All You Need to Know About Story

Assessing Story's Current State and Outlining a Long-Term Vision

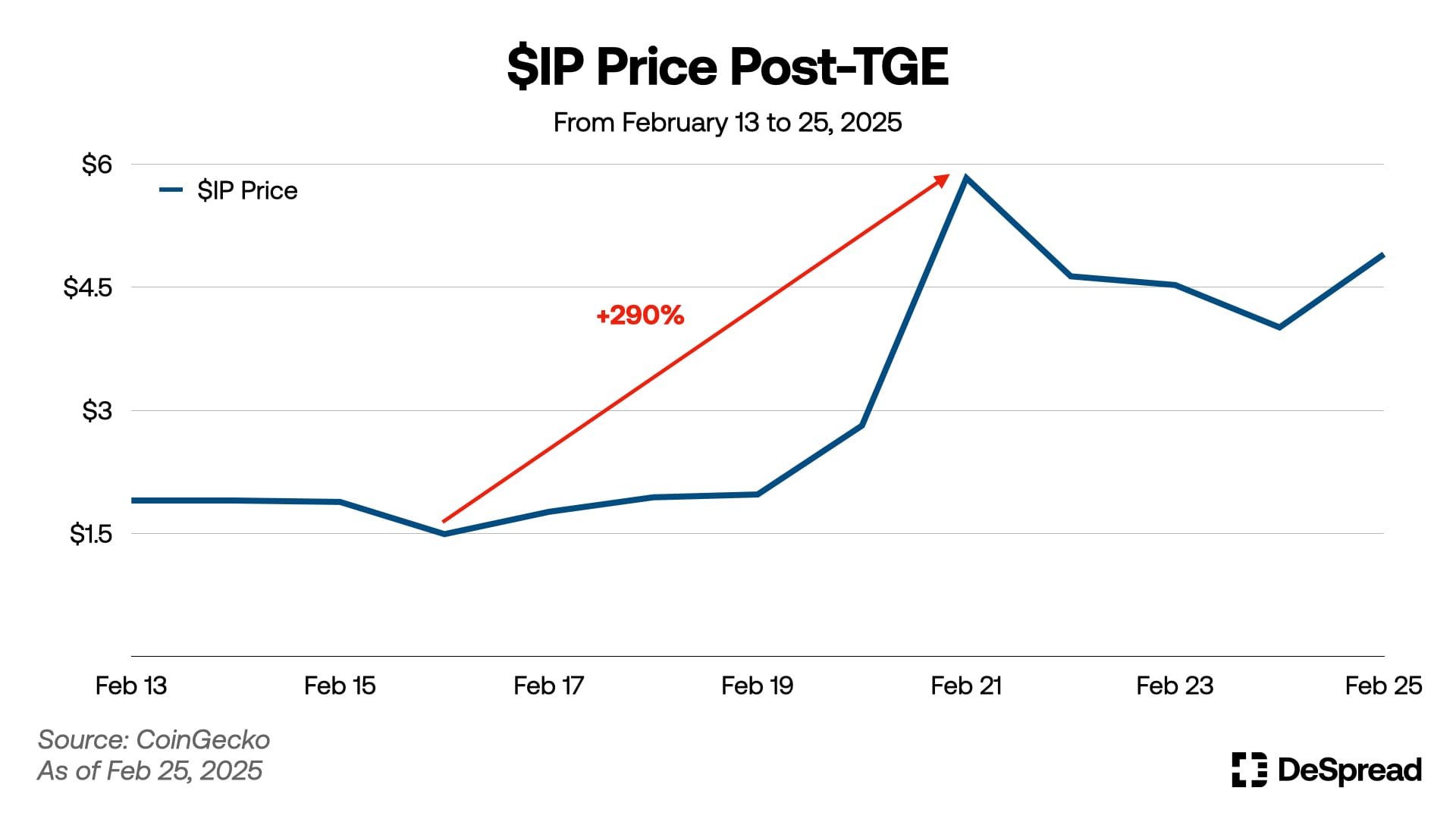

1. $IP Delivers an Impressive Performance in a Bear Market

Since the mainnet launch and Token Generation Event (TGE) on February 13, 2025, Story’s native token $IP and its ecosystem have achieved remarkable milestones. Although $IP initially fell from $2.5 to $1.5 immediately after the TGE, it rebounded dramatically by reaching approximately $6 on February 21—a nearly fourfold increase within just five days.

Notably, as of the writing date (February 25, 2025), while Bitcoin fell below $89K and the broader cryptocurrency market experienced a general downturn, $IP recorded a price of $4.9, marking an increase of over 23% compared to the previous day and capturing significant investor attention.

Over the past week, the impressive performance of $IP has recorded an overwhelming rate of increase—not only compared to Bitcoin and the overall cryptocurrency market capitalization ($TOTAL) but also against newly launched and rebranded projects that have recently attracted significant market attention ($BERA, $KAITO, $S).

Recent one-week (2025.02.19 ~ 2025.02.25) asset-specific yield trends:

- $IP (blue): +151.64%

- $KAITO (purple): +60.91%

- $S (gray): +26.45%

- $BERA (red): +7.52%

- $BTC (light green): -4.68%

- $TOTAL (white): -5.91%

As demonstrated, Story and $IP have shown stable value preservation even during a down market, and they are expected to garner even more attention from market participants in the future. This article evaluates Story's current status and positioning to determine whether its recent outperformance is sustainable compared to competing projects. Additionally, it analyzes the on-chain plays available within the ecosystem and examines the bull scenario for Story—as derived from a medium- to long-term perspective—along with identifying the project within the Story ecosystem that stands to benefit the most under that scenario.

