DI - 06: Market Commentary | 08. 09.

Crypto Market Trends in Data

1. Introduction

After surging following the Trump shooting incident, the Bitcoin price traded sideways between $62K and $70K for about two weeks until the end of July, going through major events such as the commencement of Ethereum spot ETF trading, Mt. Gox repayment, and Trump's speech at the Bitcoin Conference. During the same period, while the net inflow of Bitcoin spot ETFs steadily increased, the price of Bitcoin declined by about 17% in early August due to the instability of the macro economy triggered by Japan's interest rate hike and events such as the Israel-originated war, returning most of the price gains after the Trump shooting incident.

This article examines trends in the crypto asset market, spot ETF fund inflows, and U.S. presidential election approval rating trends.

2. Market Trends and Major Issues

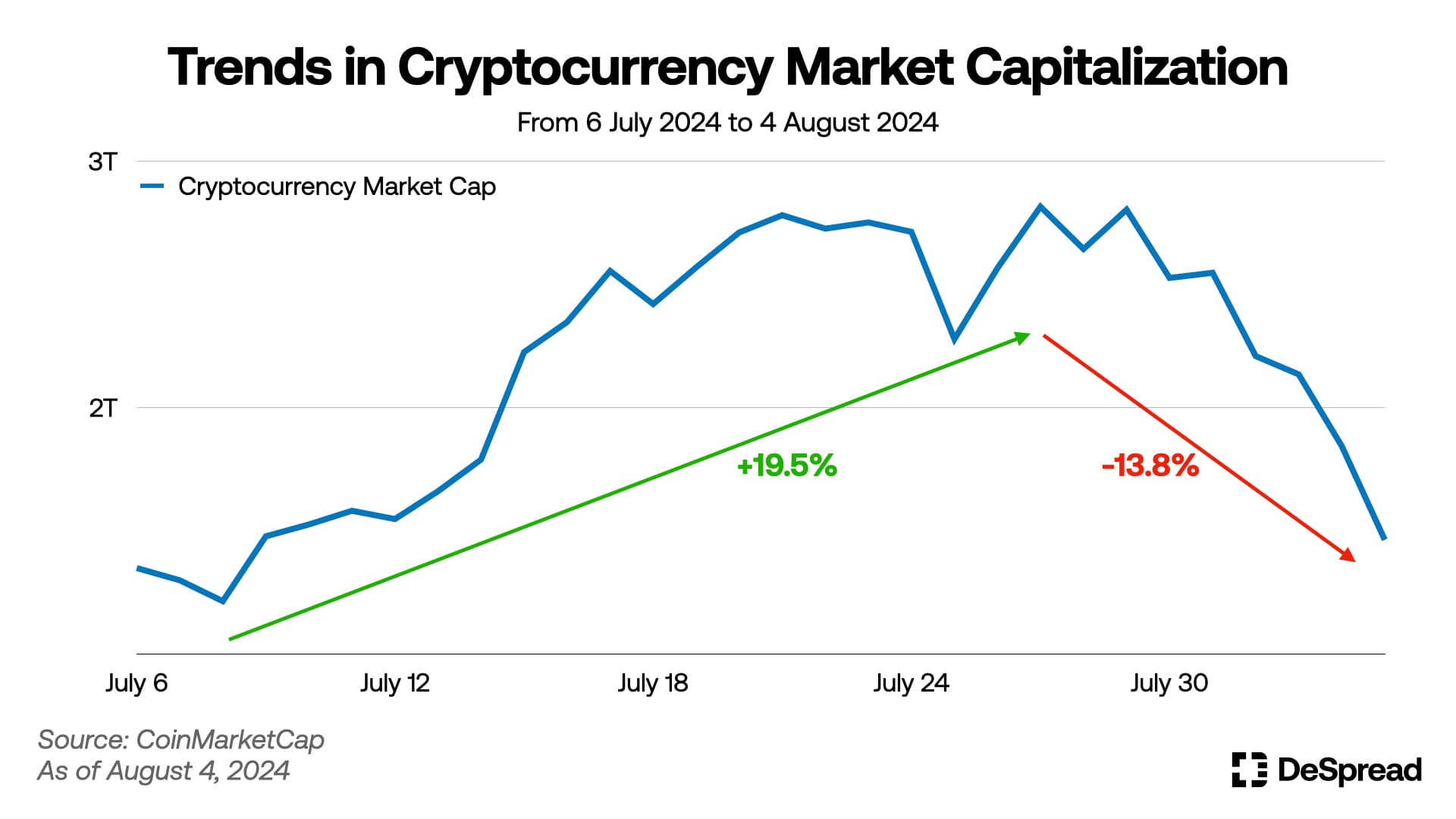

After the German government's sale of all its BTC holdings discussed in the previous DI-05, the crypto asset market recorded an upward trend starting from the Trump shooting incident. With the addition of positive events such as the commencement of Ethereum spot ETF trading on July 23 and Trump's declaration of utilizing Bitcoin as a federal reserve at the Bitcoin Conference speech on July 28, the total market cap of crypto assets rose by about 20% from $2.05T to $2.45T in July.

However, from the end of July, events such as the Bank of Japan (BOJ) interest rate hike, heightened tension of the Israel-Iran war, and weak U.S. employment indicators occurred, and the total market cap of crypto assets fell by about 14% in just 5 days after July 29.

The aforementioned events had a significant impact on global finance, especially on the East Asian stock market, including the crypto asset market. On August 5, both the KOSPI and KOSDAQ indexes fell more than 8% during the day, triggering the *sidecar and *circuit breaker, and trading was suspended for about 20 minutes. Japan's Nikkei index also fell by about 12.4%, recording the largest drop since 1987. In addition, during the same period, the price of Bitcoin showed a fluctuation range of up to 17%, falling from $59.5K to $49K.

*Circuit breaker: A mechanism triggered when the KOSPI or KOSDAQ index falls more than 8% compared to the previous day's closing index and persists for more than 1 minute. When triggered, all orders for stocks, futures, options, etc. are suspended for 20 minutes.

