DI - 05: Market Commentary | 07. 19.

Crypto Market Trends in Data

1. Introduction

Since the latter half of 2023, the cryptocurrency market has experienced an upward trend, though there has been some correction since reaching an all-time high in March this year. As of June 30th, the price of Bitcoin was approximately $60.8K, marking a 16.7% decline from its peak of $73K in March. This indicates a clear correction in the cryptocurrency market during the second quarter, contrasting with its performance in the first quarter. Several negative factors contributed to this deeper correction, including the initiation of the Mt. Gox repayment process and the potential market sale of a large amount of Bitcoin seized from illegal sites, now held by the German and U.S. governments.

This article covers market trends, major issues, developments in Korean centralized exchanges, and news related to the implementation of the Act on the Protection of Virtual Asset Users in Korea.

2. Market Trends and Major Issues

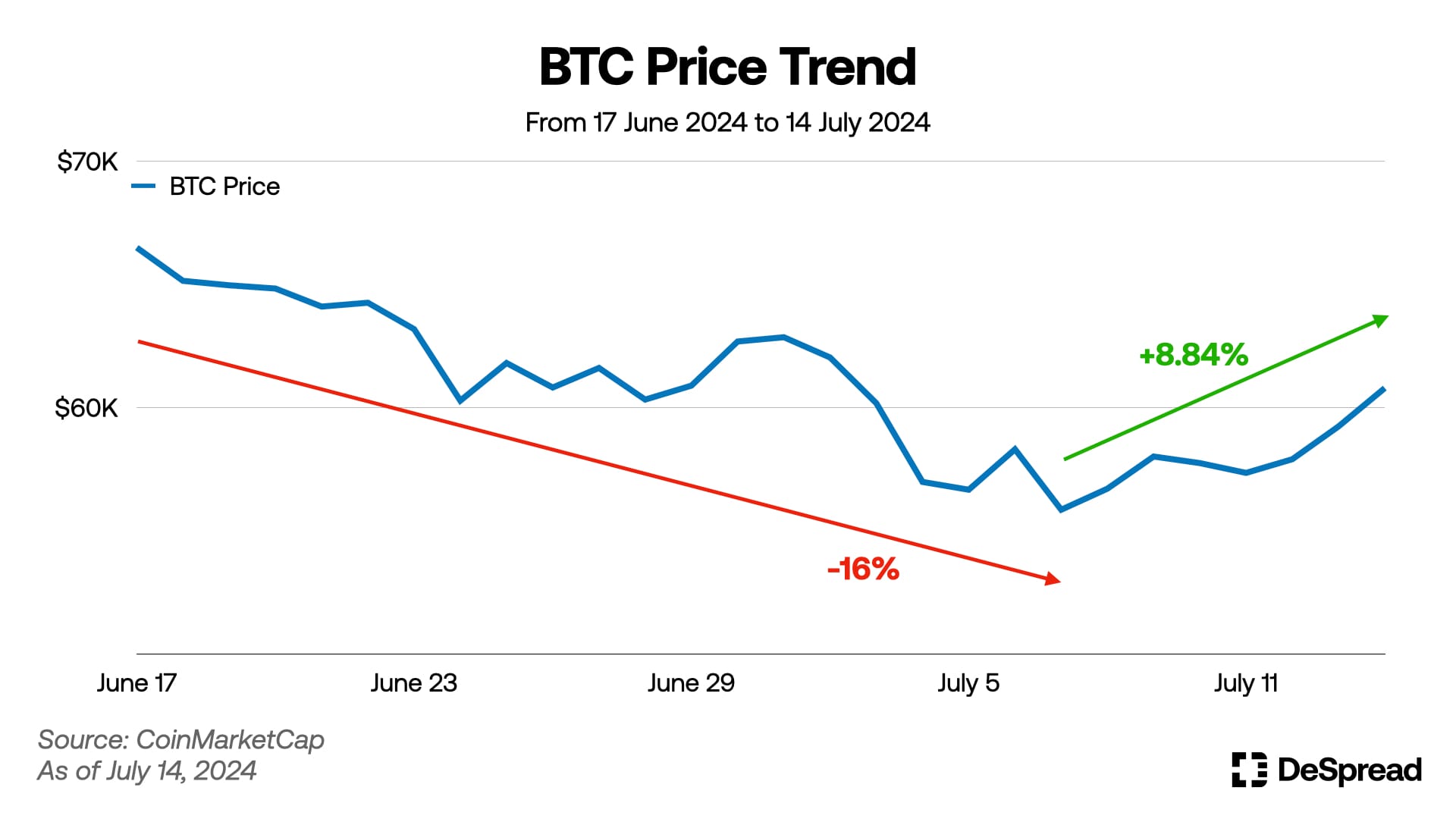

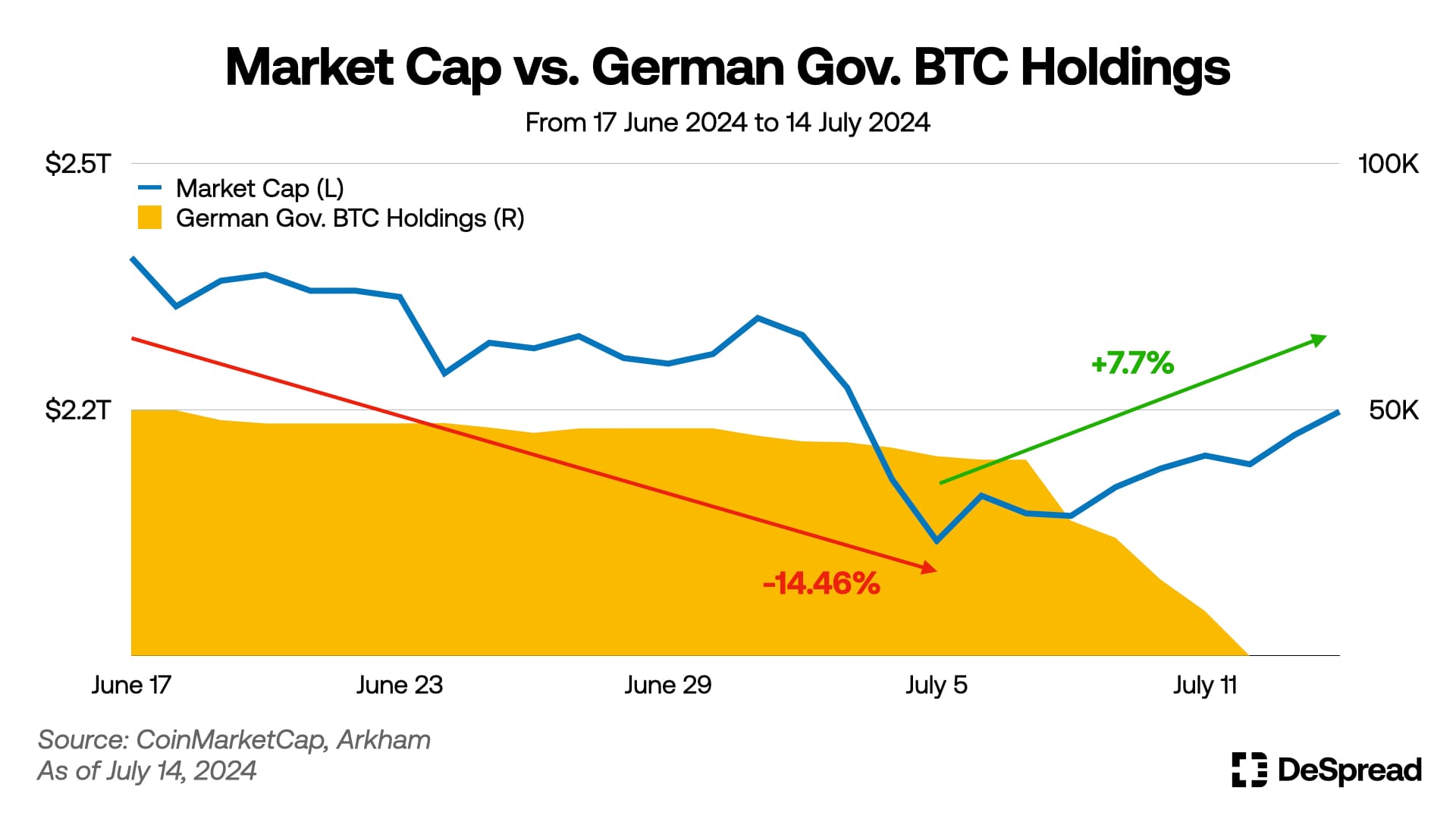

Several events in June and early July have increased selling pressure on Bitcoin, contributing to a notable price decline. On June 19, Bitcoin held by the German government was transferred to exchange and OTC wallets, followed by the transfer of Bitcoin held by the U.S. government on June 26. Additionally, the repayment process for Mt. Gox creditors began on July 5. These events collectively led to a significant drop in Bitcoin's price from $66.5K on June 17 to below $55K by July 5, a decline of up to 18%.

