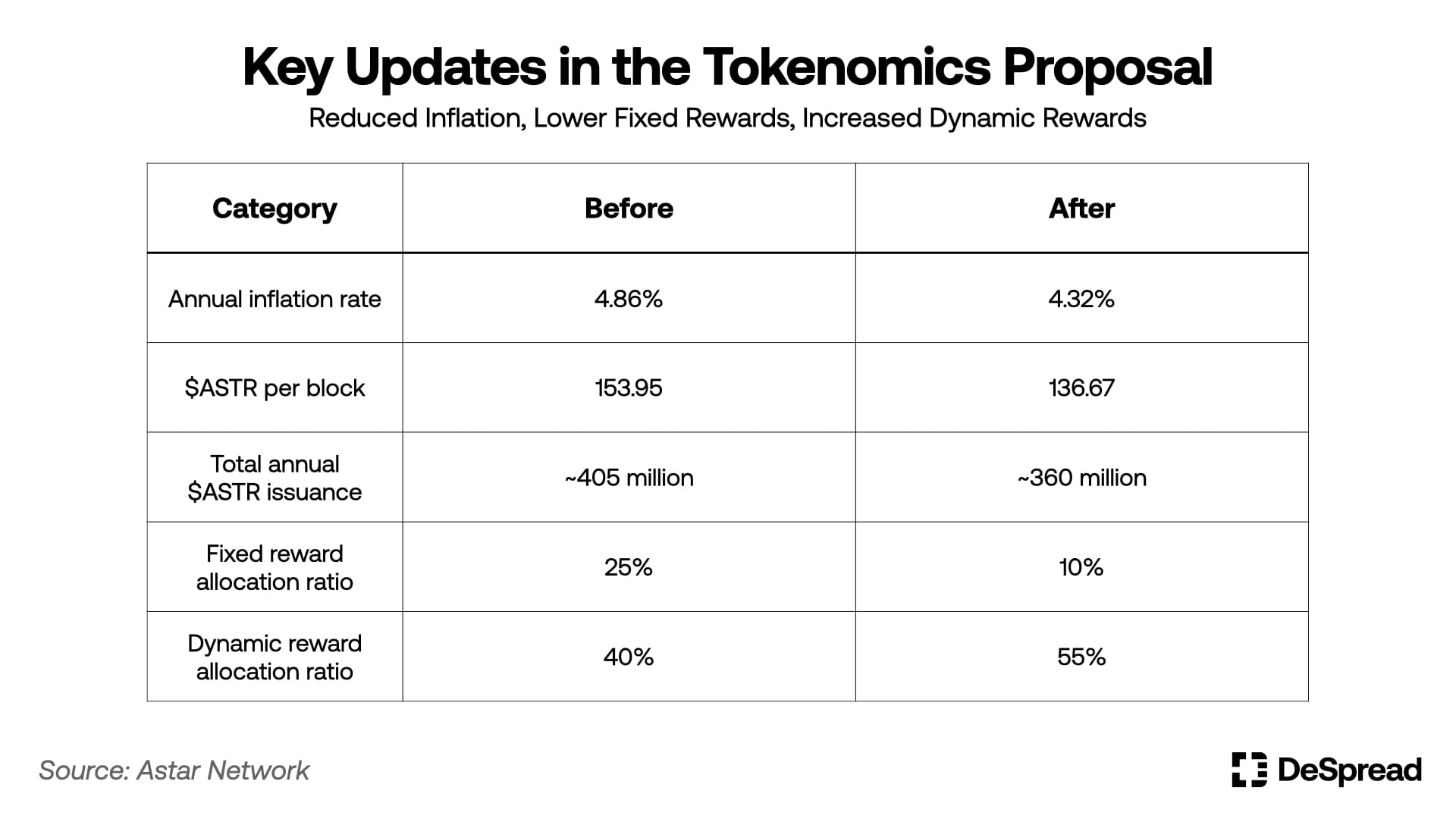

While this dynamic reward structure succeeded in reducing the annual inflation rate from 9.5% to 4.86%, it eventually revealed certain limitations. The high proportion of fixed rewards allocated to $ASTR stakers (BaseStakersPart: 25%) and the relatively low portion of variable rewards (AdjustableStakersPart: 10%) led to unstable APRs for dApp staking and continued overall inflation growth.

In response, the Astar team initiated a structural overhaul of its tokenomics in April 2025, aiming to address both excessive inflation and unstable network rewards at their root. This article explores the recent changes in $ASTR’s tokenomics designed to enhance long-term sustainability and examines how these reforms align with Astar’s broader strategic direction.

2. A Roadmap by Sustainability, for Sustainability

From day one, Astar has remained committed to providing sustainable incentives for both early users and long-term contributors. Most recently, in response to the limitations of the previously introduced dynamic inflation model, Astar initiated a major overhaul of its tokenomics to enhance the long-term viability of $ASTR and revitalize both the Astar and Soneium ecosystems.

This overhaul centers around three core pillars: 1. Restructuring the block reward mechanism, 2. Transitioning to a fixed token supply, and 3. Establishing the Astar Finance Committee (AFC).

2.1. Restructuring the Block Reward Mechanism

As mentioned earlier, while the introduction of dynamic tokenomics successfully reduced annual inflation to some extent, the imbalance between high fixed rewards and low dynamic rewards continued to limit the efficiency and sustainability of network incentives. In response, on April 18, Astar proposed a new tokenomics framework focused on reducing inefficiencies in the existing reward structure and enhancing incentive alignment with actual network usage. The proposal passed governance with a 65.1% approval rate.

The core objective of this update is to alleviate inflationary pressure and enhance incentives for network participation by fine-tuning the parameters of the staking reward structure. The main changes can be summarized into three key points:

- Reduction of Fixed Rewards

The BaseStakersPart refers to the fixed portion of rewards allocated to $ASTR stakers with each block. Previously set at 25%, this high fixed rate often led to an excessive increase in APR when staking participation was low, posing a risk to network stability. Under the new framework, this parameter has been significantly reduced to 10%. The change aims to encourage more realistic expectations for staking returns, reduce short-term sell pressure on $ASTR, and promote more sustainable participation. While this reduction may initially appear unfavorable to stakers, it is widely seen as a necessary adjustment to ensure long-term sustainability of staking yields.