2.1. August 5 Black Monday

'Black Monday' refers to the stock market crash that occurred on Monday, October 19, 1987 at the New York Stock Exchange (NYSE), causing a stock market crash from Hong Kong to Europe and the United States. The global stock market plunge that started with the decline of the Nikkei index on August 5 reminded the market of 'Black Monday'.

This chapter examines the background of the global stock market crash that occurred last Monday.

2.1.1. BOJ Interest Rate Hike

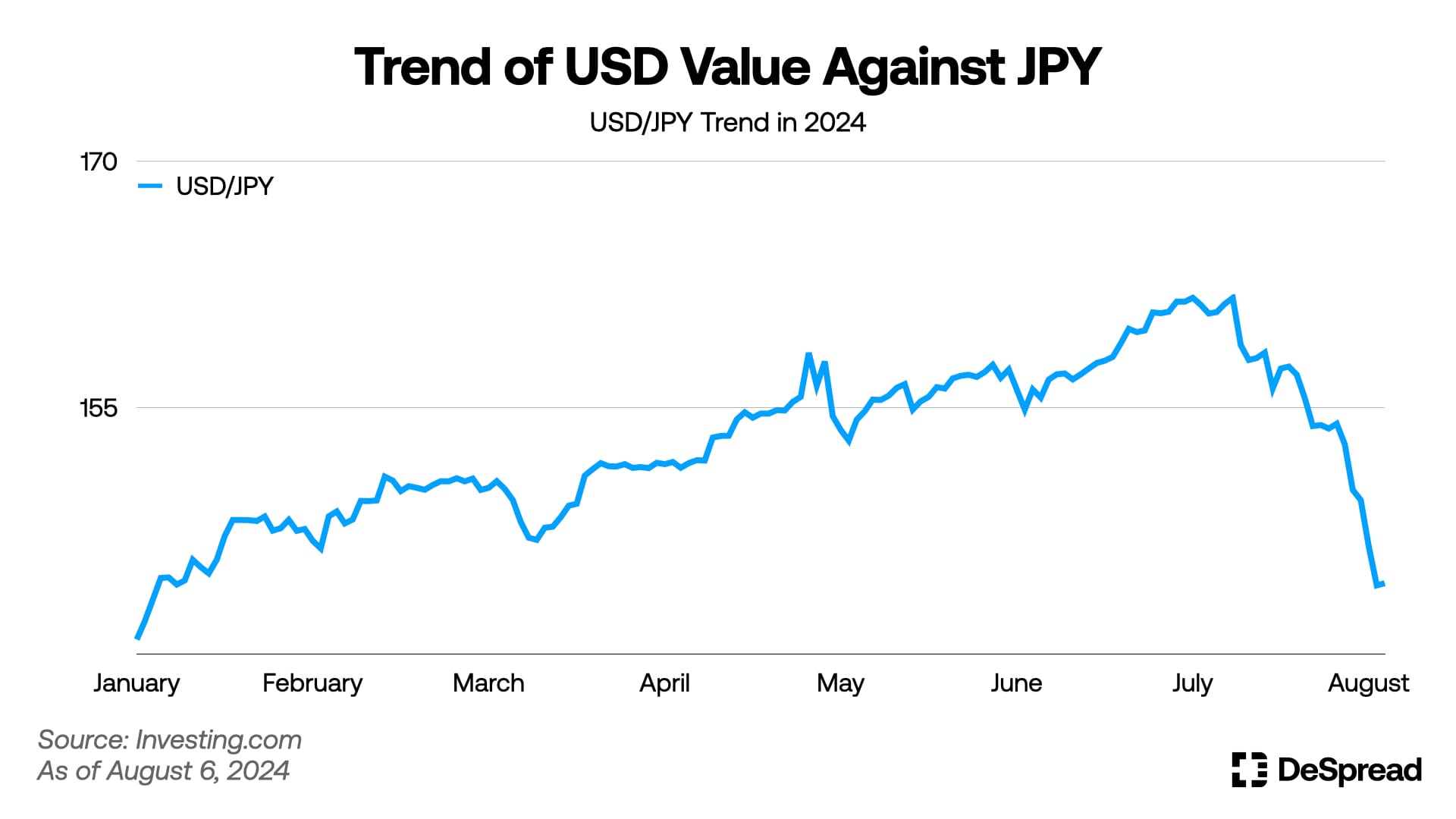

In March 2024, the Bank of Japan raised its benchmark interest rate to 0%~0.1% to curb the yen's weakness, lifting the negative interest rate maintained since 2016. However, as the value of the dollar against the yen continued to rise, the Bank of Japan took a bold move on July 31 and raised the benchmark interest rate to 0.25%. In addition, it announced that it would gradually reduce the scale of Japanese government bond purchases from the current 6 trillion yen per month to around 3 trillion yen by March 2026.

The Bank of Japan's announcement of an interest rate hike and a reduction in the scale of government bond purchases caused a sharp decline in the value of the dollar against the yen. From August 1 to 5, USD/JPY fell by up to 8% from 154 to 141.6, which led to a decrease in the yield of the yen carry trade.

The yen carry trade is a strategy of borrowing low-interest yen and investing in other financial products, which gained popularity among many investors and institutions after the Bank of Japan switched its benchmark interest rate to negative in 2016. However, as the value of the yen began to rise due to Japan's recent interest rate hike announcement, yen borrowers under pressure to repay debts began selling their holdings of financial products, and this hit the global stock market.

2.1.2. Weak U.S. Employment Indicators

In the U.S. employment report released on August 2, the number of non-farm payrolls in July was 114,000, significantly below expectations (175,000), and the unemployment rate was 4.3%, the highest since October 2021, 0.2% higher than expected. As a result, concerns about an economic slowdown increased, and the base scenario was changed to a 50bp rate cut instead of 25bp at the September FOMC (Federal Open Market Committee).

