Disclaimer: The authors have not purchased or sold any of the relevant tokens including any material non-public information while researching or drafting this report. The contents of each report reflect the personal opinions of the respective authors. Each content is provided for informational purposes only. Nothing contained in this report is investment advice and should not be construed as such.

Why Blockchain?

Since last year, I have been conducting research on “Web3 Games”, especially “game tokenomics”, and have published three articles in total.

- Part 1: Do Dive into Web3 Game: Evaluation Framework for Web3 Games

- Part 2: Do Dive into Web3 Games: Token Economy and Content Design

- Part 3: Winds Of Change: Web3 Gaming Heading to a New Frontier?

Focusing mainly on Web3 game projects that are considered to have failed in the market, such as Axie Infinity and Stepn, I analyzed the failure factors of Web3 games that applied the Play-to-Earn (P2E) mechanics and described how they could be improved.

But in this article, I would like to go back to the original question: why should a Web3 game adopt blockchain or tokenized assets? In this article, I’ll discuss what I consider to be the ideal form of tokenomics in Web3 gaming.

Setting The Framework

To discuss Web3 game tokenomics, one must establish a framework in two forms: in-game economy and business tokenomics.

In the in-game economy, I will focus on which in-game assets that directly interact with game players should be tokenized, how to design “faucet and sink” mechanisms, and how to enhance the player experience.

On the business side of tokenomics, I will focus on how to incentivize behavior by using tokens for the foundation, investors, and other stakeholders involved in the project.

In-game Economy

In in-game tokenomics, tokenized assets can be categorized into “inputs” and “final goods”. In most games, players’ economic activities are defined as the process of producing and combining various inputs to obtain final goods, and more and better final goods produce a greater amount of inputs. Web3 games mostly follow the same formula, with inputs tokenized as FTs (Fungible Tokens) and final goods tokenized as NFTs (Non-Fungible Tokens), like the approach adopted by Axie Infinity, to form an in-game economy and create a circular economy that drives players to constantly demand more and higher quality final goods(NFTs) to receive more rewards(inputs).

Since most Web2 game economies operate as closed economies, where inputs are earned through gameplay and only capital inflows are allowed, it is possible (though not perfectly) to contain threats like hyper-inflation through constant balancing efforts. However, in a web3 in-game economy, tokenized inputs and final goods are closely connected and interact with external markets, so problems can arise much more quickly than Web2 in-game economies (e.g., price fluctuations that occurred to the SLP token).

I have mentioned this logic in my previous article before, where I stated that there is little necessity in using in-game tokens in web3 games due to their features.

This phenomenon can be interpreted as originating from the following features of in-game tokens.

- Earned through PvE play: Players can earn tokens by putting in a certain amount of play time without any requirements, which can be abused as a way to earn tokens by multiple accounts or bots.

- Openess: not limited to the in-game ecosystem and interacted with in an open environment where anyone can buy and sell.

For the sustainability of the game, it is essential to continuously maintain an affordable price by adjusting the net issuance of in-game tokens, but due to the above features, it is almost impossible to promote sustainability through the design of “faucet and sink” mechanism.

The idea of tokenizing in-game items to create asset value and granting ownership to users to buy and sell them freely, regardless of how the structure is designed, leads to a P2E system and undermines the sustainability of the game. Is it possible to introduce tokenized assets into the in-game economy and still achieve sustainability? Consider the following options:

Option 1: Rewarding players with a limited reward pool based on PvP competition, not PvE play.

Option 2: Designing final goods not to produce more inputs or FT rewards than before.

Analyzing The Options

Option 1 would limit the size of the reward pool, and would reward players with tokenized assets based on their performance. Since players cannot earn rewards through PvE play, they must continue to play the game or invest capital to win against other players. This approach has been adopted by Axie Infinity, which operates seasonal rewards system using the AXS token, and Nine Chronicle, which has built a single token economy centered around its NCG token.

Option 2 eliminates inflationary factors that can threaten the in-game economy by ensuring that final goods do not generate additional in-game assets. In this option, final goods can no longer generate more in-game assets, but instead will only have cosmetic functions that users will utilize to express their identity. This is exemplified by TreasureDAO’s popular game ‘The Beacon’. Players of The Beacon can earn NFTs to decorate their characters and personal spaces by fulfilling certain conditions through gameplay.

However, even with such options, continuous value accrual to in-game rewards become a prerequisite. It is my personal opinion that the introduction of an in-game economy structure by itself is unlikely enhance the user experience or make the game more fun, and that a more likely scenario is to keep the in-game economy closed, accumulating value in governance tokens that are interacted with outside of the game and then utilized as seasonal user rewards.