- Increase in Dynamic Rewards

The AdjustableStakersPart—the variable portion of rewards determined by overall staking participation, TVL, and network activity—serves as a key mechanism for driving user engagement. Previously capped around 40%, this has now been increased to 55%, creating a substantial 45-percentage-point gap between dynamic and fixed rewards.

This adjustment strengthens the correlation between user engagement and staking rewards, while being carefully designed not to impact the reward allocations for other network participants such as collators, the treasury, or builders. As a result, the revised structure seeks to optimize the overall distribution of $ASTR issuance in a way that promotes user participation without undermining builder incentives.

- Introduction of an Inflation Floor

A new minimum inflation floor of 2.5% has been introduced to prevent network activity from declining too sharply in the event of abnormally low inflation. This safeguard guarantees a minimum level of rewards for users and operates alongside the existing token burn mechanism for transaction fees. Together, these features allow for dynamic inflation adjustments in line with network activity, ensuring a more responsive and balanced token economy.

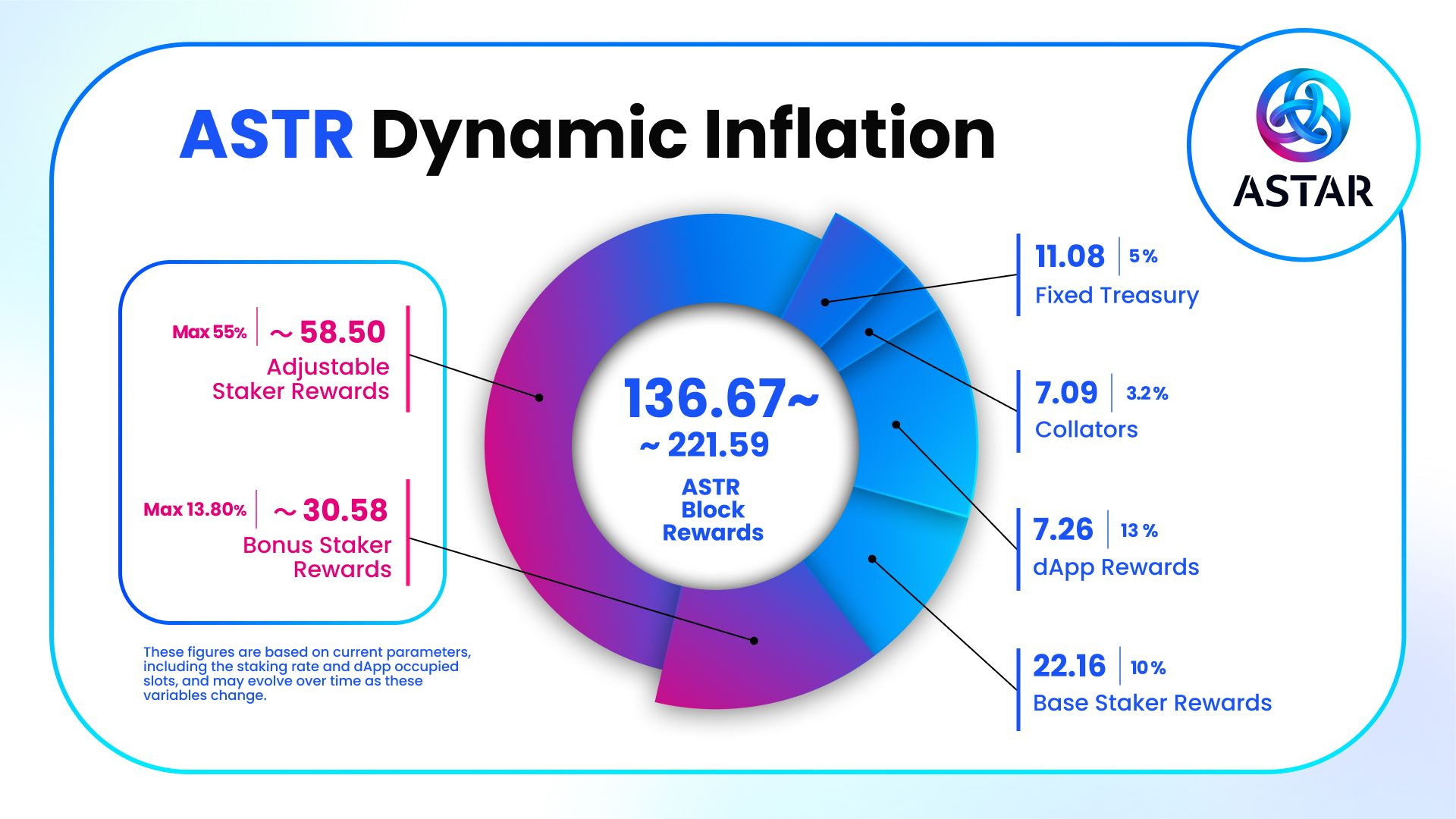

The updated block reward distribution under the new framework follows the structure outlined above. As before, Astar stakers continue to receive up to 78.8% of newly issued tokens, while the reward allocations for collators, the treasury, and builders remain unchanged.

2.2. Transition to a Fixed Supply Model

Following the restructuring of the block reward mechanism, Astar introduced a fundamental tokenomics overhaul—Tokenomics 3.0—in May, with the goal of enabling sustainable ecosystem growth. This decision was driven by three key factors: increasing institutional interest in projects with long-term value stability, the need for a new economic model following Polkadot’s transition to Agile Coretime, and the desire to reduce reliance on inflation-based incentives as the ecosystem matures.