According to Coinglass, a provider of cryptocurrency derivatives data the Fear & Greed Index, the market sentiment index, reflected these developments. During this period, the index fell from a high near the "Extreme Greed" level (74) to just above the "Extreme Fear" level (25), indicating a significant shift in investor sentiment.

2.1 Government Actions and Mt. Gox

2.1.1 German Government

On January 30, 2024, the police in Saxony, Eastern Germany, announced the seizure of approximately 50,000 BTC from the operators of the illegal movie piracy site 'movie2k.to,' which was active between 2008 and 2013. The site's two operators began purchasing Bitcoin with their site earnings in mid-2012 and reportedly used over 22,000 Bitcoins to acquire various assets, including real estate.

One of the operators was detained in November 2019 and released in 2020 after transferring Bitcoin and Bitcoin Cash worth approximately $29.6 million to the Dresden Public Prosecutor's Office. According to on-chain data platform Arkham, on January 19, 2024, the operator transferred an additional 50,000 BTC to the German Federal Criminal Police Office (Bundeskriminalamt, BKA).

Starting June 19, the BKA began transferring the seized Bitcoin to various cryptocurrency exchanges, including Coinbase, Kraken, and Bitstamp. This action raised concerns about the potential market sale of these Bitcoins, contributing to the recent market downturn.

The total cryptocurrency market capitalization also saw a decline, falling by up to 14.5% from the third week of June to July 5, mirroring Bitcoin's trend. Notably, 40,000 of the 50,000 Bitcoins seized by the German government were transferred to exchanges or other wallets after July 5, presumably for sale. This suggests that the approximately three-week market downturn could have been driven by anticipatory fear stemming from this negative development.

[Weekly Trends of BTC Held by the German Government]

- Third Week of June (06.17 - 06.23)

- June 17: 49.86K BTC

- June 23: 47.18K BTC

- Net BTC outflow: -2,680 BTC

- Fourth Week of June (06.24 - 06.30)

- June 24: 47.18K BTC

- June 30: 46.19K BTC

- Net BTC outflow: -987.24 BTC

- First Week of July (07.01 - 07.07)

- July 1: 46.19K BTC

- July 7: 40.53K BTC

- Net BTC outflow: -5,670 BTC

- Second Week of July (07.08 - 07.14)

- July 8: 39.83K BTC

- July 14: 0 BTC

- Net BTC outflow: -39,830 BTC

2.1.2 U.S. Government

According to Arkham, the U.S. government holds approximately 213,000 BTC. A significant portion of this Bitcoin was seized from the dark web marketplace Silk Road and from the hacking of the cryptocurrency exchange Bitfinex.

Silk Road operated from 2011 to 2013, facilitating the trade of illegal goods, including drugs, using Bitcoin. The FBI shut down the site in October 2013, and in November 2020, the U.S. Department of Justice seized over 69,000 BTC from the site’s revenue. In 2021 and 2022, an additional 2,875 BTC and 51,680 BTC were seized from Ryan Farace, who illegally sold drugs on Silk Road, and from James Zhong, a Silk Road hacker, respectively.

Moreover, in February 2022, over 94,000 BTC were seized from Ilya Lichtenstein, who was involved in the hacking of the Bitfinex exchange.

Over the past month, as the German government consistently sold off Bitcoin, market attention has turned to the Bitcoin holdings of various governments, including the U.S. government. Concerns increased when it was revealed that the U.S. government transferred 3,940 BTC to Coinbase on June 26, drawing attention to its holdings, which are over four times larger than those of the German government.

2.1.3 Mt. Gox

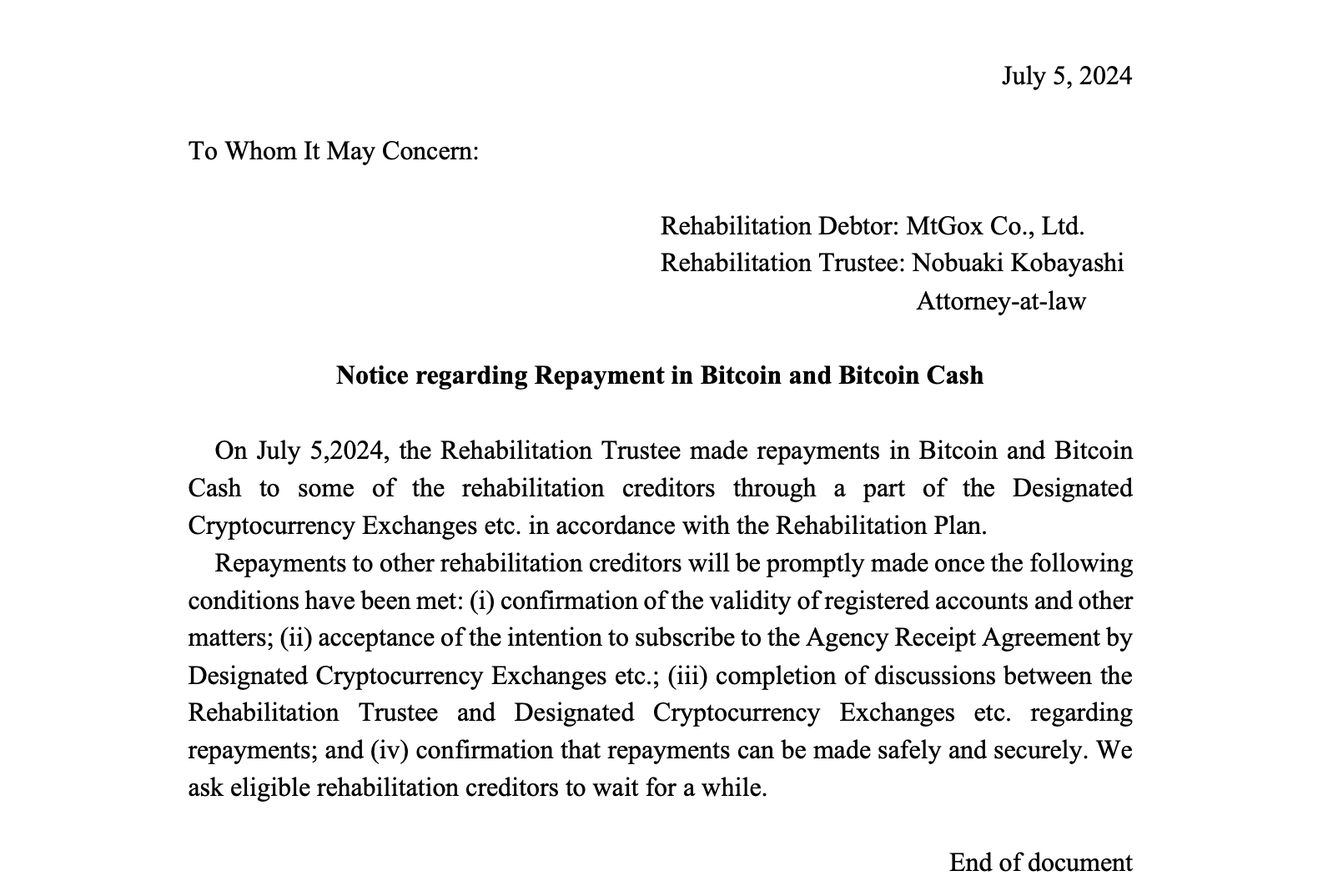

Mt. Gox, once the world's largest exchange, was founded in 2010 but suffered multiple hacking incidents between 2011 and 2014, resulting in the theft of up to 950,000 BTC. The exchange declared bankruptcy in February 2014. After years of legal battles, Mt. Gox announced a rehabilitation plan in 2021 to return recovered Bitcoin to its users. On July 5, 2024, the process began to repay 140,000 BTC to creditors.