2. Story's Ambiguous Positioning

The current crypto industry boasts an unprecedented number of applications, layers, and infrastructures compared to the past, yet it is challenging to expect a scale of new liquidity inflow that satisfies all of these. In an environment where "attention is money," having a unique narrative and clear positioning has become more critical than ever for a project to stand out among numerous competitors and capture investors’ interest.

Reflecting this trend, projects currently garnering market attention are actively carving out their distinct positioning. For instance, Berachain promotes a narrative of being a flywheel-optimized layer based on its unique tokenomics called PoL (Proof of Liquidity), while Kaito is expanding its ecosystem by leveraging a service that boasts the crypto industry's best Product-Market Fit (PMF) and advancing an InfoFi narrative.

On the other hand, although $IP has recently shown an impressive upward trend, Story’s narrative—emphasizing "on-chain IP" and "onboarding 1% of the $61T IP market on-chain"—proves somewhat challenging for investors to intuitively grasp compared to these other new chains and projects.

Furthermore, attempts to bring large-scale real-world asset groups onto the blockchain, such as through RWA (Real World Asset) or STO (Security Token Offering), have been made in the past, yet few have achieved significant success, which raises questions about the feasibility of Story’s vision.

Moreover, for on-chain IP to be truly effective, IP assets need to be accumulated on-chain to generate meaningful revenue. According to the recently released roadmap by the Story Foundation, core products for IP registration and monetization are scheduled for launch in Q2 and Q3 of this year, suggesting that it may take some time before tangible results are achieved.

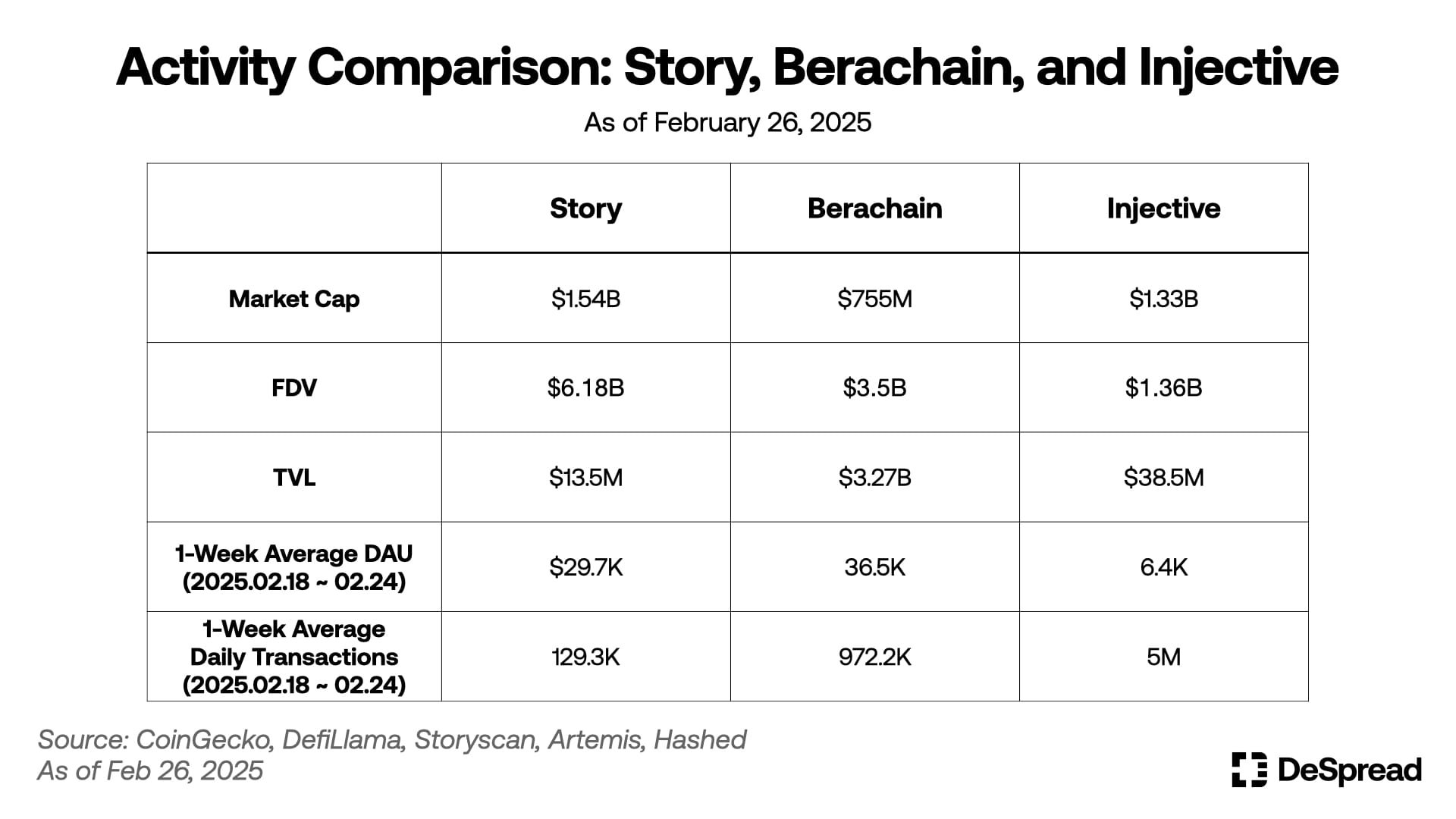

Story’s ambiguous positioning and technical shortcomings in IP onboarding have resulted in low ecosystem engagement. The table above compares Story with its new chain competitor, Berachain, and Injective—a Layer 1 project with a similar market capitalization—using metrics such as market cap, FDV, TVL, and one-week average DAU (Daily Active Addresses).