Agile Coretime: A new resource allocation model that replaces the traditional parachain slot auction system. Instead of long-term leasing through auctions, parachains can flexibly purchase and use coretime as needed. This model enhances resource efficiency and lowers entry barriers for projects.

Like the block reward restructuring, the ultimate aim of Tokenomics 3.0 is to ensure the sustainable growth of $ASTR and the Astar ecosystem by building a self-sustaining economic model. The three core components of this upgrade are the introduction of a fixed supply model, the implementation of a gradual emission decay mechanism, and the maintenance of stable APRs.

- Introduction of a Fixed Supply Model

Astar plans to move away from its current dynamic inflation model toward a fixed supply structure with a maximum cap on token issuance. Assuming an ideal staking ratio of 50%, the total supply is expected to converge at approximately 10.5 billion $ASTR, based on the projected emission decay mechanism.

This transition is underpinned by a strategic focus on enhancing token scarcity and stabilizing value. In today’s competitive environment—where many projects are struggling to survive due to excessive inflation and token dilution—a fixed supply for $ASTR could help build investor confidence and extend the longevity of the ecosystem.

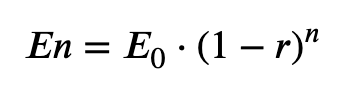

- Establishment of a Gradual Emission Decay Mechanism

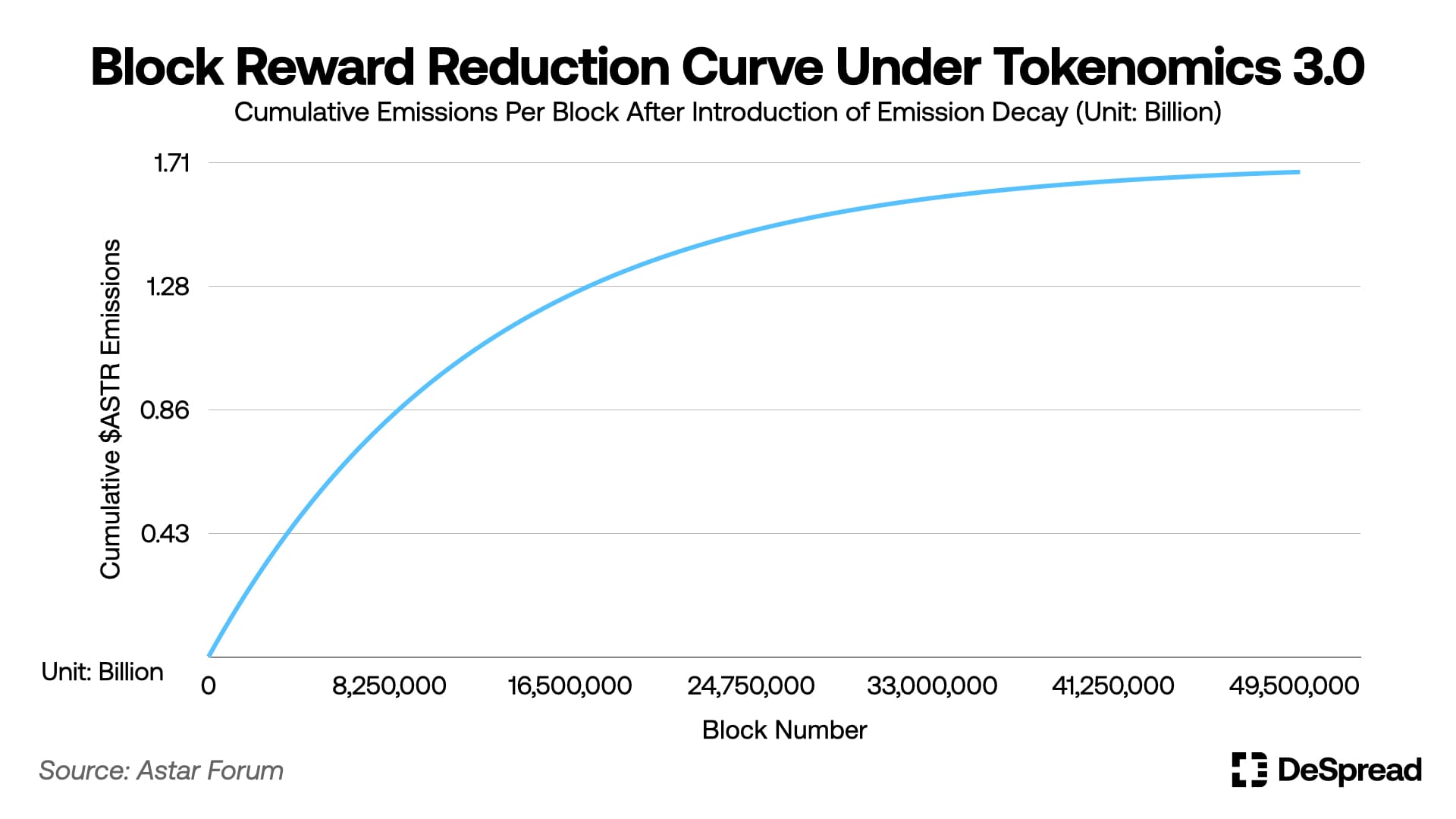

Tokenomics 3.0 introduces an emission decay structure, whereby the amount of $ASTR issued per block gradually decreases over time. While the ideal staking ratio of 50% serves as the baseline for calculating block rewards and total issuance, actual emission levels will be dynamically adjusted based on real-time staking participation.

- En = $ASTR emission at the n-th block

- E₀ = Initial $ASTR emission based on a 50% staking ratio, set at 136.67 $ASTR

- r = Emission decay rate per block, set at 0.000008%

In this model, $ASTR emissions decrease by 0.000008% with every newly produced block. Under this structure, emissions are expected to fall to approximately 81% of E₀ after one year, and to 65% after two years. Ultimately, the per-block issuance of $ASTR will asymptotically approach zero, with the total cumulative emissions converging at approximately 1.7 billion tokens.