To date, there have been two confirmed transactions related to the Mt. Gox repayment process. On July 5, 1,545 BTC were sent to the Japanese exchange Bitbank, and on July 16, 48,641 BTC were transferred to an unidentified address, which was later revealed through an email to Mt. Gox creditors to be associated with the U.S. cryptocurrency exchange Kraken.

As Bitcoin movements were observed from the German government on June 19, the U.S. government on June 26, and Mt. Gox on July 5 and July 16, market participants expressed concerns about the potential selling pressure that could follow the completion of creditor distributions. When Bitcoin movements to Bitbank were detected on July 5, Bitcoin's price dropped by approximately 3%. Similarly, the transfer of around 48,000 BTC on July 16 caused the market, which had been on an upward trend, to temporarily stall.

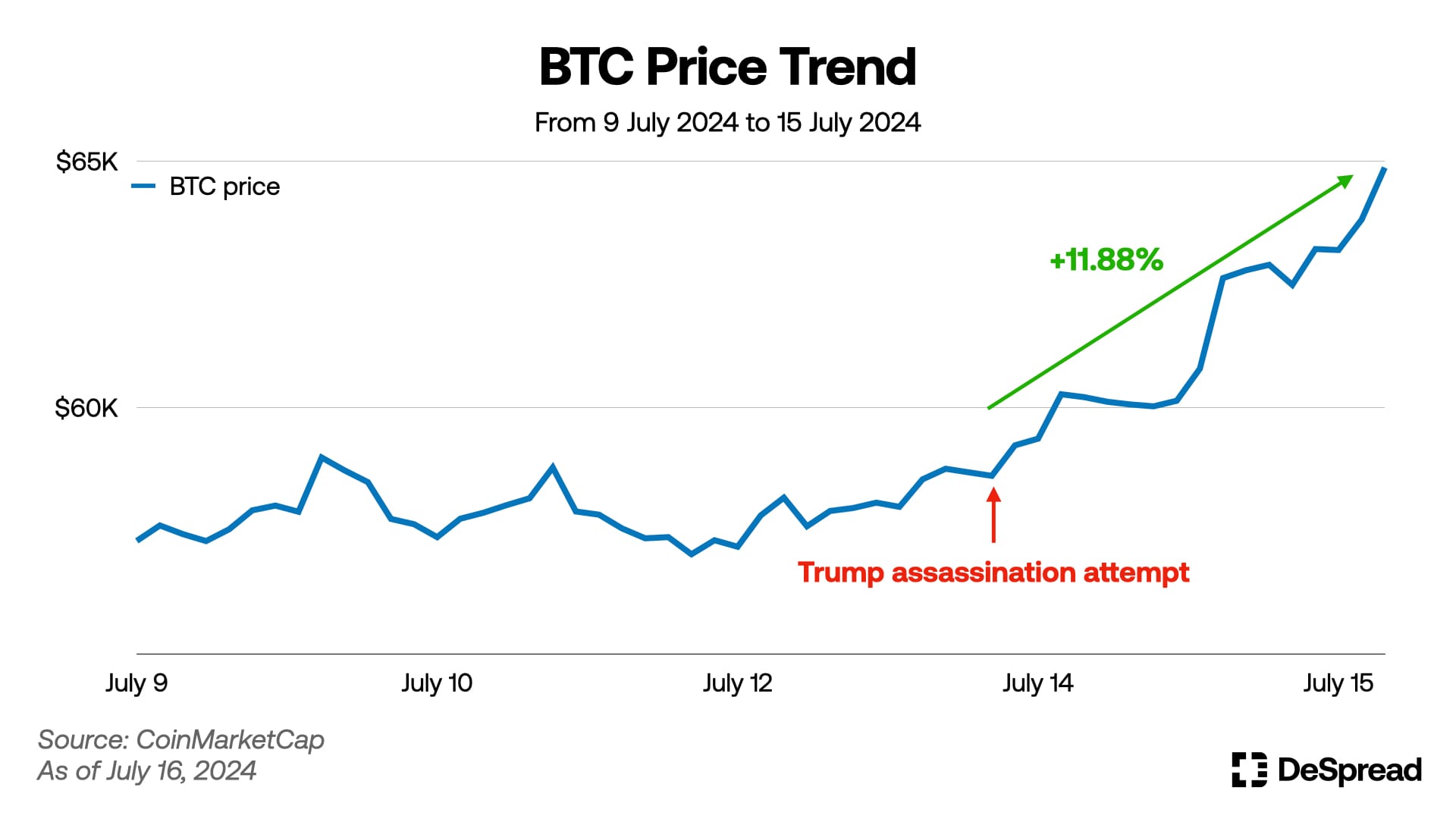

2.2 Trump Assassination Attempt and Subsequent Trends

As of July 16, Bitcoin's price has risen by approximately 16.3% from its low, surpassing $64.9K, indicating a market recovery. Several factors have contributed to this resurgence. First, the complete sale of the German government's approximately 50,000 BTC has alleviated selling pressure. Additionally, after the assassination attempt, Trump's chances of re-election, which has been favorable to cryptocurrencies, have surged to 71%. The potential approval of an Ethereum spot ETF has also added to market optimism. Lastly, strong support near the 200-day moving average has played a significant role in the market's recovery. These elements collectively indicate that the market is regaining momentum, reflecting renewed investor confidence and positive sentiment.

On July 13, during a campaign rally in Pennsylvania, an assassination attempt on Trump led to a surge in his election probability on Polymarket, reaching 71%. Concurrently, Bitcoin's price rose by about 12% by July 15, nearing $65K. The Republican Party, to which Trump belongs, has consistently demonstrated a favorable stance towards cryptocurrencies. They have voted to repeal SAB121 and pass FIT21, and have consistently opposed SEC Chairman Gary Gensler in lawsuits related to cryptocurrency businesses.

*SAB121: A bill requiring financial institutions to record custodial cryptocurrencies as liabilities on their balance sheets.

*FIT21: A bill aimed at promoting innovation in the U.S. digital asset ecosystem while strengthening consumer protection. It grants new jurisdiction to the CFTC over digital commodities and clarifies the SEC's jurisdiction over digital assets.

Furthermore, Trump, the Republican presidential candidate, has been a prominent advocate for Bitcoin. He launched official Trump NFTs in December 2022 and has made several pro-Bitcoin statements, establishing himself as a significant figure in the cryptocurrency industry. On July 16, Trump officially nominated J.D. Vance, a known cryptocurrency supporter, as his vice-presidential candidate, further raising expectations that a Trump administration would implement favorable regulations and market structures for cryptocurrencies.

Despite the completion of the German government's Bitcoin sales, the Trump assassination attempt, and the potential approval of an Ethereum spot ETF injecting optimism into the market, there are still challenges to maintaining a sustained bullish trend. The selling pressure from Mt. Gox repayments and the U.S. government's Bitcoin holdings must be resolved. Additionally, a decrease in Federal Reserve interest rates and the establishment of pro-cryptocurrency regulations following Trump's election could support a continued upward trend.

