EigenLayer — Leveraging Ethereum's Security

Exploring the Ecosystem Established by EigenLayer and Its Derived Protocols

1. Introduction

Since the second half of 2023, the much-anticipated approval of Bitcoin spot ETFs has come to fruition, leading to a significant influx of institutional funds. As a result, the price of Bitcoin has reclaimed its peak for the first time in four years since November 2021. During this period, the transaction volume on CEXs (Centralized Exchange) such as Binance and Upbit surpassed $1 trillion, and the popularity of CEX mobile applications has risen, indicating an increase in market participation by retail investors.

Moreover, there has been an increase in on-chain activities by investors who withdraw assets from CEXs to use in DeFi (Decentralized Finance) for earning interest on their digital assets or to receive airdrops. This has led to a doubling in the TVL (Total Value Locked) in the DeFi sector compared to the latter half of the previous year.

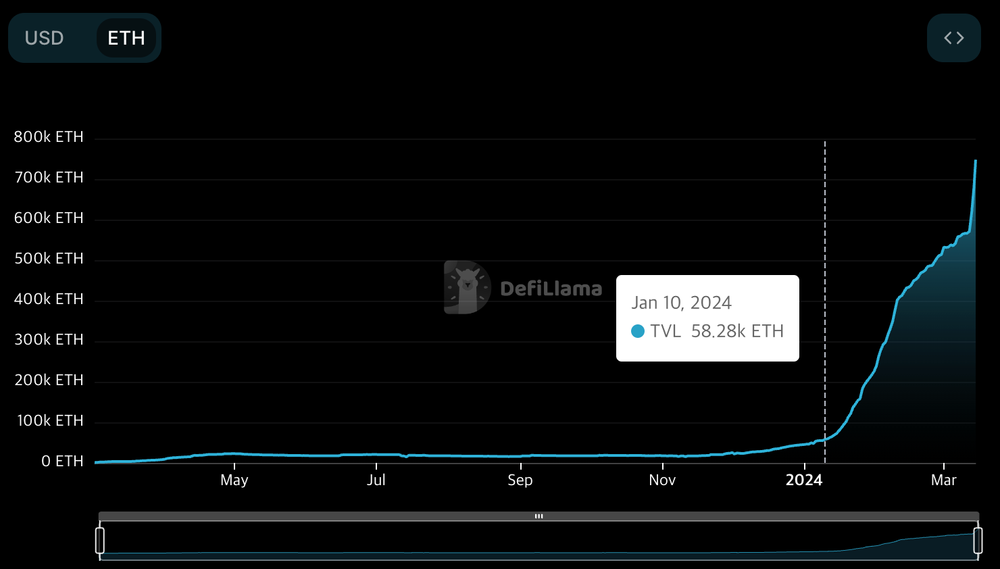

EigenLayer, an Ethereum-based protocol, has experienced remarkable growth in 2024, with its Total Value Locked (TVL) surging nearly tenfold since the start of the year. This impressive performance has propelled EigenLayer to the third position in the overall DeFi protocol TVL rankings. The protocol's substantial TVL growth has significantly contributed to the overall expansion of the DeFi sector's TVL, highlighting its increasing prominence and influence within the decentralized finance ecosystem.

EigenLayer emerged by proposing a restaking function that utilizes ETH staked for the validation of the Ethereum network to share security with other protocols while providing additional interest to protocol participants. Thanks to its proposal to maximize the efficiency of capital and security within the Ethereum network, EigenLayer attracted investments of around $160 million from crypto VCs, including a16z.

Furthermore, by effectively utilizing a point system that has become an essential grammar for airdrop farming, it heightened investors' expectations. Through various derivative protocols that maximize the point system, EigenLayer's TVL has shown a steep increase from the beginning of the year to the present.

This article will cover the overall aspects of EigenLayer while focusing on the synergies being created by various derivative protocols with EigenLayer.

2. What is EigenLayer

After the Ethereum network transitioned from the PoW (Proof of Work) consensus mechanism to PoS (Proof of Stake) in 2022, about 980K Ethereum validation nodes have staked 32 ETH each on the Beacon Chain, a network dedicated to Ethereum's validation, participating in network verification. In PoS, the value staked in the network is directly linked to the network's security, meaning that approximately 31 million ETH are ensuring the reliability of the Ethereum network. Ethereum's Dapps (Decentralized application) could deploy smart contracts on the Ethereum network, thereby sharing in its trust and security.

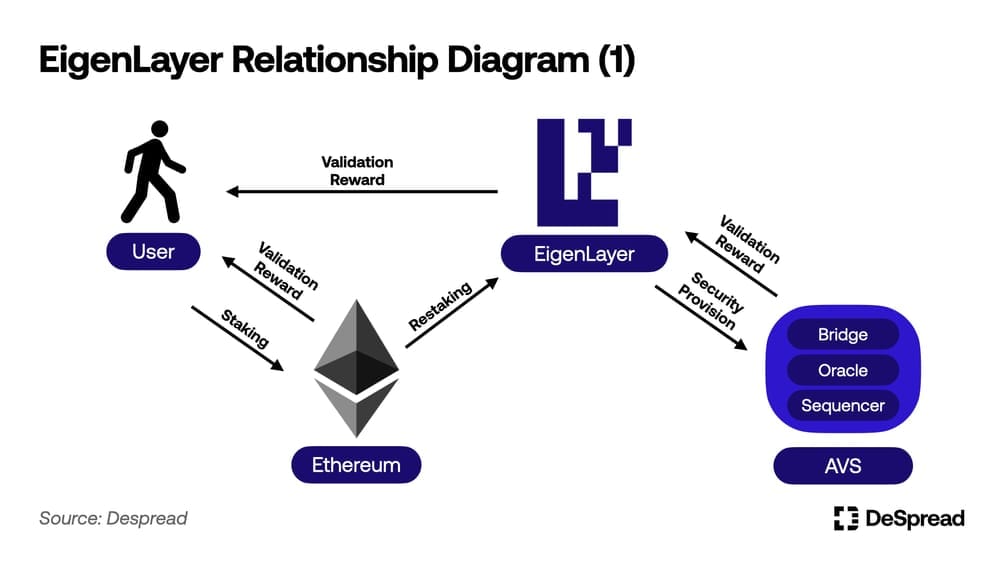

However, protocols known as AVSs (Actively Validated Service), such as bridges, sequencers, and oracles, face significant challenges utilizing the Ethereum network alone for functionality. This is due to their role as intermediaries between chains or their need for faster synchronization times than what the Ethereum network can provide. Consequently, these AVSs have faced the task of building their own trust networks and, in the process of doing so in a decentralized manner, have needed their consensus mechanisms.

AVSs aspiring to establish their trust networks through a PoS structure, akin to Ethereum's consensus mechanism, encounter several issues during the process of bootstrapping their networks:

- A lack of avenues to promote their projects and attract stakers.

- Stakers typically need to purchase the AVS network's native tokens, which are often volatile and hard to obtain, leading to lower accessibility compared to ETH.

- AVSs must offer higher APY than ETH to attract stakers, as stakers forgo other asset management opportunities to participate in network verification, thereby incurring higher capital costs.