Assuming Tokenomics 3.0 is implemented in September 2026, the projected total supply of $ASTR is calculated as follows:

- Current supply: 8.4 billion

- Additional emissions until September 2026: ~400 million

- Long-term emissions based on the decay model: ~1.7 billionThis results in a total capped supply of approximately 10.5 billion $ASTR.

The exponential decay mechanism is designed to gradually reduce inflationary pressure without causing a sudden drop in network activity due to sharp reward cuts. As such, it is expected to help strike a balance between incentivizing ecosystem growth and maintaining long-term token value.

- Maintaining Stable APR

As discussed in Section 2.1, the Astar network has long faced a challenge where low staking participation resulted in excessively high APRs. To address this, Tokenomics 3.0 proposes a more concrete and stable target APR structure. Assuming a 50% staking ratio, the current APR of approximately 17% is projected to gradually decrease to 13.8% after one year and 11% after two years. While these nominal figures indicate lower returns—potentially giving the impression of reduced incentives for builders and stakers—if $ASTR's value stabilizes as intended under the revised tokenomics, the actual reward value may increase in real terms.

In line with its overarching goal of sustainable growth, Astar also plans to introduce a network fee burn mechanism. Under this system, 50% of transaction fees will be burned to reduce circulating supply, 30% will be allocated to collators, and the remaining 20% will be reinvested into ecosystem development.

Community sentiment around Tokenomics 3.0 has been largely positive. The introduction of a fixed supply model and measures to ease inflation are seen as significant steps toward protecting the value of $ASTR and ensuring the sustainable growth of the ecosystem.

However, concerns have also been raised. One key issue is that lower dApp staking rewards could weaken incentives for developers and participants, potentially reducing $ASTR’s utility to mere governance participation, which could trigger user attrition and jeopardize the project’s viability. While there is general consensus on the importance of reducing inflation, critics argue that this alone is insufficient. They emphasize the need to establish more concrete and scalable use cases to stimulate demand for $ASTR. I agree with these concerns raised by the community: expanding the practical utility of $ASTR is essential, and this should be an ongoing topic of discussion well before Tokenomics 3.0 goes into effect.

2.3. AFC: The Brain Behind Sustainability

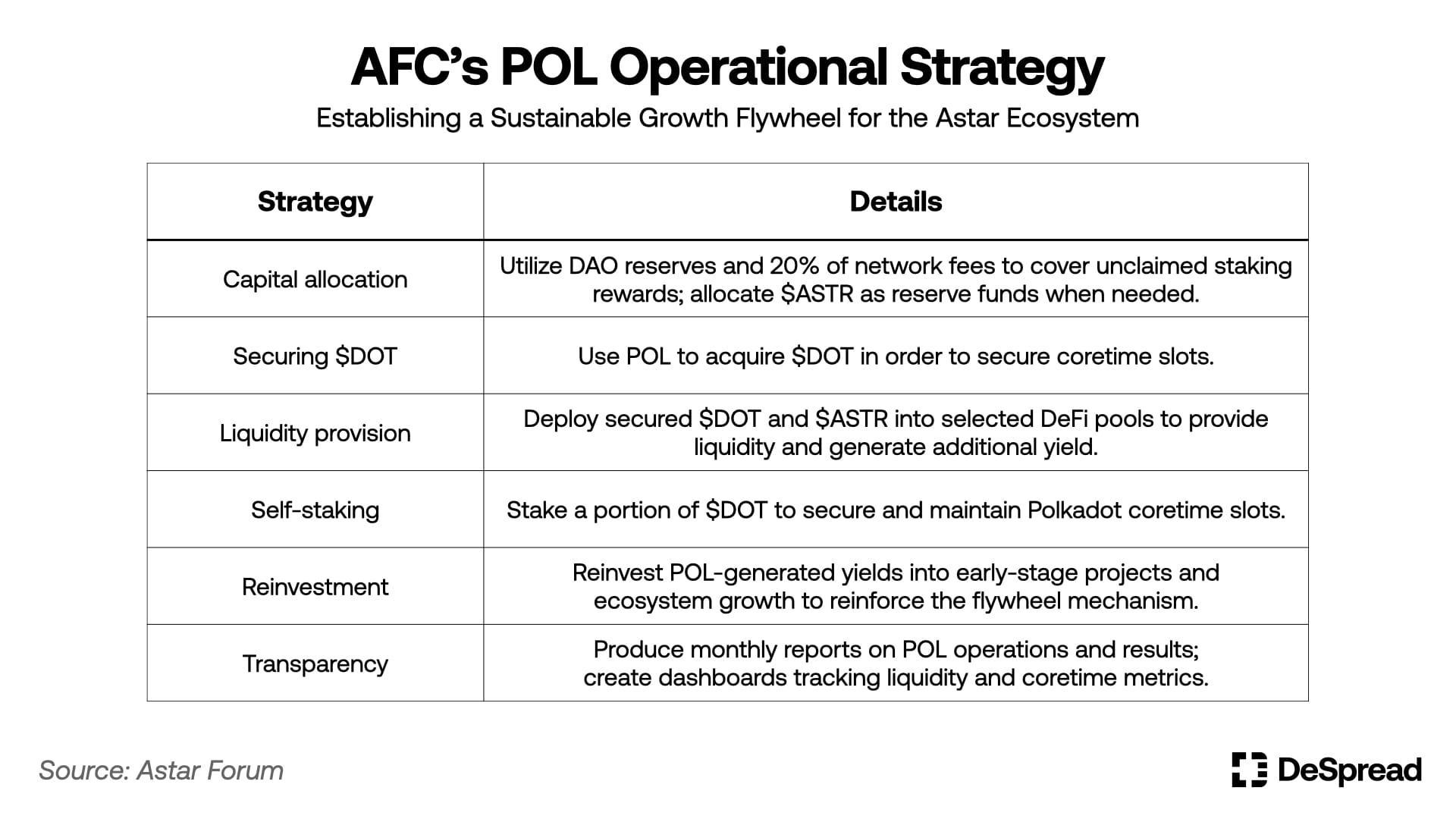

The Astar Finance Committee (AFC) is a newly established body tasked with the strategic management of the Astar DAO Treasury. Officially launched in April, AFC’s core objectives include generating sustainable revenue streams, accelerating the growth of the Astar ecosystem, and establishing a long-term value return model for $ASTR.