2.3 ETF and Institutional Funds Flow

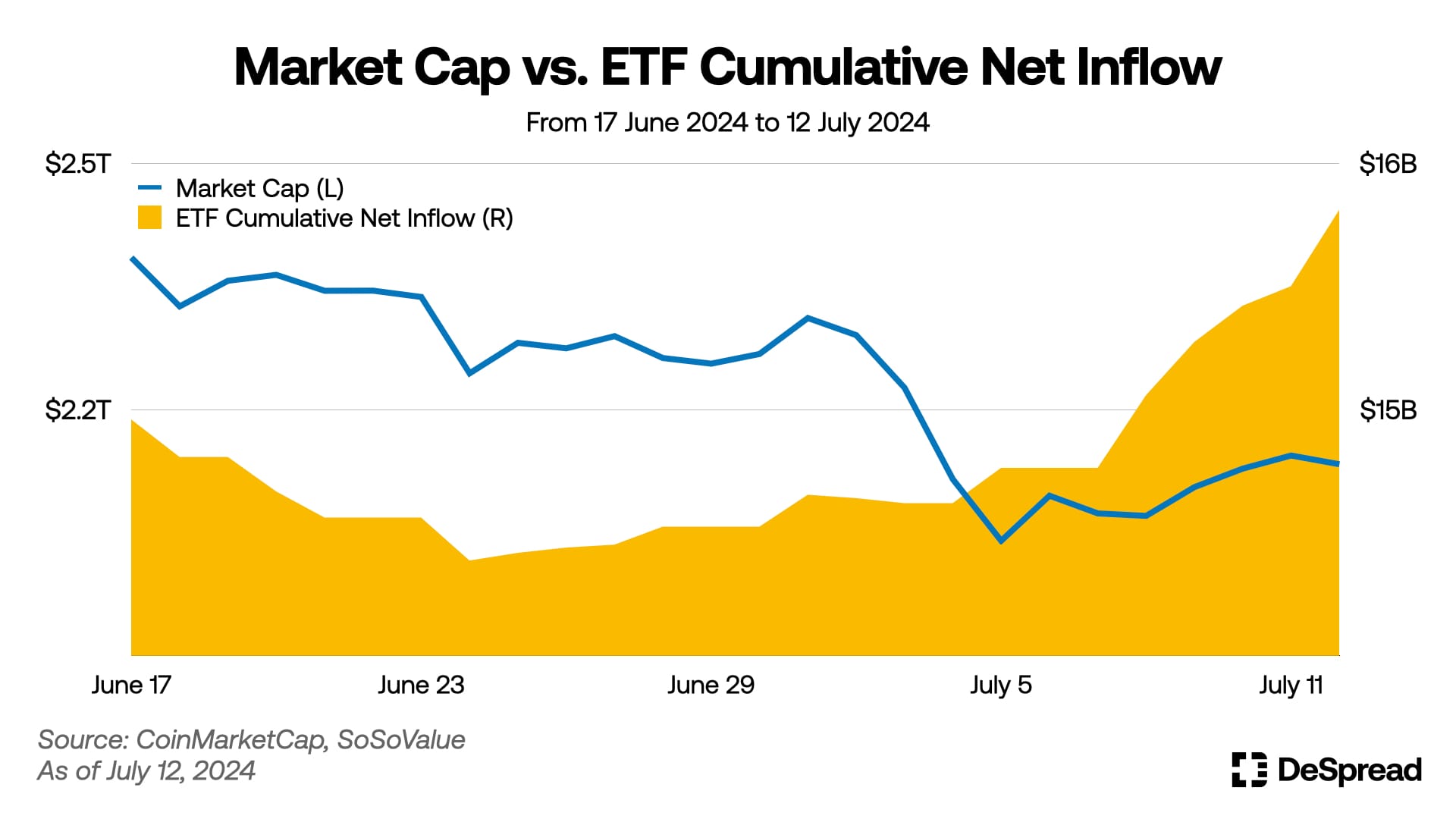

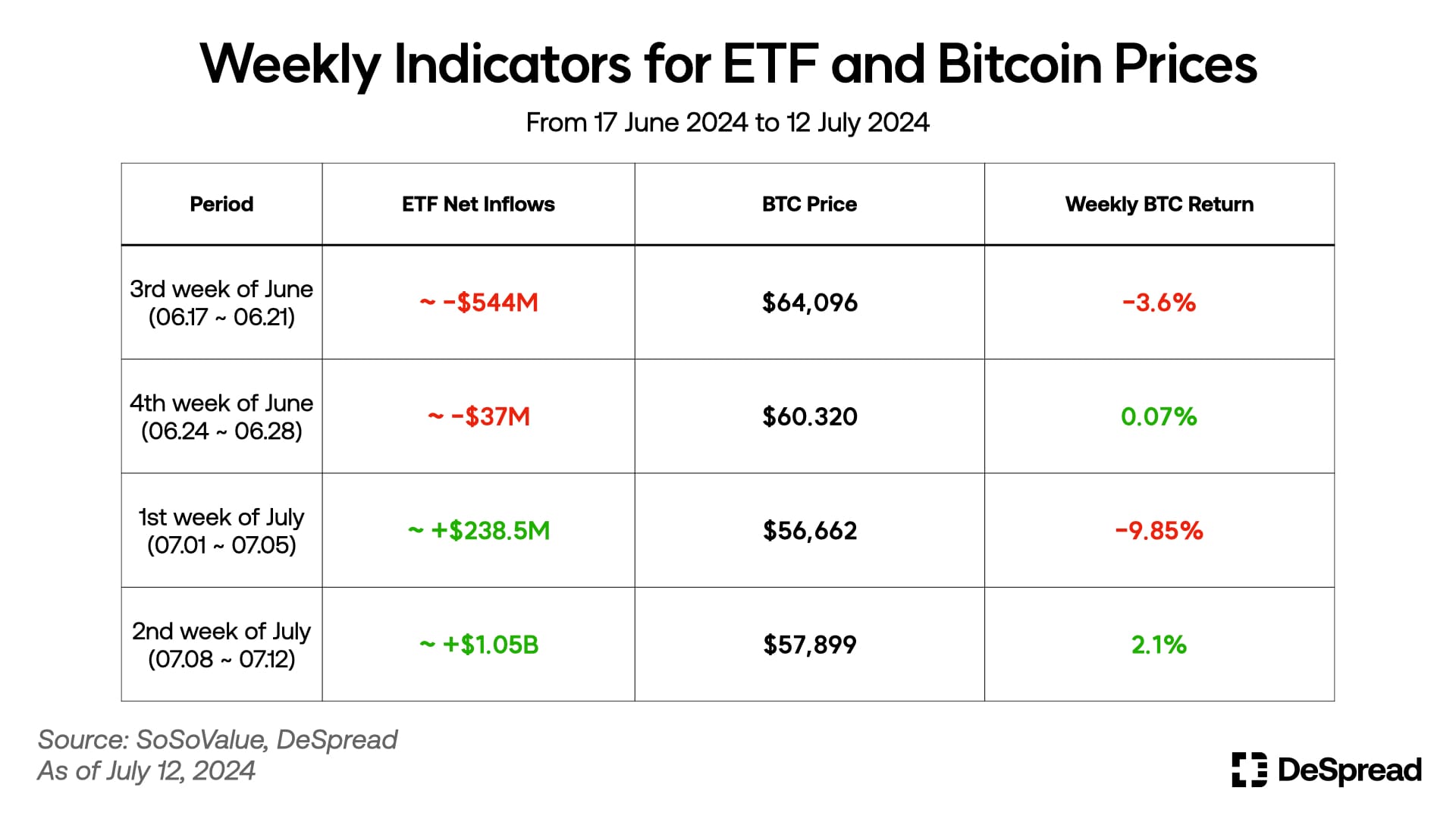

The graph illustrates the trend in total cryptocurrency market capitalization and the cumulative net inflow of Bitcoin spot ETFs from June 17 to July 12, 2024. As of July 12, the net assets held by Bitcoin spot ETFs are as follows:

- Total net assets of Bitcoin spot ETF: $51.34B (4.52% of the total Bitcoin market capitalization)

- Cumulative net inflow: $15.81B

In the previous report, it was noted that the net inflow of ETF funds and Bitcoin market capitalization followed similar trends throughout June. However, during the first week of July (07.01 - 07.05), Bitcoin's price dropped by approximately 10%, while the net inflow into Bitcoin spot ETFs increased. This indicates a weakening correlation between ETF fund inflows and Bitcoin market capitalization during that period. In the second week of July (07.08 - 07.12), an additional $1.05B flowed into Bitcoin spot ETFs, bringing the cumulative net inflow to approximately $15.81B.

