Berachain — The Bear that Captures Both Liquidity and Security

Focusing on Berachain's Ecosystem Flywheel and Testnet v2

1. Introduction

Proof of Stake (PoS), which has recently been adopted as the most popular network consensus mechanism, has a characteristic that the more tokens staked in the network, the higher the security.

However, the native tokens of PoS networks are not only used for staking but also for paying gas fees and as the base currency within the ecosystem. This leads to a paradoxical structure where the more staking volume increases, the lower the liquidity and network activity of the network's DeFi (Decentralized Finance) ecosystem becomes.

This lack of liquidity causes high slippage in decentralized exchanges (DEXs) and hinders the growth of various protocols that operate based on token deposits, negatively affecting the entire ecosystem. As a result, today's ecosystem protocols are forced to conduct excessive airdrops to secure liquidity or build their own Layer 2 or appchains, leading to liquidity fragmentation and degradation of user experience across the blockchain industry.

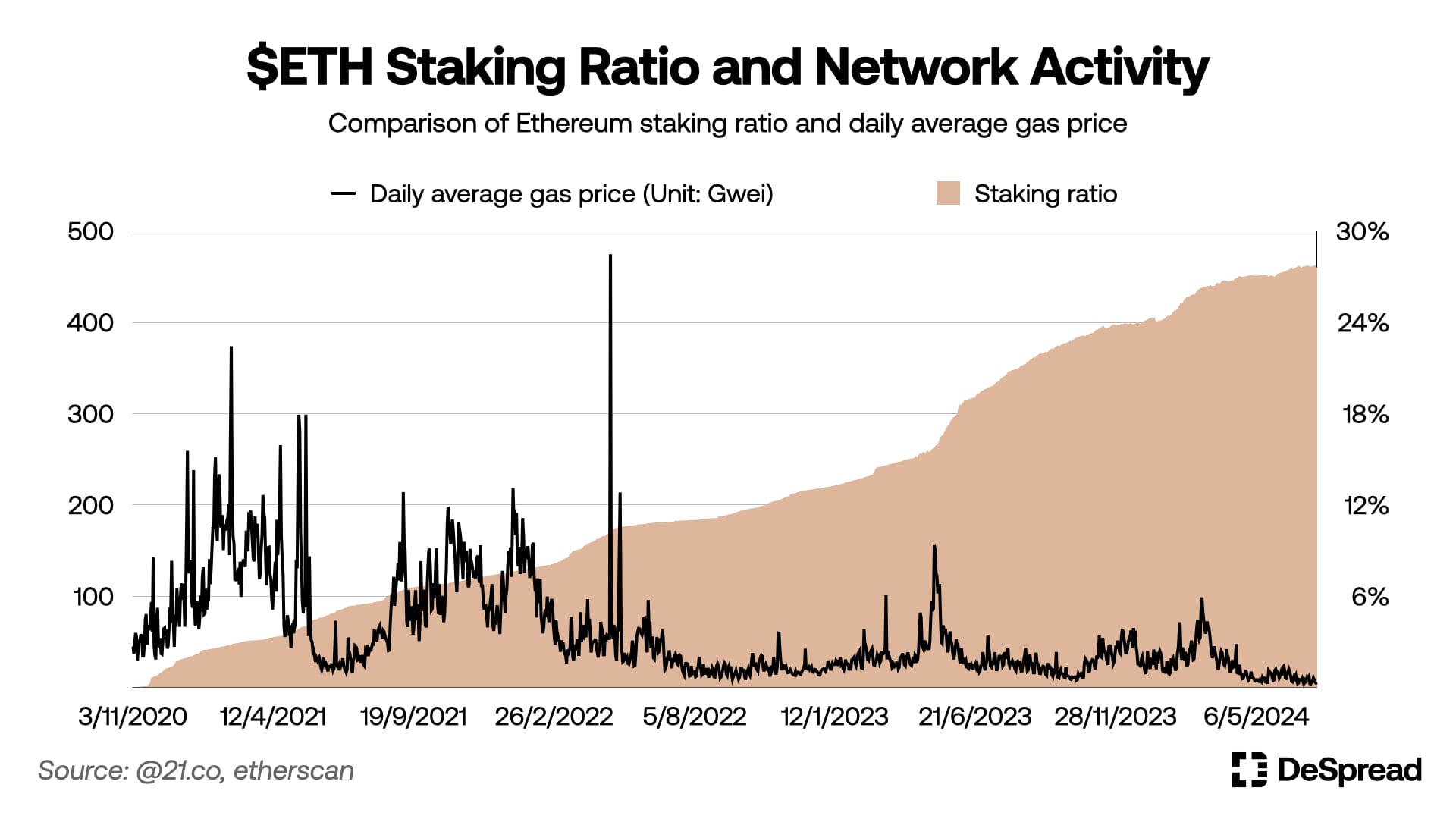

Even on the Ethereum mainnet, restaking protocols have recently gained attention, and the ETH staking ratio has continued to increase, reaching an all-time high of around 28%. However, the average daily gas cost is around 5 Gwei, indicating a decreasing trend in network traffic.

In the PoS structure, users are given a binary choice to either stake limited liquidity to the network or deposit it into protocols, and a phenomenon occurs where incentives between validators and protocols are not aligned.

Although many foundations have recently recognized the seriousness of this problem and are attempting to coordinate interests through grant payments, technical and marketing support for ecosystem contribution protocols, this approach has limitations as it is difficult to reflect the opinions of ecosystem participants such as network users or validators and ultimately can lead to centralization towards the foundation.

If one of the core ideals of blockchain is to create an environment that is "Can't be evil" rather than "Don't be evil," a new attempt is needed to systematically improve the dilemma of ecosystem liquidity and network security inherent in PoS. Berachain aims to solve these chronic problems of PoS-based networks by establishing a structure that can simultaneously complement both liquidity and network security in the ecosystem through game theory-based tokenomics.

In this article, we will examine Berachain's consensus mechanism and tokenomics model, focusing on the unique incentive structure and ecosystem formed through them.

2. Berachain, Capturing Both Network Security and Ecosystem Liquidity

Berachain is an EVM-compatible Layer 1 network built through BeaconKit, a framework that enables the construction of customizable EVM execution environments using the Cosmos SDK.