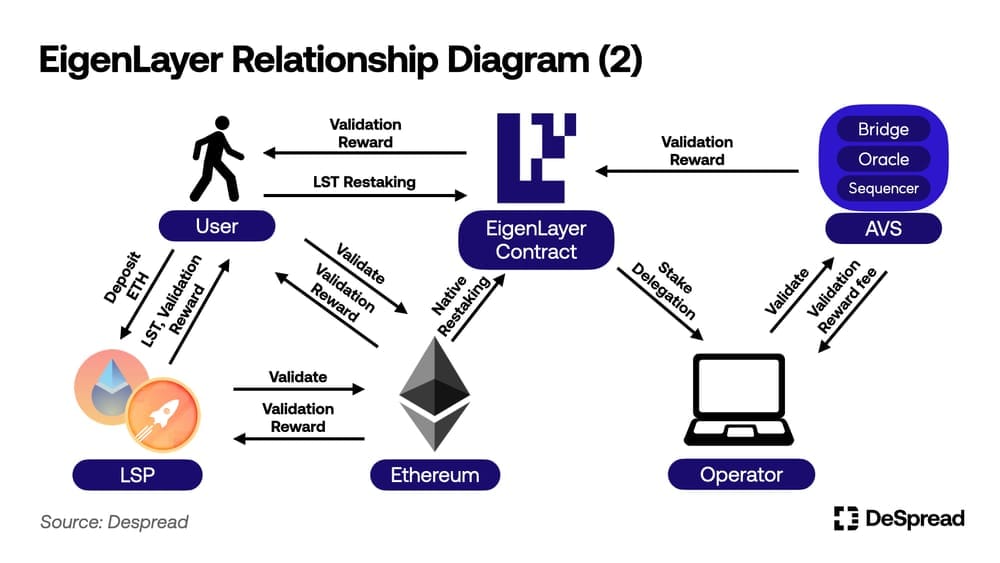

EigenLayer emerged to solve these issues through a feature called Restaking, which allows the ETH staked on the Ethereum Beacon Chain to be leveraged again for participation in AVS validation. Restaking provides restakers with the opportunity to participate in AVS network verification and earn additional validation rewards without the need to purchase other network tokens, using either ETH or LST. For AVSs, EigenLayer aims to offer an environment where they can promote their projects and build a trust network based on the liquidity of restakers recruited through EigenLayer.

2.1. Leveraging Ethereum's Security through Restaking

Currently, validators on the Ethereum network risk being slashed up to 16 ETH of their staked 32 ETH for actions that compromise network security. If their staked ETH falls below 16 ETH, they lose their validator status. This means if there's a way to utilize the staked liquidity as collateral, it's possible to leverage up to 16 ETH of the stake elsewhere, as long as the staking balance remains above 16 ETH, allowing continuous participation in Ethereum network validation.

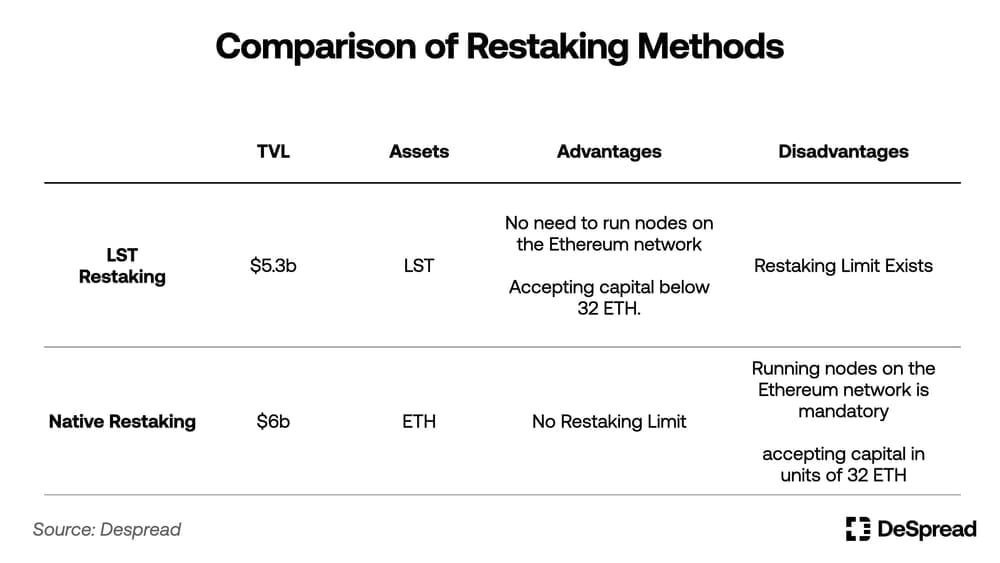

Restaking in EigenLayer refers to the act of leveraging the idle portion of a validator's staked ETH as collateral. This is done by exposing it to the slashing criteria of AVSs that use a PoS consensus algorithm and utilizing it for validation to provide security. Currently, EigenLayer supports two methods of restaking: *LST (Liquid Staking Token) Restaking and Native Restaking.

*LST Restaking: Though referred to as Liquid Restaking on EigenLayer, this text denotes it as LST Restaking to reduce confusion with subsequent concepts that will be introduced.

2.1.1. LST Restaking

LSTs (Liquid Staking Token) are tokens issued as certificates of deposit by LSPs (Liquid Staking Protocol), which connect depositors of ETH to entities that operate Ethereum nodes on their behalf. LSPs address certain limitations of Ethereum network staking, such as:

- Allowing users to participate in Ethereum network validation and receive validation rewards with less than 32 ETH of capital.

- Enabling the use of LST in DeFi protocols to generate additional income, or allowing for immediate liquidity by selling LST in the market without waiting for the unstaking period, effectively providing the same benefits as unstaking.

A prominent LSP, Lido Finance, currently has around ten million ETH deposited. Many DeFi protocols have started to adopt Lido Finance's issued LST, stETH, as an asset that can be utilized within their protocols, making it an essential infrastructure within the Ethereum ecosystem.

EigenLayer offers a restaking function that involves depositing the Ethereum network deposit certificate, LST, into EigenLayer smart contracts and participating in AVS validation and exposing it to the AVS network's slashing criteria. This method is known as LST restaking.

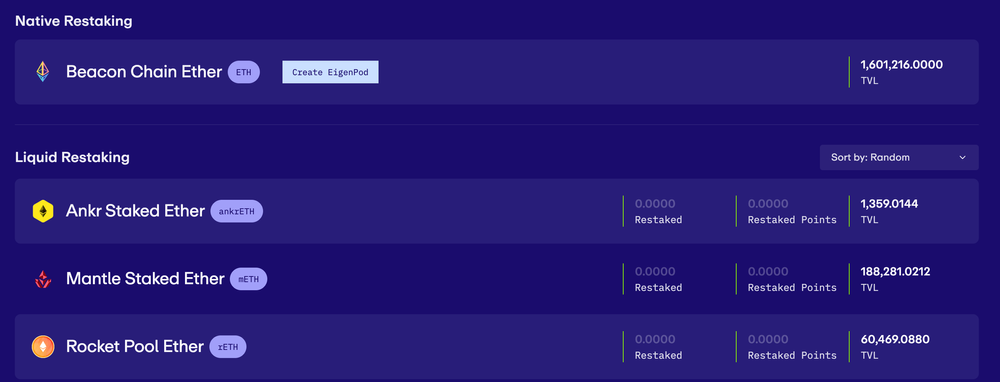

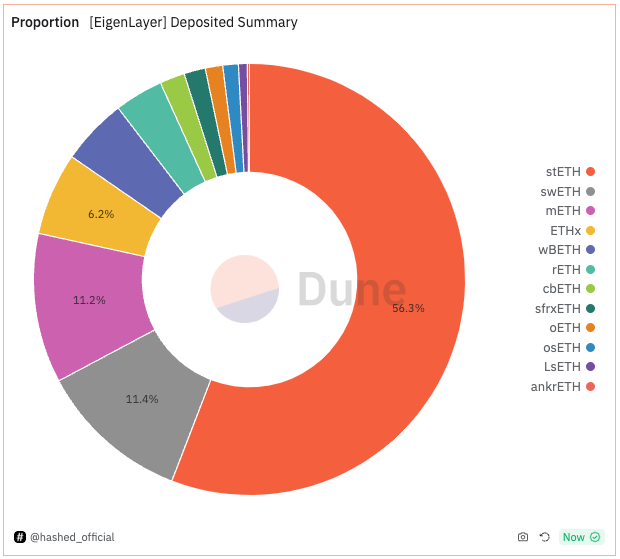

With the launch of its mainnet in June 2023, EigenLayer began supporting restaking for stETH, rETH, and cbETH, and currently supports a total of 12 types of LST restaking.

The EigenLayer development team has made efforts to ensure the protocol's decentralization and neutrality by setting limits for each LST. These measures include accepting LST restaking deposits only during specific periods or limiting the incentives and governance participation rights a single LST can acquire from EigenLayer to a maximum of 33%. To date, there have been five increases in LST restaking limits within EigenLayer, and no further schedule for increasing deposit limits has been announced as of the writing of this document.