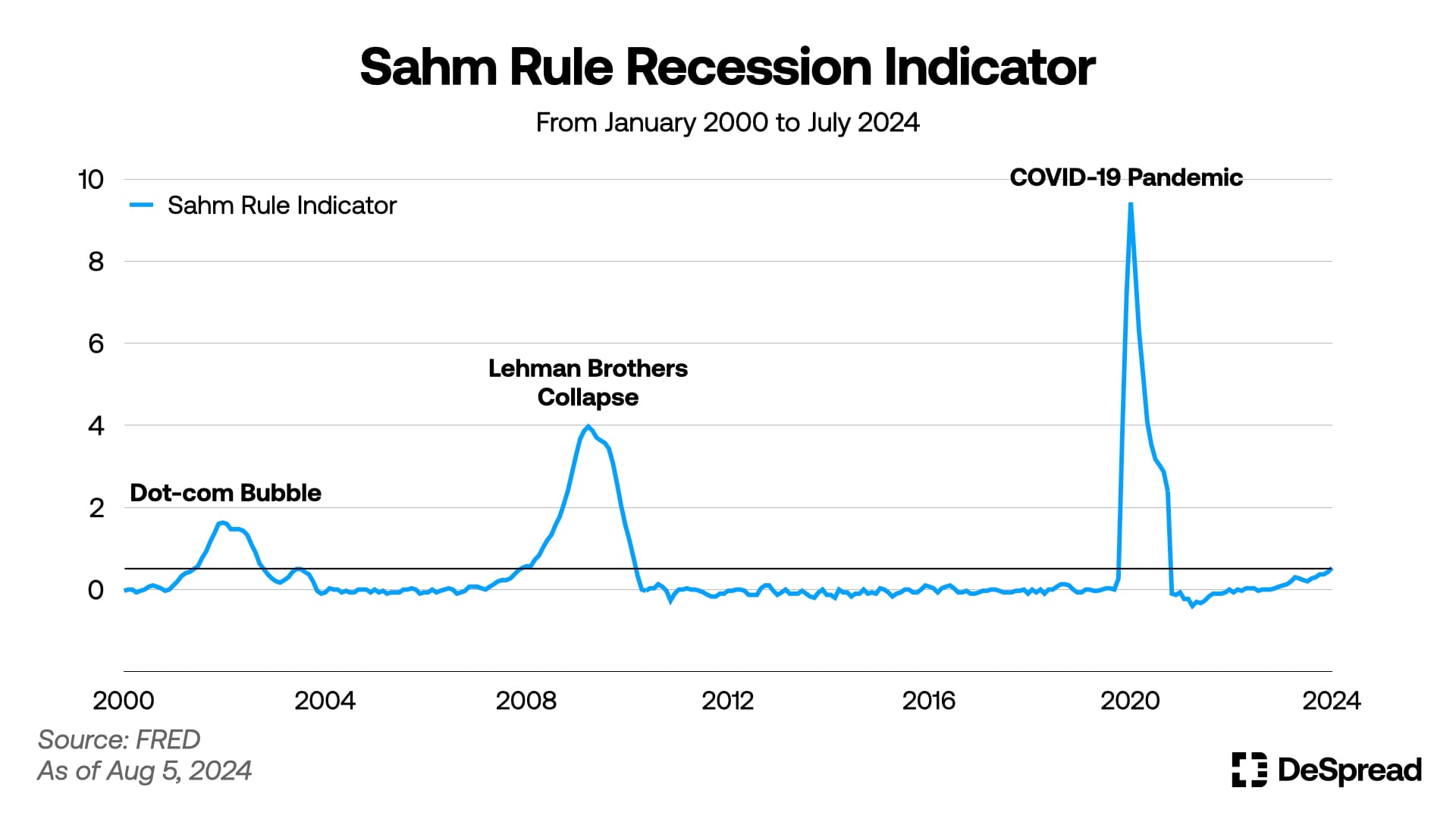

The Sahm Rule, an indicator signaling the start of a recession when the 3-month moving average of the unemployment rate rises by 0.5% or more compared to the minimum of the previous 12 months' 3-month average, also reached the threshold, heightening recession concerns. However, some argue that the recent rise in unemployment rate may have been somewhat exaggerated due to the surge in unemployment during the pandemic and the recent increase in labor supply due to a surge in immigrants, making it difficult to view it as a clear sign of a recession.

Concerns about an economic slowdown due to weak U.S. employment indicators, along with the aftermath of the aforementioned Japanese interest rate hike, impacted not only U.S. stock markets such as the Nasdaq and S&P 500 but also the plunge in East Asian stock markets, including South Korea and Japan. In addition, heightened geopolitical tensions in the Middle East also negatively affected global stock markets.

The crypto asset market was also affected by these macroeconomic factors. In addition, the sale of ETH worth $368.2M, estimated to be held by Jump Trading, which is under investigation by the U.S. Commodity Futures Trading Commission (CFTC), outflows from Ethereum spot ETFs, and a decline in the possibility of Donald Trump, who is pro-crypto, being elected due to the rise in Kamala Harris' approval rating, put further pressure on the market.

The issues within the crypto asset market mentioned above will be examined in more detail below.