2.4 CME Open Interest Indicator and Institutional Participation

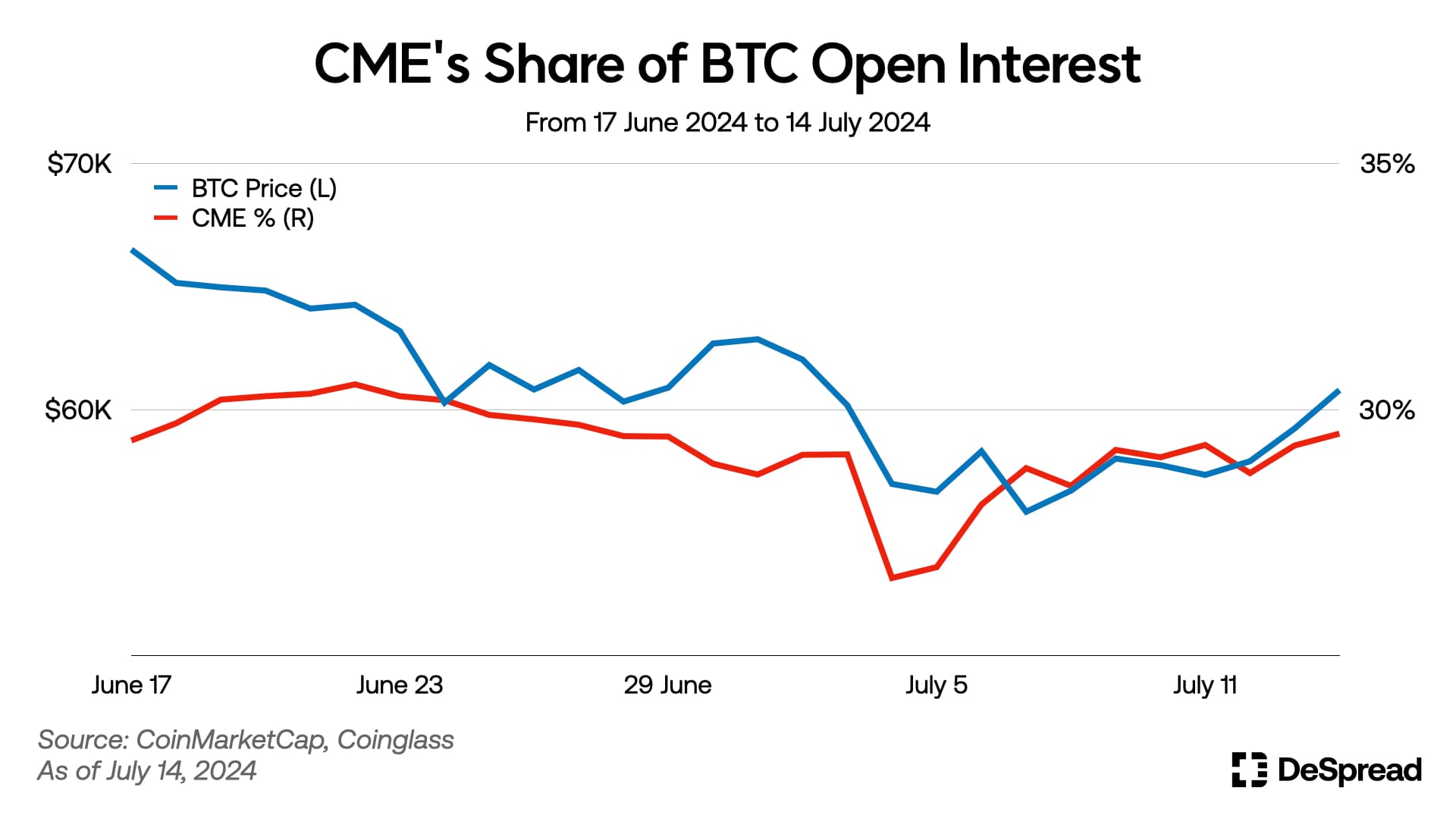

The Chicago Mercantile Exchange (CME) is one of the world's largest derivatives exchanges and has been offering Bitcoin futures trading since December 2017. As a derivatives exchange regulated by the Commodity Futures Trading Commission (CFTC), CME allows trading only by individuals and institutions that meet the financial resources and credit standards required by both the CFTC and CME. Consequently, most of CME's members are financial institutions such as asset managers and hedge funds that manage large-scale assets.

Due to these stringent requirements, the open interest (OI) on CME (the number of outstanding futures contracts) is considered a key indicator for gauging institutional activity. Since the approval of Bitcoin spot ETFs, CME's share of total Bitcoin open interest rose to a peak of 33% by the end of March. Although it briefly fell to 27% in early May, it has since rebounded.

As shown in the graph, over the past month (June 17 to July 14), CME's share of Bitcoin open interest has remained stable in the 29% to 30% range. It reached a short-term low of 26.6% on July 5 but has steadily increased since then, currently standing at around 30%.

3. Korean Centralized Exchanges

3.1 Listing Trends and Coinone's Moves

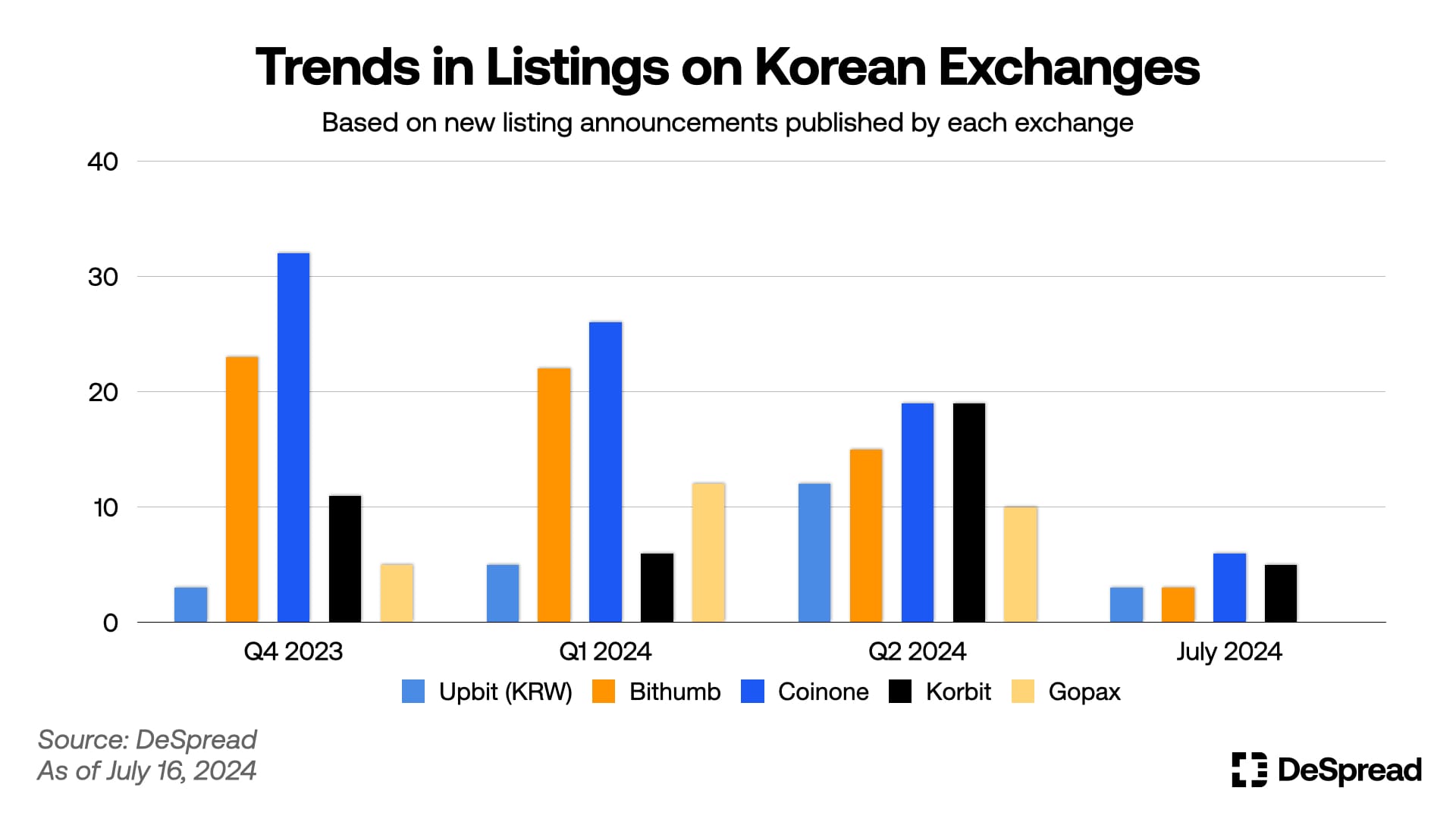

The graph illustrates the listing trends on the top five Korean exchanges (Upbit, Bithumb, Coinone, Korbit, and Gopax) from Q4 2023 to July 2024. For Upbit, only listings in the KRW market were considered. The total number of listings across the five exchanges remained relatively stable, with 74 listings in Q4 2023, 71 in Q1 2024, and 75 in Q2 2024.

Among these, Coinone has consistently led in the number of listings, adopting the most aggressive listing strategy. Not only has Coinone been prolific in the number of listings, but it has also shown a notable focus on the memecoin sector. In June, Coinone listed Cat in a Dog's World (MEW) and Book of Meme (BOME), followed by Brett (BRETT) and Wen (WEN) in July. This aggressive approach to listing memecoins highlights Coinone's quick adaptation to market trends, which started with the listings of MEME and BONK in Q4 2023.

