Stablecoin Market and Regualtions in Global: An Overview

Stablecoin markets and regulatory adoption in global

1. Introduction

Stablecoins play a crucial role in the cryptocurrency market due to their low volatility and high versatility, being widely used in P2P remittances, exchanges, and DeFi applications. Beyond their importance in the crypto market, discussions are ongoing about their potential impact on traditional financial markets, including banking, securities, payments, international remittances, and trade.

The stablecoin market is rapidly growing, with an increasing number of users. Consequently, there is a growing need for countries to clearly define stablecoins, establish accountability and management frameworks, and implement policies to prevent potential issues. Following the regulatory framework for stablecoins announced by the Monetary Authority of Singapore in 2023, various countries are expected to release and enforce their own stablecoin regulations in 2024.

- EU (MiCA): The European Union's Markets in Crypto Assets regulation (MiCA) was announced in March 2022, passed with overwhelming support in April 2023, and is set to take effect in December 2024. Additionally, the EU has drafted technical standards for stablecoins backed by multiple fiat currencies or assets, which will come into effect in the summer of 2024.

- Hong Kong: A stablecoin regulatory proposal is expected to be released in early 2024, with preparations for a stablecoin sandbox underway.

- United States: Federal Reserve Chairman Jerome Powell emphasized the need for a stablecoin bill to House Democrats, and Representative Maxine Waters stated in an interview that "the passage of the stablecoin bill is very close." This has heightened expectations for stablecoin regulations.

- United Kingdom: Bim Afolami, the UK Treasury Minister, announced at a Coinbase-hosted event in February 2024 that a stablecoin bill is planned within six months. Consequently, relevant legislation is anticipated in 2024.

The issuance of stablecoins linked to various national currencies not only facilitates new capital inflows but also suggests the potential creation of an on-chain foreign exchange market for exchanging different national currency stablecoins, similar to traditional forex markets. This article will explore the current state of the stablecoin market, the characteristics of major stablecoins, and ongoing regulatory developments. In part two, we will delve into the status of countries preparing stablecoin regulations and examine the features of emerging stablecoins.

2. Current State of the Stablecoin Market

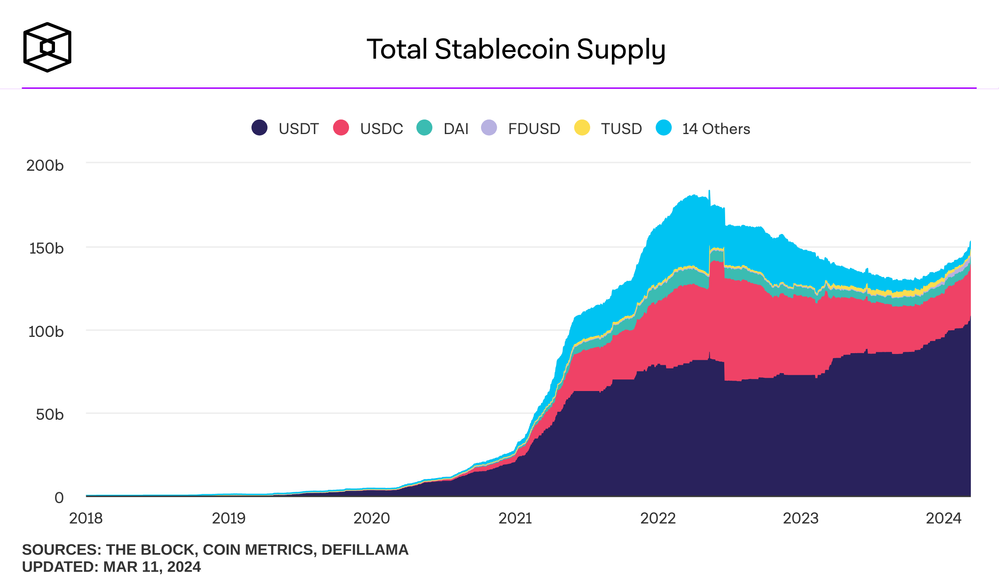

- Market Trends: According to data from The Block, the total supply of stablecoins has been steadily increasing since 2020, reaching a peak of $180.4 billion on March 30, 2022. Although the supply decreased due to the downturn in the cryptocurrency market, it has been rising again since September 2023. As of March 12, 2024, the total supply of stablecoins stands at approximately $153.6 billion (around 200 trillion KRW).