2.1.2. Native Restaking

While LST restaking involves using LSTs as collateral to participate in the validation of AVSs, native restaking is a more direct method where Ethereum PoS node validators connect the ETH they have staked in the network to EigenLayer.

Ethereum node validators can participate in AVS validation by leveraging their staked ETH as collateral. They do this by setting the address for receiving unstaked ETH not to their own wallet address but to a contract called EigenPod, created through EigenLayer.

In other words, Ethereum network validators give up the direct right to receive the ETH they have deposited, engaging in native restaking to participate in AVS validation. This exposes their staked assets not only to Ethereum network's slashing criteria but also to that of the AVS, albeit with the potential for additional rewards.

Executing native restaking requires staking 32 ETH and managing an Ethereum node directly, which presents a higher barrier to entry compared to LST restaking. However, it is not subject to the limit restrictions of LST restaking.

2.2. Operators

After proceeding with restaking in EigenLayer, restakers have the option to either run AVS validation nodes directly or delegate their restaked shares to an operator. Operators act on behalf of restakers to participate in AVS validation and earn additional validation rewards.

Operators grant slashing rights over the stakes they hold or are delegated to AVS, install the necessary software for AVS validation, and then participate in the validation process. In return, they can collect fees set by themselves from the restakers.

However, the process of sharing security with AVS is currently operational only on the Testnet. Consequently, there are no operators or AVSs in EigenLayer at this moment, and restakers are not receiving any additional validation rewards. Recently, EigenLayer has mentioned that preparations for launching the first AVS, EigenDA, on the mainnet and activating AVS validation in Stage 2 are in the final stages.

Summarizing the relationship diagram of EigenLayer up to this point, it looks as follows

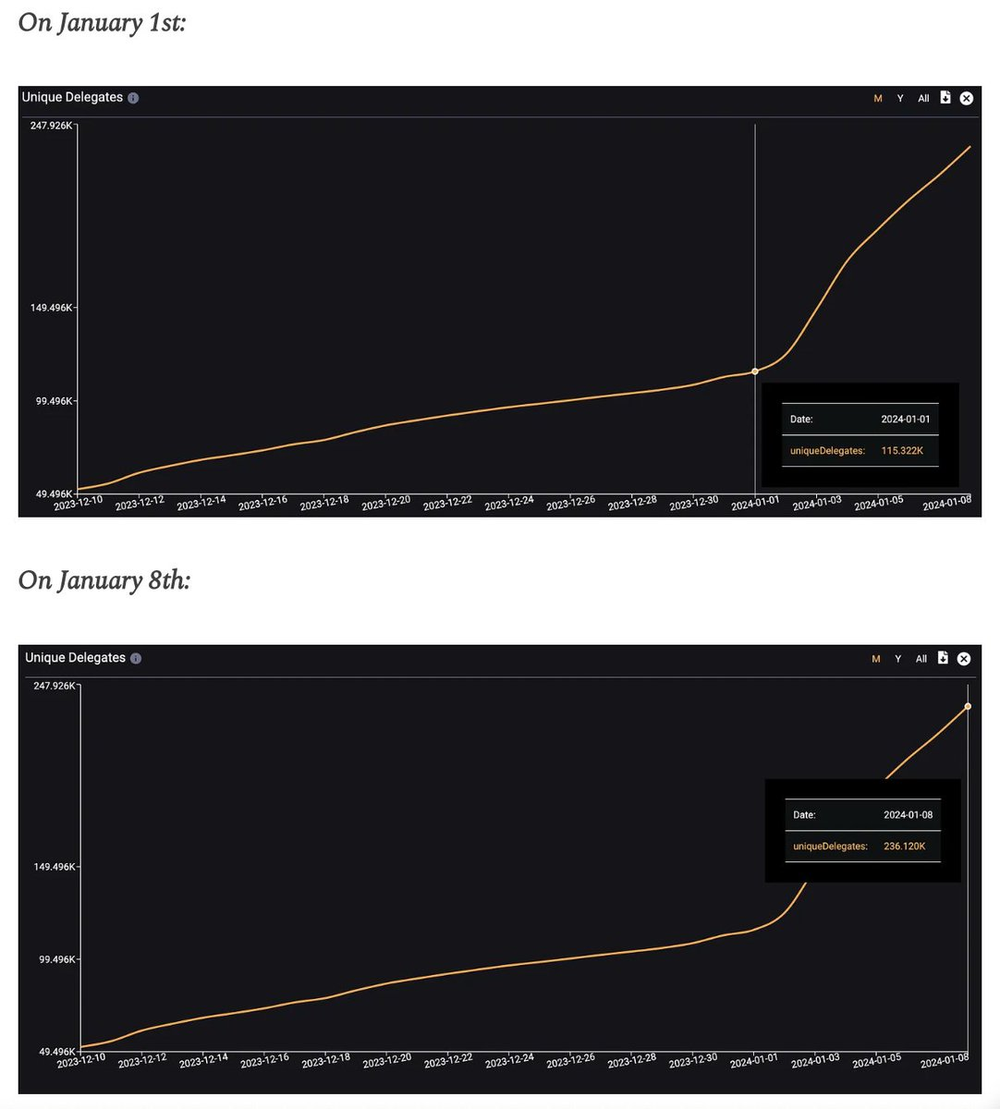

2.3. EigenLayer Points

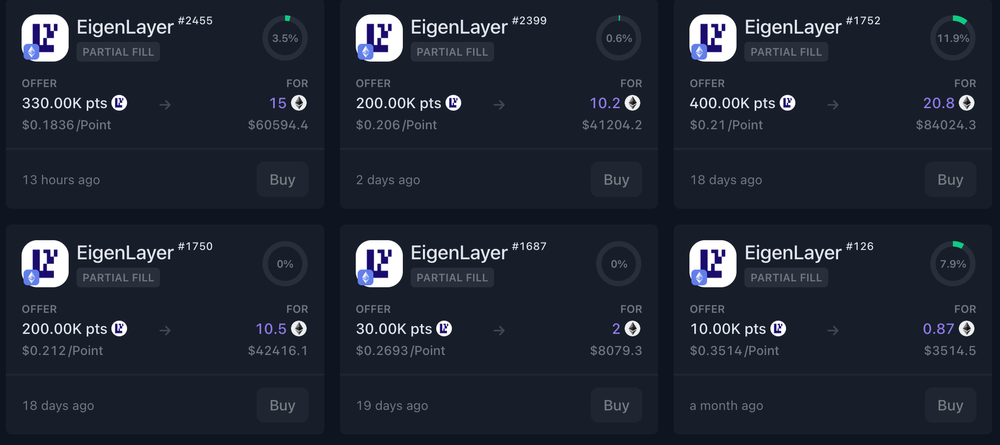

EigenLayer awards one EigenLayer Point per hour for each ETH deposited by restakers, under the guise of measuring contribution. Despite the team not clearly specifying the use of points or announcing any details about the launch of an EigenLayer token, many users are engaging in restaking in anticipation of a point-based airdrop when the token is eventually launched.

As of the date of writing, approximately 2.6 billion EigenLayer Points have been distributed among all restakers, and on the over-the-counter trading platform Whales Market, EigenLayer Points are trading at $0.18 each.

This allows the market to estimate the expected value of an EigenLayer token airdrop at around $440 million, a significant expectation compared to the $120 million valuation of Celestia's airdrop based on its price on the day of the airdrop. This demonstrates considerable market anticipation and interest in the airdrop.

However, users engaging in restaking for the purpose of farming points face several inconveniences:

- LST restaking has a limit, making it impossible for users to deposit as much as they want, when they want.

- Native restaking requires a capital of 32 ETH and involves running an Ethereum network node directly.

- Restaking freezes liquidity in EigenLayer, forcing users to forego other opportunities for generating additional income.

- Unstaking in EigenLayer to access tied-up liquidity entails waiting for a 7-day escrow period.

To mitigate these disadvantages and make restaking more efficient, LRPs (Liquid Restaking Protocol) have emerged. Utilizing LRPs for farming EigenLayer Points has become an even more attractive investment option for users.