3. ETF Flow

3.1. Bitcoin Spot ETF

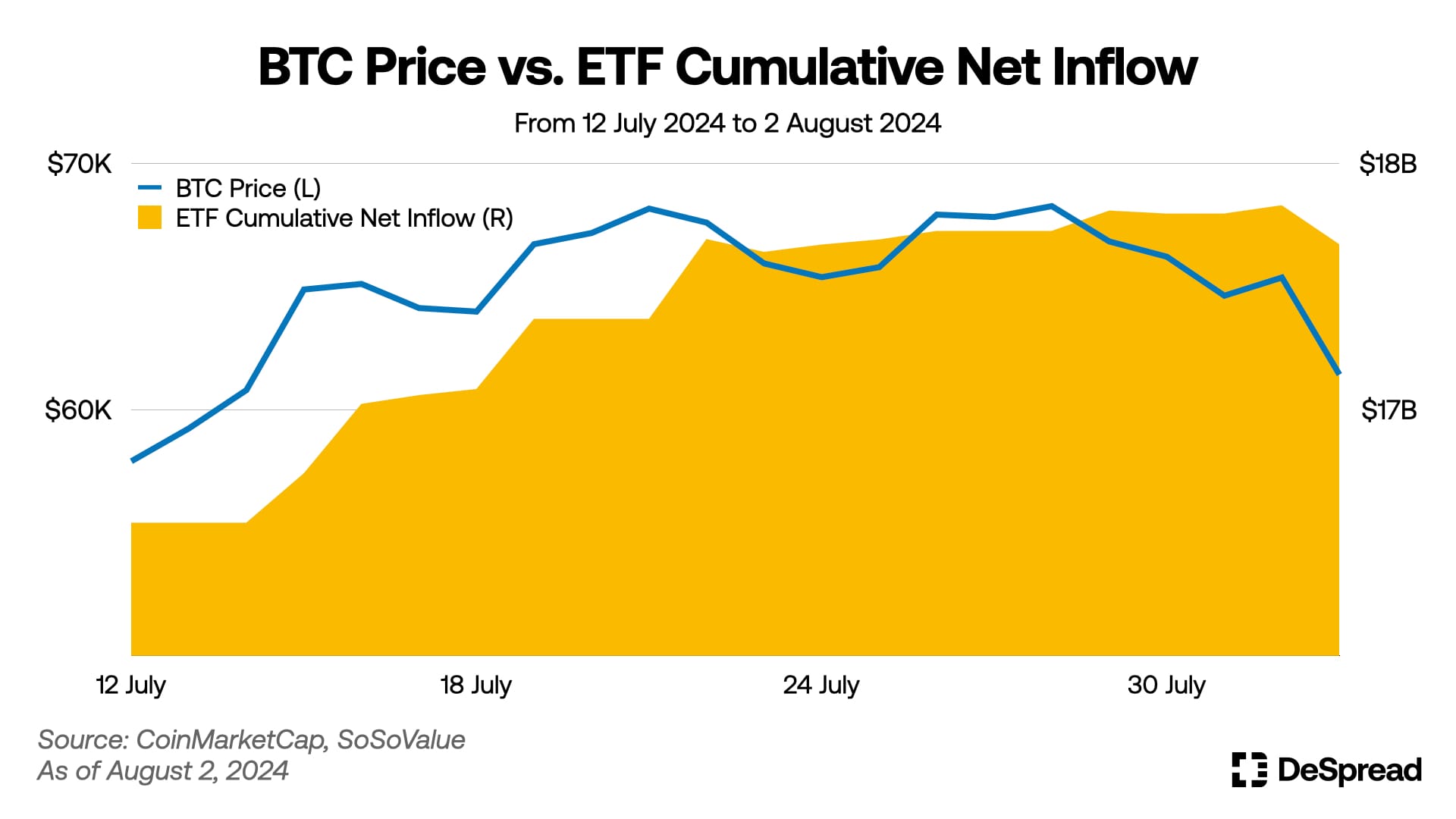

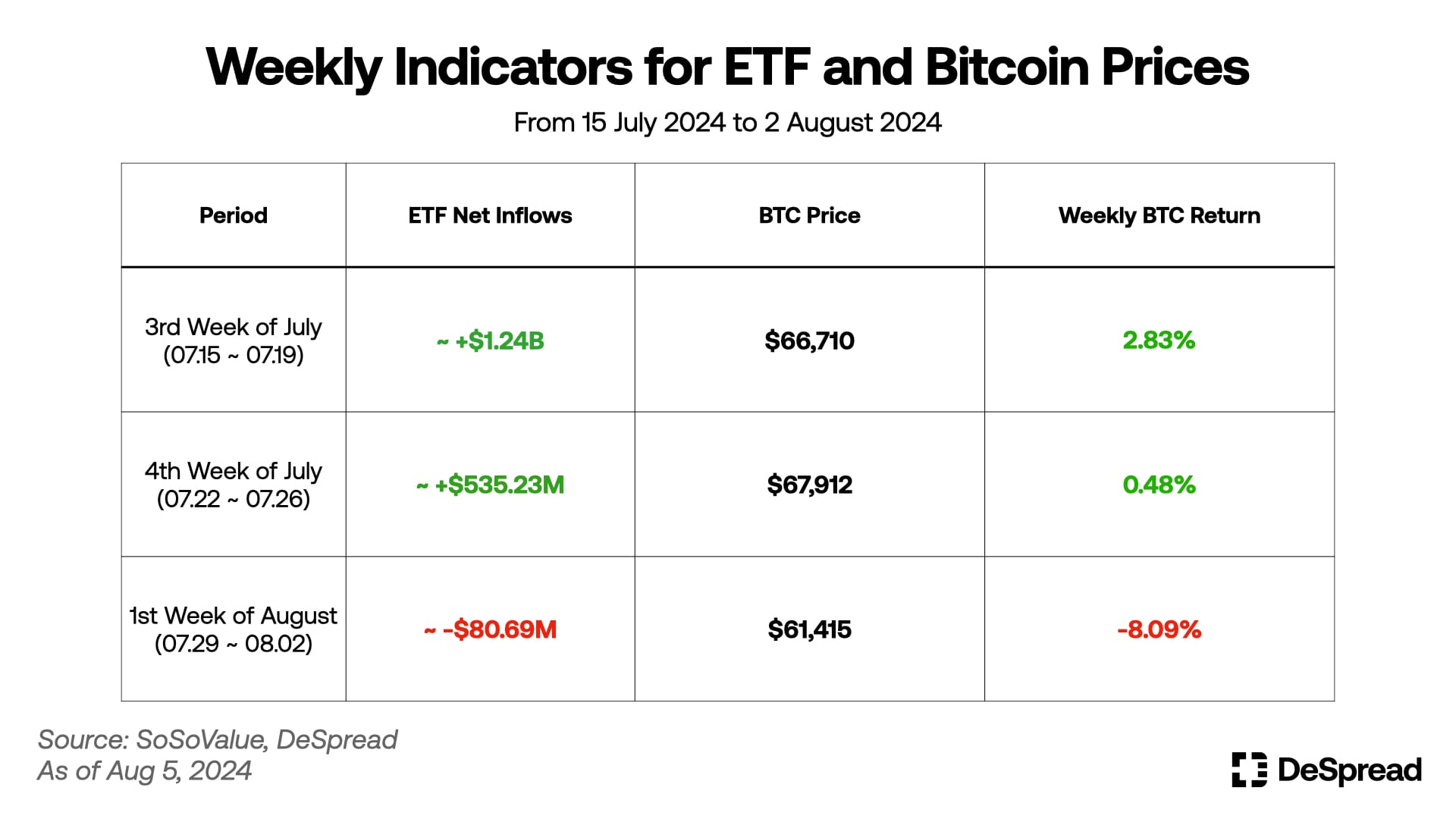

The graph above shows the Bitcoin price trend and the cumulative net inflow of Bitcoin spot ETFs from July 12 to August 2, 2024. As of August 2, the fund size of Bitcoin spot ETFs is as follows:

- Total net assets held by spot ETFs: $57.2B / 4.71% of Bitcoin's total market cap

- Cumulative net inflow: $17.5B

From mid-July to early August, the size of ETF fund net inflows and the Bitcoin price generally showed the same direction