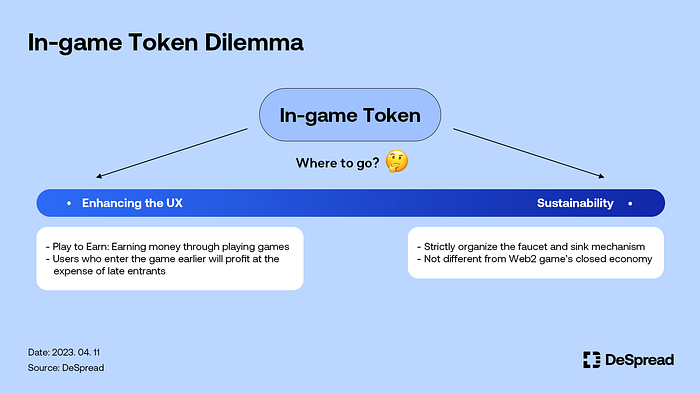

The introduction of in-game tokens (FTs and NFTs) presents a dilemma between enhancing the user experience and achieving sustainability. If it is intended to have a two-for-one effect of earning money while playing the game, it is likely to result in a Ponzi structure in which users who enter the game earlier will profit at the expense of late entrants, which is not sustainable. On the other hand, if the faucet and sink mechanism in the game environment is strictly organized to achieve sustainability, it is not different from a Web2 game’s closed economy, which makes the introduction of tokenized assets meaningless. It may be possible to design a system that divides players into two tiers, one that continuously invests capital and the other that earns money through gameplay, like Lineage-like games. But I do not believe that the introduction of in-game tokenomics will provide any advantages in designing such structures.

As a result, it is almost impossible to “build an in-game economy” by “introducing tokenized assets” in “web3”, and it seems that a viable web3 game structure is to build a closed in-game economy like web2 games and reward governance tokens or NFTs to players as seasonal rewards.

Ideal Game Tokenomics Example

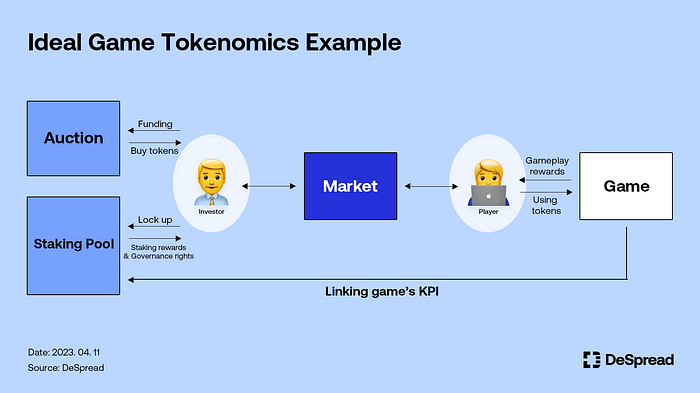

Due to the above inadequacies of in-game tokenomics, the main focus shifts outside of the game. By applying tokenomics in the external environment, it is not only possible to facilitate the funding process, but it may also trigger positive behavior among investors and players, which may be one of the most important reasons to adopt blockchain and tokenomics.

Here is an example of game tokenomics:

- Investor <> Auction

- Investors provide capital to a game project and buy tokens through a token auction. - Investor <> Staking pool

- Investors lock up their tokens in a staking pool and receive staking rewards, governance rights, etc.

- You can also think about linking the game’s KPIs to the staking reward rate. - Player <> Game

- Creating demand from players by linking tokens to subscriptions or tickets required to play the game.

- Players receive token rewards based on their gameplay performance. - Investor <> Market <> Player

- Investors and players create demand and supply for tokens in the market.

Based on the above assumption, we can think of several methods to apply.

- veTokenomics (by Curve Finance) or gamified staking (by Bridgeworld).

- Lock up tokens in a staking pool for a certain period of time to receive rewards and gain governance rights.

- Reward rates and privileges increase proportionally to the amount of tokens, as well as the lockup period.

- In the case of a platform business with multiple participants and limited inflation, such as Curve Finance, a competitive structure can be designed.

- Gamified staking systems, like Bridgeworld, can constantly create demand for reward-boosting NFTs. - Use a retroactive airdrop to distribute tokens based on project contributions instead of holding a traditional token auction.

Echelon Prime Case Study

Echelon prime is a web3 gaming platform backed by Paradigm that similarly implements a structure of tokenomics, centered around a single token called PRIME. Parallel, the first game to be onboarded to the platform, is a triple-A Trading Card Game (TCG) going through its closed-beta stage. Although it’s still early to judge, the tokenomics of Echelon Prime is worth investigating.