3. LRP (Liquid Restaking Protocol)

LRPs accept deposits of ETH or LST from users and perform restaking on EigenLayer on their behalf with the deposited assets. Additionally, LRPs issue LRTs (Liquid Restaking Token) as certificates for the deposited assets, allowing users to generate additional income by utilizing these LRTs in DeFi protocols or sell them in the market, thus bypassing the need to wait for the EigenLayer unstaking escrow period to recover their deposits. Apart from the fact that the assets are deposited in EigenLayer, LRPs structurally resemble LSPs.

Terminology

- LSP (Liquid Staking Protocol): A protocol that substitutes for Ethereum network validation.

- LST (Liquid Staking Token): A token issued by LSPs to depositors as a certificate for the principal amount.

- LRP (Liquid Restaking Protocol): A protocol that substitutes for restaking on EigenLayer.

- LRT (Liquid Restaking Token): A token issued by LRPs to depositors as a certificate for the principal amount.

Moreover, most LRPs, apart from issuing EigenLayer Points, also provide their own protocol points to depositors. Consequently, utilizing LRPs offers several benefits over direct restaking through EigenLayer, such as:

- Creating added value through the use of LRT.

- Closing restaking positions by selling LRT.

- Earning additional airdrops through protocol point farming.

However, the EigenLayer Points generated through restaking via an LRP are credited not to the wallet address of the user who deposited the assets but to the ownership address of the LRP. Therefore, LRPs promise to allocate any EigenLayer token airdrops they may receive to their depositors and provide a dashboard for users to check the EigenLayer Points they have accumulated through the LRP.

In the following sections, we will classify LRPs based on two criteria and continue with detailed explanations.

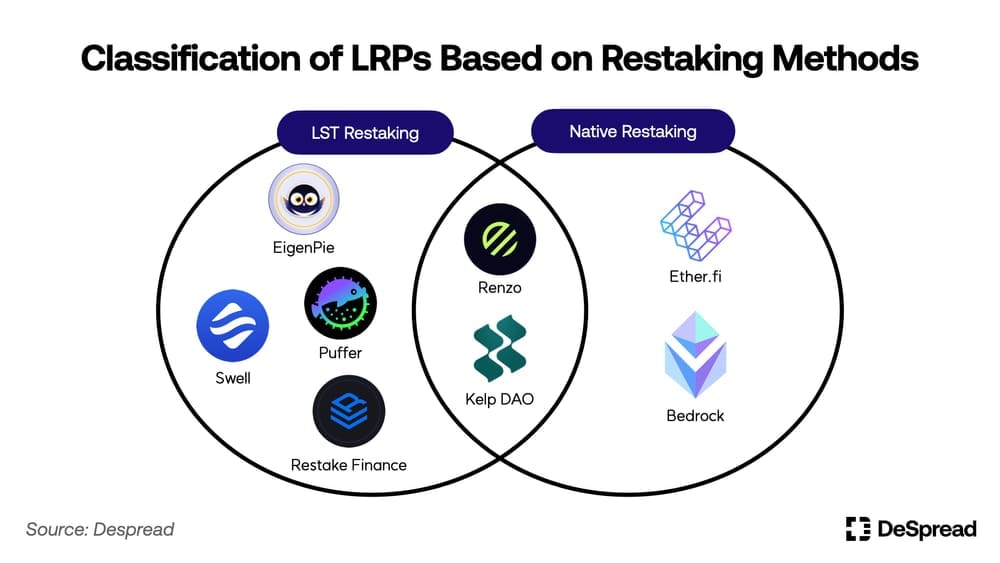

3.1. Classification of LRPs Based on Restaking Methods

As previously discussed, there are two restaking methods in EigenLayer: LST restaking and Native restaking. These methods differ in terms of the type of assets they accept for deposit and whether or not they involve operating Ethereum network nodes.

LRPs that adopt the LST restaking method can construct their protocol through a relatively simple mechanism. They accept LST from users, deposit these into the EigenLayer contract, and then issue an equivalent value of LRT to the depositor. However, they are directly affected by the limit restrictions of LST restaking. Therefore, unless EigenLayer reopens LST restaking, the deposited LSTs during periods of limit restrictions will remain within the LRP protocol, and depositors will not accumulate EigenLayer Points until their assets are restaked.

On the other hand, LRPs that adopt the native restaking method have to manage and operate Ethereum network nodes directly since they accept ETH from users. This requires more effort in constructing, operating, and managing the protocol compared to LRPs that use the LST restaking method. However, there are no limit restrictions like those in LST restaking, allowing depositors to start farming EigenLayer Points immediately upon deposit.

Based on these characteristics, LRPs offer restaking methods that suit their protocol concept, and they do not necessarily need to stick to a single restaking method. For example, Kelp DAO initially began by supporting LST restaking to quickly gather TVL following the launch of EigenLayer and subsequently adopted a strategy to provide native restaking functionality.

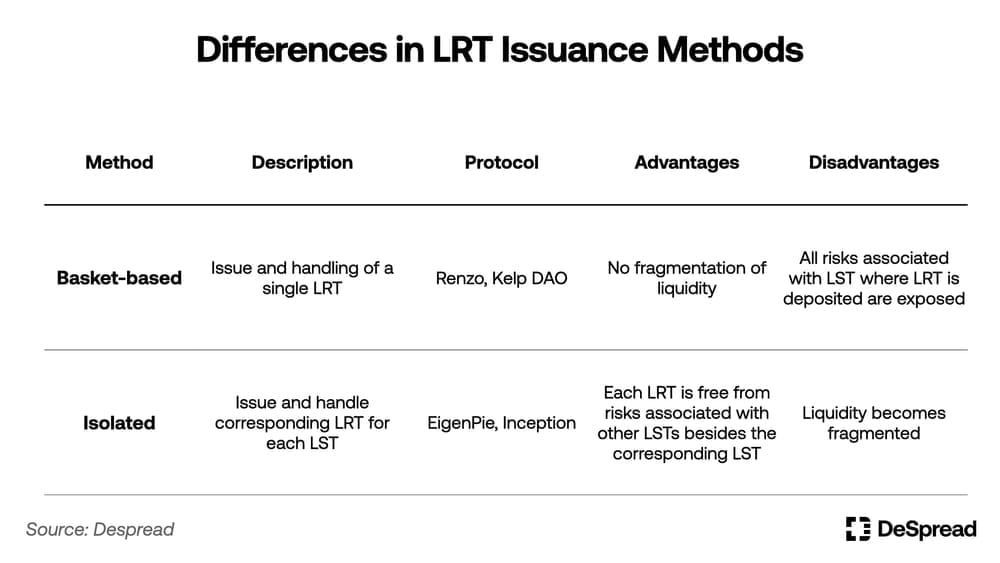

3.2. Classification of LRP Based on the Method of LRT Issuance

In an LRP that accepts a variety of LST types or ETH instead of a single asset and executes restaking, the method of issuing LRT can be categorized into Basket-based and Isolated methods.

The Basket-based method deals with a single type of LRT, issuing and paying out one LRT regardless of the type of LST the user deposits into the LRP. Since it handles only one LRT, it is intuitive for users, and it has the advantage of not fragmenting the liquidity of LRT. However, a disadvantage is that the entire LRP is exposed to the individual risks of the deposited LSTs, and efforts such as adjusting the proportion of LST deposits within the LRP are required to prevent these risks.

On the other hand, the Isolated method issues and pays out separate LRTs corresponding to each LST handled by the LRP. This means that while it has the disadvantage of fragmenting the liquidity of LRT, the risks associated with each LST are also isolated, eliminating the need to worry about adjusting deposit proportions.

Despite the fact that the Isolated method carries fewer risks and is relatively more convenient to set up and operate, most LRPs adopt the Basket-based method. This approach is intuitive for users and facilitates collaboration with DeFi protocols.

Beyond these fundamental characteristics, LRPs also attract users by highlighting their unique features and market entry strategies through various examples. Let's examine these aspects in more detail through a few examples.

3.3. Exploring Prominent LRPs

3.3.1. Ether.fi

Ether.fi began as an LSP with the concept that stakers could retain full control over their deposited ETH, and it was the first LRP to support native restaking following the launch of EigenLayer. This enabled Ether.fi to offer its depositors EigenLayer point farming through native restaking, even during periods when restaking limits were imposed, thereby consistently increasing its TVL.