[Memecoin Listings by Exchange During Analysis Period]

- Upbit: No cases

- Bithumb: BONK (May 2024), MEW (June 2024), BRETT (July 2024) - Total 3 cases

- Coinone: MEME (November 2023), BONK (December 2023), MYRO (February 2024), MEW (June 2024), BOME (June 2024), BRETT (July 2024), WEN (July 2024) - Total 7 cases

- Korbit: BONK (April 2024) - Total 1 case

- Gopax: No cases

Bithumb consistently ranks second in terms of the number of listings, while Upbit, the largest exchange in South Korea, showed a more cautious approach to new listings until Q1 2024. However, since Q2 2024, Upbit has become more active in listing new cryptocurrencies, increasing its listing count from 5 in the previous quarter to 12. This shift indicates that the competition for trading volume share among major Korean exchanges is becoming increasingly fierce.

3.2 Competition for Third Place

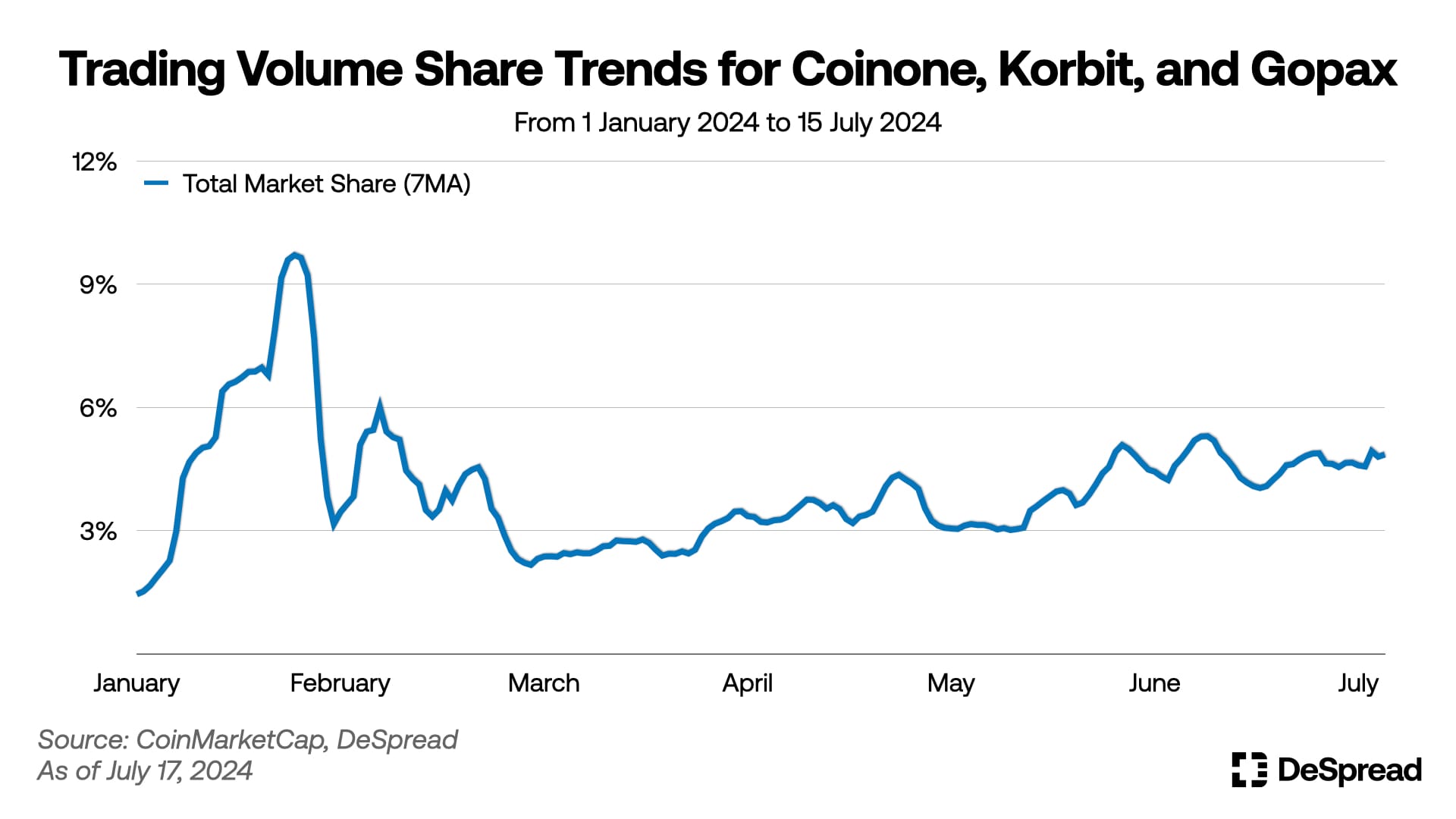

In the Korean cryptocurrency market, the trading volume share of the top five exchanges is predominantly held by Upbit and Bithumb, which together account for approximately 95% of the market. Coinone, Korbit, and Gopax share the remaining market share. In January 2024, the combined trading volume share of Coinone, Korbit, and Gopax (based on a 7-day moving average) surged past 9%. This spike was largely attributed to Korbit’s event focused on WEMIX trading volume during that month.

The combined market share of these three exchanges dropped below 3% by March, but it has been gradually increasing since then, reaching around 4-5% as of the time of writing.

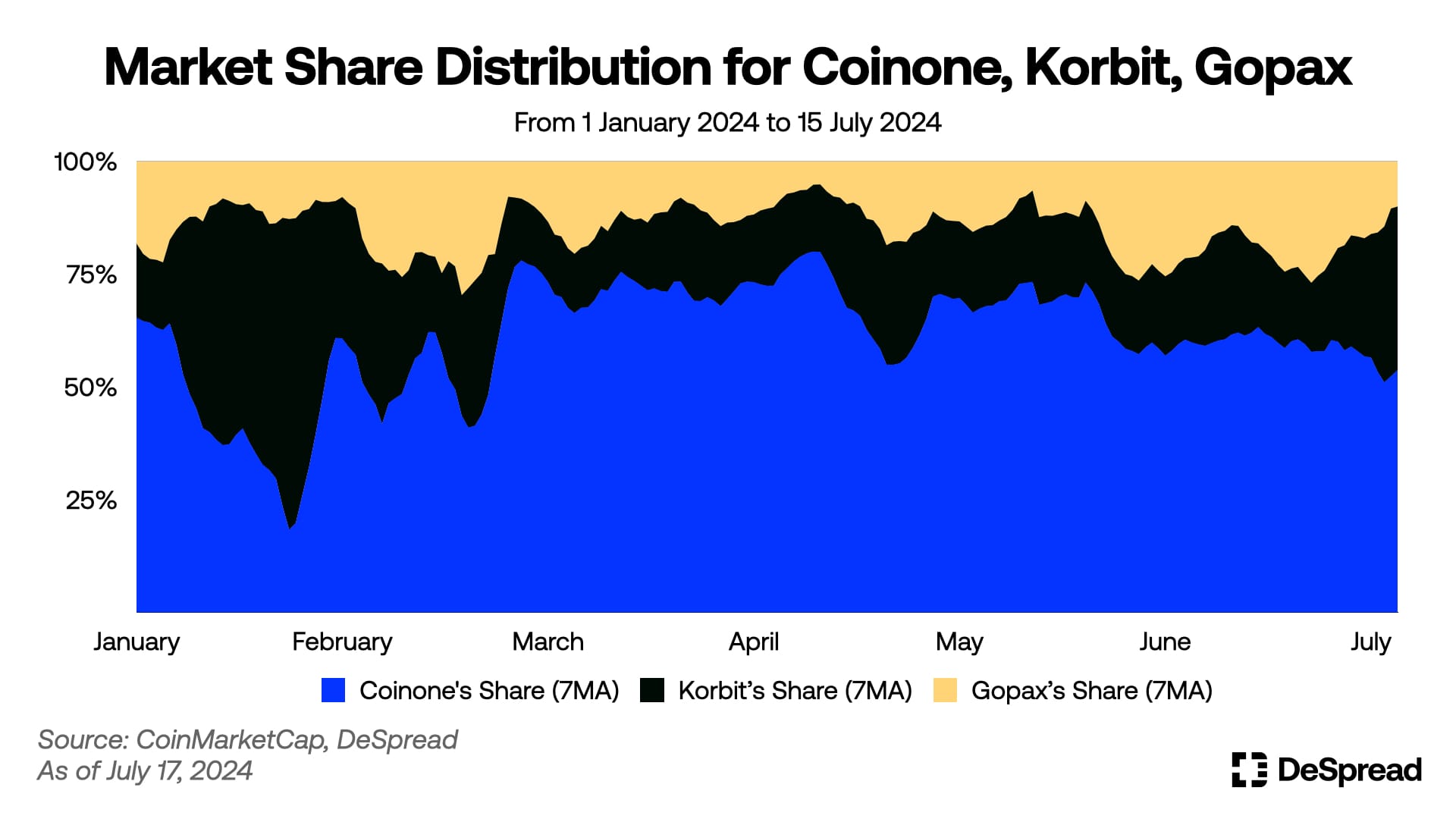

Analyzing the distribution of trading volume shares among Coinone, Korbit, and Gopax, Coinone consistently maintains the third position with a market share exceeding 50% for most periods. Nonetheless, in January, Korbit’s market share briefly soared to 88.8% due to the WEMIX deposit and trading volume event.