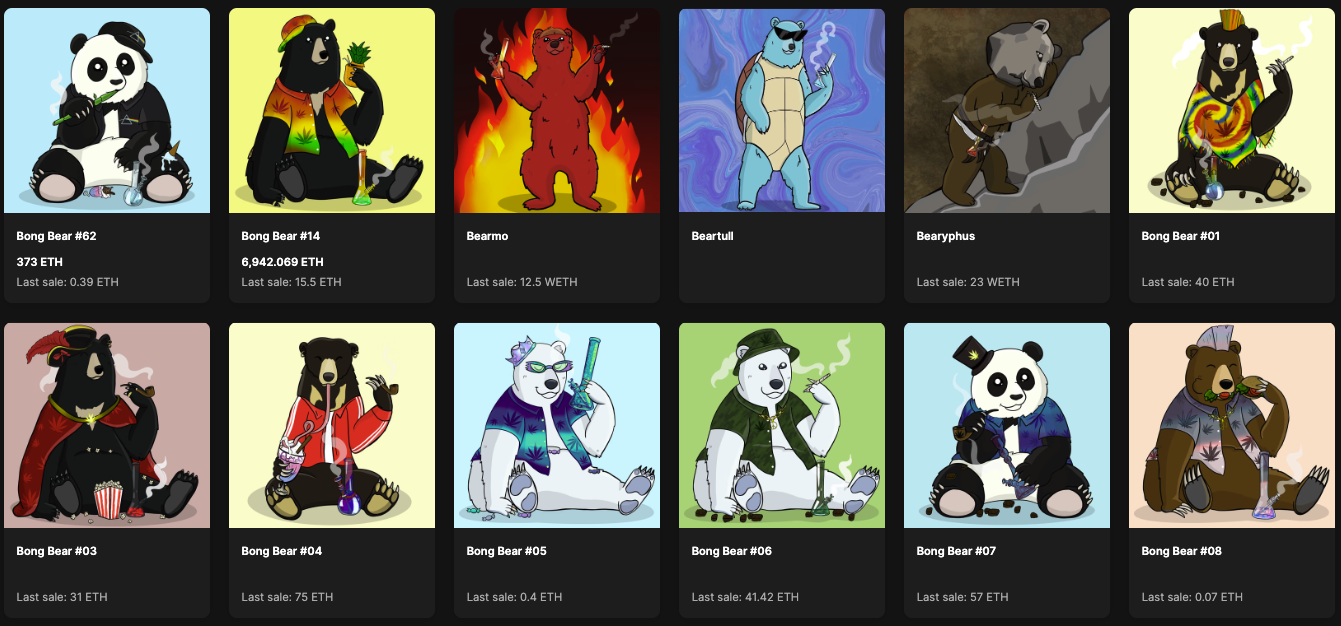

Generally, blockchain projects announce a whitepaper containing the development team's technical vision, build a community through various campaigns, and recruit potential users. In contrast, Berachain originated from an NFT project called 'Bong Bears' and the community formed around it.

Bong Bears was launched in 2021 when the NFT market was gaining significant attention and received a great response from the community of the popular DeFi project at the time, Olympus DAO. Subsequently, they airdropped derivative NFT collections such as The Bond Bears, The Boo Bears, and The Baby Bears to Bong Bears holders, providing benefits to existing holders and continuously expanding the community.

At that time, the term Berachain was mentioned like a meme within the Bong Bears community. However, the developer Dev Bear started the actual development of Berachain, and currently, the testnet is in progress, with the mainnet launch approaching.

This case contrasts with recent blockchain projects that invest enormous time and capital in building loyal communities but experience significant user churn after their own token airdrop. It could attract much attention from crypto users.

However, another decisive reason why Berachain could be positioned as a promising Layer 1 for many users is that it attempts a new consensus mechanism called Proof of Liquidity (PoL), which aims to overcome the incentive alignment problem of participant entities that existing PoS-based networks have faced, through game theory-based tokenomics.

2.1. PoL(Proof of Liquidity)

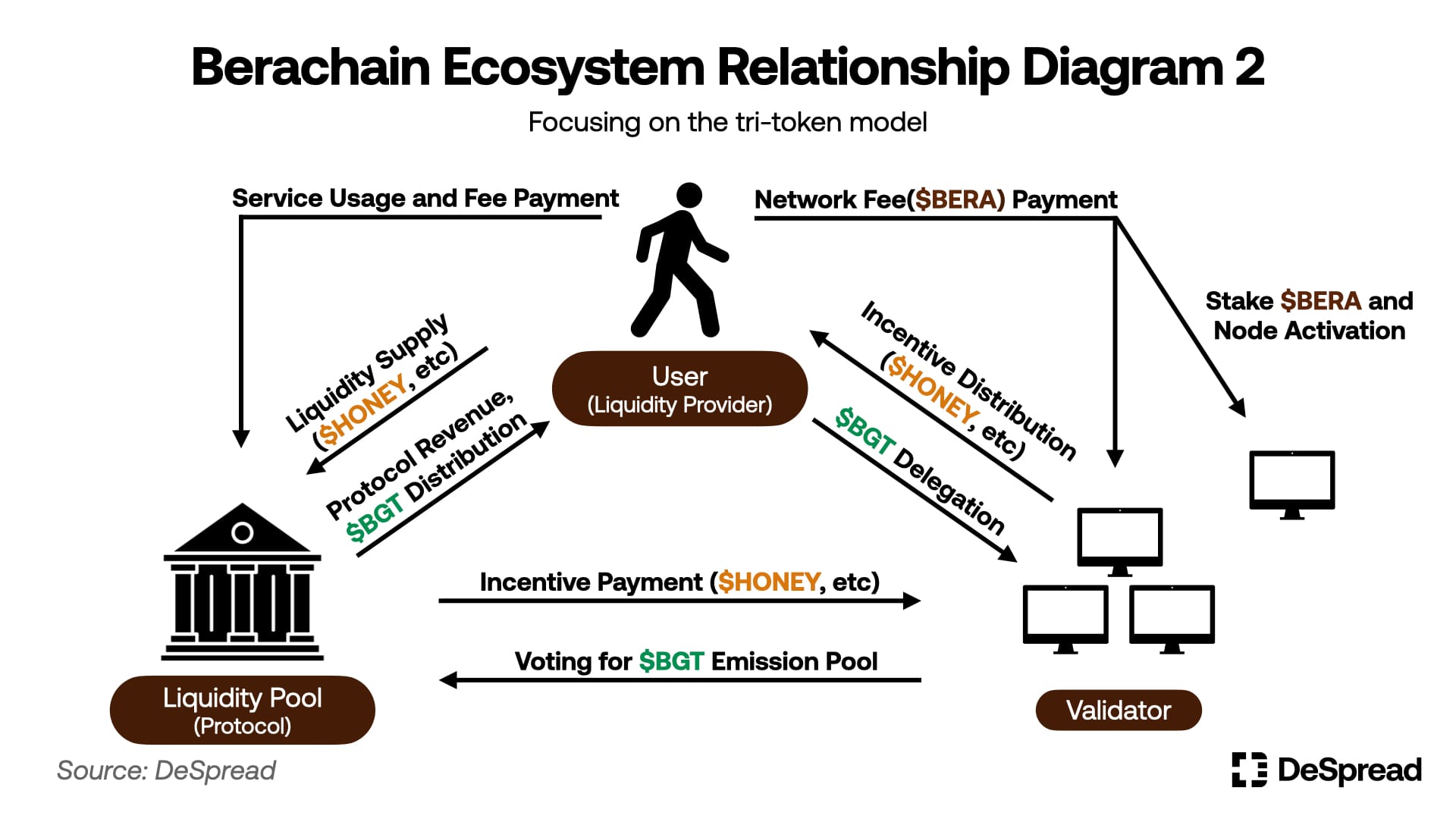

Berachain's PoL consensus mechanism involves the following stakeholders:

- Validators: Entities that run Berachain nodes and participate in network validation

- Liquidity Providers: Entities that provide liquidity to protocols within the ecosystem

- Protocols: Entities that wish to provide specific services on the Berachain network and require network liquidity

In Berachain's PoL, liquidity providers who supply liquidity to a specific protocol's liquidity pool receive the Berachain's network tokens that are issued as rewards for each block. Liquidity providers can indirectly participate in the network validation process by delegating the tokens they receive to validators. In this process, liquidity providers can receive both interest for providing liquidity and the profits generated by network validators.