Ether.fi issues two types of LRTs: eETH and weETH. eETH is the basic LRT received upon depositing ETH into Ether.fi, employing a rebase mechanism where interest is reflected in the token amount. Rebase tokens adjust the token balance in holders' wallets at the time of interest payment, maintaining a 1:1 value ratio with the underlying asset. However, some DeFi protocols do not support this token mechanism. To enhance compatibility between LRTs and DeFi protocols, Ether.fi provides the functionality to wrap eETH into weETH, a reward-bearing token where interest is reflected in the token's value.

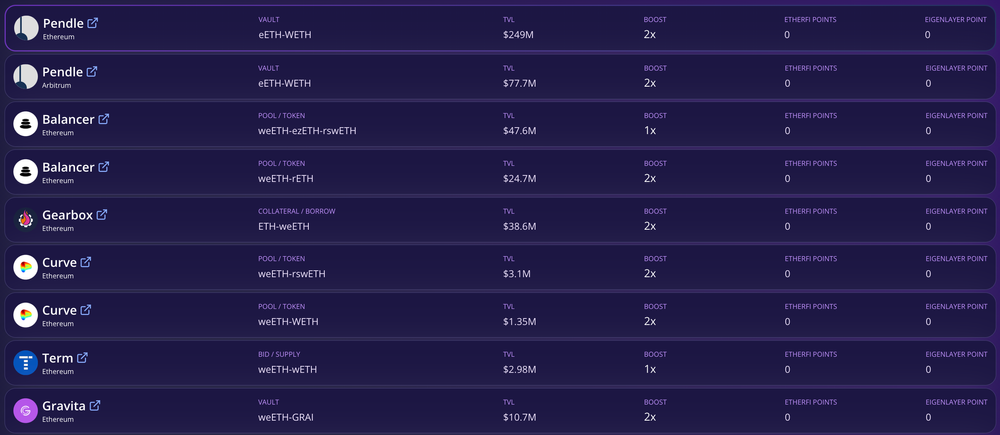

Ether.fi rewards LRT holders with EigenLayer points and its proprietary protocol points, ether.fi loyalty points. To reduce selling pressure on LRTs and expand their utility, Ether.fi collaborates with various DeFi protocols, allowing users who deposit LRTs into DeFi protocols to continuously accumulate EigenLayer points. Ether.fi also hosts events to boost ether.fi loyalty points for users engaging in DeFi activities with their LRTs.

Users can engage in various DeFi activities using eETH or weETH, such as:

- Providing liquidity to weETH/WETH pools on decentralized exchanges like Curve and Balancer.

- Offering weETH as collateral in lending protocols like Morpho Blue and Silo.

- Issuing overcollateralized stablecoins with weETH as collateral in protocols like Gravita.

- Utilizing derivative product protocols like Pendle and Gearbox.

Through these activities, users can farm EigenLayer and ether.fi loyalty points while earning interest from DeFi protocols or utilizing tokens received as collateral for LRT in various plays. Ether.fi has recently supported LRT bridging to Ethereum L2 Arbitrum and Mode Network, laying the foundation for users to hold and use LRT in DeFi with lower gas fees.

On March 18, Ether.fi announced the TGE (Token Generation Event) of its governance token, $ETHFI, and conducted an airdrop of 6% of the total supply based on ether.fi loyalty points. A second airdrop season is scheduled for June 30, with 5% of the total ETHFI supply allocated.

Currently, Ether.fi has the highest TVL among LRPs, approximately $3 billion, representing about a quarter of the total restaking liquidity in EigenLayer.

3.3.2. Kelp DAO

Kelp DAO began as a Basket-based LRP, offering LST restaking for two assets, Lido Finance's stETH and Stader Labs' ETHx, and issuing a single LRT, rsETH, in return.

Initially, as the limits for EigenLayer LST restaking were raised, a surge of users quickly filled the caps, facing high gas fees and the inconvenience of time zone differences. In response, Kelp DAO proposed a solution where users could deposit their LST into the protocol, and Kelp DAO would handle the restaking once the deposit limit was reached. Depositors would receive Kelp DAO's proprietary protocol points, Kelp Miles, attracting a large user base. Like other LRPs, it designed its system to boost Kelp Miles points when users utilize their LRT in specific DeFi protocols, encouraging restaking and LRT utilization.

Kelp DAO has now added native restaking to its offerings, providing depositors with unlimited EigenLayer point farming. Similar to Ether.fi, it focuses on enhancing user convenience by providing access to restaking on the Arbitrum network, allowing users to hold and use their LRTs in DeFi more easily.

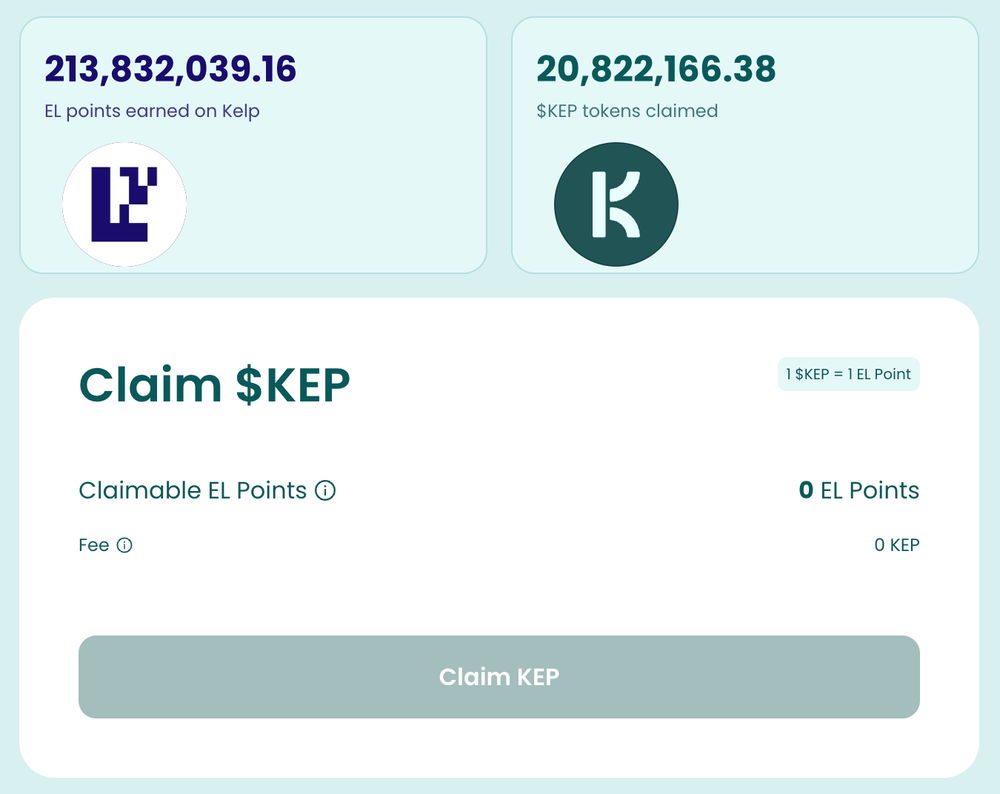

Additionally, Kelp DAO differentiates itself from other LRPs by enabling users to liquidate the EigenLayer points they've farmed into a token called $KEP.

Users can convert their accumulated EigenLayer points into $KEP tokens by paying a 0.5% fee. They can then sell these tokens on the market to monetize their EigenLayer points or supply liquidity to decentralized exchanges like Balancer, generating additional revenue and earning Kelp Miles points. Furthermore, users who have not deposited assets in Kelp DAO can also buy $KEP on the market, effectively gaining the same benefits as if they had accumulated EigenLayer points through Kelp DAO.