For anyone who missed or had issues with the live stream, here's some additional gameplay footage.

— Parallel (@ParallelTCG) February 23, 2023

Please note: This is Closed Alpha footage displaying limited gameplay interactions. pic.twitter.com/xgORbOIbjv

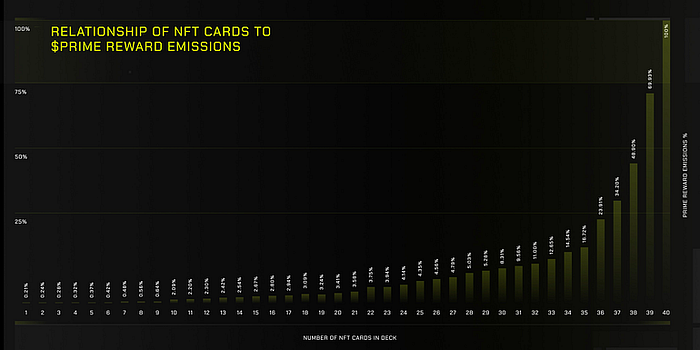

- NFT sales and Caching

- Echelon prime leverages what is called “caching”: a mechanism that distributes PRIME tokens in proportion to the rarity and amount of NFTs when staking relevant NFTs.

- The project raises capital through NFT sales, and investors receive tokens through caching. - Gamers acquire card NFTs, which serve as in-game assets, by using PRIME tokens, and the number of NFTs they own is proportional to the PRIME rewards they earn from playing.

- NFTs of Parallel, which is soon to be released on the Echelon Prime platform, can be bought using PRIME tokens. Moreover, players can receive PRIME tokens as rewards from gameplay pools based on their performance.

- Parallel also features an in-game currency known as Glints, which can be obtained using PRIME tokens and functions independently of PRIME.

- When players use PRIME tokens, the tokens are reallocated to reserve pools, gameplay pools, and other destinations.

That’s All You Need

This is what I consider the ideal form of tokenomics for games.. It enables investors and players to utilize a single token and ensures a balance between token supply and demand. However, I believe that tokenomics alone is not enough for a game project to succeed. The crucial factor for a game is “how to attract a vast number of gamers”, which primarily depends on the game’s quality and entertainment value, as well as operational tactics like marketing and balancing, and not just the tokenomics.

How To Introduce In-game Tokens

Regardless, is it possible to tokenize in-game currencies and introduce in-game tokens? Here is my perspective on the matter.

When opening your in-game economy to the outside world, two primary factors need to be taken into account. Firstly, the in-game economy’s currency inflation rate should be kept at a viable level. This entails creating a structure that maintains a balance between the rate of generating and reducing in-game currency, also known as “faucet and sink.” Secondly, operational measures should be implemented to ensure that the in-game currency inflation remains under control.

Secondly, the in-game economy should be sizable enough to avoid the collapse of the entire economy when external capital is withdrawn. The term “scale” refers not only to the market capitalization size of the in-game currency but also to the diversity of its applications. This aligns with Tascha’s recommendation concerning the stablecoin industry post-UST crash, which is to have “low-correlation demand.”

Since there’s limited use case for Luna token aside from backing UST, If de-peg pressure is high enough, Luna price would be pushed to zero as there’s no other demand to help shore up price. In contrast, most fiat currencies have unspeculative demand tied to commerce & trade. Thus even when a currency is shorted heavily by speculators, it won’t go to zero barring major misstep in monetary policy. — Source: ‘5 Lessons From Terra/Luna Fallout, for Future Stablecoin Designers, Investors, and Regulators’, Tascha

Faucet and Sink Mechanisms — An Example From Eve Online

Eve Online is a space-themed MMORPG that has been in service since 2003 and has almost 8,000 planets, each with its own economic system. The game is renowned for its robust in-game economy, making it an excellent example for those contemplating introducing in-game tokens. This is especially relevant since numerous MMORPGs frequently experience excessive inflation.