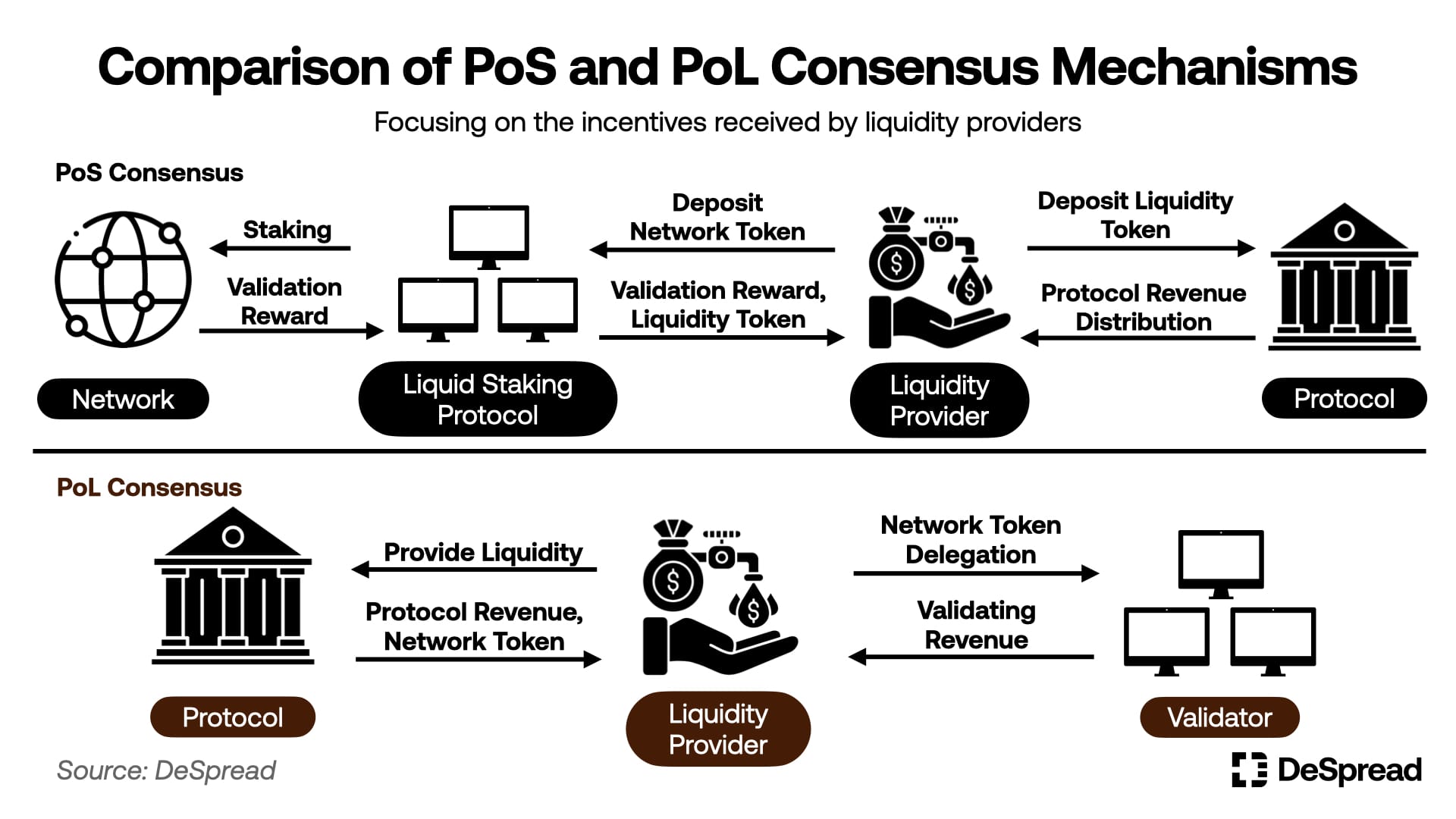

This structure may seem at first glance to have a similar effect to depositing assets in a liquid staking protocol on a PoS chain, receiving liquid tokens, and depositing them in another protocol to gain profits, just in a different order.

However, in the PoS method, as various liquid staking protocols compete, the types of tokenized tokens diversify, resulting in liquidity fragmentation. On the other hand, Berachain has this function built into the chain, which has the advantage of preventing liquidity fragmentation.

Furthermore, validators in Berachain have the authority to determine the liquidity pool where block rewards are distributed through voting. This means that network validators have the authority to directly increase the incentives for a particular liquidity pool. Due to this feature, in the PoL method, unlike the PoS method, liquidity providers and protocols can be more closely involved in the consensus mechanism.