After undergoing community voting and a review by the Astar Foundation, AFC finalized its membership on May 8, selecting five committee members and one observer as announced here. The committee includes key contributors who have long supported the Astar ecosystem, such as the Head of DeFi at Soneium and prominent Astar ecosystem contributors. The AFC holds meetings weekly or biweekly and is committed to maintaining transparency through monthly progress briefs and quarterly comprehensive reports outlining its performance, plans, and treasury operations.

One of the AFC’s primary mandates is to establish a self-sustaining feedback loop by securing Polkadot coretime slots independently—without relying on future crowdloans—through Protocol-Owned Liquidity (POL). This objective, also mentioned in the Tokenomics 3.0 framework, is vital to enhancing Astar’s financial independence and autonomous security, and is therefore an essential milestone for the network’s long-term sustainability.

To implement its POL strategy, the AFC will pursue the following actions:

In addition, there are ongoing discussions around using revenues generated from POL operations to buy back and burn $ASTR, as well as to diversify the treasury portfolio with assets like $BTC and $ETH. As such, the AFC’s initiatives will be a critical area to watch in assessing the long-term sustainability of the Astar ecosystem.

3. $ASTR: Evolving into a Multi-Layer Asset

Astar’s native token, $ASTR, is evolving beyond the confines of a single network to become a multi-layer asset with diverse utility across multiple ecosystems. In particular, its integration with Soneium—an Ethereum Layer 2 closely aligned with Astar—has positioned $ASTR as a core asset within the Soneium ecosystem as well.