for three weeks. However, in the first week of August, the BTC price showed a large drop of about 8% due to the impact of the events mentioned earlier.

3.2. Ethereum Spot ETF

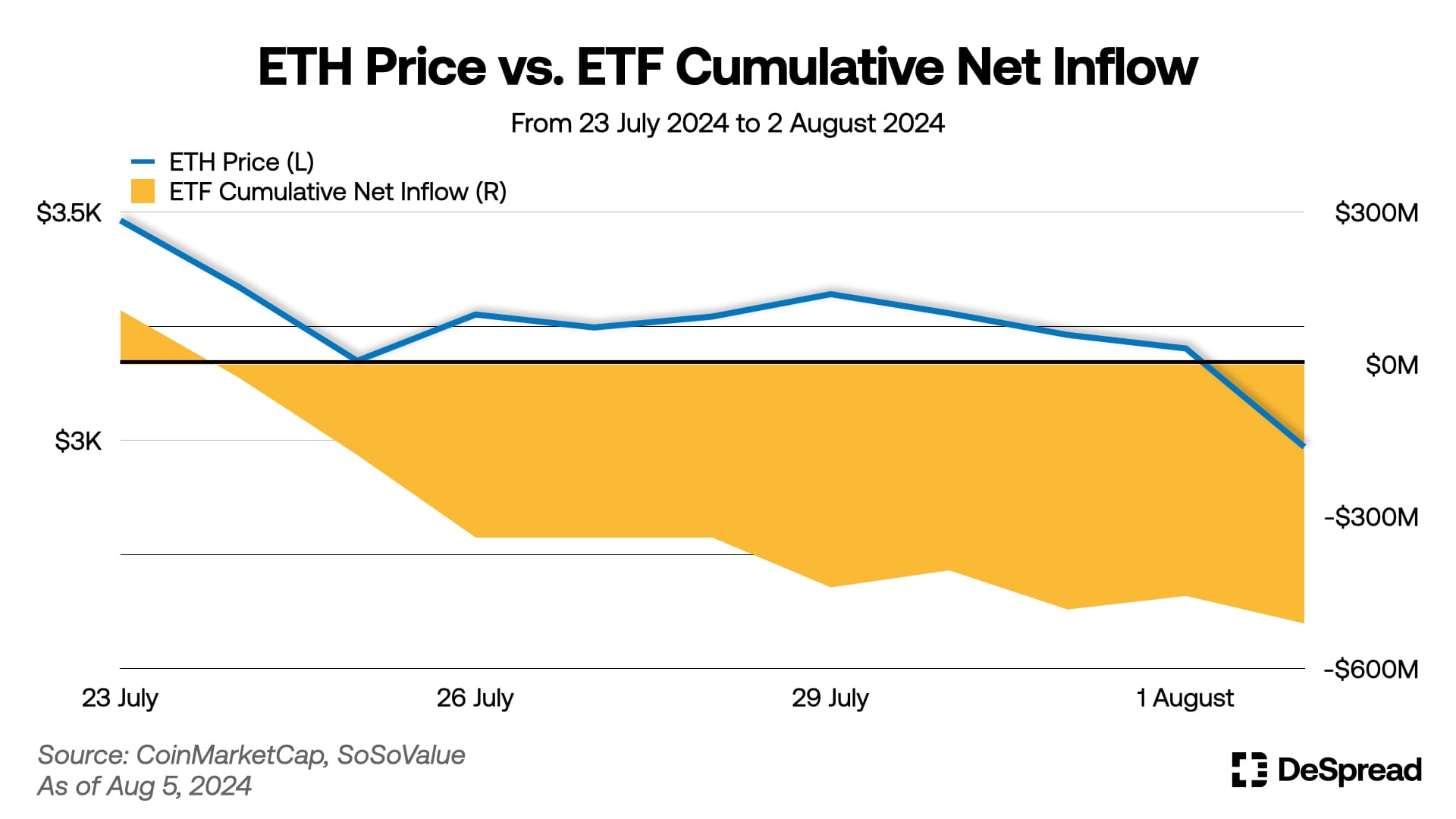

The graph above shows the Ethereum price trend and the cumulative net inflow of Ethereum spot ETFs from July 23, 2024, the start date of Ethereum spot ETF trading, to August 2. As of August 2, the fund size of Ethereum spot ETFs is as follows:

- Total net assets held by spot ETFs: $8.33B / 2.32% of Ethereum's total market cap