Among these, Story holds the highest market cap and FDV; however, it falls short in network activity, as measured by TVL, DAU, and daily transaction volumes. In particular, Story’s TVL is about 242 times lower than Berachain’s and 2.85 times lower than Injective’s, with transaction counts also significantly trailing those of its competitors.

Although it can be argued that the Story ecosystem is still in its nascent phase—having only emerged about two weeks ago—it is expected to take time before the catalyst for explosive growth in the Story ecosystem, such as IPFi (IP + DeFi), is fully realized. Therefore, it appears unlikely that the Story ecosystem will achieve the same level of activation as its competitors in the near future.

3. A Promising Opportunity Amidst Its Challenges

Considering that the Story ecosystem is still incomplete and in its early stages, actively engaging in on-chain plays now may present a significant opportunity to secure high returns in future user reward programs. The Story Foundation has allocated 50 million $IP—equivalent to 5% of the total supply—as initial incentives for dApps within the ecosystem, with a firm commitment that these funds will eventually benefit users.

Accordingly, this chapter will examine on-chain play strategies available to users, focusing on dApps that are anticipated to evolve into key players within the future Story.

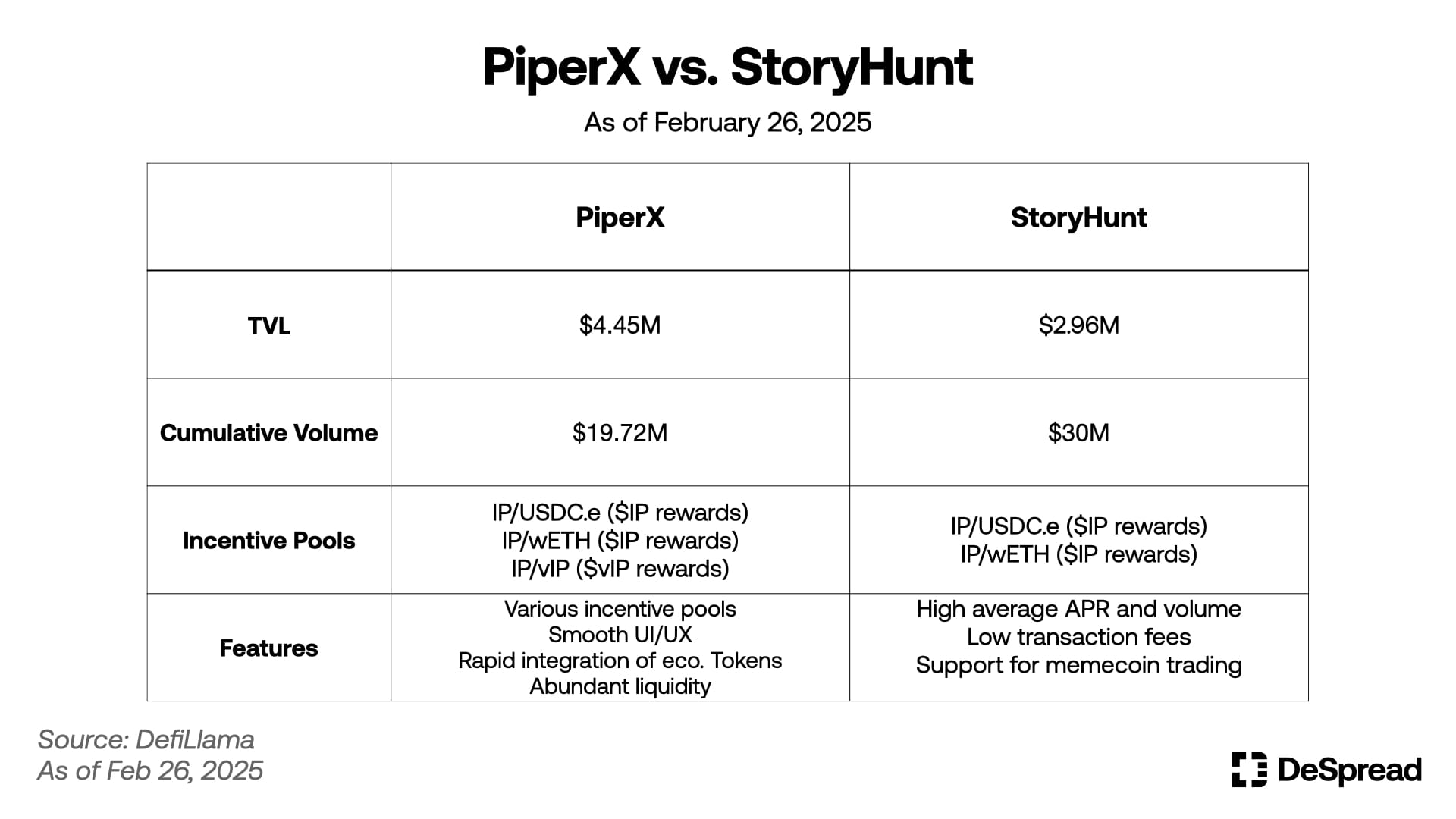

3.1. LP - PiperX & StoryHunt

Currently, the Story ecosystem features two DEXs—PiperX and StoryHunt—and the primary strategy for earning $IP incentives on these platforms is LP farming. The table below compares the characteristics, actionable strategies, performance, and future prospects of both PiperX and StoryHunt.