2.1.1. Ecosystem Flywheel

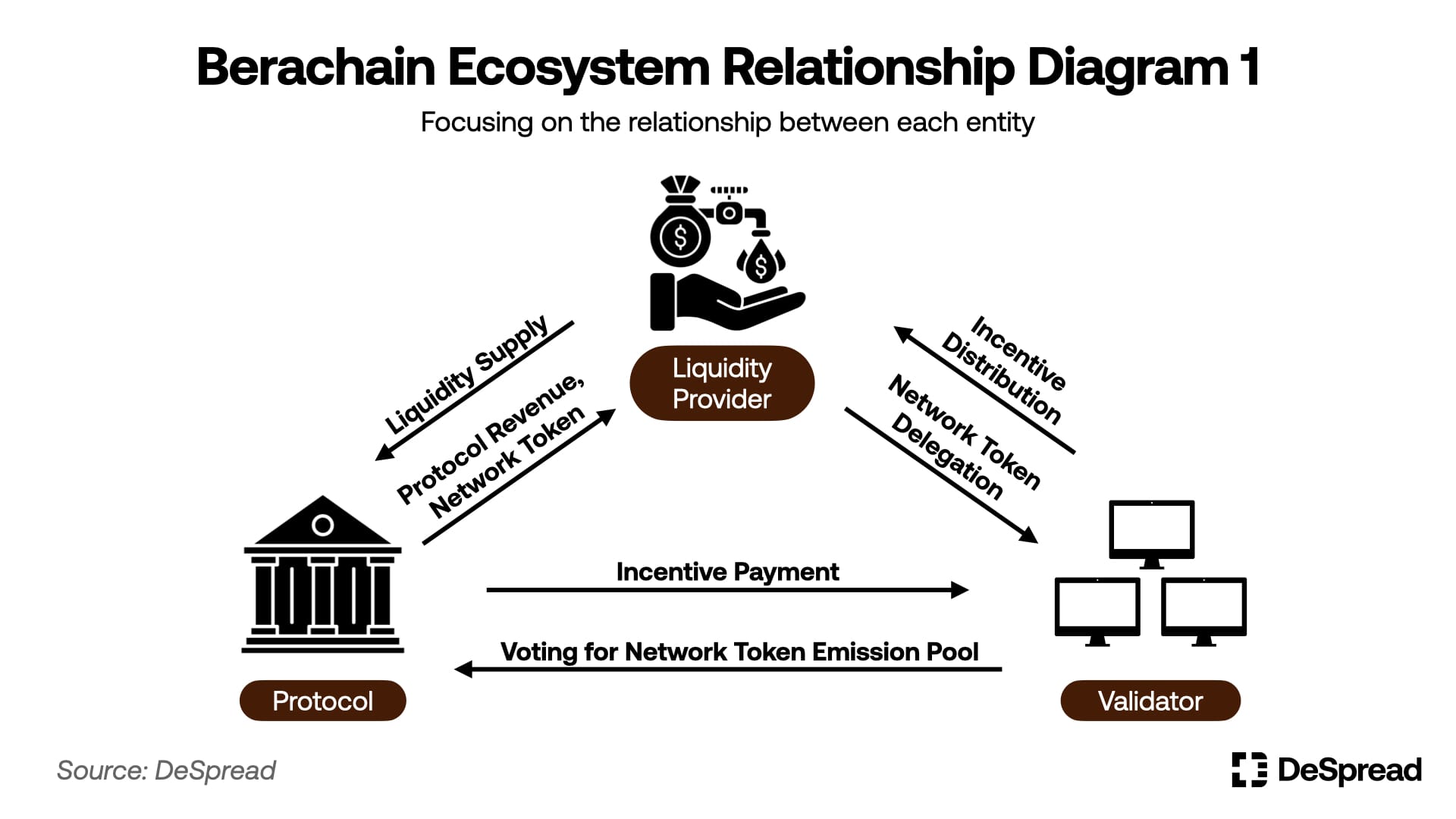

Protocols launching on the Berachain network will provide incentives to validators using invested capital, issued tokens, and protocol fees to receive many votes from validators and bootstrap liquidity for their liquidity pools.

This also encourages validators to distribute the assets received as incentives from protocols to network token delegators in order to secure more voting rights. The act of validators distributing incentives received from protocols encourages liquidity providers to delegate the network tokens they receive through liquidity provision to validators rather than selling them on the market, further strengthening network security.

In this way, through the PoL mechanism, Berachain has built a structure that draws in projects and liquidity providers, who were unable to directly participate in the network consensus mechanism in the existing PoS structure, as key participants. The three entities are closely connected by exchanging liquidity and incentives, and an ecosystem flywheel is implemented where value circulates from liquidity providers to projects, from projects to validators, and again from validators to liquidity providers.

2.2. Tri-Token Model

To better leverage the flywheel characteristics of PoL, Berachain adopts a tri-token model that utilizes the following three types of network tokens:

- $BERA: The token used as Berachain's network usage fee, and gas fees are burned. Validators must stake 69,420 $BERA to activate their node.

- $BGT: The inflation reward distributed to liquidity pools voted by validators and a token that cannot be transferred or traded as it is attributed to accounts. Liquidity providers can take the following actions with the $BGT they receive after providing liquidity:

- Burn $BGT and receive $BERA at a 1:1 ratio

- Delegate to validators

- $HONEY: A stablecoin pegged to the value of $1 and serves as the base currency within the Berachain ecosystem. On the testnet, it is implemented by wrapping USDC, and there is potential for it to be converted to an over-collateralized form in the future. A 0.5% fee is charged upon issuance, which is distributed to $BGT holders.

If we apply the tri-token model described above to the relationship diagram of Berachain's participants, it can be represented as follows:

In Berachain, $BGT, which determines the distribution of inflation rewards, is non-tradable and can only be received through liquidity provision. Therefore, it has a structure where specific whales cannot quickly secure a large amount of $BGT and exert influence on governance. This structure encourages protocols that want $BGT distribution allocation for ecosystem liquidity to allocate incentives to validators with many voting rights and go through a persuasion process.

The act of Berachain's network participants reaching a social consensus for their own interests leads to the enhancement of Berachain's network security and liquidity. The secured security and liquidity contribute to attracting more users to the Berachain ecosystem.

As more users flow into the network ecosystem and network usage increases, the amount of $BERA burned as gas fees will increase, and the demand for $HONEY, which is widely adopted as collateral and trading assets in ecosystem protocols, will also rise. This directly translates to profits for $BGT holders.

3. bArtio Testnet

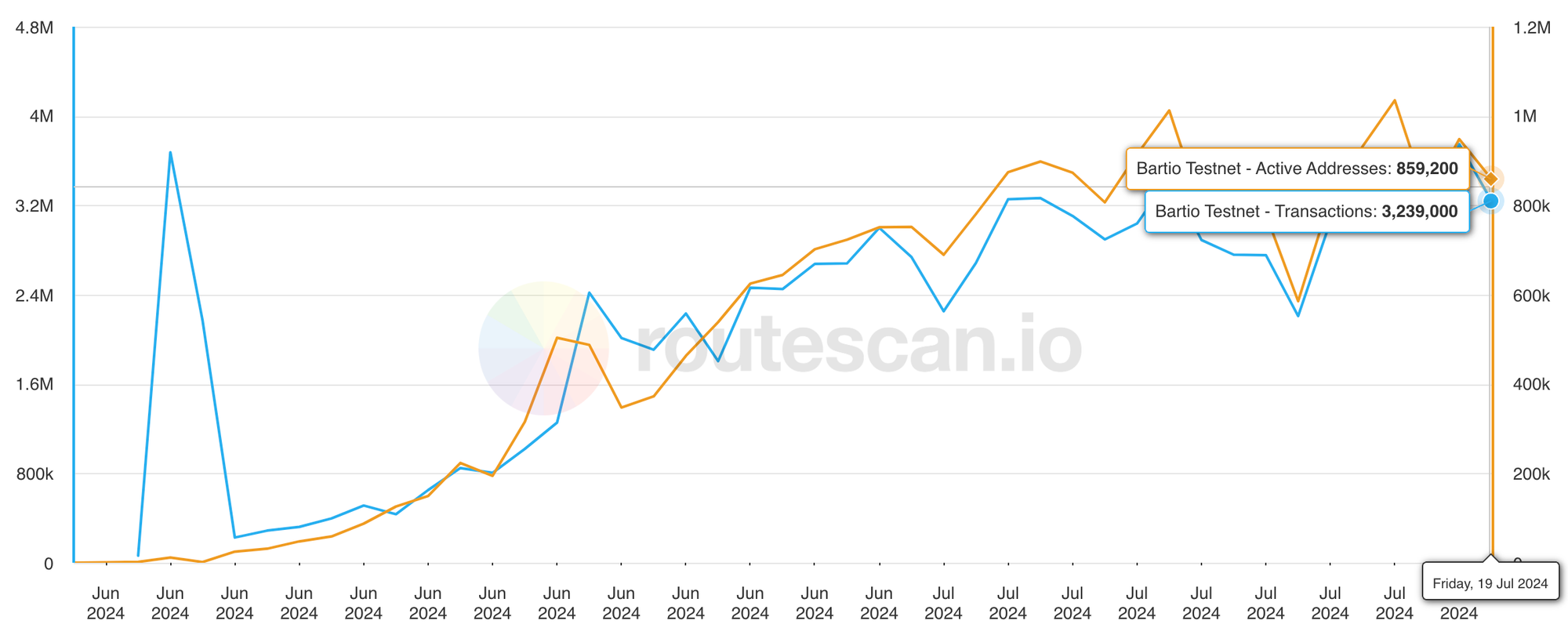

With its loyal community and unique PoL mechanism, Berachain has garnered much attention. It achieved good results, such as reaching one million active wallets within eight days of starting its first testnet, 'Artio Testnet,' in January 2024.