- Cumulative net inflow: $510.7M

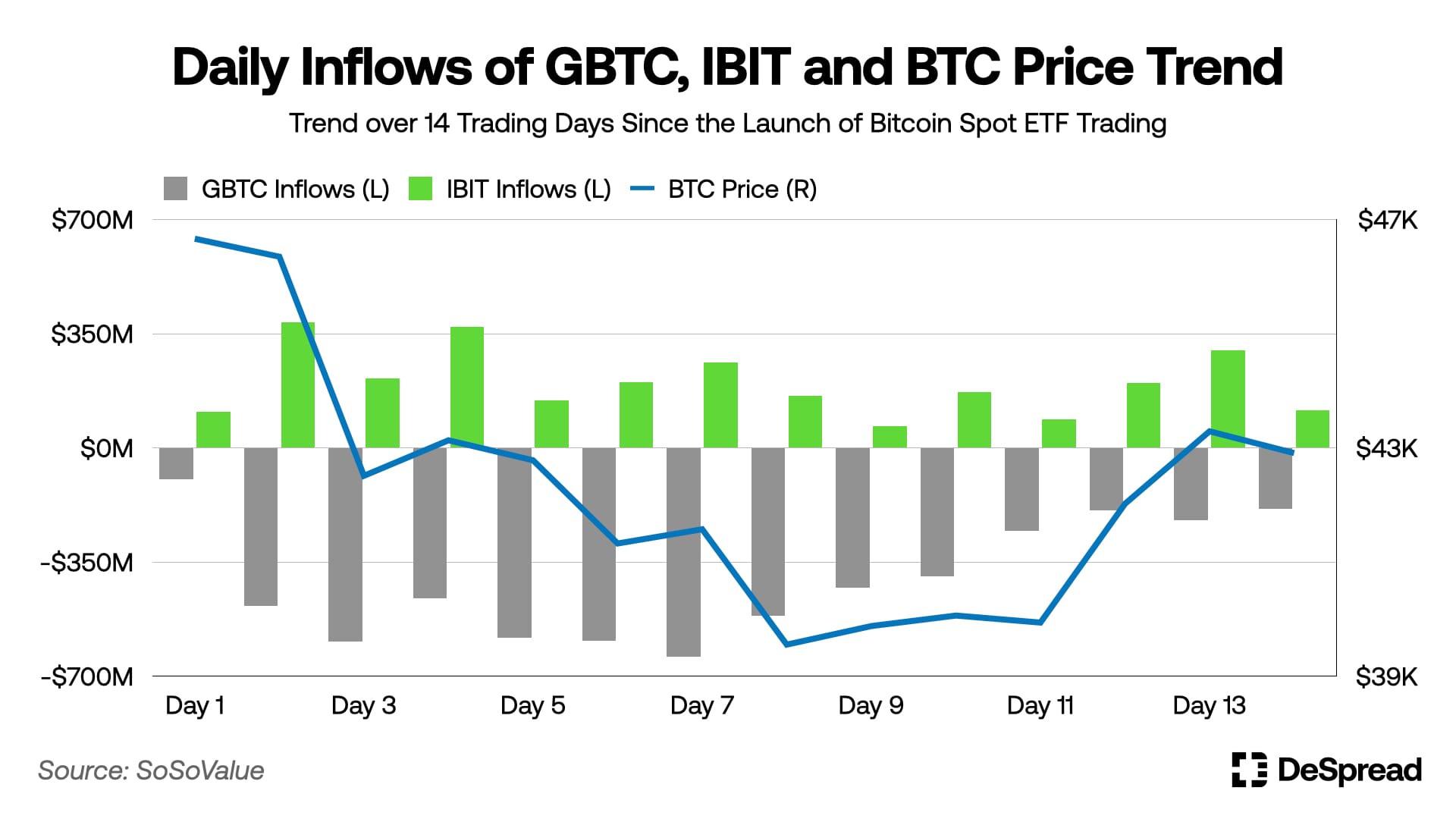

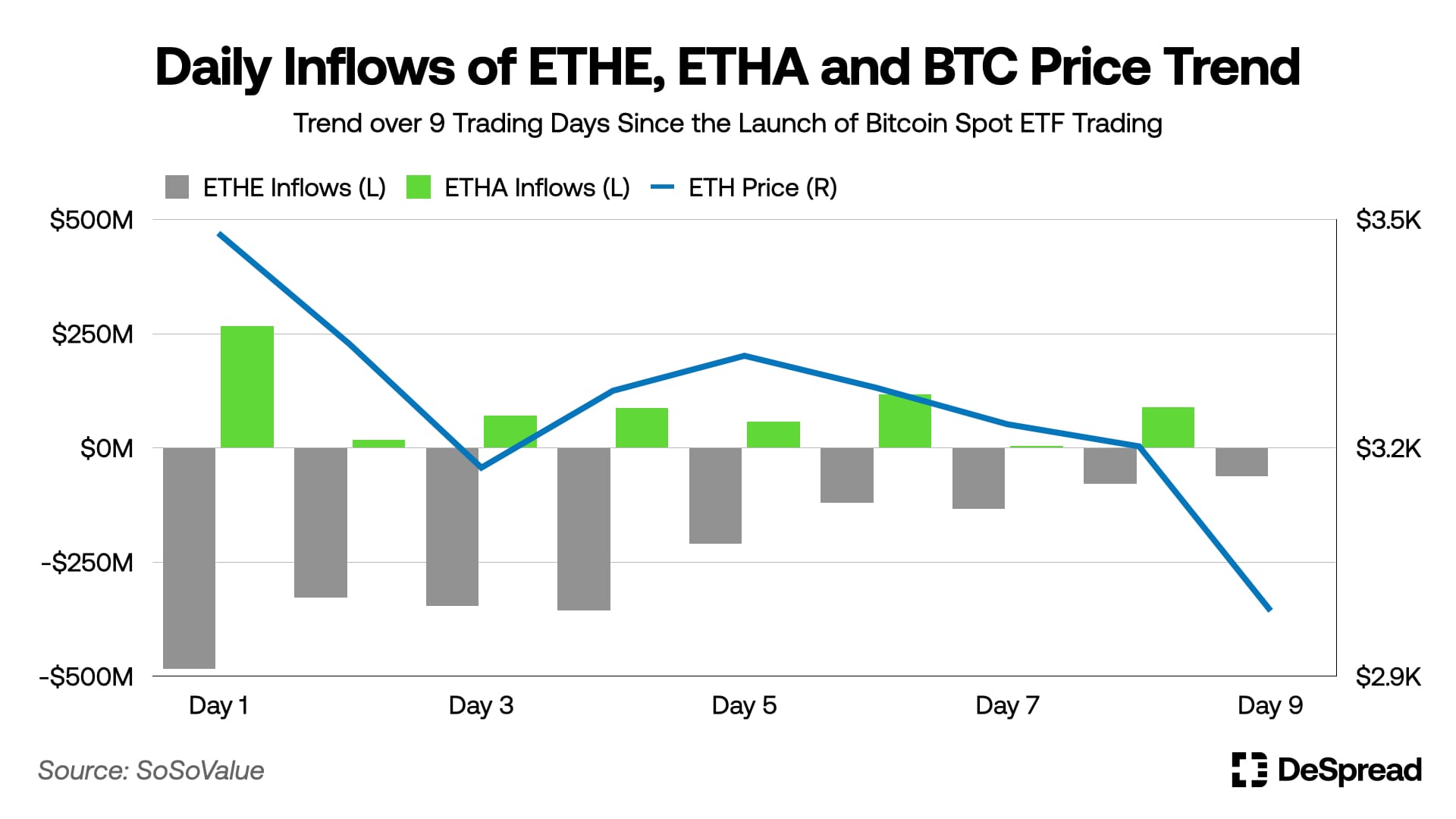

Although most Ethereum spot ETF products showed net inflows after the start of Ethereum spot ETF trading, Grayscale's ETHE product alone saw a net outflow of about $2B, leading ETH's downward trend. This pattern of price decline due to Grayscale's ETF product net outflow can also be found in the early days of Bitcoin spot ETFs.

During the two weeks immediately after the launch of Bitcoin spot ETFs, a total net outflow of $4.8B occurred from Grayscale's GBTC, which has a high fee rate, and the outflow trend continued in the entire ETF, causing the Bitcoin price to drop by about 15%. Afterward, as the outflow speed of GBTC slowed down and net inflows continued into other Bitcoin spot ETF products, led by BlackRock's Bitcoin spot ETF product IBIT, the price of Bitcoin rose by 80% over about two months, reaching a new high of $73.8K.

In Ethereum spot ETFs, the net outflow of Grayscale's ETHE product is rapidly decreasing compared to the initial stage, and BlackRock's Ethereum spot ETF product ETHA is also steadily recording net inflows, showing a similar pattern to the early days of Bitcoin spot ETFs.

4. Polymarket & U.S. Presidential Election

4.1. What is Polymarket?

Polymarket is a prediction market platform where you can bet stablecoins (USDC) on the future outcome of specific topics.