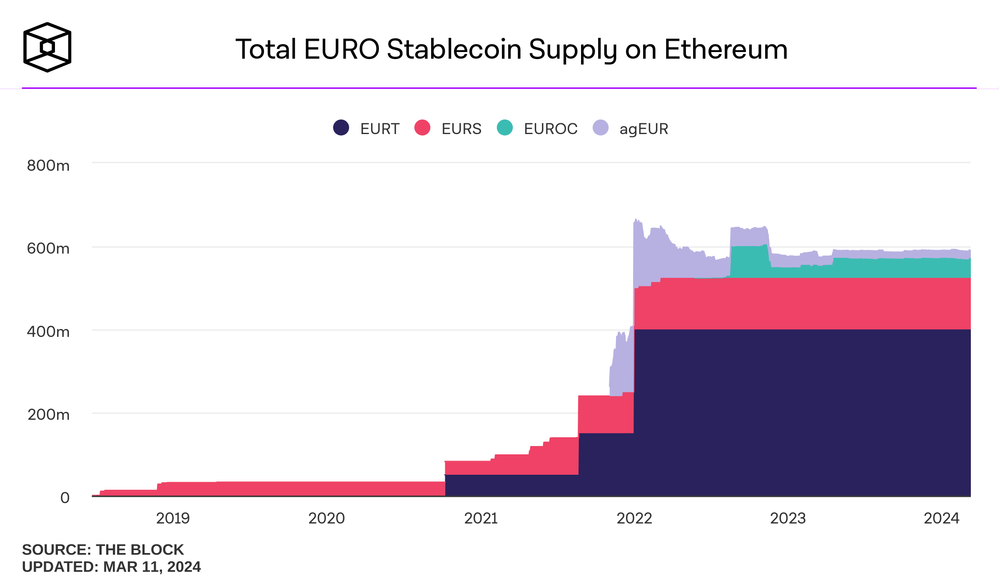

- Dollar-based Stablecoin Market Share: USDT, with a supply of $108.13 billion, accounts for 70.5% of the market, while USDC, with a supply of $31.38 billion, holds 20.5%. Together, these two stablecoins make up 91% of the total supply of dollar-based stablecoins, which is about $153 billion. The total supply of euro-based stablecoins is around $600 million, indicating that dollar-based stablecoins dominate 99% of the stablecoin market. This dominance suggests that the market could potentially surpass traditional forex markets in size.

3. Status of Major Projects

3.1. USDT

- Issuer: Tether Limited

- Pegging Mechanism: Pegged 1:1 to fiat currency, fully backed by Tether's reserves

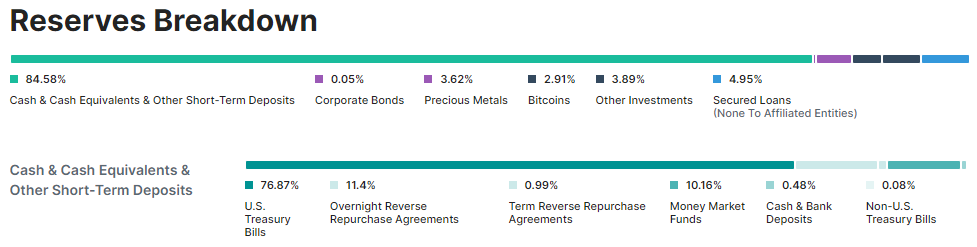

- Collateral Breakdown:

- Cash and Cash Equivalents: 84.58%

- U.S. Treasury Bonds: 76.87%

- Overnight Reverse Repo Agreements: 11.4%

- Institutional Reverse Repo Agreements: 0.99%

- Money Market Funds: 10.16%

- Cash and Bank Deposits: 0.48%

- Non-U.S. Government Bonds: 0.08%

- Corporate Bonds: 0.05%

- Precious Metals: 3.62%

- Bitcoin: 2.91%

- Other Investments: 3.89%

- Secured Loans: 4.95%

- Cash and Cash Equivalents: 84.58%

- Verification Method: Audit reports by an accounting firm (BDO Italia since Q2 2022, providing quarterly audits)

- Fees and Deposit/Withdrawal Policies:

- Minimum Deposit/Withdrawal Amount: $100,000

- Fiat Deposit Fee: 0.1%

- Fiat Withdrawal Fee: $1,000 or 0.1%

- Issuance Eligibility: Verified members only

3.1.1. Recent Updates

- Revenue Status:

- According to BDO's Q4 2023 report, Tether's net profit was approximately $2.9 billion (about 3.86 trillion KRW), and its operating profit was about $1 billion (about 1.33 trillion KRW). The primary revenue source was interest income from U.S. Treasury holdings, along with profits from the appreciation of its Bitcoin and gold holdings. For context, Bank of America's net profit for the same period was $3.1 billion, indicating Tether's substantial profit scale.

- Trust Issues:

- Tether faced demands for audits since 2017 but initially refused, leading to suspicions of issuing USDT without sufficient dollar reserves and manipulating Bitcoin prices. The U.S. Commodity Futures Trading Commission (CFTC) subpoenaed Tether, and though Tether indirectly proved its reserves through legal and bank balance confirmations in mid-2018, the absence of formal audits limited trust recovery.