Considering the Story ecosystem's low TVL, the overall high volatility in the recent cryptocurrency market, and the additional expected rewards including airdrops and incentives, the most appropriate choice for LP provisioning in Story is the IP/USDC.e pool. Although the APR for the IP/USDC.e pool is somewhat volatile, it has averaged between 230% and 360% over the two weeks since its launch.

PiperX

- The only DEX that offers $vIP rewards through IP/vIP LP provisioning.

- Provides a more user-friendly UI/UX compared to StoryHunt.

- Offers a choice between Concentrated (V3) and Standard (V2) LP provisioning.

- Charges relatively higher trading fees.

- Interacts with the DeFAI agent DaVinci.

StoryHunt

- Achieves a higher average APR based on cumulative trading volumes relative to its TVL.

- Charges lower trading fees.

- Supports meme coin <> meme coin trading.

- Interacts with Benjamin, the most anticipated agent in the Story ecosystem.

- Actively collaborates with ecosystem projects by providing additional $IP rewards to holders of Story's flagship NFT, Mimboku.

- Features a somewhat less intuitive UI/UX.

3.2. Looping - Unleash Protocol

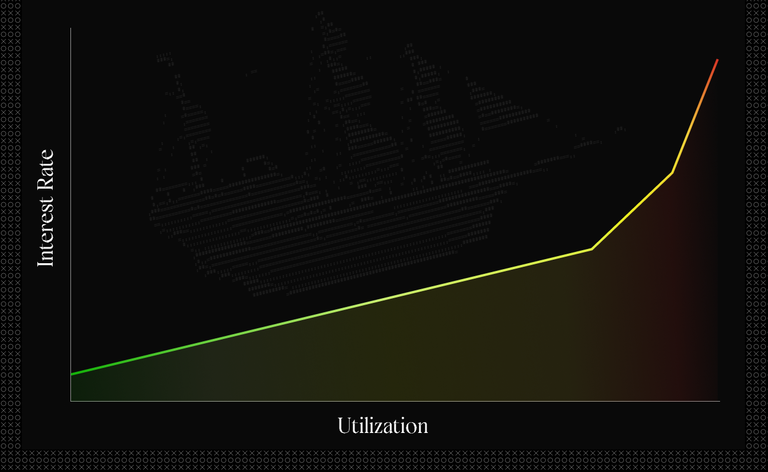

Unleash Protocol is a lending market that supports borrowing and lending various assets, including $IP, $wETH, $vIP, and USDC.e. Unlike PiperX and StoryHunt—where earning interest requires depositing $IP along with another crypto asset—Unleash Protocol offers the advantage of generating interest income with a single asset deposit. Currently, the loan APR for $IP is around 200%, and as the utilization ratio increases, the interest yield for liquidity providers rises sharply.

Unleash Protocol serves as a core money market within the Story ecosystem, enabling the development of diverse strategies in conjunction with dApps such as PiperX, StoryHunt, and the re-staking protocol Verio, which will be explained below.

- Supply collateral on Unleash Protocol to borrow $IP, then stake on Verio to earn additional rewards.

- Borrow $IP on Unleash Protocol, stake with $vIP on Verio, then use $vIP as collateral on Unleash Protocol to borrow more $IP—this process can be looped.

- Borrow various assets on Unleash Protocol and provide liquidity on PiperX and StoryHunt.

3.3. Liquid Staking - Verio

Verio is a liquid staking protocol that, during the ongoing Singularity Stage (until March 2), is the only platform offering $IP staking rewards. This has attracted significant attention, making it the top dApp in the Story ecosystem by TVL.