However, due to the limitations of the infrastructure environment where Berachain uses the Cosmos-based consensus mechanism CometBFT to execute the EVM, issues arose in EVM compatibility and scalability during the testnet operation. In June 2024, Berachain launched a new second testnet called 'bArtio Testnet' to address these issues and the shortcomings revealed during the process of testing the operation of the PoL mechanism.

3.1. Perfect EVM Compatibility

In the process of developing the chain, the Berachain team created and utilized an EVM-compatible framework called Polaris to connect the Cosmos-based consensus mechanism CometBFT with the EVM execution environment.

Polaris is a framework that enables compatibility between CometBFT and EVM through a technology called precompile, which converts and stores the same operations commonly used in two different program execution environments. The Berachain team built and tested the Artio Testnet using this Polaris framework.

However, during the testing process, the following limitations of Polaris were identified:

- The consensus engine of the Cosmos SDK waits for the EVM to complete transaction processing before generating blocks, causing bottlenecks when a large number of transactions are received at once.

- Operations not implemented as precompiles do not function properly in Polaris, leading to EVM compatibility issues.

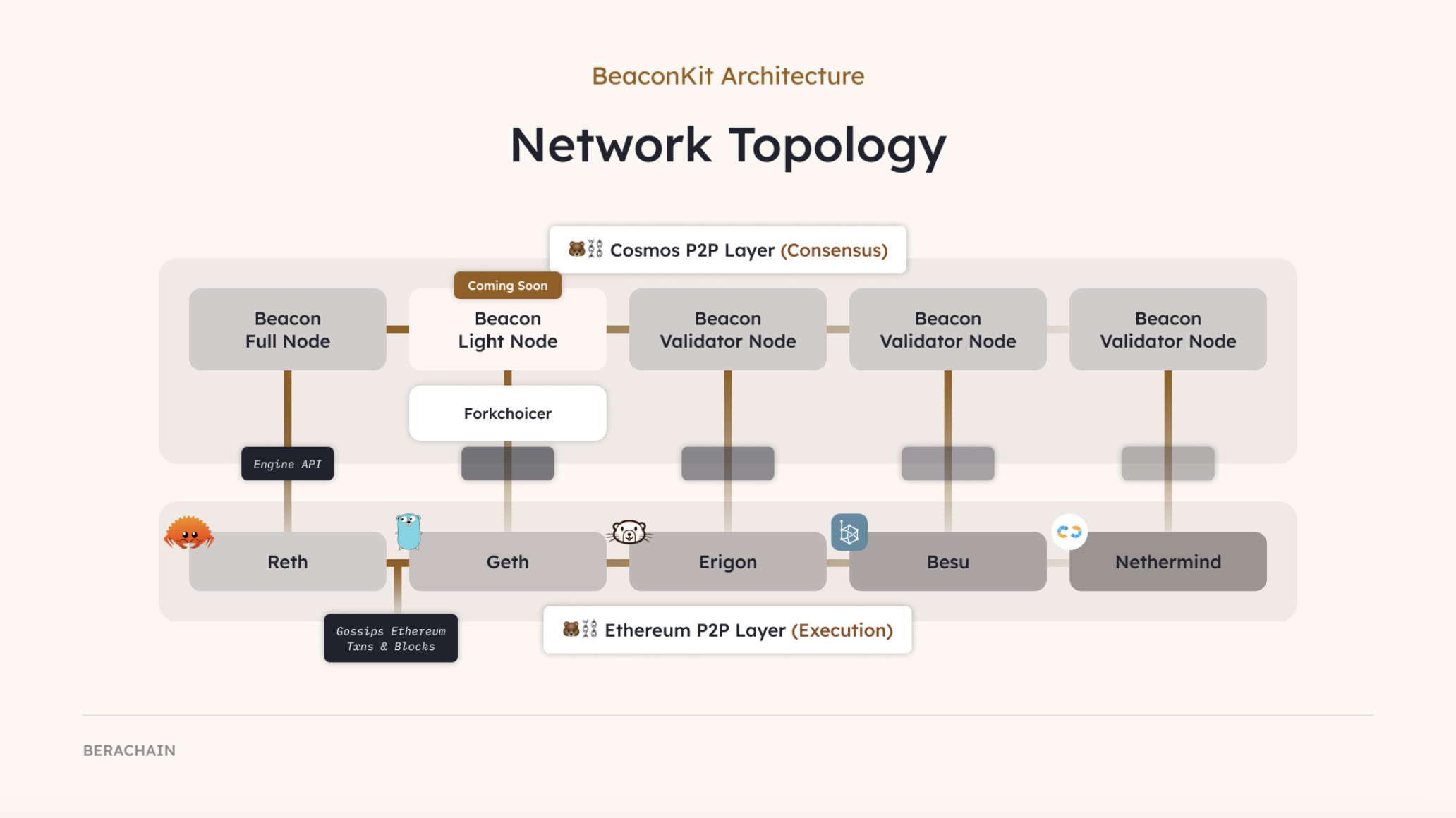

To address these limitations of Polaris, bArtio Testnet newly introduced a new EVM-compatible framework called BeaconKit, which was designed taking inspiration from the Beacon Chain of Ethereum 2.0.

3.1.1. BeaconKit

Unlike Polaris, BeaconKit operates with a clear separation between the execution layer (EVM) and the consensus layer (CometBFT), and the two layers are connected and compatible through the EngineAPI. Thanks to this architecture, BeaconKit can use standard Ethereum execution clients (Geth, Erigon, Nethermind, etc.) as is.

In bArtio Testnet, since Ethereum execution clients are used as is, it can provide an EVM execution environment 100% identical to Ethereum. Even when the Ethereum execution environment is updated, Berachain can apply the same effect of the EVM execution environment update on the Ethereum mainnet without any special measures, simply by having validators install and run the clients provided by Ethereum.

Moreover, unlike Polaris, BeaconKit operates the execution layer and consensus layer independently, creating an environment where a bottleneck in one layer does not affect the other layer. Additionally, by introducing the 'Immediate Execution' feature, where validators propagate the post-execution state values of all transactions included in a block to other validators when generating blocks, transaction processing speed has been significantly improved, resolving the scalability issues that Polaris previously had.