- Formal Audits Implementation:

- About three and a half years later, in March 2021, Tether began providing quarterly audit reports through an accounting firm, which somewhat alleviating investor concerns. However, unlike its competitor Circle (USDC issuer), which releases monthly audit reports, Tether's quarterly reports pose regulatory risks. Both the EU's MiCA and New York Department of Financial Services require monthly asset disclosures.

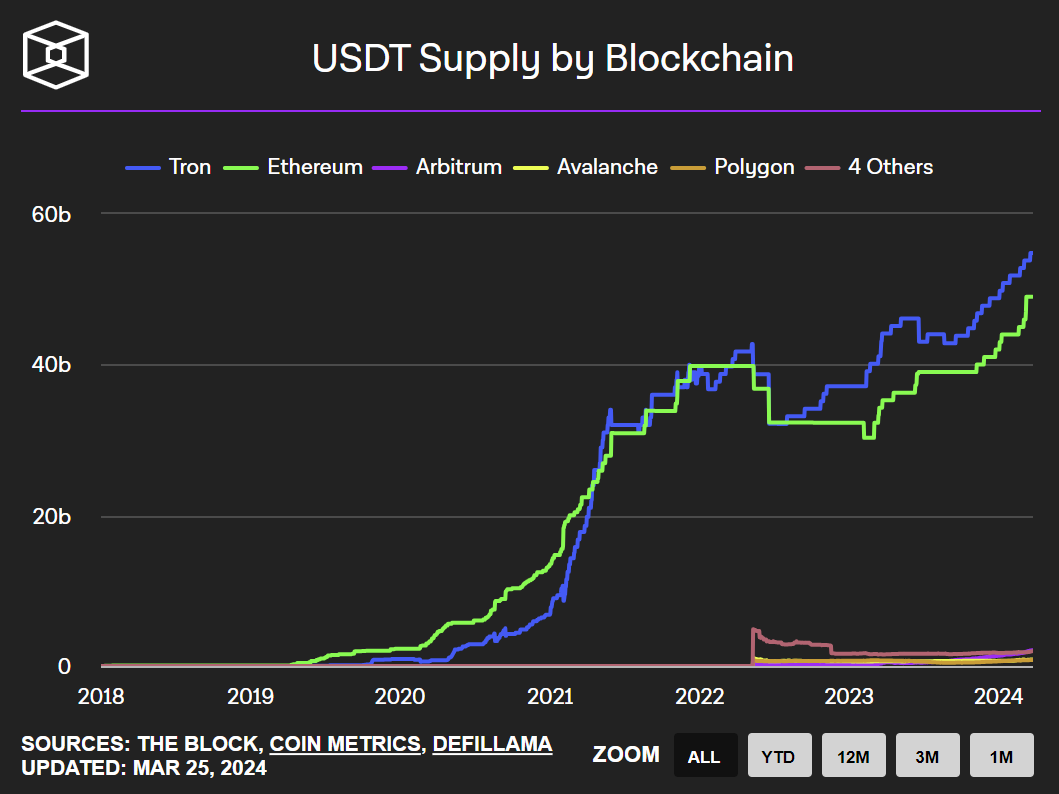

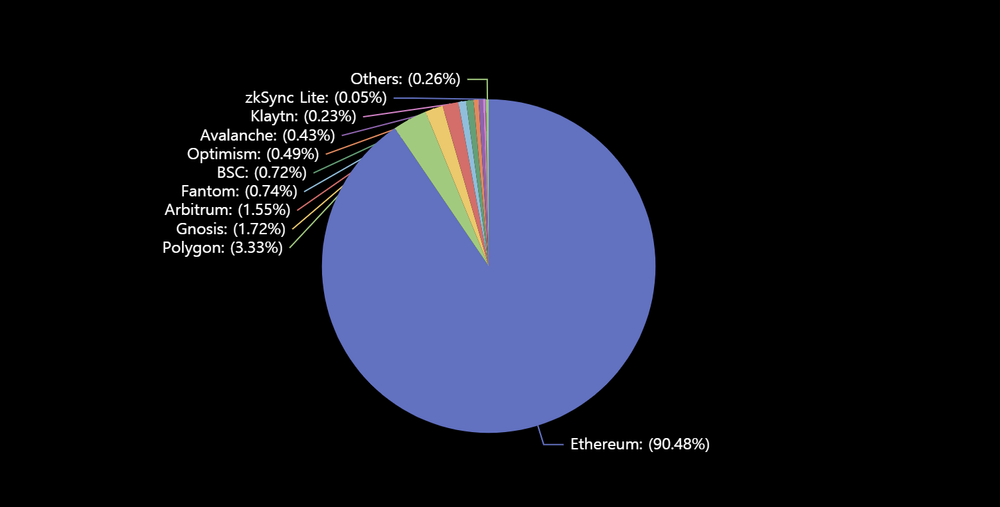

- USDT Issuance by Blockchain:

- USDT is primarily used as a trading pair on centralized exchanges, with significant transfers on the Tron blockchain due to its low transaction fees. As a result, USDT issuance on Tron has rapidly increased, surpassing Ethereum, which was previously the leading issuance platform. Currently, about 50% of USDT is issued on Tron, while approximately 44.79% is issued on Ethereum.