3.3.3. EigenPie

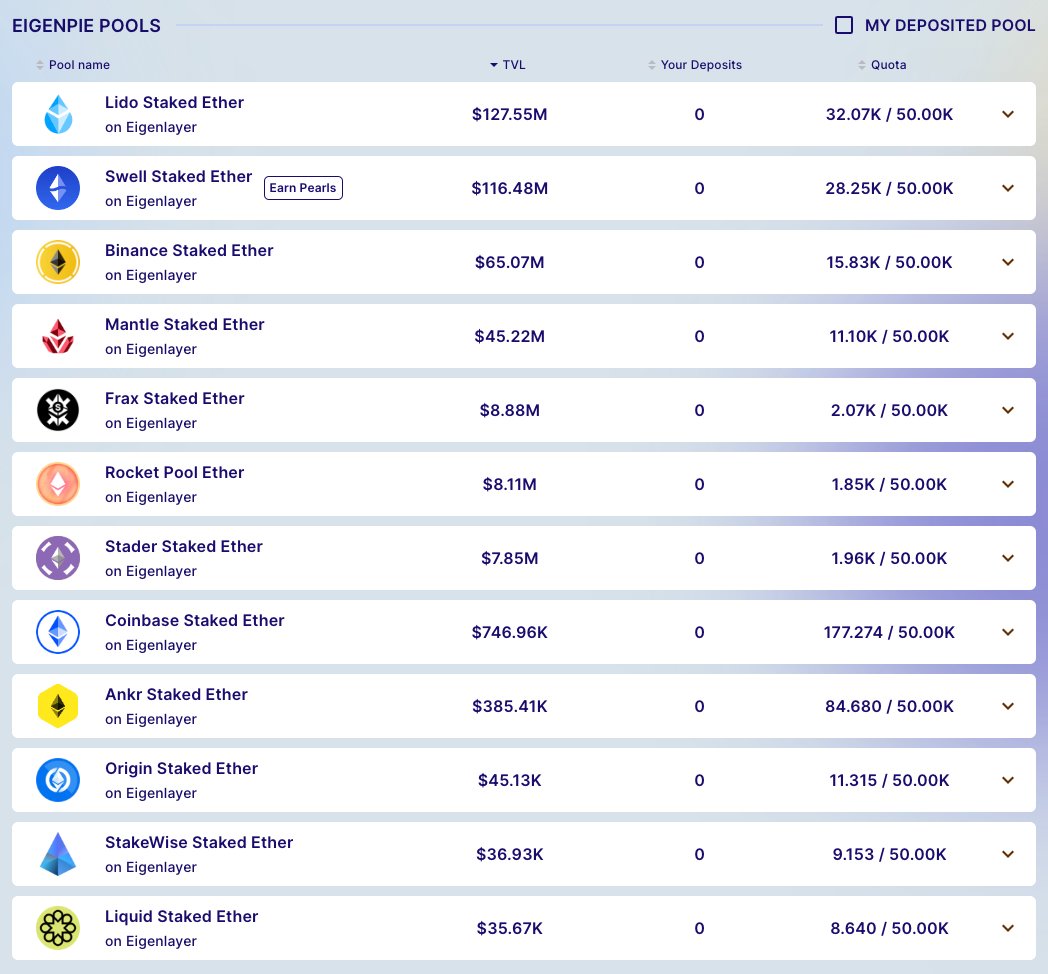

EigenPie is a sub-DAO launched by the MagPie ecosystem, aimed at aggregating governance tokens to wield significant influence over DeFi protocol decisions, specifically for EigenLayer. It supports restaking for all LSTs supported by EigenLayer's LST restaking and adopts an Isolated method, issuing and distributing separate LRTs for each deposited LST.

Having isolated pools for each LST frees EigenPie from risks associated with the concentration of specific LSTs, making it easier to form partnerships with specific LST protocols and conduct campaigns. For example, the LSP Swell Network conducted a campaign in collaboration with EigenPie before launching its native restaking feature, rewarding users who deposited its native LST, swETH, in EigenPie with Swell Network's proprietary points.

Depositors in EigenPie can accumulate both EigenLayer points and EigenPie points. It has been officially announced that users who receive these points will have the opportunity to participate in the airdrop and IDO of its upcoming governance token, $EGP.

However, EigenPie does not support native restaking, making it subject to the limitations of EigenLayer's LST restaking caps. Additionally, with twelve types of issued LRTs, its liquidity is more fragmented compared to other LRPs, resulting in relatively fewer collaborations with DeFi protocols.

4. Leveraged Point Farming

LRPs offer users convenient access to EigenLayer point farming by acting as intermediaries for restaking and providing LRTs. Additionally, by introducing their proprietary protocol point systems and collaborating with DeFi protocols to boost these points through campaigns, they have attracted a large number of airdrop farmers to the EigenLayer ecosystem.

However, in the early stages of LRP emergence, there was a lack of lending protocols that could collaborate with LRPs to use LRTs as collateral assets. As a result, users participating in protocol point boosting campaigns could only farm EigenLayer points honestly, based on the amount of LRT they held.

Gravita, an over-collateralized stablecoin issuance protocol, allowed users to issue stablecoins using Ether.fi's weETH as collateral. Users could then leverage their positions through a process known as looping—issuing stablecoins backed by LRT as collateral and using these stablecoins to purchase and deposit more LRT, thereby farming more EigenLayer points. However, the high gas fees on the Ethereum network and Gravita's minimum usage requirement of issuing at least 2,000 stablecoins posed significant barriers to entry for many users attempting to loop.

The landscape changed on January 10, 2024, when Pendle Finance began supporting Ether.fi's eETH, enabling leveraged point farming with small amounts of capital. This development sparked considerable interest among airdrop farmers in using Pendle Finance for EigenLayer point farming. As a result, EigenLayer and LRP's TVL saw significant increases.

4.1. Pendle Finance

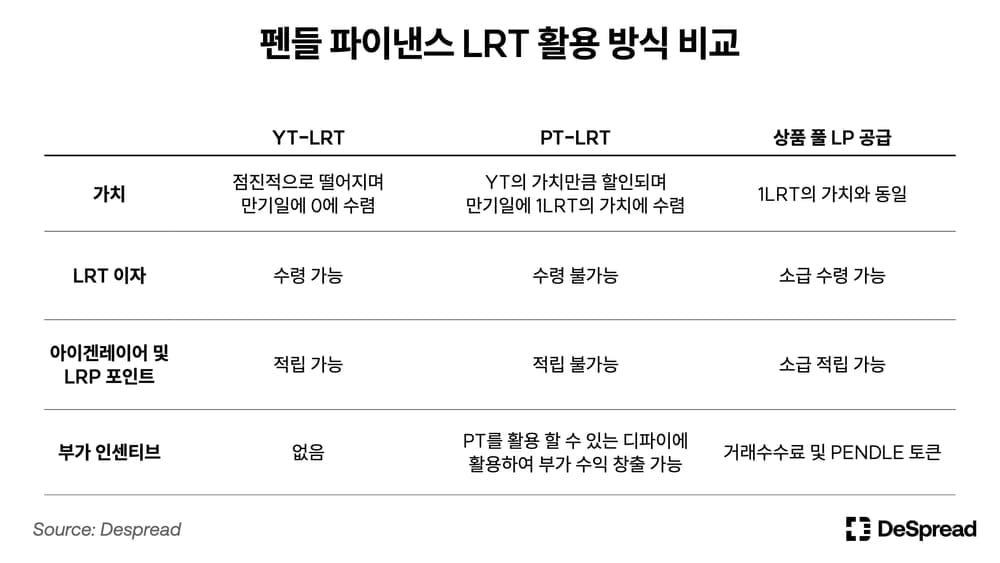

Pendle Finance is a DeFi protocol that enables the trading of yield-bearing tokens like LST and LRT by setting a specific maturity date and splitting them into one principal token (PT) and one yield token (YT).

The total value of the YT and PT always equals the value of the underlying asset, with the YT holders entitled to claim the interest accrued from the start of holding until maturity. Consequently, the value of YT approaches zero as it nears its maturity, whereas the PT's market value is discounted in proportion to the increase in demand for the YT token.

For more detailed information about Pendle Finance, please refer to "Pendle Finance — Discovering Unexplored Trading Market".

In collaboration with Ether.fi, Pendle Finance introduced Ether.fi's eETH as the first LRT available for use on its platform. Ether.fi designed its system to allocate EigenLayer points and Ether.fi loyalty points to users holding the YT token of eETH, YT-eETH. This allows users to purchase YT-eETH, which becomes cheaper as it approaches maturity, and accumulate the interest and points due until that date.