Features of The Eve Online Economy

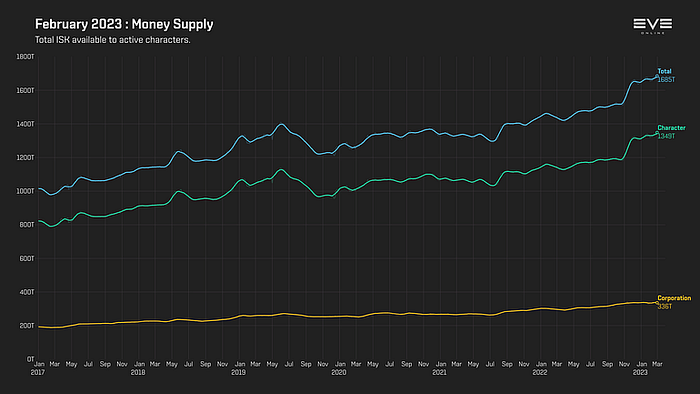

The in-game economy of Eve Online is centered around its in-game currency, ISK. CCP Games, the developer of Eve Online, analyzes the amount of currency, currency velocity, price levels, and production, similar to real-world economics and publishes economic reports on a monthly basis. Since its launch in 2003, the total supply of ISK has grown around eight times, while the amount of dollar M2 currency in the real economy has grown roughly four times since the early 2000s. This suggests that Eve Online has a thriving virtual economy.

EVE Online’s economy reaches sustainability due the following reasons:

- Typically, MMORPGs are known to supply users with more in-game currency as their characters grow. However, this is not the case in EVE Online, where PVP (player versus player) combat is available almost everywhere. In the case where a character faces its own death, items are burned. This mechanism suppresses the rate of inflation.

- The game charges for monthly subscriptions, which are represented as in-games items called “PLEX”. Subscriptions cat act as a firewall against bots, which may produce excess ISK in the in-game economy.

- Since PLEX is treated as an in-game item, it is also possible to purchase it by earning ISK through gameplay. Players who want to play EVE Online for free produce ISK to buy PLEX sold by other players. This process has the effect of burning ISK in exchange for transaction fees.

- Almost all items are produced and traded by players, and the game focuses on controlling the amount of currency through NPC rewards.

For more information, check out this article by DeftCrow on Thisisgame.

Tokenizing In-game Currency Means

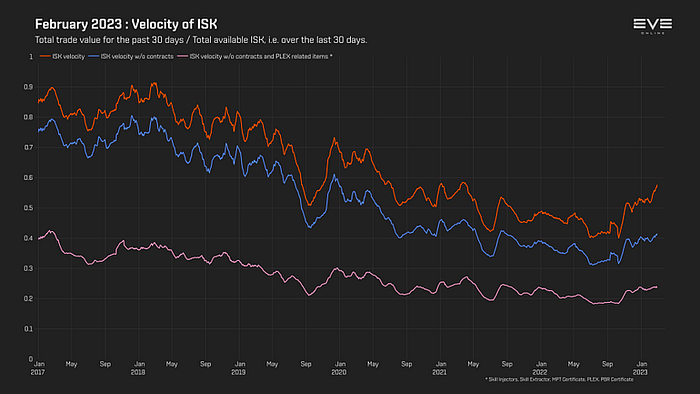

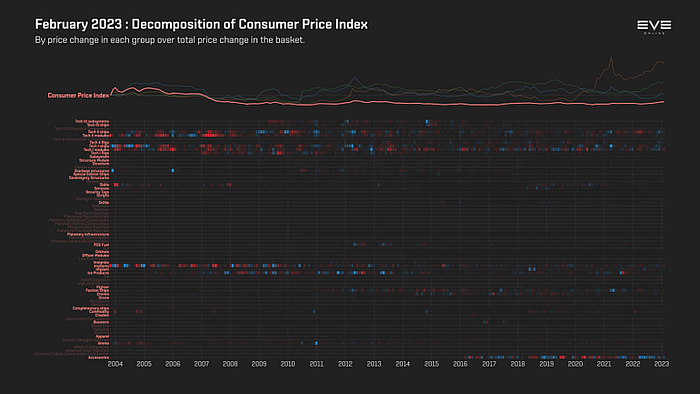

CCP Games produces monthly reports on the EVE Online in-game economy which include metrics such as the total supply of ISK, the value of production, the ISK velocity, and price level like the Consumer Price Index (CPI) and Producer Price Index (PPI).

To build a sustainable economic system, it is crucial to introduce good policies, while quantifying and analyzing the in-game currency, value of production, and price levels.

We can break down the economy into four elements: the amount of money(M), the velocity of money(V), the price level(P), and the total value of production(Y). Game developers can analyze these factors to look at the big picture, and adjust the amount of in-game currency accordingly for a more sustainable economy. Essentially, it requires the game developer to become a small central bank of its own to introduce and set policies for its in-game currency.

Moving to An Open Economy

Furthermore, how can we tokenize an in-game currency successfully? Although there is no established approach, I believe that the most probable route is to ensure that the in-game economy is sufficiently large and has diverse demand for the currency. This demand should be for various uses, such as transactions and consumption (primarily in-game) in addition to speculative demand.