3.1. A Key Enabler of Multi-Layer Security

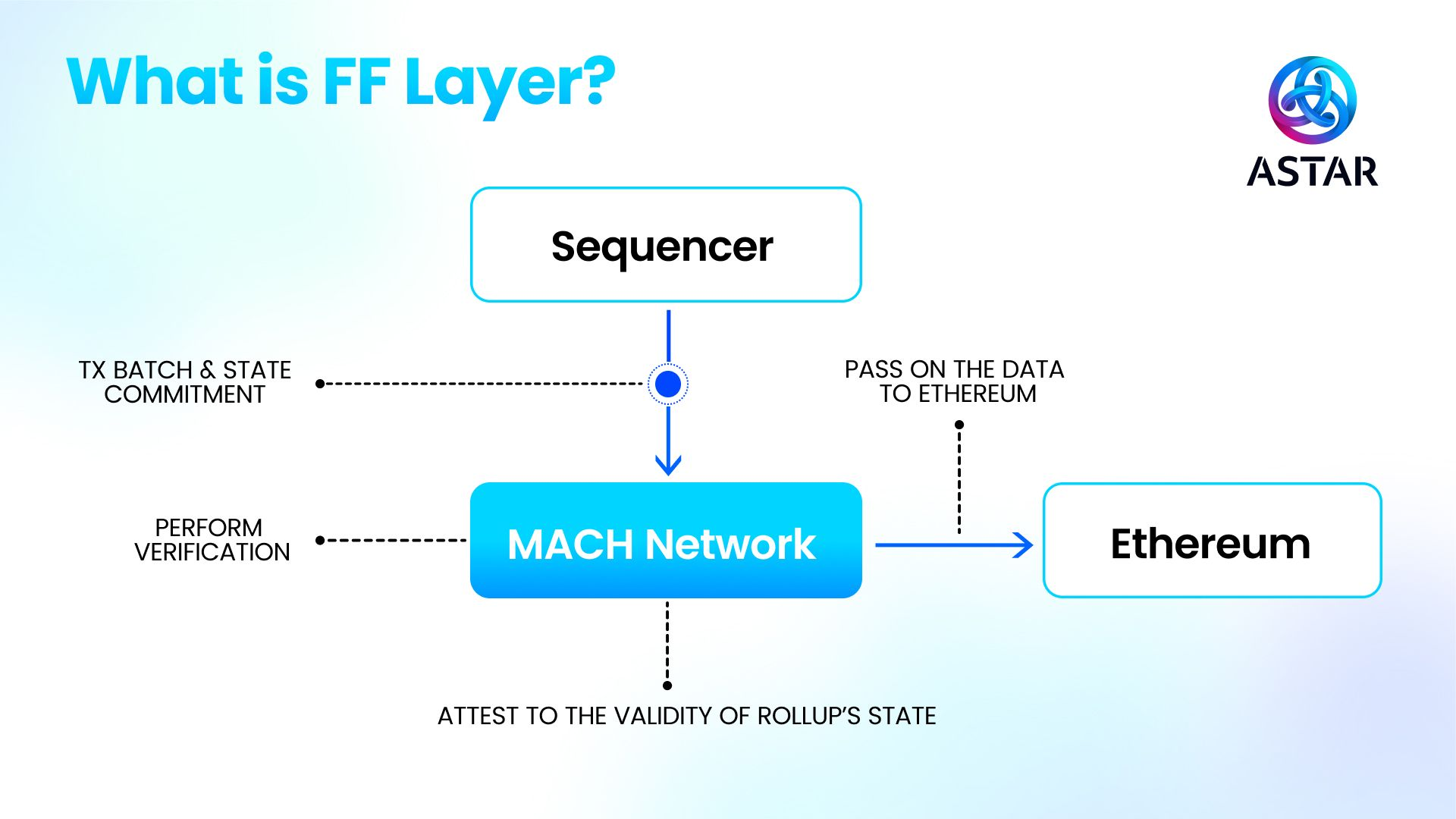

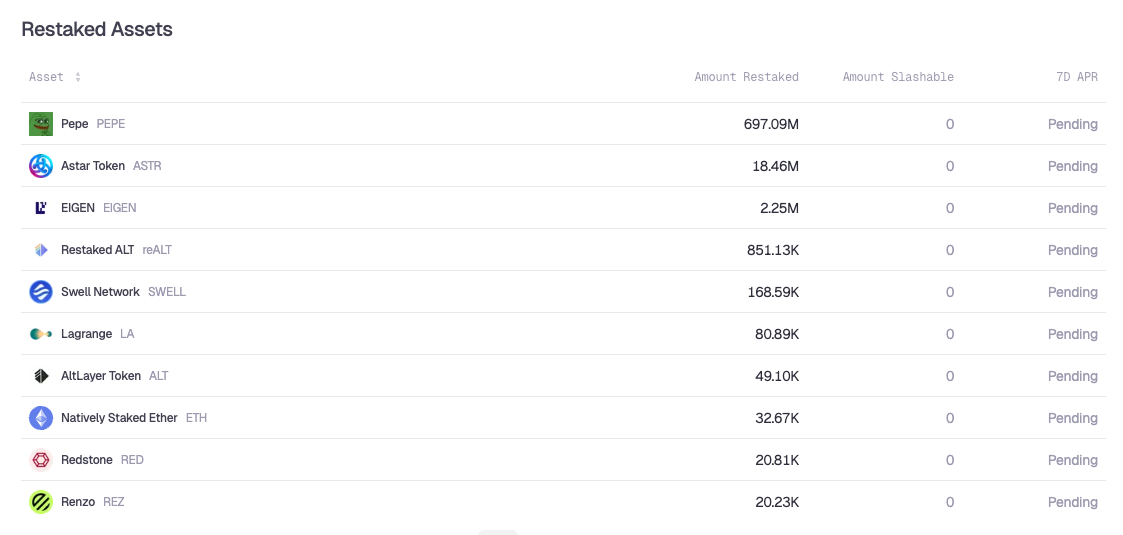

In April, Astar launched the Fast Finality (FF) Layer in collaboration with leading players in the Ethereum restaking ecosystem—AltLayer and EigenLayer. The FF Layer functions as an Autonomous Verifiable Service (AVS) built on EigenLayer’s restaking framework. It provides decentralized verification of rollup state transitions and enables near-instant finality—within 10 seconds—for transactions occurring on Soneium.

This represents a fundamental upgrade to the OP Stack-based Soneium, which traditionally incurred a roughly 15-minute delay in transaction finality due to its fraud-proof mechanism. By eliminating this bottleneck, the FF Layer lays the groundwork for latency-sensitive decentralized applications—including gaming, DeFi, and SocialFi—to operate more efficiently and responsively within the ecosystem.

At the core of the FF Layer’s technology lies AltLayer’s MACH (Modular Actively Validated Checkpointing) network. MACH is a solution designed to validate rollup states in real time, ensuring finality within 10 seconds while reducing reliance on centralized sequencers. This architecture plays a critical role in enabling decentralized and low-latency operations across the network.

Notably, the MACH network is integrated with EigenLayer’s restaking framework, allowing users to restake a variety of Ethereum ecosystem assets—including $ETH, $ASTR, and $EIGEN—to earn additional yields. In return, Soneium benefits from enhanced economic security backed by these restaked assets, creating a robust foundation for trustless validation and cross-layer collaboration.