3.2. USDC

- Issuer: Circle

- Pegging Mechanism: Pegged 1:1 to fiat currency, fully backed by Circle's reserves

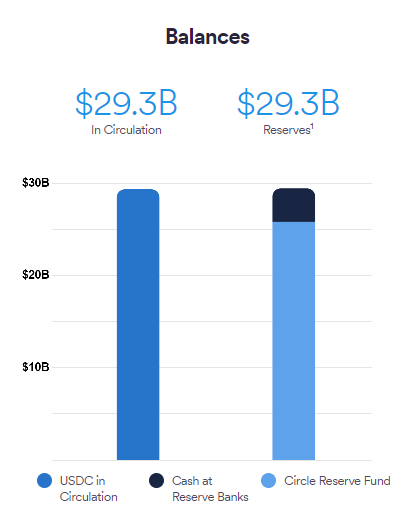

- Collateral Composition (as of March 7, 2024): Cash 12.28%, Circle Reserve Fund 87.72%

- Circle Reserve Fund (Ticker: USDXX): Held at The Bank of New York Mellon, managed by BlackRock, comprising 58.01% U.S. Treasury Repurchase Agreements and 41.99% U.S. Treasury Debt (as of March 11, 2024).

- Verification Method: Monthly audit reports by one of the Big Four accounting firms (currently Deloitte)

- The monthly reports, conducted by a reputable accounting firm, and the transparent management of funds contribute to USDC's higher reliability compared to USDT.

- Fee Policy: Free

- Issuance Eligibility: Verified members only

3.2.1. Recent Updates

- Revenue Status:

- Circle's revenue for the first half of 2023 was approximately $779 million. To expand market share, Circle implements a zero-fee policy, resulting in smaller revenue compared to USDT. However, its conservative fund management and regulatory compliance efforts are expected to attract increased institutional demand.

- Deppegging Incident:

- In March 2023, following the collapse of Silicon Valley Bank (SVB), it was revealed that $3.3 billion (around 8-9%) of Circle's $40 billion reserves were held at SVB, causing USDC's price to drop to $0.86. The U.S. government's full guarantee of SVB's deposits resolved the incident without reserve losses.