3.2. Strengthening the PoL Mechanism

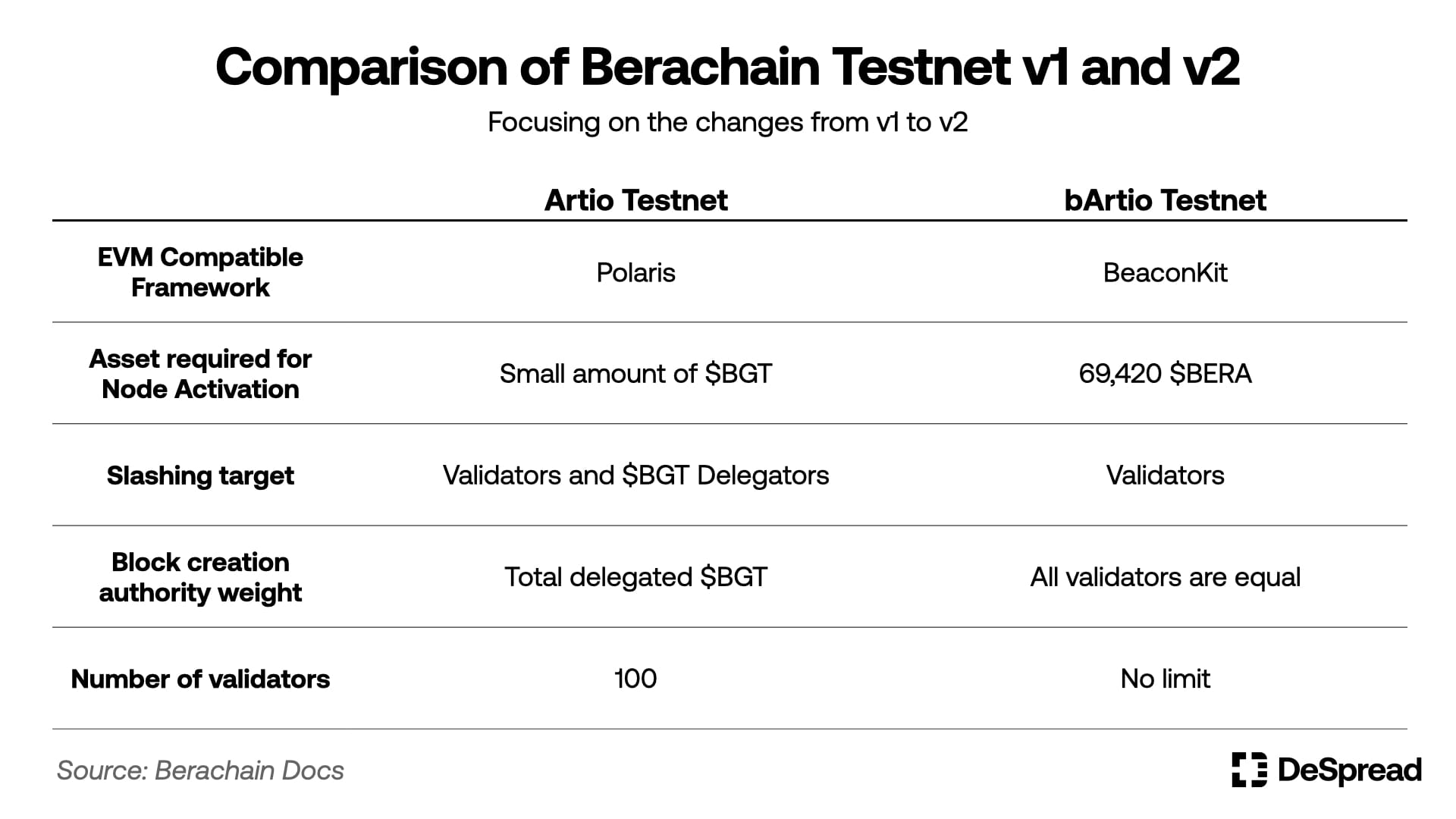

In addition to changing the EVM-compatible framework to BeaconKit, the following changes have been applied to bArtio Testnet to strengthen the PoL mechanism:

- Change in validator participation conditions: Previously, a small amount of $BGT staking was required to activate a node, but in bArtio Testnet, it has been changed to staking 69,420 $BERA, increasing the stake deposited in the network and enhancing network security.

- Change in slashing conditions: Previously, when a validator's incorrect validation behavior occurred, the $BGT of liquidity providers who delegated $BGT to that validator was also slashed. Now, slashing only occurs on the $BERA staked by the validator, completely separating the roles of $BGT and $BERA in the PoL ecosystem and placing more responsibility on validators.

- Change in block creation authority criteria: Previously, the authority to create new blocks increased according to the amount of $BGT delegated to a validator. This has been changed to give validators equal opportunities to create new blocks regardless of the amount delegated. However, block rewards still increase according to the amount of $BGT delegated.

- Increase in validator limit: To enhance network decentralization and security, the validator limit, which was previously capped at 100, has been removed. As of the writing date, July 16, a total of 150 entities are participating in Berachain network validation.

The changes made in the transition from Artio Testnet to bArtio Testnet can be summarized in a table as follows (note that these changes can be modified at any time before the mainnet launch by the team or through governance):

While Artio Testnet tested whether the PoL mechanism operates properly, the currently ongoing bArtio Testnet is adjusting the details and parameters of PoL and preparing for the actual mainnet launch.

The daily transaction count of the bArtio Testnet has gradually increased since its launch to about 3.2 million, with about 860,000 active wallets, and more than 150 projects are preparing to utilize the high EVM compatibility, scalability, and PoL mechanism that Berachain has built.

4. Exploring the Berachain Ecosystem

In typical Layer 1 networks, the foundation issues tokens, allocates a portion of the issued tokens to the ecosystem, operates grant and hackathon programs, and builds the ecosystem, which is common practice.

Although the Berachain team operates an incubation program called Build-a-Bera, Build-a-Bera conducts seed investments in projects undergoing incubation using the Berachain team's capital and provides support such as mentoring. However, there are no plans to directly distribute Berachain's tokens to the ecosystem through grants or hackathons.

One of Berachain's founders, Smokey The Bera, has even expressed a critical view of the grant systems operated by other networks. The reason the Berachain team can take this stance is that Berachain's consensus mechanism, PoL, fundamentally supports ecosystem projects by allocating $BGT to users who provide liquidity to liquidity pools.

Rather, in terms of the fact that 'consensus' is reached among network participants and that it bootstraps the liquidity of the relevant protocol rather than directly providing assets to the protocol development team, it can be seen as a much healthier form than the ecosystem bootstrapping programs being conducted by other networks.

Due to the structure of PoL, where network participants are involved in each other's incentives, communication and consensus among validators, protocols, and liquidity providers are even more important in the Berachain ecosystem. As a result, despite still being in the testnet stage, many partnerships and collaborations are taking place, and some protocols are attempting to simultaneously perform multiple roles, such as directly running nodes.

Next, let's take a look at the representative protocols in the Berachain ecosystem.

4.1. Native dApps

Berachain has native dApps that serve as infrastructure for the basic functions of the ecosystem, which the team has directly built. Currently, three types of native dApps are operating on the testnet: BEX, Bend, and Berps.

- BEX: A decentralized exchange where users can trade without intermediaries or directly create trading pools.

- Bend: A decentralized lending protocol where users can borrow $HONEY using various assets as collateral or provide $HONEY liquidity and receive interest.

- Berps: A decentralized perpetual futures exchange where users can create leveraged positions using $HONEY as collateral or deposit $HONEY to provide liquidity for position holders' trading profits and receive trading fees.