3.2. Sharing in Soneium’s Revenue

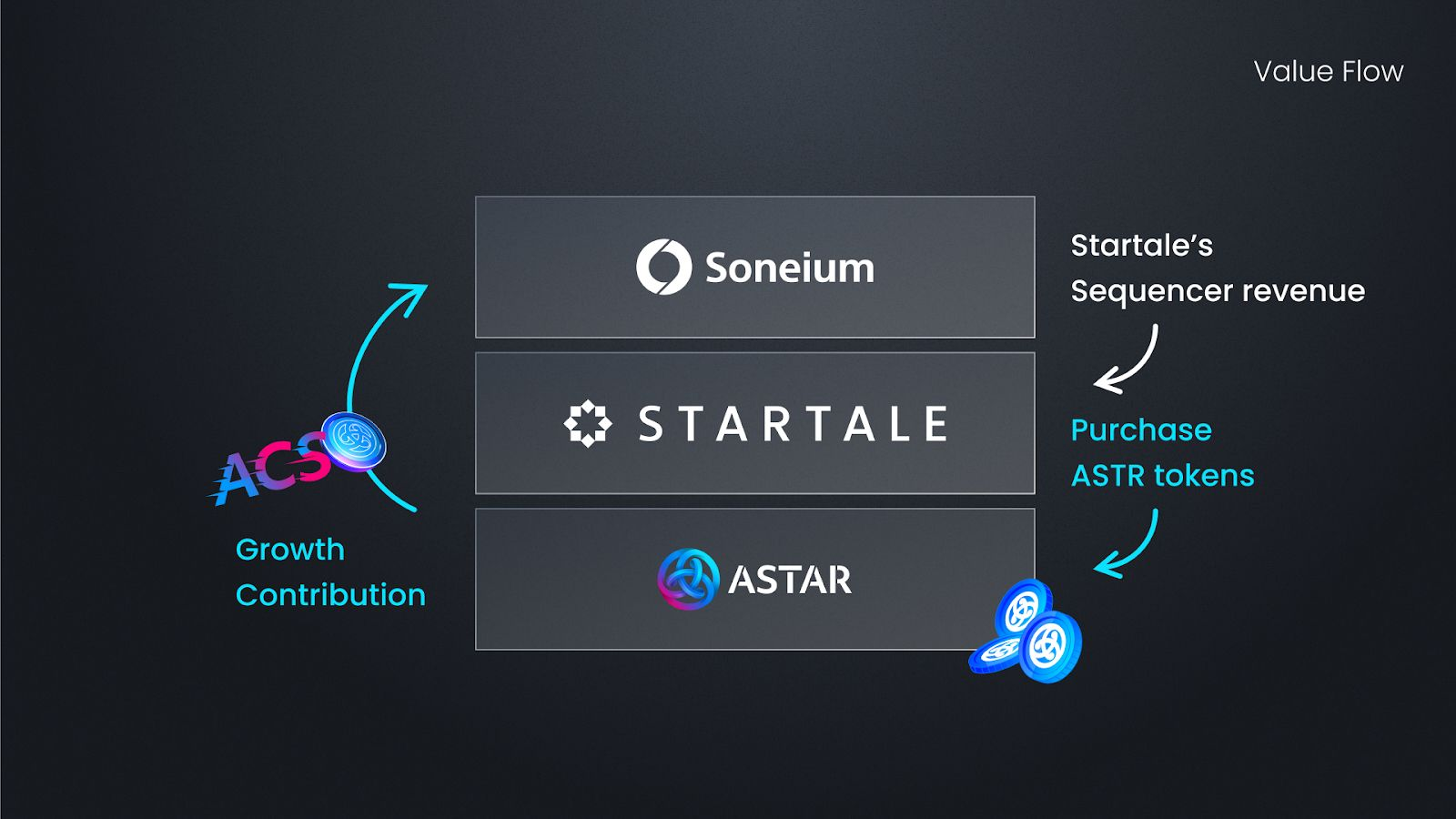

The operation of Soneium’s sequencer—which processes transactions on the Layer 2 network—is managed by SBSL, the joint venture between Sony Group and Startale Labs. The sequencer generates revenue by batching Layer 2 transactions and submitting the results to Ethereum (Layer 1). In Soneium’s case, this revenue is shared between Sony Group and Startale.

In April, Startale announced that a portion of the sequencer revenue would be used to purchase $ASTR on the open market—and that this process was already underway. By tying $ASTR buybacks directly to revenue generated from real user activity on Soneium, the ecosystem establishes a value feedback loop that redistributes protocol-level earnings back into the broader network. This mechanism strengthens $ASTR’s role as a key beneficiary of Soneium’s growth, especially in the absence of a native token for Soneium itself.

In this way, while Astar contributes to the growth of the Soneium ecosystem through initiatives like the ACS campaign and $ASTR staking-based shared security, Soneium reciprocates by linking sequencer revenue to $ASTR value support. Together, this creates a sustainable, mutually reinforcing growth cycle between the two ecosystems.

3.3. Expanding Beyond Astar into the Soneium Ecosystem

In early 2025, Astar launched the ACS (Astar Contribution Score) campaign to strengthen $ASTR’s position and influence within the Soneium ecosystem and to help drive ecosystem revitalization. Aimed at expanding $ASTR utility, increasing the number of $ASTR holders, enhancing integration with Soneium, and supporting the growth of the modular ecosystem, the ACS campaign allocated a total of 100 million $ASTR in rewards to incentivize participation across a wide range of ecosystem players.