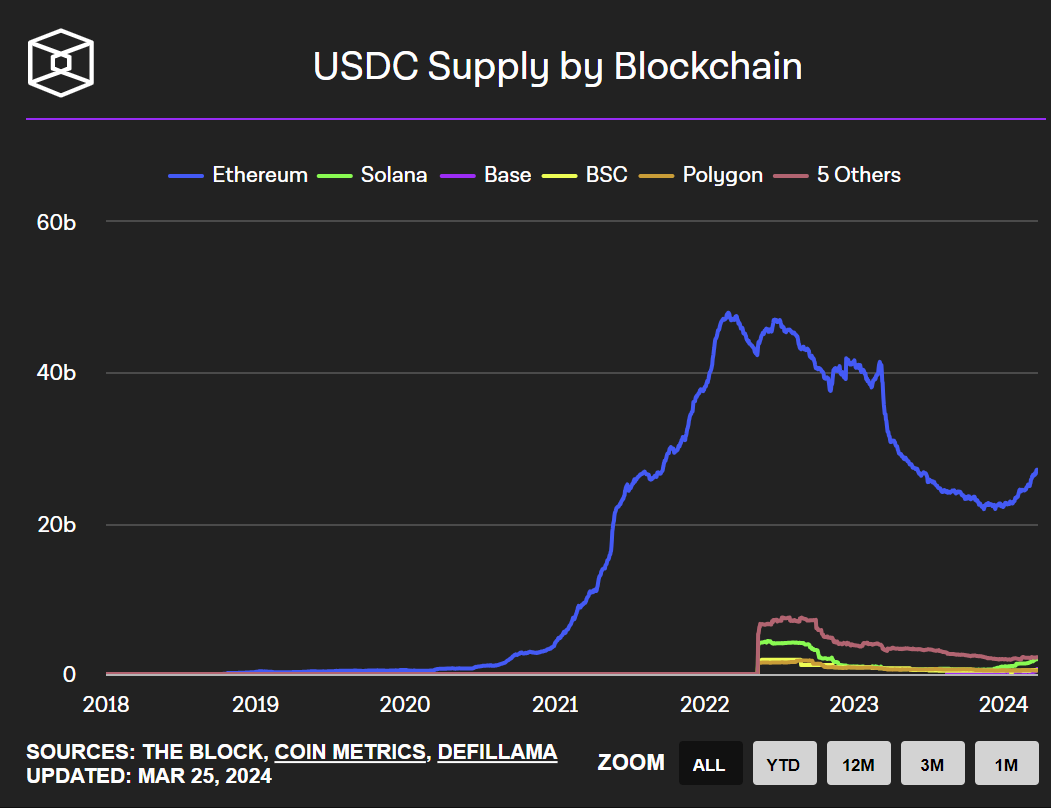

- Issuance Status:

- USDC's issuance is predominantly on the Ethereum blockchain, accounting for 80% of the total supply. Unlike USDT, Circle has not issued USDC on the Tron blockchain. In February 2024, Circle decided to cease Tron support following its risk management framework, allowing customers to transfer Tron-based USDC to other chains until February 2025.

- USDC is more widely used in the DeFi ecosystem than on centralized exchanges. With the growth of DeFi on Solana, USDC issuance on the Solana chain is increasing.

3.3. DAI

- Issuer: MakerDAO

- Pegging Mechanism: Collateralized through the Maker Vault with an over-collateralization model.

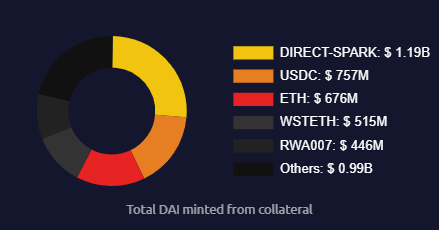

- Collateral Composition: Cryptocurrency and Real World Assets (RWA)

- Spark dApp Collateral: $1.19 billion (approx. 26%)

- USDC: $757 million (approx. 16.55%)

- ETH: $676 million (approx. 14.77%)

- WSTETH: $515 million (approx. 11.25%)

- RWA007 (Real World Assets): $446 million (approx. 9.75%)

- Others: $0.99 billion (approx. 21.64%)

- Verification Method: On-chain data

- Fee Policy: Varies with Vault liquidity

- Issuance Eligibility: Anyone can participate

3.3.1. Recent Updates

- Revenue Status:

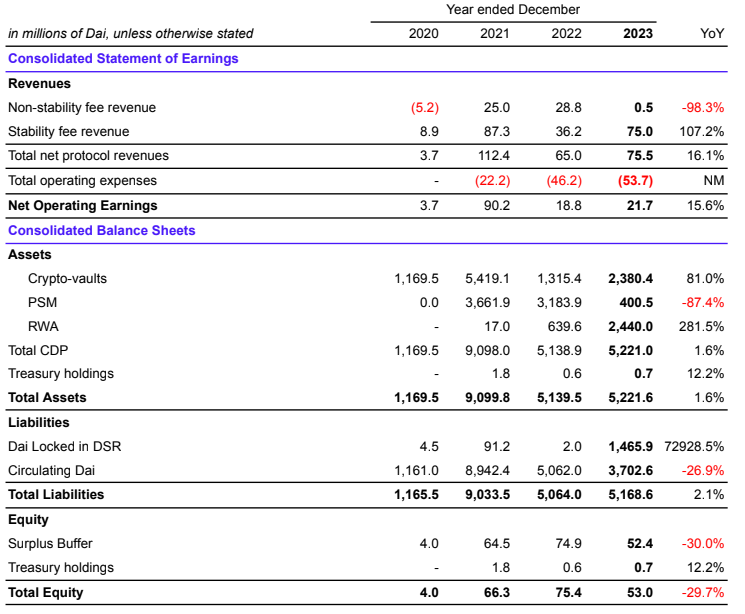

- MakerDAO's 2023 revenue was $75.5 million, with a net profit of $21.7 million, marking a 15.6% increase compared to 2022. The proportion of RWA assets in its collateral increased by 281.5%, indicating a shift in collateral composition.

- Issuance Status:

- DAI is used across various blockchains, with 90% of its issuance concentrated on Ethereum. This high concentration is attributed to the fact that Spark, the main dApp for generating DAI, currently supports only Ethereum and Gnosis chains.

- Characteristics:

- Unlike centralized stablecoins like USDT and USDC, which are pegged to fiat currencies and backed by regular audit reports, the decentralized DAI is transparently backed by on-chain collateral, and anyone can participate in its issuance.