All three exchanges—Coinone, Korbit, and Gopax—are actively listing new cryptocurrencies and conducting trading support events to attract users and increase trading volumes. The ongoing efforts of Korbit and Gopax to challenge Coinone’s seemingly stable third-place position make the competition dynamic and worth watching.

3.3 Upbit's Strength in Bull Markets, Competitors' Strength in Bear Markets

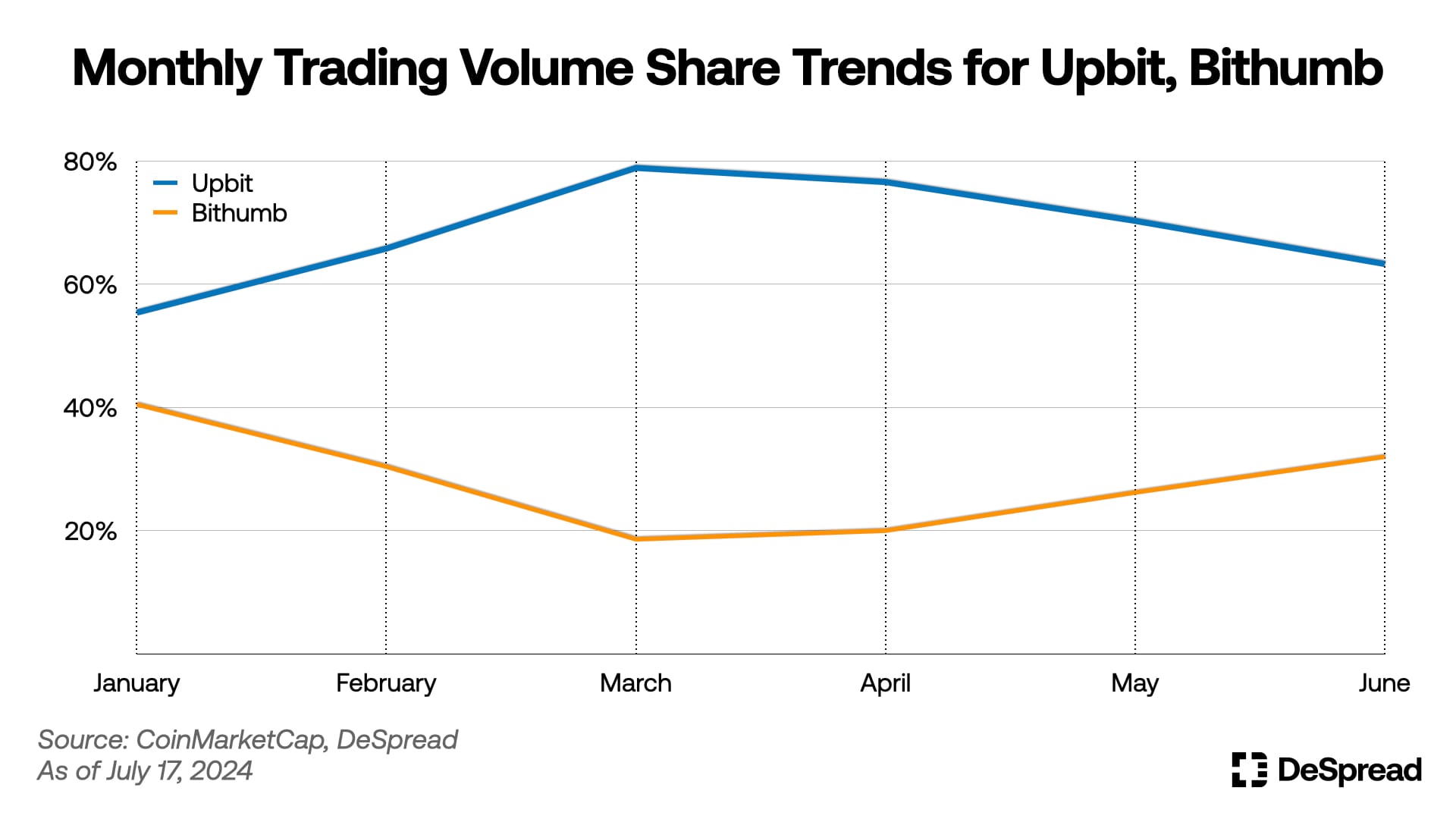

As previously expounded in "DI - 04: Market Commentary," Upbit has displayed a remarkable knack for dominance, commanding up to 80% of the market share. During the euphoric bull market of Q1 2024, Upbit's share catapulted from 55.4% in January to a staggering 78.9% in March. Meanwhile, Bithumb's market share tumbled from 40.5% to a mere 18.6%, underscoring Upbit's unrivaled ability to ride the bullish wave.

However, as the cryptocurrency market found itself in the tempestuous waters of a correction in Q2 2024, the gap between Upbit and Bithumb's market shares began to narrow. Upbit's market share dipped from its zenith of 78.9% in March to a more modest 63.3% in June, a drop of roughly 16%. Bithumb, on the other hand, its market share rose from 18.6% to 32% during the same period.