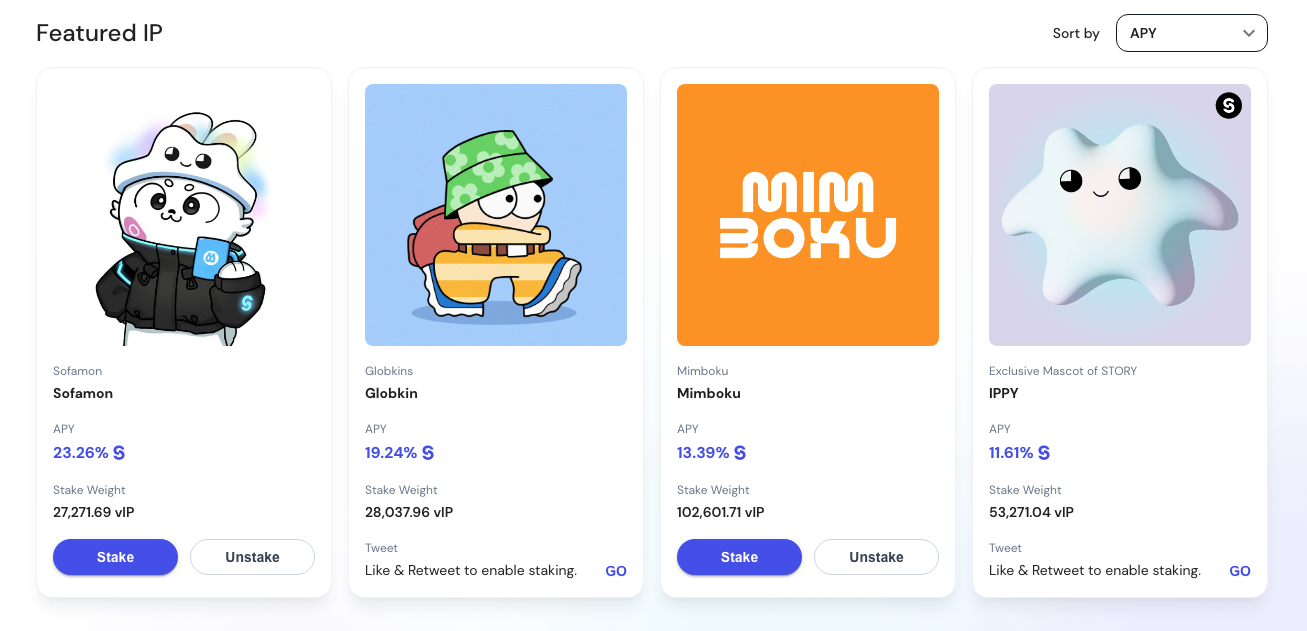

True to Story’s IPFi identity, Verio provides an opportunity to earn extra yields by re-staking $vIP—the liquid staking token (LST) of $IP—across various IP assets. Currently, Verio supports IP assets such as Sofamon, Globakins, Mimboku, and Story’s official mascot, IPPY. Depending on the yields generated by each asset, users can expect additional returns ranging from a minimum of 11.6% up to 23.3%.

However, compared to the over 200% APY offered by the Story DEX and lending market mentioned earlier, $vIP yields only about 5.3%. Even with re-staking set at the maximum lock-up period of 90 days, the returns are relatively modest—around 20%. Moreover, continuous monitoring is needed to ensure that the re-staked IP assets are indeed generating revenue and delivering the promised APY to users.

3.4. Memecoin - WTF, SONA, LILBENJI

It’s true that compared to other chains like Solana, Base, and Berachain, Story currently lacks sufficient infrastructure for meme coin trading—including robust DEXs, on-chain analytics tools, and strong investor interest. Nonetheless, there are a few notable meme coins or low market cap ecosystem tokens. However, given their very low trading volumes and market caps combined with high price volatility, utmost caution and risk management are essential when dealing with these tokens.

WTF (What The Freg) is the first AI agent based on TCP/IP, with a market capitalization of $4.5M as of February 28, 2025. Designed specifically for memes, WTF evaluates the originality of certain memes and supports text-based image generation. In the future, the native token $WTF is planned to be offered as tips, much like $DEGEN on Warpcast.

The native token of Solo AI, an AI-based music generation service that raised $2M from HongShan, formerly of Sequoia China, currently has a market capitalization of $5.6M.

Among Story agents, the most highly anticipated is the DeFAI agent Benjamin, who raised $6M in public funding for his debut token. Launched on February 27, 2025, the token’s market capitalization quickly surged to $16M and now remains around $14.5M, reflecting the strong interest in Benjamin.