- However, DAI faces challenges such as inefficiencies due to over-collateralization, difficulties in managing collateral value fluctuations, and variable fees.

4. Failure Cases of Stablecoins

Existing stablecoins, such as DAI, faced difficulties in gaining widespread adoption due to the capital inefficiency and lack of scalability inherent in over-collateralized models. To address these issues, various projects secured substantial investments and attempted innovative approaches but were ultimately thwarted by ambiguous regulations and structural limitations.

Notable failure cases include the Basis, Terra, and Diem (formerly Libra) projects. Despite securing $133 million in investments, Basis was halted due to regulatory issues. Terra suffered from a de-pegging attack, causing approximately 59 trillion KRW in damages. Similarly, the Facebook-led Diem project was indefinitely postponed and eventually terminated due to regulatory pushback.

These failures highlighted the need for clear regulatory guidelines and the necessity for technical solutions to ensure the success of stablecoins. Below are detailed explanations of these major failure cases:

- Basis

- Objective: Basis aimed to resolve the capital efficiency issues of stablecoins.

- Funding: Secured $133 million from major investors including Andreessen Horowitz, Polychain Capital, and Meta Stable in 2018.

- Failure: Regulatory concerns suggested that the token could be subject to U.S. securities regulations, which would significantly reduce liquidity and resistance to censorship. Consequently, Basis returned the capital to investors and discontinued the project.

- Terra

- Objective: Terra sought to address capital efficiency using an algorithmic stablecoin model.

- Mechanism: Utilized a dual-token system with LUNA and UST, pegging UST to the dollar through LUNA.

- Failure: In May 2022, a large-scale de-pegging attack caused UST to lose its dollar peg, leading to hyperinflation of LUNA and the collapse of the system. The estimated damage was around 59 trillion KRW, causing widespread shock.

- Diem (formerly Libra)

- Objective: Diem, led by Facebook, aimed to launch a global stablecoin backed by multiple currencies, including the dollar and euro.

- Participation: Involved 28 companies, including Mastercard, Visa, and Uber, with plans to expand to 100 companies.

- Failure: Faced strong regulatory resistance from the EU and G7 countries, leading to indefinite postponement and partner withdrawals. The project was renamed Diem, scaled down to a dollar-pegged stablecoin, but ultimately failed to resolve regulatory ambiguities and was terminated.

These cases underscore the global concerns over the monetary policy influence of stablecoins and the large-scale damages, such as those from the Terra incident, prompting the need for robust stablecoin regulations and guidelines. Achieving success in stablecoin projects requires not only technological solutions but also the establishment of clear regulatory standards.

5. Definitions and Regulatory Status of Stablecoins by Country

5.1. Singapore (MAS)

- Stablecoin Definition:

- Digital payment tokens pegged to the value of one or more specified fiat currencies.

- Applicability:

- Applies to single-currency stablecoins (SCS) pegged to the Singapore dollar or G10 currencies issued in Singapore.

- Key Requirements:

- Value Stability: Must meet requirements for composition, valuation, custody, and audit of reserve assets.

- Capital Requirements: Must maintain minimum base capital and liquid assets.

- Face Value Redemption: Must redeem at face value within five business days upon request.

- Disclosure Obligations: Must disclose information on value stabilization mechanisms, holder rights, and audit results.

- MAS-Regulated Stablecoin Certification:

- Issuers can apply for certification as an "MAS-regulated stablecoin" if the above requirements are met, and only certified stablecoins can be labeled as such.

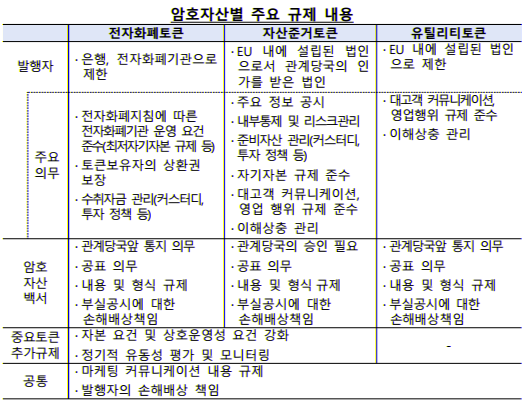

5.2. Europe (MiCA)

- Stablecoin Definition:

- In Europe, stablecoins are categorized based on their backing mechanisms into:

- E-money tokens: Issued against fiat currency on a 1:1 basis, providing redemption rights to holders.

- Asset-referenced tokens: Stabilized by a basket of assets including fiat currency, commodities, cryptocurrencies, etc.

- Utility tokens: Not considered stablecoins as they stabilize value through algorithms.

- Only e-money tokens and asset-referenced tokens are included in the stablecoin category, with regulations differing based on issuance purpose and backing assets.