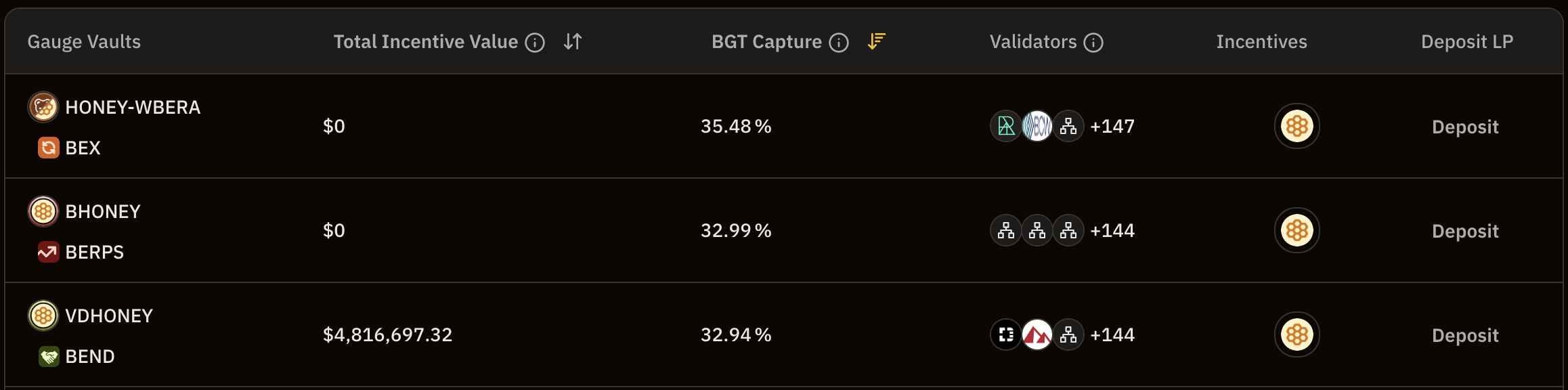

These native dApps not only provide basic DeFi functions to users in the early Berachain ecosystem before other protocols are launched but also serve as the pools where $BGT is distributed to liquidity providers, which is the starting point of the PoL mechanism. In the currently ongoing bArtio Testnet, the liquidity pools (gauges) that can receive $BGT distributions are also composed of native dApp liquidity pools.

Native dApps expand the usage of $HONEY by utilizing it as the main collateral asset and further strengthen Berachain's tri-token model through a structure that distributes the profits generated from the protocols to $BGT holders.

Furthermore, they serve as a catalyst for diversifying the ecosystem by encouraging developers who want to launch protocols on Berachain to develop creative protocols that utilize the PoL mechanism in various ways, rather than basic infrastructure protocols.

4.2. How DeFi Protocols Utilize PoL

DeFi protocols on other networks typically attract liquidity by providing additional incentives to liquidity providers, and then use the secured liquidity to attract user traffic and generate protocol revenue from fees.

However, Berachain's DeFi protocols do not provide additional incentives to liquidity providers. Instead, they provide additional incentives to validators and strive to build the following flywheel:

- Provide incentives to validators who voted for $BGT distribution to their protocol, encouraging more $BGT to be delegated to those validators.

- As more $BGT is delegated to those validators to receive incentives, more $BGT emissions occur in their protocol's liquidity pool.

- Additional liquidity flows in from the outside to receive the $BGT emissions distributed more to the liquidity pool, increasing protocol traffic and revenue.

- Repeat steps 1-3.

Furthermore, in the process of building this flywheel, protocols are emerging that aim to provide user convenience and create added value for the environment where negotiations are constantly taking place to exchange protocol revenue and future added value, or to gather users' fragmented liquidity to exercise more authority in the negotiation process and generate profits.

4.2.1. Kodiak

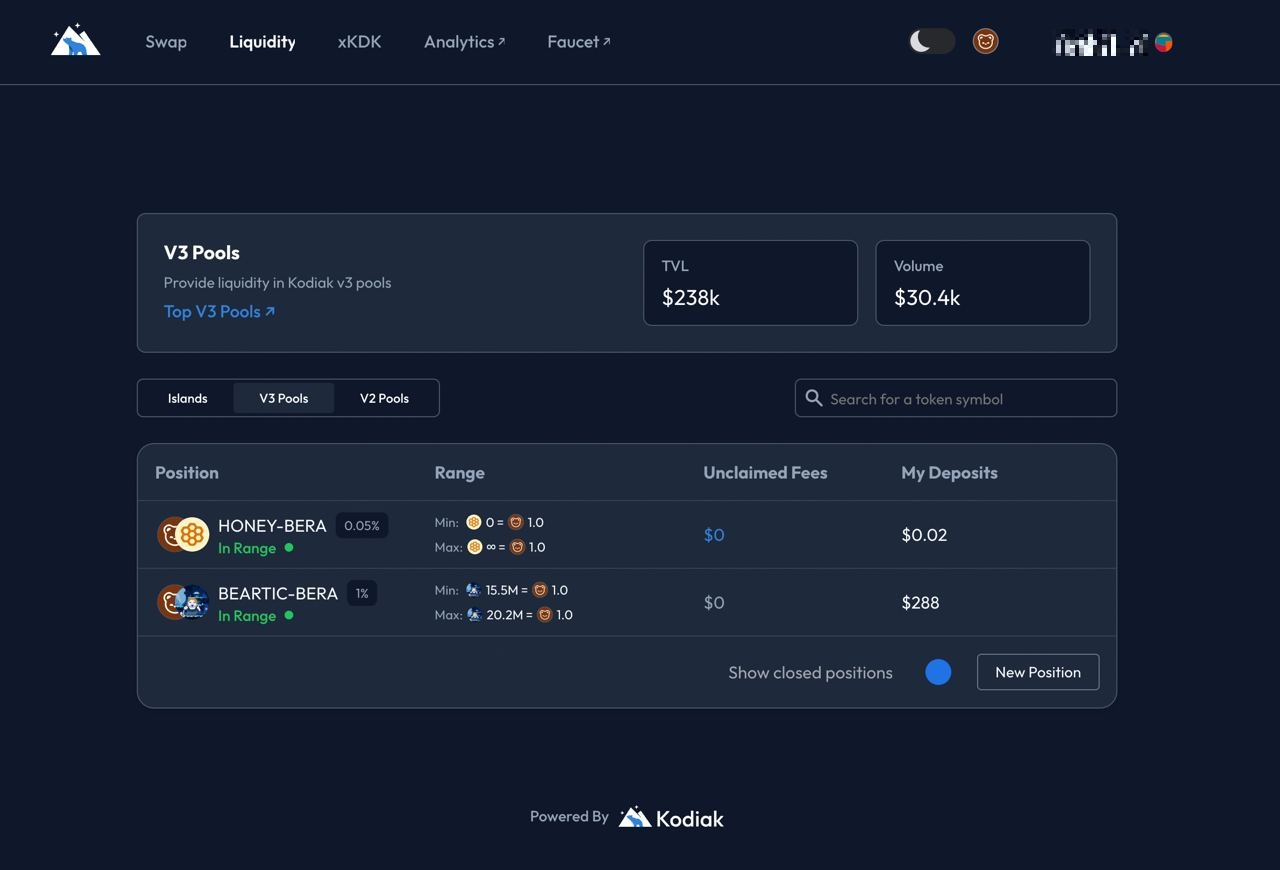

Kodiak is a DEX that can provide concentrated liquidity provision (CLAMM, Concentrated Liquidity AMM) to trading pools, similar to Uniswap v3. It helps users supply liquidity intensively to specific ranges, offering higher-efficiency $BGT farming compared to BEX.

Kodiak has two types of tokens, $KDK and $xKDK, and users can exchange the two tokens within the protocol.

- $KDK: An incentive token paid to liquidity providers and traders.

- $xKDK: Kodiak's governance token and a non-tradable token. Holders are provided with a portion of the revenue generated within Kodiak, such as fees incurred during swaps and incentives submitted by other protocols.

With concentrated liquidity provision, users can farm $BGT with high capital efficiency. However, if the liquidity provided by the liquidity provider falls outside the range due to price fluctuations, the liquidity deposited by the liquidity provider is not utilized for trading at all. Therefore, liquidity providers cannot receive $BGT farming and trading fees, requiring continuous range management by liquidity providers.