4. Flexible Staking as a Short-Term Risk Factor

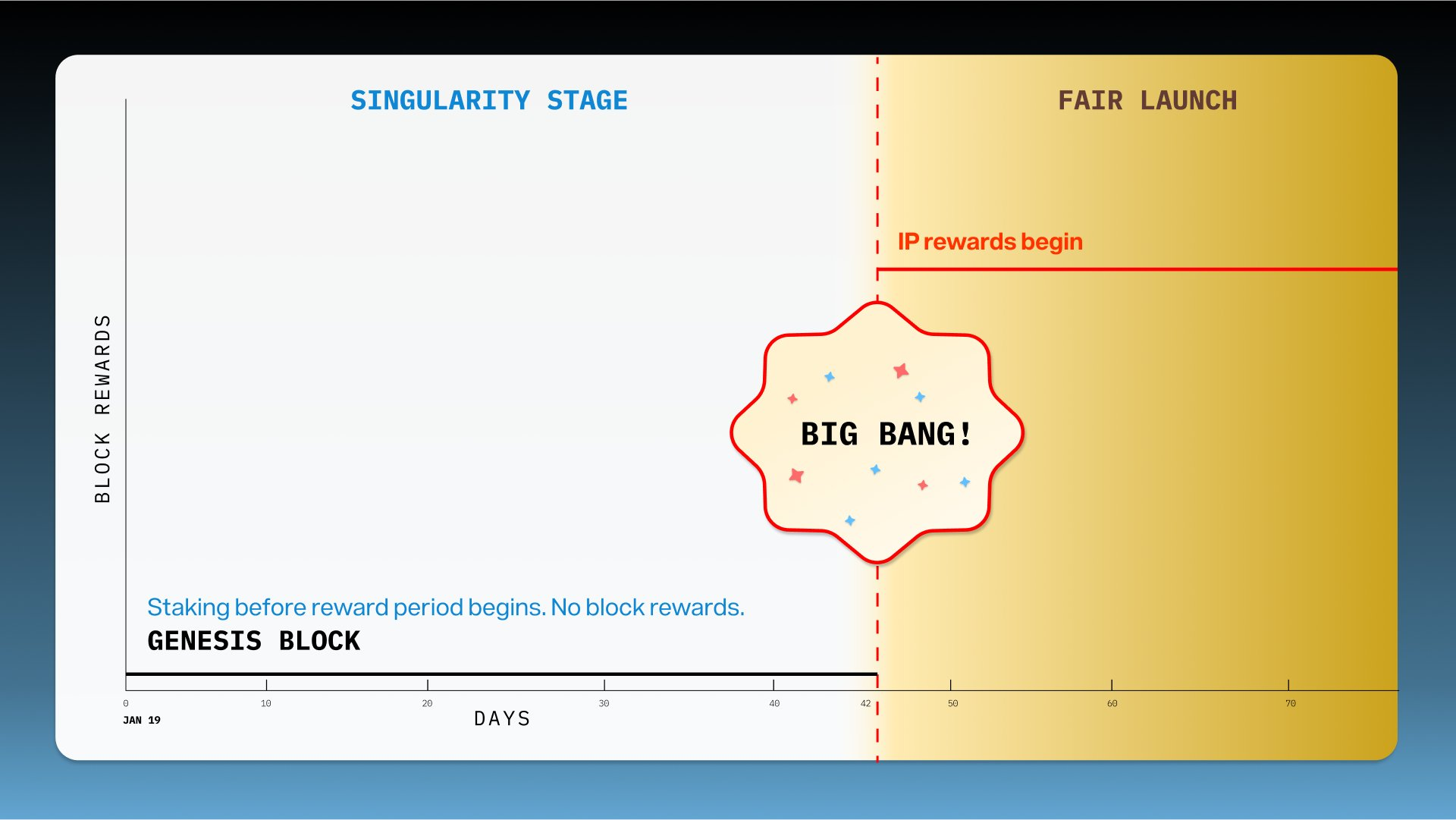

In the Story ecosystem, there is a Singularity Stage from January 19 (when the Genesis Block was created) until March 2—42 days later. During this period, no $IP staking rewards are distributed, and staked $IP cannot be unstaked.

As of February 28, 2025, the Story staking dashboard shows that a total of 50,411,996.15 $IP is staked across 32 validators, representing 20.16% of the current circulating supply. Moreover, about 25.1 million $IP—equivalent to 32% of staked tokens and 6.4% of the circulating supply—could potentially exert selling pressure as soon as the 2-week unbonding period ends on March 16.

To clarify this further, let’s first review Story’s staking mechanism.

Story distinguishes between Locked tokens, which cannot be traded or transferred, and Unlocked tokens, which are freely transferable. Validators must decide in advance whether to accept Locked or Unlocked tokens from their delegators, and this decision cannot be changed later.

Both Locked and Unlocked tokens can be staked, and both require a 14-day unbonding period before withdrawal. However, there is a key difference in the staking period: Locked tokens only support flexible staking (allowing immediate unbonding requests), whereas Unlocked tokens enable users to select longer staking periods (such as 90, 360, or 540 days) in exchange for additional rewards. In this case, users can only request unbonding once the selected staking period has expired.

The aforementioned 25.1 million $IP corresponds to the volume staked via flexible staking held by three addresses. While it is difficult to ascertain the owners of these addresses—and it is unlikely that all of this amount will be sold—in a worst-case scenario where unbonding is requested immediately after the Singularity Stage, this volume (representing 6.4% of the circulating supply) could indeed exert significant selling pressure.

Addresses with 25.10 million $IP in flexible staking

- 0x42b8ab83bdef9badaec2e59c397fdac74f0b9b95 holds 15.59 million $IP

- 0x6530b70a9583b2e9229cca10c19a13f59ef6f410 holds 9 million $IP

- 0xb47aedf533cc3c1651a8af2312fe55e317006821 holds 504,000 $IP

5. Focus on Agents, Not the $61T IP Market

Having examined Story’s positioning and current state from a short-term perspective, this chapter now turns to the vision Story must present for long-term growth.

Earlier, I questioned the feasibility of Story’s vision to “on-chain 61T worth of IP assets,” but Story is making proactive moves with an alternative positioning and narrative—becoming a “layer for the economic activity of AI agents.” I believe this narrative is the direction Story should take to build a unique moat in the crypto industry over the medium to long term.

The AI agent sector in the crypto industry is currently transitioning. With around 1,400 agents in existence and after experiencing a significant downturn, the mere fact that an AI agent automatically posts on Twitter is no longer enough to capture investors’ attention. To gain a competitive edge in this fierce market, agents will need to consistently deliver superior performance and activity metrics, maintain token prices through mechanisms like buybacks and burns, and achieve objective, quantifiable results—beyond just subjective criteria such as high service quality or partnerships with well-known projects.