- In Europe, stablecoins are categorized based on their backing mechanisms into:

- Regulatory Types for Stablecoins:

- The regulations for issuing and operating e-money tokens and asset-referenced tokens differ significantly.

- E-money Token Issuance and Operation Regulations:

- Issuer Qualification:

- Limited to banks and electronic money institutions, requiring licenses under the directive on the business of electronic money institutions (Directive 2009/110/EC).

- Key Obligations:

- Compliance with operational requirements for electronic money institutions, including minimum capital requirements.

- Guarantee of redemption rights for token holders at nominal value at any time, with minimal fees.

- Prohibition of interest payments for holding tokens.

- Safe fund management, ensuring funds are invested in same-currency assets to avoid exchange rate risks, and managing funds safely through custodial services.

- Implications:

- Strict qualification and obligation regulations promote the soundness of e-money token issuance and operations, but there are criticisms of limited innovation due to the central role of traditional financial institutions.

- Issuer Qualification:

- Asset-referenced Token Issuance and Operation Regulations:

- Approval and Rejection Rules:

- Pre-approval from EU authorities is required for issuance, with the authority to reject approval if the business model poses a serious threat to financial stability, monetary policy, or monetary sovereignty. Consultation with European supervisory authorities is necessary before approval or rejection.

- Investor Protection Regulations:

- Issuers must provide clear, fair, and non-misleading information to holders, including details on value stabilization mechanisms, reserve asset policies, and holder rights in the white paper. Conflict of interest management policies must be established and disclosed. Monthly disclosures of circulation and reserve asset values/compositions are required, along with mandatory disclosure of significant events and provision of redemption rights to holders.

- Reserve Asset Management Regulations:

- Issuers must continuously maintain and conservatively manage reserve assets, including policies for composition, allocation, risk assessment, creation/destruction procedures, and appropriate custodial policies to protect reserve assets. Reserve assets must be stored with authorized credit institutions, professional investment firms, or licensed crypto asset service providers, with liability for reserve asset losses. Interest payments for holding tokens are prohibited.

- Approval and Rejection Rules:

- Potential for Stablecoin Utilization:

- The MiCA regulation clarifies the definitions and issuance requirements for stablecoins, increasing the likelihood of stablecoin issuance and utilization within Europe.

- Major companies such as Galaxy Digital, DWS, and Flow Traders are issuing euro-based stablecoins, while fintech firms like Monetae in Spain are conducting experiments under the supervision of banks.

- Given the high proportion of the euro in the foreign exchange market, more diverse and active attempts in the euro-based stablecoin market are expected under MiCA regulation, enhancing the potential for stablecoin utilization.

5.3. Japan (PSA)

Japan established definitions and systems for stablecoins through the third revision of the Payment Services Act (PSA) in June 2022, which governs remittances and payments.

- Stablecoin Definition:

- Defined by the Japan Financial Services Agency (JFSA) as "digital currency type" stablecoins pegged 1:1 to fiat currency and "crypto asset type" stablecoins pegged to cryptocurrencies, with the latter further categorized as either crypto assets or securities under the PSA.

- Digital Currency Type Stablecoin Regulations:

- Classified as electronic payment instruments with three essential characteristics:

- Transferable for goods/services to unspecified persons.

- Transferable through electronic payment systems.

- Exchangable for property value with unspecified persons.

- Four types of electronic payment instruments:

- Property value transferable for goods/services to unspecified persons.

- Exchangable property value as in type 1.

- Specific monetary trust beneficiary rights.

- Designated by the Financial Services Agency (FSA).

- Banks and digital currency issuers fall under type 1, and digital currency issuers are classified under type 3 as specified by the FSA.

- Crypto asset types may be classified under type 4.

- Classified as electronic payment instruments with three essential characteristics:

Types 1 and 2 electronic payment instruments require bank or money transfer business licenses, making access difficult. Type 3 requires only trust company licenses, making it relatively easier to enter.

The PSA revision also includes regulations for intermediaries of electronic payment instruments, divided into dealer and handling business licenses.

- Dealer Business License

- Required for activities such as:

- Trading or exchanging electronic payment instruments.

- Mediating transactions of electronic payment instruments.

- Managing electronic payment instruments on behalf of others.

- Managing funds received from users on behalf of money transfer businesses.

- Required for activities such as:

- The dealer business license allows handling of both domestically issued and foreign-issued electronic payment instruments if the following conditions are met:

- Issued by entities licensed under laws equivalent to the PSA or banking law.

- Thoroughly audited reserve assets by credible organizations.

- Appropriate actions taken if the electronic payment instrument is involved in criminal activities.

- Handling Business License:

- Required for intermediating electronic payment instruments issued by banks, involving managing funds related to bank accounts and foreign exchange transactions.