- Launching the in-game economy as a closed economy

- First of all, when an in-game economy is launched, it needs to be launched as a closed economy. Without sufficient economic scale, an in-game economy is at risk of being heavily influenced by large-scale capital movements in an open economy, or the use of in-game currency being heavily weighted toward speculative demand.

- Therefore, it may be sufficient to launch the game as a closed economy that only allows capital to flow in, with a provision that the in-game currency can be tokenized based on the size of the in-game economy (similar to Uniswap’s “fee switch” concept). - Application of exit taxes after tokenization

- After tokenizing the in-game currency, it will be necessary to impose exit taxes on its outflow. Since the in-game economy will remain small relative to the larger market after the introduction of an open economy, a gradual reduction in exit taxes must be applied through governance as the in-game economy grows. This means starting with high exit taxes on currency outflows and gradually decreasing them over time.

Game Company Motivations

Introducing in-game tokens can be viewed as a step towards creating a true “metaverse,” or virtual state, which has many implications. Game companies are motivated to do this mainly because the virtual economy can be recognized as having real-world value. By introducing in-game tokens and establishing a stable metaverse, the in-game economy can be linked to real-world markets, allowing the game economy’s value to be measured in terms of market capitalization and projected to its affiliated developer. There is also the possibility of financcializing games by creating and operating fianancial products using in-game currencies and assets, but that is too far down the road to discuss in detail.

Closing Thoughts

To summarize:

- Game tokenomics is more relevant to the interaction between investors and players outside of the game than within the in-game economy itself.

- In the case of in-game tokens, the aim is to create a virtual economic system that closely resembles the real-world economy, and gradually shift towards an open economy as the game’s economy expands.

- The primary purpose of gaming tokenomics is not to enhance the entertainment value or fun of the game, but to promote positive investor and player behavior towards the game project.

Justifying the integration of blockchain technology for the sole purpose to design tokenomics for the in-game economy is far-fetched. In order for a project to be sustainable, participants must be willing to take risks and invest their own resources, such as money and time. However, that is a rarity in in-game economies, except for games with gambling aspects.

I don’t think there’s a lot of potential left for tokenomics in the realm of Web3 games beyond what we’ve discussed in this article. Rather than continuing to explore this topic, it may be more beneficial to return to the fundamentals and examine how blockchain technology can contribute to games and improve the overall gamer experience. Before concluding, I would like to refer to an article written by Derek Lau, the VP of Immutable Game Studio, that discusses how blockchain technology can be utilized in games.

So how is blockchain actually used in games?

— excerpt from Derek Lau’s article

- Give players ownership and tradeability

- Blockchain allows players to legally and securely own, trade, and sell in-game items, enhancing the gaming experience by allowing players to craft and upgrade items and then sell them to others. - Create digital goods with real scarcity

- Blockchain provides provable and unalterable scarcity of in-game items, which is enforced by code and transparent, meaning players can trust that items will remain rare and valuable. - Serve as a record of ownership

- The blockchain records the transaction and owner history of each asset, allowing players to know its usage and ownership history, and potentially own historically significant items. - Unlock new business models in gaming

- Blockchain offers alternative monetization options for games, including direct sale of in-game items, transaction fee on marketplace transactions, and sale of tokens with permanent benefits. It also enables innovative models such as in-game land ownership and social economies. - Align incentives between all participants

- Enabling players to own and trade in-game items creates a shared interest between players and developers, leading to a win-win scenario as players’ items become more valuable if the game succeeds, and incentivizes everyone in the ecosystem, such as content creators, third-party developers, and investors, to contribute to the game’s success, leading to significant growth and higher chances of success. - Reverse the fundraising approach for game developers

- Blockchain enables a reverse game development business model where developers can fundraise upfront by selling exclusive in-game assets to early backers, allowing for upfront fundraising and providing early backers with potentially valuable digital assets if the game succeeds, similar to a Kickstarter campaign on steroids. - Allow third parties to build a business on top of the game

- The decentralization of in-game assets and logic on the blockchain provides security and confidence for third parties to build without fear of game developers taking away their work, enabling the creation of businesses, such as trading tools or tournament leagues, that are not subject to a single centralized authority.

<References>

- Echelon prime docs

- coldplunge, Twitter thread

- Eve online, Monthly Economic Report — February 2023

- DeftCrow, 이브 온라인의 경제가 특별한 이유는 무엇인가?

- Derek Lau, Blockchain game design: analysis of opportunities and design challenges