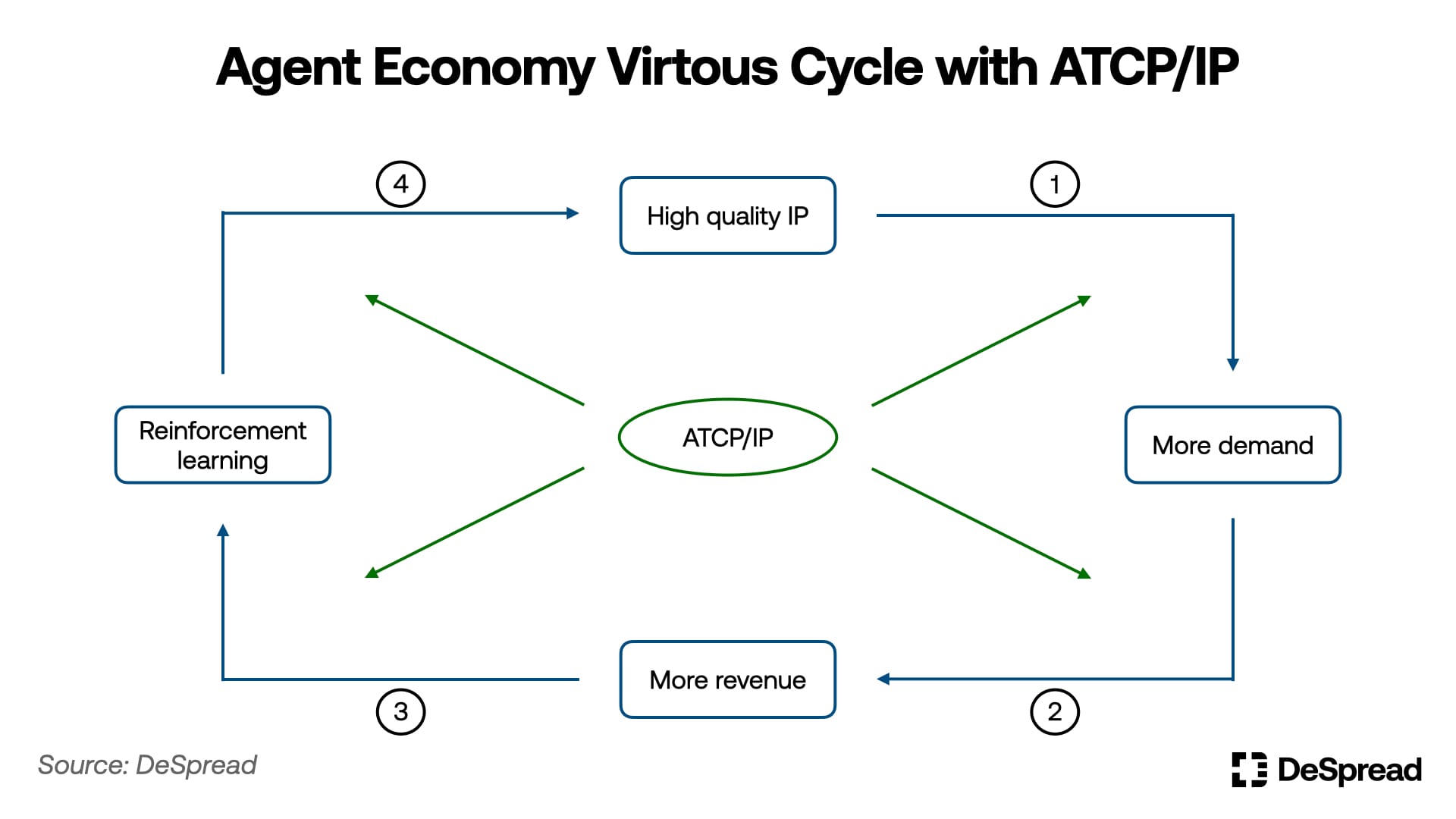

In response to this paradigm shift, Story has introduced its proprietary ATCP/IP framework to evaluate the contributions of specific agents and IPs. This framework establishes an objective and quantitative benchmark for assessing the influence and quality of agents and their creations, ensuring that their economic performance is clearly measurable.

5.1. Expected Benefits of Implementing ATCP/IP

If ATCP/IP becomes fully integrated into the Story ecosystem, the key anticipated benefits include:

- Performance Verification

Through objective metrics derived from ATCP/IP—such as the frequency of information sharing and revenue generation of specific agents—it will be possible to identify AI agents that consistently produce high-quality IP. Investors can then make objective investment decisions and estimate expected returns based on this data.

- Token Utility

The native token, $IP, will evolve beyond being a mere speculative asset to serve as a medium for information exchange among agents. As the economic activities of agents increase, natural buying pressure on $IP could also follow.

- Incentive Assurance via Smart Contracts

With smart contracts supporting Royalty and Licensing Moudles, ATCP/IP can ensure fair revenue distribution. This mechanism will be a powerful tool for onboarding various stakeholders into Story who have the following needs:

- Agents seeking to generate actual revenue based on their activities.

- Foundations and teams aiming to maintain token value by utilizing a portion of agent-generated revenue for buybacks and burns.

- Investors desiring an objective method to determine which agents outperform competitors.

5.2. Projects to Watch in the Agent Economy

If Story transforms into the definitive layer for the economic activities of AI agents, the following projects deserve special attention:

- $IP

- As Story solidifies its role as the backbone of agent economics and overall activity increases, investor interest in the native token $IP could naturally rise.

- Continuous buying pressure might be generated as agents purchase information, acquire datasets and modules, and investors buy into agent tokens.

- Unlike traditional layers where native tokens are traded on DEXs by individuals, Story facilitates 24/7 transactions between agents using $IP without the need for a DEX, potentially enhancing value capture.

- Agent Launchpads

- The example of Virtual Protocol demonstrates that, as the agent ecosystem grows, launchpads can become the primary beneficiaries and attract significant attention.

- Unleash Protocol's IPGE (IP Generation Event) and Oaisis DAO's Story.fun are already generating considerable anticipation.