In summary, intermediaries must obtain handling business licenses for bank-issued instruments and dealer business licenses for instruments issued by money transfer businesses or trust companies. Both licenses are needed to intermediate the two types of instruments.

- Potential for Stablecoin Utilization:

- Following the PSA revision, major companies like DeCurret, ENF, Jasmy, and GMO Group are actively issuing yen-based stablecoins.

- Notable progress includes MUFG's collaboration with Ginko for corporate cryptocurrency payment systems and trade finance, and JPYC's partnership with Promat for trust-type JPYC issuance.

- MUFG anticipates stablecoin utilization will accelerate after obtaining a dealer business license in June 2024.

- The regulatory foundation is expected to boost stablecoin issuance and utilization in Japan, marking 2024 as a pivotal year for the Japanese stablecoin market.

5.4. New York Department of Financial Services (NYDFS)

In June 2022, New York became the first U.S. state to issue the "Virtual Currency Guidance," which includes specific regulations regarding stablecoins.

- Stablecoin Guidance

- Redemption of Stablecoins: Stablecoins must be backed by reserves equivalent to the value of the stablecoins issued in the market at the end of each business day.

- These reserves must be segregated from the issuer’s own assets and held at depository institutions that are either state or federally chartered and insured by the FDIC, or at custodians approved in writing by the DFS.

- Stablecoin Reserves: The reserves must consist only of the following assets:

- U.S. Treasury bills with maturities of three months or less acquired by the issuing institution.

- Reverse repurchase agreements collateralized by U.S. Treasury bills, notes, or certain long-term Treasury bonds, subject to DFS-approved conditions on over-collateralization.

- These reverse repurchase agreements must be either tri-party or bilateral agreements with counterparties whose creditworthiness can be verified. Information on the counterparty’s identity and credit rating must be submitted to the DFS at least 14 days before the agreement is made.

- Government money market funds (MMFs) with minimum allocations to direct obligations of the U.S. government, and subject to DFS-approved limits on the asset ratios and constraints on the funds.

- Deposit accounts at state or federally chartered depository institutions, subject to DFS-approved limits on the proportion or absolute value of reserves, and based on the risk characteristics of the institution.

- These deposit accounts should also account for reasonably necessary amounts to meet anticipated redemption requirements.

- Auditing of Stablecoin Reserves

- Issuers must have their reserve disclosures audited at least monthly by an independent certified public accountant (CPA) licensed in the U.S., as specified in the guidance.

- These audits must adhere to the auditing standards of the American Institute of Certified Public Accountants (AICPA), and both the CPA information and the audit agreement must be pre-approved in writing by the DFS.

- During each monthly audit, the CPA must randomly select at least one business day from the period being audited and the final business day of that period to verify the issuer's reserve disclosures.

- Redemption of Stablecoins: Stablecoins must be backed by reserves equivalent to the value of the stablecoins issued in the market at the end of each business day.

Currently, stablecoins such as Circle's USDC and PAXOS's PYUSD, USDP, and BUSD are issued in compliance with the New York Department of Financial Services (DFS) guidelines. Therefore, these guidelines are expected to significantly influence future U.S. stablecoin regulations.

If such influence materializes, Tether's USDT may need to undergo substantial changes to comply with the regulatory environment. Unlike Circle, which issues monthly audit reports, Tether publishes reports quarterly and holds collateral not included in the reserve asset requirements, such as Bitcoin. These differences could pose challenges under new regulations, potentially leading to significant changes in the stablecoin market. Therefore, it is crucial to monitor the regulatory environment for stablecoins in the U.S., the largest stablecoin market.

6. Conclusion

This article reviewed the current status of stablecoins, the features of major stablecoins like USDT, USDC, and DAI, and the regulatory discussions in Singapore, the EU, and Japan. As stablecoin regulations become clearer, diverse attempts are emerging, and projects facing operational difficulties may increase, highlighting the significant impact of regulations. Monitoring the progress of regulatory implementations is crucial for understanding market trends.

In the next article, we will examine the progress of countries preparing to introduce stablecoin regulations, compare existing regulatory policies, and explore new stablecoin projects to understand the diverse development potential of the stablecoin market. Finally, we will compare the stablecoin market with the traditional foreign exchange market to discuss its future growth potential.

References

- Translation of Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937, Bank of Korea

- Theblock Stablecoin Data

- Transparency Report, Tether

- Transparency & Stability, Circle

- MakerDAO 2023 Annual Report

- MakerBurn

- DeFiLlama

- MAS Finalises Stablecoin Regulatory Framework

- 일본 스테이블코인 규제 톺아보기, Declan Kim

- CBDC와 스테이블코인: 한국은행, Circle, Paxos의 인사이트, Hashed Open Research

- NYFDS Virtual Currency Guidance