In response, Kodiak additionally provides a vault feature called Kodiak Islands, which automatically adjusts the liquidity provision range according to market conditions. This solves the cumbersome problem of liquidity providers having to manage the liquidity provision range while simultaneously resolving the issue of idle liquidity arising from the concentrated liquidity provision range being exceeded, ensuring that abundant trading liquidity is maintained on Berachain. Furthermore, by using the native dApp BEX in the process of automatically adjusting the liquidity provision range, it establishes a mutually complementary relationship with native dApps.

Currently, Kodiak operates a validator node on bArtio Testnet, and there is a possibility that validator activities will be synchronized with the protocol mechanism in the future, so it is necessary to pay attention to the future development of the protocol.

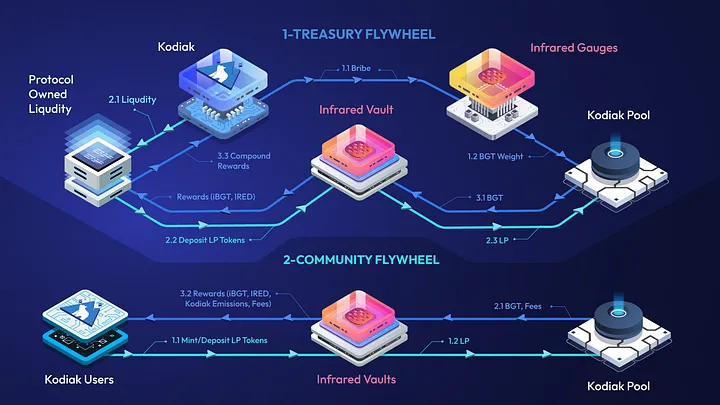

4.2.2. Infrared

Infrared is a liquid staking protocol in the Berachain ecosystem. It operates vaults that provide liquidity to liquidity pools where $BGT emissions occur on behalf of users, and delegates the $BGT generated by utilizing the liquidity deposited by users in those vaults to its own validator nodes. It then provides users with $iBGT, a liquidity token for $BGT, and $IRED, a governance token.

- $iBGT: A token that liquefies $BGT. Users can utilize $iBGT in other DeFi protocols to generate additional revenue.

- $IRED: Infrared's governance token. It has the authority to determine the $BGT voting rights of Infrared validators and can receive fees generated in Infrared.

In this way, by providing users with the benefit of simultaneously guaranteeing the two functions of $BGT, exchange for $BERA and voting rights, it can acquire a large amount of $BGT. Moreover, as Infrared gathers more $BGT within the Berachain ecosystem, the role of $IRED, the token that can exercise the voting rights of that $BGT amount, also becomes more important. Therefore, it is expected that many protocols will appear that design a structure utilizing $IRED as a substitute role for $BGT.

A representative protocol designing such a structure is Kodiak, introduced above. Kodiak plans to collaborate with Infrared to open a Kodiak vault within Infrared, providing Kodiak's liquidity providers with the opportunity to farm $IRED instead of $BGT.

Moreover, derivative DeFi protocols such as Gummi and BeraBorrow are continuously emerging, stating that they will enable $iBGT to be used as collateral, forming an ecosystem centered around Infrared.

Furthermore, Infrared recently unveiled a liquid staking feature for $BERA in addition to liquid staking for $BGT, aiming to establish itself as a protocol providing comprehensive liquid staking solutions within the Berachain ecosystem.

4.3. How Communities Utilize PoL

Berachain's DeFi protocols are attempting to resolve the liquidity war that will unfold within PoL based on quantitative incentives expressed in numbers and are further striving to provide users with convenience and capital efficiency.

In addition to this approach, there are also movements in the PoL ecosystem to form communities through NFTs and memes, establish a presence through various community activities, and subsequently generate and distribute profits through that presence.

This method inevitably involves more qualitative aspects, which can lead to inefficiencies in incentive distribution compared to the approach of DeFi protocols. However, as the complexity that arises when derivative protocols emerge and combine in the DeFi ecosystem can hinder new users from entering Berachain, there may be an increasing demand for intuitive and qualitative approaches to the liquidity war.

Moreover, given that Berachain originated from an NFT project and has the most cult-like community, this approach may be a much more 'Berachain-like' strategy than the one being taken by DeFi protocols.

4.3.1. The Honey Jar

The Honey Jar is a community gathered around the core philosophy of building a community-driven flywheel that connects each entity and constructs sticky liquidity that does not easily disperse. It evolved around an NFT called 'Honeycomb' in 2022.

Similar to how Berachain grew, the Honey Jar community has expanded by issuing and distributing derivative NFT series of Honeycomb to holders. Based on the expanded community, it has been able to further solidify its presence by forming partnerships with various projects being developed within Berachain and providing various benefits from those projects to NFT holders.

Recently, it has been providing various services helpful to users who have initially entered the Berachain ecosystem, such as creating various educational materials related to Berachain and a testnet faucet. Furthermore, it is incubating projects such as S&P (Standard & Paws), a community-based evaluation service that assesses the credibility of projects within the Berachain ecosystem, and Bera Infinity, a platform that calculates and rewards contributions to the Berachain ecosystem, functioning as a venture studio for the Berachain ecosystem beyond just a community.

Honey Jar also operates a validator node within the Berachain ecosystem. As a result of building a strong presence within the Berachain community through the various activities and services mentioned above, as of July 2023, Honey Jar has positioned itself as the validator with the most $BGT delegated.

Recently, it has established a DAO to negotiate incentives and form liquidity partnerships with protocols scheduled to launch on Berachain and distribute the incentives obtained through this to Honeycomb NFT holders, preparing for the liquidity war that will begin with the launch of the Berachain mainnet.

5. Conclusion

Starting from an NFT project, Berachain has built a structure that closely connects and aligns the interests of three entities: validators, liquidity providers, and protocols, by introducing the PoL consensus mechanism based on a loyal community.

Furthermore, various DeFi protocols are building new types of models and preparing for launch to actively utilize Berachain's consensus mechanism, and community-based projects are also striving to solidify their presence within the ecosystem in their own ways.

In this way, an ecosystem flywheel is being built based on Berachain's PoL consensus mechanism. However, this flywheel can also act as a vicious cycle structure. Therefore, for sustainability, Berachain has the following challenges to solve:

- $BGT inflation: In a situation where $BGT is continuously inflated, there is ultimately a limit to creating demand for $BGT solely through liquidity inflows from external ecosystems. In the long run, the amount of $BERA burned needs to be increased, but given that the PoL structure focuses on securing liquidity, it may be difficult to increase actual network usage.

- Possibility of centralization: As the ecosystem matures, there is a possibility that a strong cartel centered around specific validators, protocols, and liquidity whales will form. If the ecosystem unfolds only around this cartel, it can make it difficult for new protocols to enter the Berachain ecosystem and ultimately hinder the influx of new users.

To solve this, the emergence of user-friendly protocols that can attract new users and encourage active transactions will be essential. Additionally, consensus among ecosystem participants with sustainability in mind will be necessary to ensure that protocols that positively impact the ecosystem can receive sufficient liquidity support.

The success or failure of Berachain's attempt to integrate liquidity and security through an incentive mechanism is expected to have a significant impact on the overall blockchain industry going forward. Given that it is currently in the testnet stage, it is necessary to observe how Berachain will solve these challenges in the future.