Let's explain further with a real-life example:

The photo mentioned is based on the status of Pendle Finance's eETH product as of the writing date, with details as follows:

- The product matures on June 27, 2024, leaving about 103 days from the writing date.

- The 7-day average APY of eETH is 3.13%, and its current price is $3,872.

- The price of YT-eETH is $196, offering an annual interest yield of -99.8% if purchased at that value.

- The price of PT-eETH is $3,676, offering an annual interest yield of 20.02% if purchased at that value.

As of the writing date, the exchange ratio of eETH to YT-eETH is about 1:20. Ether.fi is running a campaign that provides double the Ether.fi loyalty points to users holding YT-eETH. Therefore, a user who swaps one eETH for YT-eETH and holds until maturity would receive the following interest and points:

- Interest for holding 20 eETH

- EigenLayer points for holding 20 eETH

- Ether.fi loyalty points equivalent to holding 40 eETH

However, since the value of YT-eETH gradually decreases to zero by maturity, the actual value the holder can recover is only the basic interest generated from the 20 eETH. Calculated at the current price, this amounts to approximately $640, about one-sixth of one eETH's value at $3,872, indicating users are willing to incur this loss to participate in point farming by purchasing the cheaper YT-eETH.

As the value of YT-eETH for point farming was highly regarded, the discounted PT-eETH also became an attractive investment option with increased discount rates. Additionally, the demand for supplying LP to Pendle Finance's eETH product trading pool has increased as users seek to receive incentives. Currently, approximately one-third of all LRT issued on Ethereum are utilized by Pendle Finance.

Following the collaboration with Ether.fi, Pendle Finance has continued to engage in similar collaborations with other LRPs, increasing the number of supported LRTs, and providing leveraged point farming for EigenLayer and LRTs through the Arbitrum network. Recently, derivatives that pay high interest using undervalued PT-eETH as collateral have emerged in Silo Finance, allowing Pendle Finance to benefit from the EigenLayer ecosystem, achieving about a tenfold increase in TVL since the beginning of the year.

4.2. Gearbox

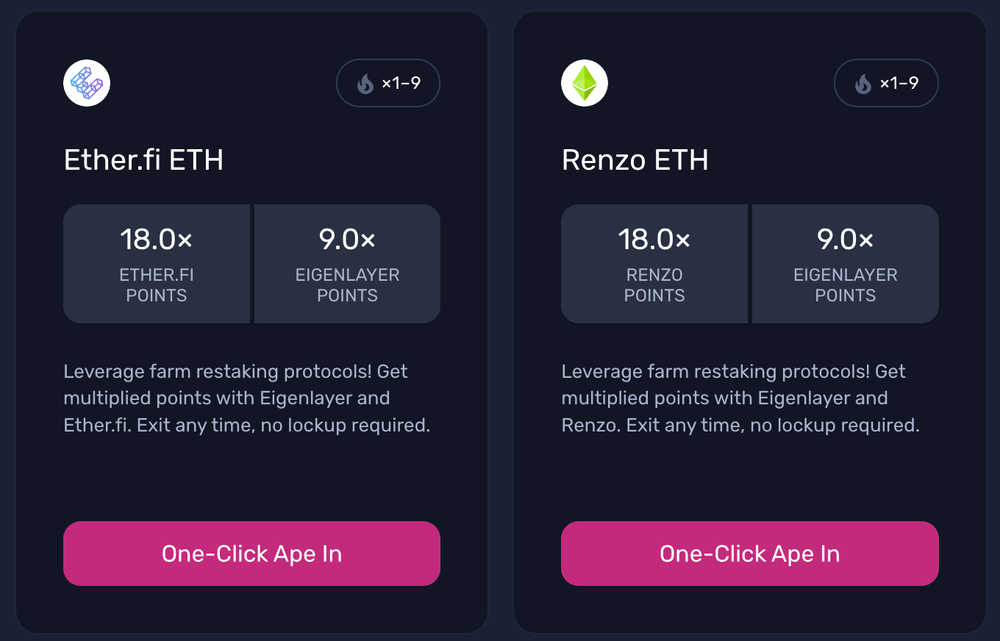

The leverage yield farming protocol Gearbox offers leverage point farming in a different way from traditional lending protocols like Pendle Finance, attracting users' attention.

Borrowers on Gearbox must create a smart contract called a Credit Account before borrowing assets. Then, they can leverage their positions by storing their collateral assets and borrowed assets from the protocol together in the Credit Account. Borrowers can then use the leveraged spot assets through the Credit Account for margin trading provided by Gearbox or for various DeFi yield farming opportunities such as Convex and Yearn Finance.

With this structure, Gearbox has launched leverage point farming strategies through collaboration with LRP protocols. By allowing EigenLayer points and LRP native points to be accrued in the Credit Account and received in the borrower's wallet, Gearbox offers users leverage point farming with a maximum leverage of up to 9x.

Gearbox provides relatively intuitive UI/UX compared to Pendle Finance, offering smooth accessibility to leverage point farming even for users unfamiliar with DeFi usage. Within just three weeks of launching the leverage point farming feature, Gearbox was able to increase TVL by approximately 5x.

5. Risks

Many protocols that utilize deposited ETH in the Ethereum network as collateral are interconnected, forming a vast ecosystem. Even now, numerous derivative protocols utilizing LRP, LRT, and EigenLayer points are emerging, and there are many discussions about the growth potential of the EigenLayer ecosystem. However, there are also many voices expressing concerns about various potential risks associated with EigenLayer.

In the EigenLayer whitepaper, fundamental risks associated with EigenLayer are outlined: 1) Misappropriation of AVS funds through collusion among operators providing security to AVS and participating in validation, and 2) Slashing due to unintended vulnerabilities such as AVS programming bugs. Improvement measures for operator collusion include implementing a system to monitor the possibility of collusion and diversifying operators by incentivizing them to focus on smaller AVSs. Improvement measures for unintended slashing include thorough AVS security audits and community veto rights against slashing.

Even if the above risks are mitigated, there is still a possibility of as-yet-unobserved risks due to the delegation of stakes to EigenLayer operators and the main functions providing security to AVS not yet operating on the mainnet. Additionally, in the case of LRT and derivative protocols utilizing LRT, there are additional risks such as vulnerabilities in the contracts and oracles of each protocol, which may be attacked. Moreover, excessive debt collateralized by LRT through derivative protocols could lead to significant cascading liquidations even with minor slashing in EigenLayer.

Vitalik Buterin, the founder of Ethereum, also expressed concerns about EigenLayer by posting an article titled “Don't Overload Ethereum's Consensus”, suggesting the possibility of social consensus attacks by validators staking through EigenLayer to hard fork the Ethereum network for their own benefit.

6. The Future of EigenLayer

In the short term, EigenLayer is gearing up to launch its first AVS, EigenDA, and is on the verge of introducing Stage 2 updates, which will allow for security sharing and restaking interest on AVS.

EigenDA, created by EigenLabs, the team behind EigenLayer, is an AVS (Availability Security Sublayer) that utilizes EigenLayer's security to provide a data availability layer where there is no independent consensus algorithm. Currently, several Layer 2 chains such as Celo, Mantle, and Fluents have mentioned adopting EigenDA as their data availability layer.

Furthermore, after the Stage 2 mainnet launch, Stage 3 testing, which allows for security sharing with other AVSs besides EigenDA, is scheduled. Many prominent projects such as Ethos, Hyperlane, and Espresso are preparing to receive security from EigenLayer as AVSs after the Stage 3 mainnet launch.

During this journey, it remains uncertain whether EigenLayer will launch a token, and if so, what role that token will play within EigenLayer and what incentives will be provided to users who accumulate points. However, assuming EigenLayer proceeds with a token airdrop, let's diagnose the medium to long-term future of EigenLayer according to the author's perspective.

6.1. EigenLayer Tokenomics

The assets deposited in EigenLayer are utilized for the security of AVSs. Therefore, the TVL metric of EigenLayer goes beyond simply indicating how much assets are deposited in EigenLayer and can be interpreted as the overall security index of the AVSs. However, after the airdrop, there is a possibility of a decrease in EigenLayer's TVL as a result of airdrop farmers withdrawing their restaking.