- However, with numerous agent launchpads already present on other networks, long-term success will depend on whether launchpad activity can establish a value chain that directly enhances the value of their own tokens and $IP.

- Agent Frameworks

- Upcoming releases like Unleash Protocol's Benjamin Toolkit and Oaisis DAO's Story Agent Kit are highly anticipated.

- Nevertheless, because Story is integrating several frameworks that were highly popular during previous AI booms (such as ai16z, ARC, and Zerebro), the market share for Story’s native framework may be limited.

5.3. Slowly, but Grandly

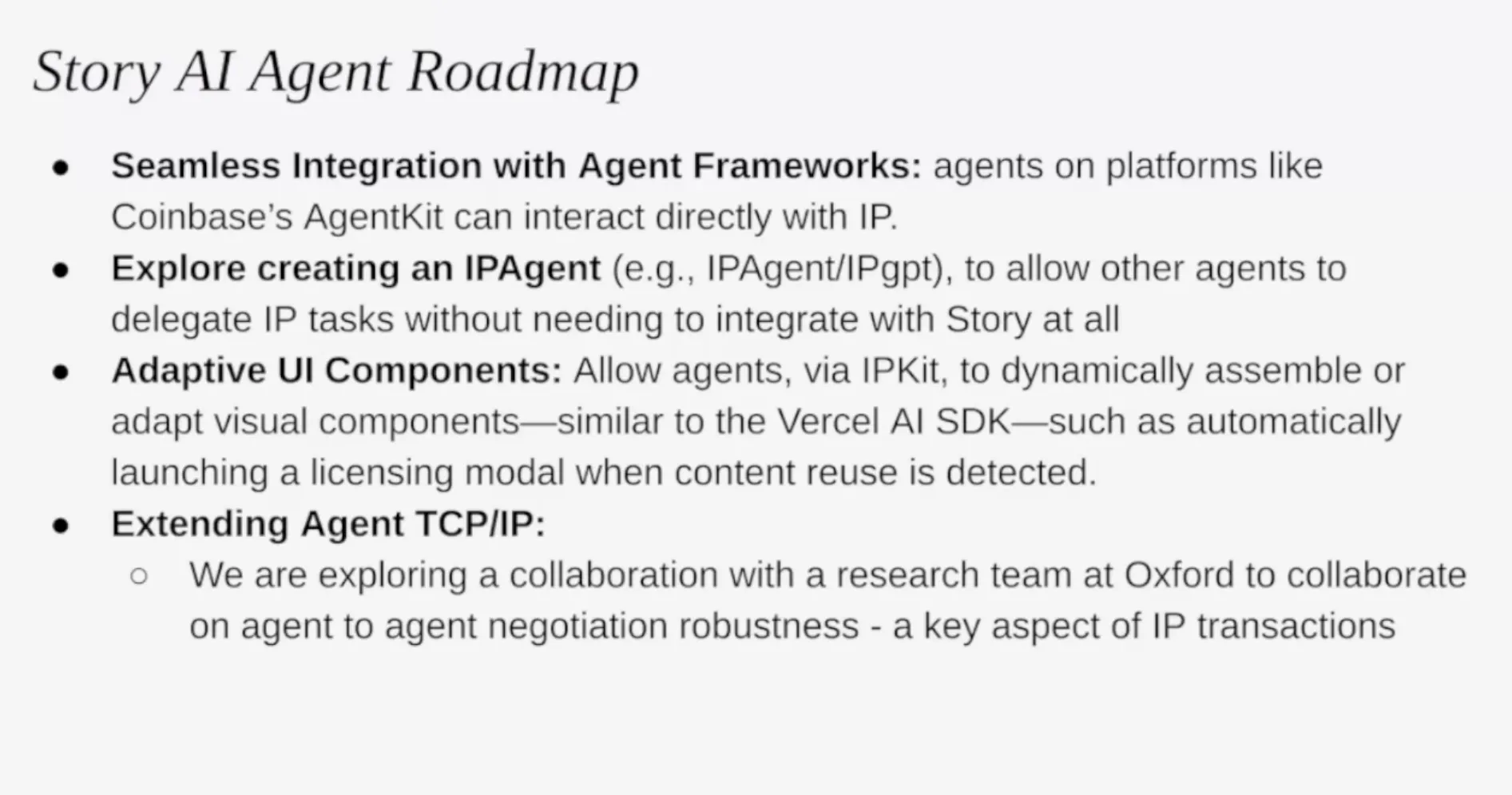

A layer for AI agents is the core positioning that Story should lead in the long term. According to the recently released technical roadmap, the Story Foundation also recognizes the integration with agents as a key strategy, and it plans to sequentially roll out the related features in line with its long-term plan.

Of course, aside from technical aspects, it may take time for the cryptocurrency market to regain its previous investor sentiment and for agents to once again emerge as a major sector. Nevertheless, Story has bet on the AI narrative, and if it continues to evolve as outlined in its published roadmap, it is highly likely to establish itself as a core player in the forthcoming agent era.

In fact, not only Story but also existing major players—such as Virtual Protocol, which recently announced the Agent Commerce Protocol (ACP), and ARC, which has evolved into a framework-based launchpad—are all working hard to build a flywheel where their product activation is directly tied to token value for long-term growth.

Although Story may be a latecomer in the agent sector, its proprietary structure, which encompasses both on-chain and off-chain revenue generation through solutions like PIL (Programmable IP License) and ATCP/IP, suggests that it has greater growth potential than typical applications.