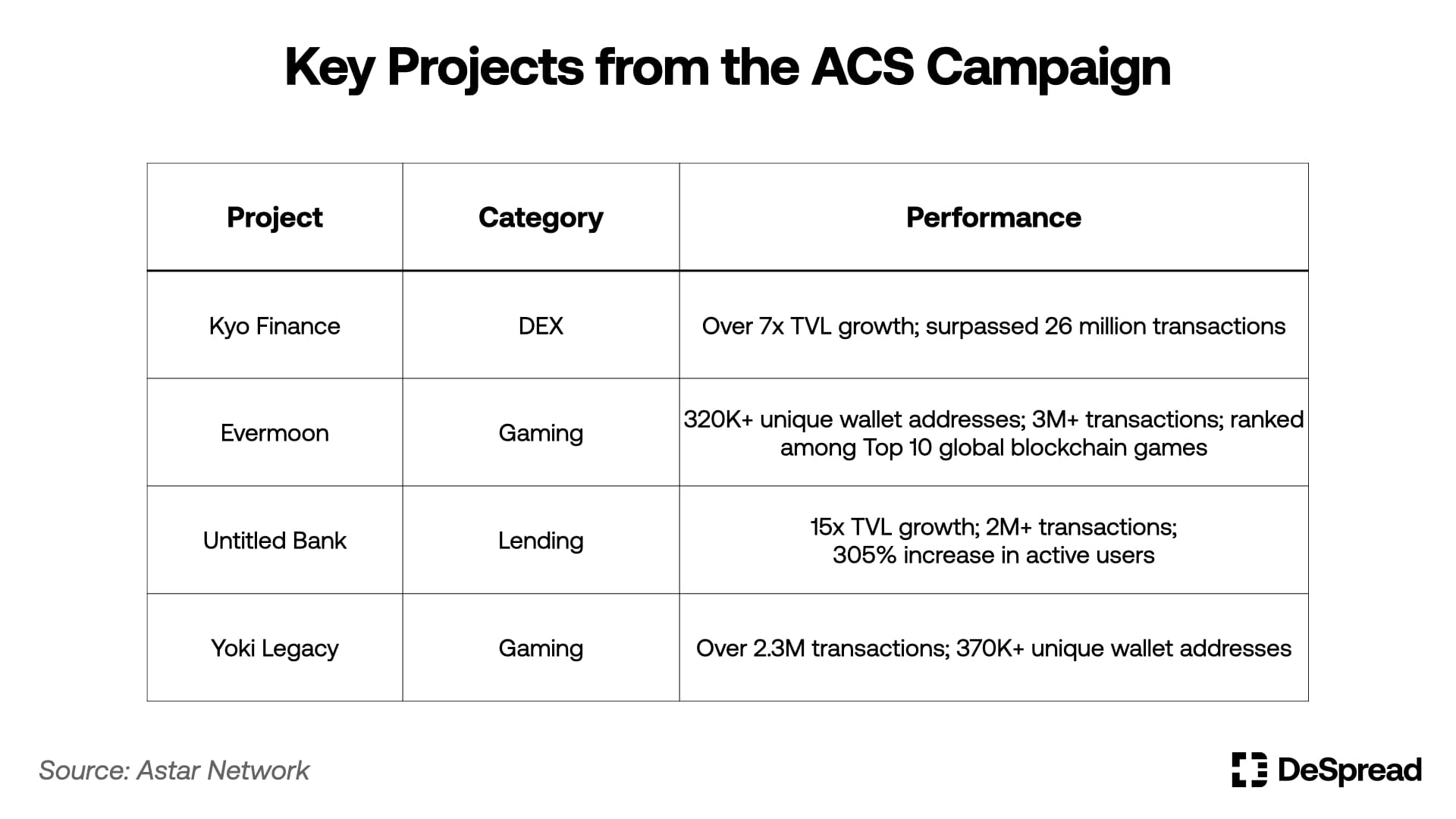

$ASTR rewards were distributed based on a total of 1 billion ACS points. The point distribution model assigned the highest weight to TVL contributions, effectively encouraging users to provide liquidity and engage actively with the ecosystem. Running from February 20 to May 30, 2025, the ACS campaign delivered significant growth across multiple indicators within the Soneium ecosystem:

- 5.5x TVL Growth: According to DefiLlama, Soneium’s total value locked (TVL) increased from $35.57 million on February 20 to $194.59 million by May 30—a 5.5x growth. Notably, Kyo Finance, a leading DeFi protocol on Soneium, saw its TVL rise from $6.35 million to $48.18 million during the same period, marking more than 7x growth.

- Expanded User Participation: During the ACS campaign, the number of unique wallet addresses on the Soneium network reached 3.57 million, and total transaction count surpassed 1.47 million.

- Strengthened $ASTR Influence: Approximately 675 million $ASTR—including LSTs—were deposited into the Soneium ecosystem during the ACS period, reinforcing $ASTR’s role as a core asset. A key factor in this outcome was the application of a 2x multiplier on ACS points for $ASTR deposits, which significantly incentivized its use within the ecosystem.

Through the ACS campaign, $ASTR has expanded its utility and user base, establishing itself as a key liquidity asset and store of value across both the Astar Network and the Soneium Layer 2 ecosystem. With strengthened integration and user engagement, $ASTR is now positioned as a native token with both scalability and practicality as a multi-layer asset. Moving forward, the value flywheel between Astar and Soneium—centered around $ASTR—is expected to accelerate further.

3.4. Beyond Soneium: Toward the Superchain Ecosystem

Astar’s multi-layer expansion strategy is now extending beyond Soneium to encompass the broader Optimism Superchain ecosystem. The Superchain refers to a collective of Ethereum Layer 2 networks—such as Base, Mode, and Zora—that operate under a unified structure through standardized adoption of the Optimism OP Stack.

As part of its Evolution Initiative, Astar deployed a new $ASTR smart contract in June that supports both Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Optimism’s Superchain token standard, ERC-7802. This redefined $ASTR as a cross-chain asset optimized for the Superchain ecosystem. With the support of Chainlink CCIP, $ASTR can now move seamlessly between Astar and Soneium through a secure burn-and-mint bridge.

Additionally, by implementing the ERC-7802 standard, Astar enables $ASTR to be used freely across multiple Superchain networks without wrapping. This standard supports crosschainMint and crosschainBurn functions, allowing $ASTR to operate under a consistent address and logic across various chains. As a result, $ASTR can now serve a wide range of decentralized applications—including DeFi, gaming, payments, and SocialFi—on OP Stack-based Layer 2 networks such as Base, Zora, and Mode.

Through this strategy, $ASTR is evolving from a single-chain governance token into a universal asset that can be utilized across the entire Superchain ecosystem. This transformation directly supports Astar’s vision of Web3 mass adoption and positions $ASTR at the center of its liquidity hub strategy.

4. Conclusion

The recent developments within Astar—including the restructuring of block rewards, the introduction of Tokenomics 3.0, and the launch of the Astar Finance Committee (AFC)—are not isolated moves aimed at short-term price action. Rather, they represent a cohesive, long-term strategy to secure the sustainability of both $ASTR and the broader Astar ecosystem.

The block reward overhaul addresses inflation reduction; the fixed supply and emission decay model introduced in Tokenomics 3.0 aims to preserve $ASTR’s long-term value; and the formation of the AFC provides a foundation for financial autonomy and operational maturity at the protocol level.

Furthermore, Astar has evolved into a multi-layer platform that interacts across Ethereum, Polkadot, and Soneium. In parallel, $ASTR has transformed from a simple governance token into a multi-layer asset playing a central role in security, liquidity, and infrastructure across decentralized applications.

The key question now is whether this structural foundation will translate into meaningful user demand and on-chain activity. Astar’s strategic collaboration with Animoca Brands, along with potential integrations with major Japanese and Asian IPs, will be pivotal—not just in driving traffic, but in fostering a vibrant and use-case-rich ecosystem.

It remains crucial to closely observe how practical utility and organic demand will be built on top of Astar’s stable tokenomics and modular architecture—and whether $ASTR can ultimately fulfill its role at the core of this evolving multi-layer network.

References

- DeSpread, Astar Network — Introducing zkEVM to Extend to the Ethereum Ecosystem

- 아스타, ACS 포인트 TVL 기반 보상 안내

- 아스타, 아스타, 알트레이어, 아이겐레이어, 고속 완결성 레이어 출시를 위해 손잡다

- 아스타, 아스타의 동적인 토크노믹스: 지속성과 유연성을 모두 담다

- Astar Forum, Proposal to Change ASTR Tokenomics to Fixed Supply

- Startale, ASTR Investment Initiative

- Astar Subsquare, [Democracy] Public proposal for Astar Finance Committee (AFC)

- Astarm ACS Recap: 100 Days of Onchain Contribution and Ecosystem Momentum

- Astar Docs