Therefore, if EigenLayer were to announce tokenomics, there is a possibility of designing tokenomics focused on preserving the liquidity that has been restaked so far, attracting more AVSs based on that liquidity, and encouraging more restaking to strengthen the network effect.

Especially during the initial launch, it is expected that tokens will be provided as additional incentives for operating to diversify operators. Furthermore, as the time comes when multiple AVSs are registered in EigenLayer to receive security, it is expected that EigenLayer tokens will be distributed as additional incentives to operators and restakers providing security to AVSs with less security provided for risk diversification.

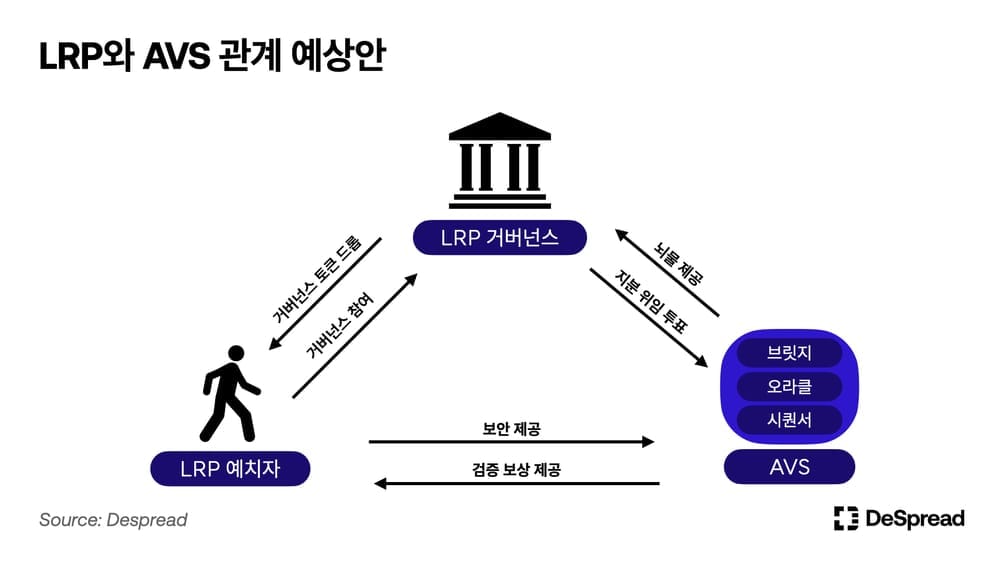

6.2. Relationship Between LRP and AVS

There exists a possibility that AVSs may provide airdrops of their own tokens to restakers in order to attract more security. The RaaS (Rollup as a Service) protocol AltLayer, which is set to become an AVS on EigenLayer, has already issued its own token, $ALT, and airdropped a portion of it to EigenLayer restakers.

In January 2024, protocols like Dymension and SAGA announced the adoption of Celestia as their data availability layer and disclosed plans to airdrop their native tokens, $TIA, to their stakers. This resulted in a doubling of the $TIA quantity staked in the network. Similarly, airdrops targeting restakers of AVSs like AltLayer have the potential to drive restaking as a major narrative in the market even after the launch of EigenLayer tokens.

Furthermore, from the perspective of AVS, promoting their AVS through LRPs, where a large number of restakers and security options are available, can yield greater effects with lower capital costs compared to promising airdrops to an unspecified multitude and conducting unilateral promotion. Thus, there is anticipation for various partnership announcements between LRPs and AVS. For example, Omni Network, which supports cross-messaging functionality for rollup networks, has announced partnerships with Ether.fi and revealed support for approximately $600 million worth of stakes from Ether.fi. This announcement has sparked expectations for an airdrop of Omni Network tokens among Ether.fi depositors.

Moreover, it is anticipated that LRPs will attempt to systemize their interoperability with AVS through tokenomics. For instance, LRPs could distribute governance tokens to restakers, allowing them to choose AVSs that provide security. By utilizing these governance tokens, users who vote on AVSs could receive rewards in the form of AVS's native tokens. This structure would strengthen the alignment of incentives among LRPs' restakers, LRP governance token holders, and AVSs.

6.3. Evolution of LRT's utility

Currently, most restakers utilize LRT in DeFi protocols like Pendle Finance to maximize point leverage, thereby optimizing their point farming in EigenLayer. The sustainability of EigenLayer's point issuance system remains uncertain post-token issuance. However, with the diminished expected value of EigenLayer points among restakers, there might be a potential decrease in the TVL of protocols facilitating leverage point farming.

However, LRT holds the potential to offer the highest interest rates among tokens pegged to the value of ETH once security is provided to AVS. Consequently, DeFi protocols that previously used ETH or LST could offer users higher returns by integrating LRT.

Currently, protocols such as Morpho Blue and Silo Finance for lending, as well as Gravita for over-collateralized stablecoin issuance, allow the use of LRT as collateral. Furthermore, platforms like Whales Market facilitate OTC trading of weETH (Ether.fi's LRT) as collateral. The utility of LRT is expanding, evidenced by Ether.fi's recent introduction of the Liquid feature, enabling the use of Ether.fi's LRT for yield generation across various DeFi protocols.

LRPs like Ether.fi and Renzo officially support bridges and native restaking for LRT on Layer 2 networks such as Arbitrum, Mode Network, and Blast, allowing DeFi protocols on Layer 2 networks to adopt LRT as an asset. Additionally, projects like Mitosis, aimed at serving as a liquidity hub for modular rollup networks, are collaborating with Ether.fi to expand LRT interoperability across different chains.

6.4. Superfluid Restaking

Returning to the realm of restaking as discussed earlier, the EigenLayer whitepaper introduces another method called Superfluid Restaking alongside native restaking and LST restaking.

Superfluid Restaking involves supplying liquidity to AMM DEX pools containing ETH and LST, such as Uniswap and Curve, and restaking the received LP tokens into EigenLayer. This method allows stakers to earn restaking rewards as well as interest from the fees generated by the pool.

While there is no official mention of EigenLayer supporting Superfluid Restaking in the whitepaper yet, the possibility remains open. If EigenLayer adopts this feature in the future, it could pave the way for various derivative protocols to emerge, potentially creating another facet of the ecosystem.

Vector Reserve, a protocol designed with Superfluid Restaking in mind, operates by supplying various LRT and LST to DEX pools as liquidity and issuing vETH, an index token backed by the value of received LP tokens. Vector Reserve plans to enhance its functionality, including Superfluid Restaking, once EigenLayer begins supporting it.

7. Conclusion

EigenLayer has evolved from a simple concept of sharing Ethereum network security and generating additional revenue to expanding its ecosystem with numerous derivative projects that cater to infrastructure builders and investors' demands. AVSs like bridges and sequencers leverage Ethereum's security to establish their own network security, while investors see the potential to maximize the capital efficiency of ETH beyond LST by utilizing LRT.

Despite the high likelihood of unnoticed risks due to the absence of operational AVSs based on EigenLayer, many users are still engaged in restaking to farm points with no clear utility. Moreover, user interest in EigenLayer point farming has been accelerated through LRPs and derivative protocols, leading to the current stage where capital deposited in EigenLayer-backed LRTs is used to build vast empires.

EigenLayer has clearly sparked interest and expectations among participants in the infrastructure industry and the crypto market with its innovative grammar. As it gears up for full operation with the mainnet launch, it will be necessary to closely monitor whether EigenLayer will bring about a new DeFi summer for Ethereum, as some anticipate, or whether, as some fear, it will exacerbate Ethereum's complexity and potentially lead to cascading collapses.

References

- EigenLayer

- EigenLayer Docs

- Upgrading Ethereum 2.9.7 Slashing

- AVS Research

- Navigating the Risks and Rewards of Actively Validated Services

- EigenLayer Stats

- Ether.fi Docs

- Kelp DAO Docs

- EigenPie Medium

- Pendle Finance — Discovering Unexplored Trading Market

- Gearbox Docs

- EigenLayer — The Point to the Points

- Vector Reserve Docs