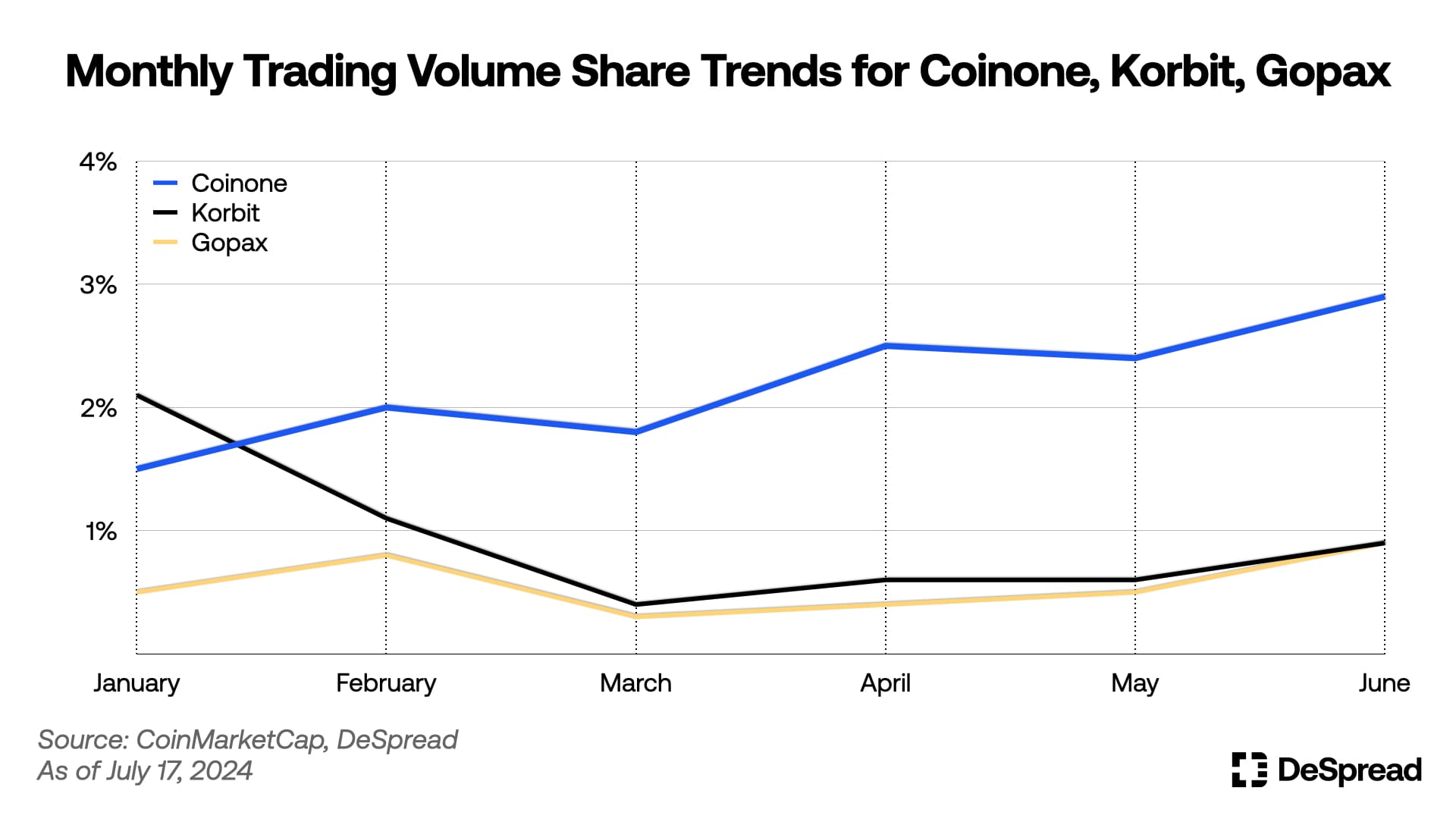

Like Bithumb, the other three exchanges—Coinone, Korbit, and Gopax—also saw an uptick in their trading volume market share during the market correction phase. Coinone, in particular, enjoyed a meteoric rise, with its monthly trading volume market share climbing from 1.8% in March to 2.9% in June, marking an impressive growth rate of approximately 61%.

4. Act on the Protection of Virtual Asset Users and Common Guidelines

On July 19, the first phase of the Act on the Protection of Virtual Asset Users (hereafter referred to as the Virtual Asset Act) will come into effect. This legislation focuses on defining virtual assets, protecting investor funds, regulating unfair trading practices, and enhancing the supervisory authority of financial regulators. For a detailed background and specifics of the Virtual Asset Act, please refer to the previous article "Crypto Regulation in South Korea: An Overview."

Market participants are particularly interested in the common guidelines for listing and delisting the over 600 currently supported virtual assets under this act. These guidelines, jointly developed by the Financial Supervisory Service (FSS) and the Digital Asset Exchange Alliance (DAXA), apply equally to domestic companies and international projects, significantly impacting future trends in the Korean virtual asset market.

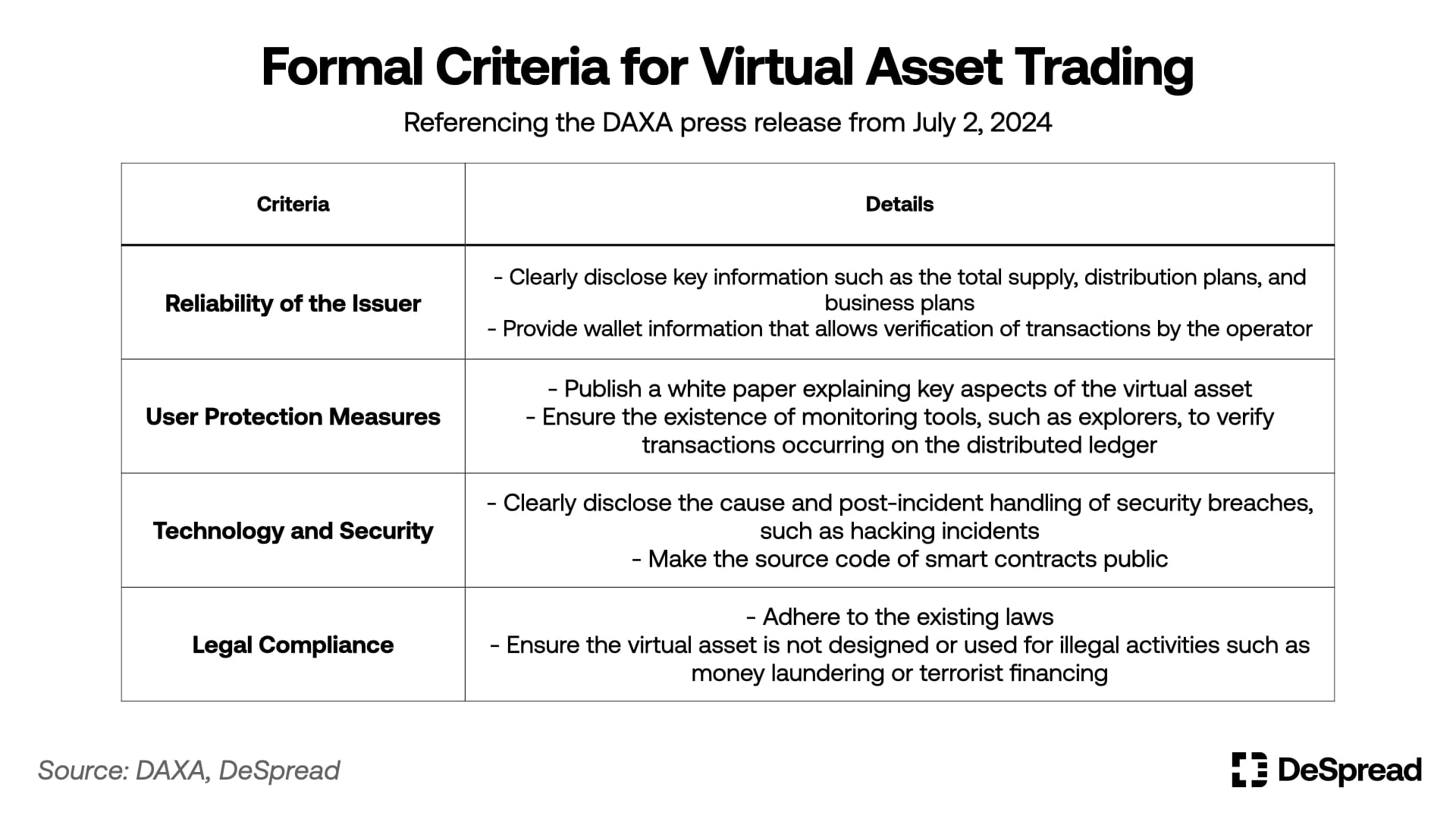

According to a press release from DAXA on July 2, the evaluation of new virtual asset listings will incorporate both formal and qualitative criteria, with maintenance reviews conducted quarterly. The formal criteria include absolute requirements that, if not met, will preclude the asset from being listed. The qualitative criteria involve a comprehensive evaluation of various factors related to the virtual asset. Key points of the formal criteria disclosed by DAXA are as follows:

While the primary goal of the first phase of the Virtual Asset Act was to establish basic order to protect investors by regulating unfair trading, the upcoming second phase of legislation will need to address additional market order establishment, including the refinement of issuance, disclosure, and distribution regulations, as well as the diverse fields of the blockchain industry.

In refining the regulations for issuance, disclosure, and distribution, the focus will be on moving away from the uniform regulations applied to virtual assets and virtual asset businesses in the first phase. Instead, the second phase aims to apply segmented regulations based on the functions and underlying assets of virtual assets, as well as the types of services provided by businesses.

Moreover, to promote the overall development of the domestic virtual asset industry beyond user protection, it is essential to revamp regulations, especially in areas that lack comprehensive regulation compared to other countries. These areas include the issuance and distribution of stablecoins, the blockchain gaming industry, and regulations for virtual asset spot ETFs. By doing so, the Korean market can enhance its competitiveness on the global stage.

References

- 국민대학교 법학연구소, 가상자산 이용자 보호법의 한계와 새로운 가상자산기본법 제정 방안

- DAXA, 가상자산거래소, 신규•기존 가상자산 거래지원 관련 모범사례 마련 및 시행

- CNBC, The German government owns around $2 billion in bitcoin

- Sachsen.de, Ermittlungsverfahren gegen die Betreiber von movie2k.to

- DOJ, U.S. Attorney Announces Historic $3.36 Billion Cryptocurrency Seizure And Conviction In Connection With Silk Road Dark Web Fraud

- CNBC, Mt. Gox begins repaying bitcoin to creditors a decade after exchange’s collapse

- CNBC, Bitcoin launderer pleads guilty, admits to massive Bitfinex hack