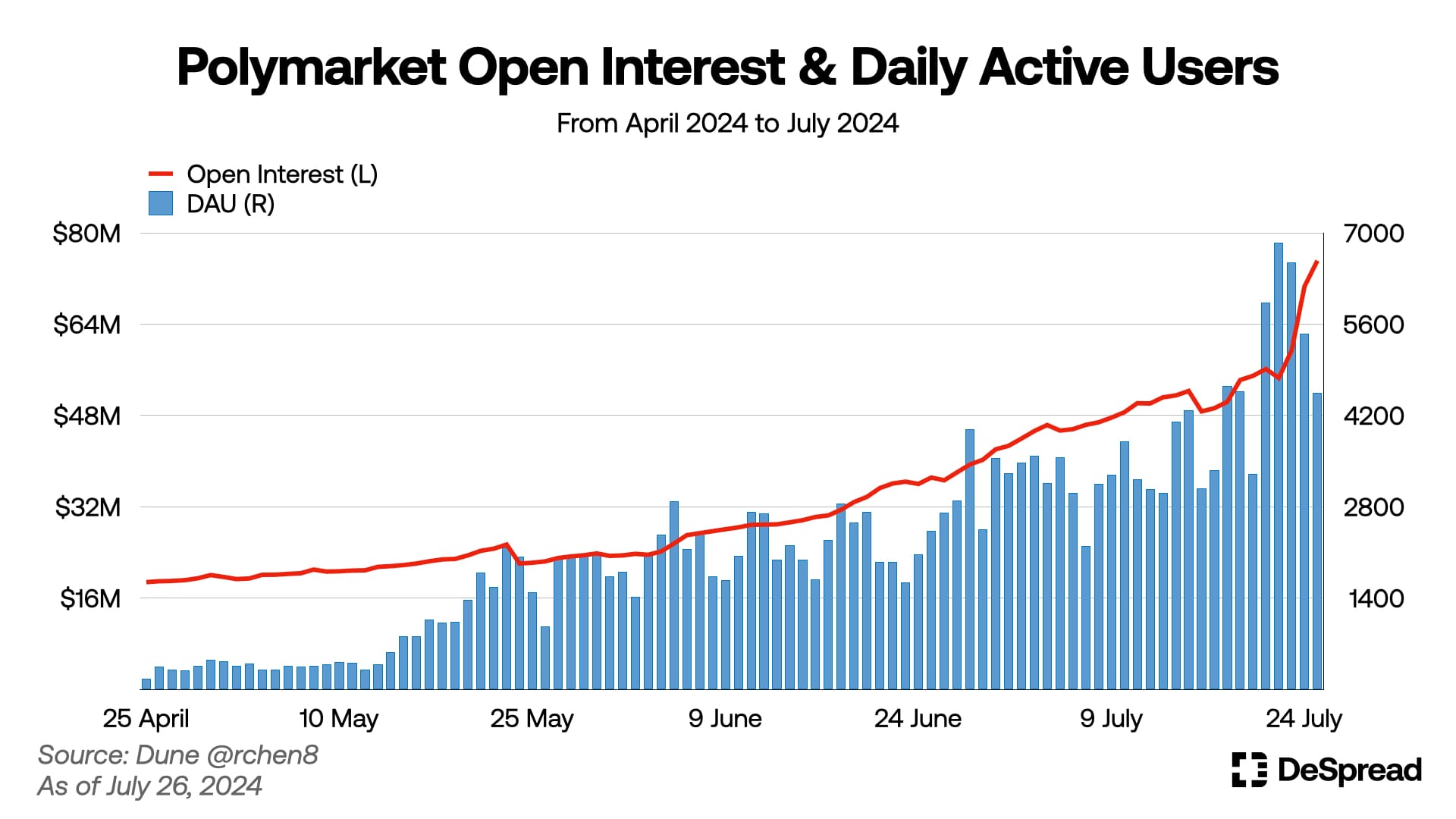

Interest in the U.S. presidential election is growing as major issues such as the Trump shooting incident on July 13 and Biden's resignation on July 21 overlap. Reflecting this trend, as of the writing date (August 2), 8 out of the top 12 topics on Polymarket are related to the U.S. presidential election.

As interest in the election increases and the demand for participating in predicting the results of various events surrounding it rises, the number of daily active users and trading volume on Polymarket is also showing a steady upward trend. Prediction results within Polymarket tend to show a slightly more favorable trend for the pro-crypto camp, which can be seen as a natural result considering that Polymarket is a blockchain and crypto asset-related project.

4.2. U.S. Presidential Race as Seen Through Polymarket

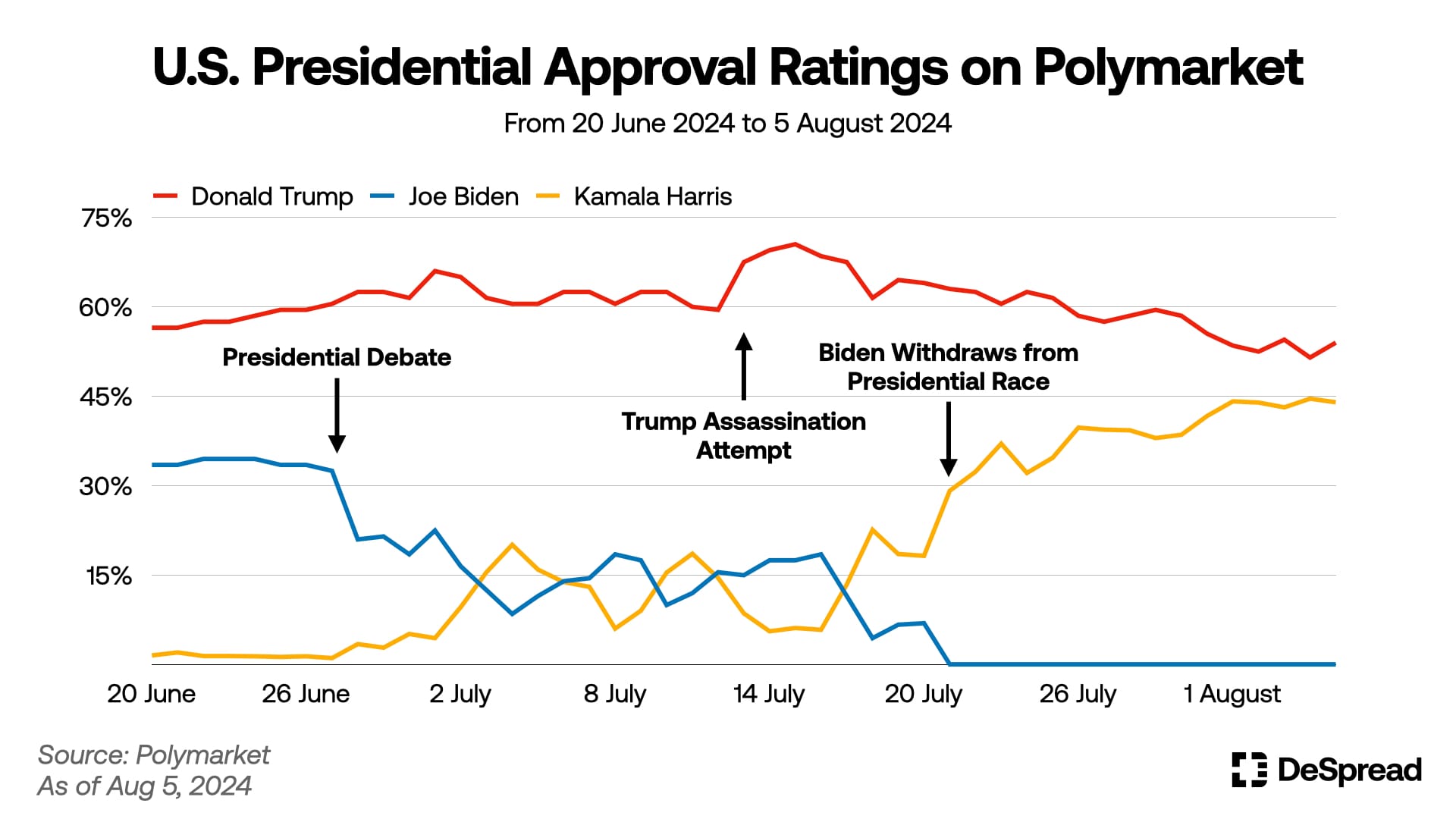

After the presidential debate between Trump and Joe Biden on June 27, the probability of Joe Biden's election on Polymarket decreased sharply, and Kamala Harris emerged as a new presidential candidate from the Democratic Party.

During the same period, Trump maintained an approval rating in the upper 50% to lower 60% range, rising to 71% after the shooting incident. However, it subsequently fell and remained in the 60% range for a while.

On July 21, Joe Biden announced his withdrawal from the presidential candidacy and expressed his position to support Harris as the Democratic presidential candidate. Immediately after that, Harris' predicted probability of being elected rose sharply by about 20%p, and currently stands at 44%, surpassing Joe Biden's predicted probability of being elected before the presidential debate, which was 34.5%, rapidly catching up to Trump.

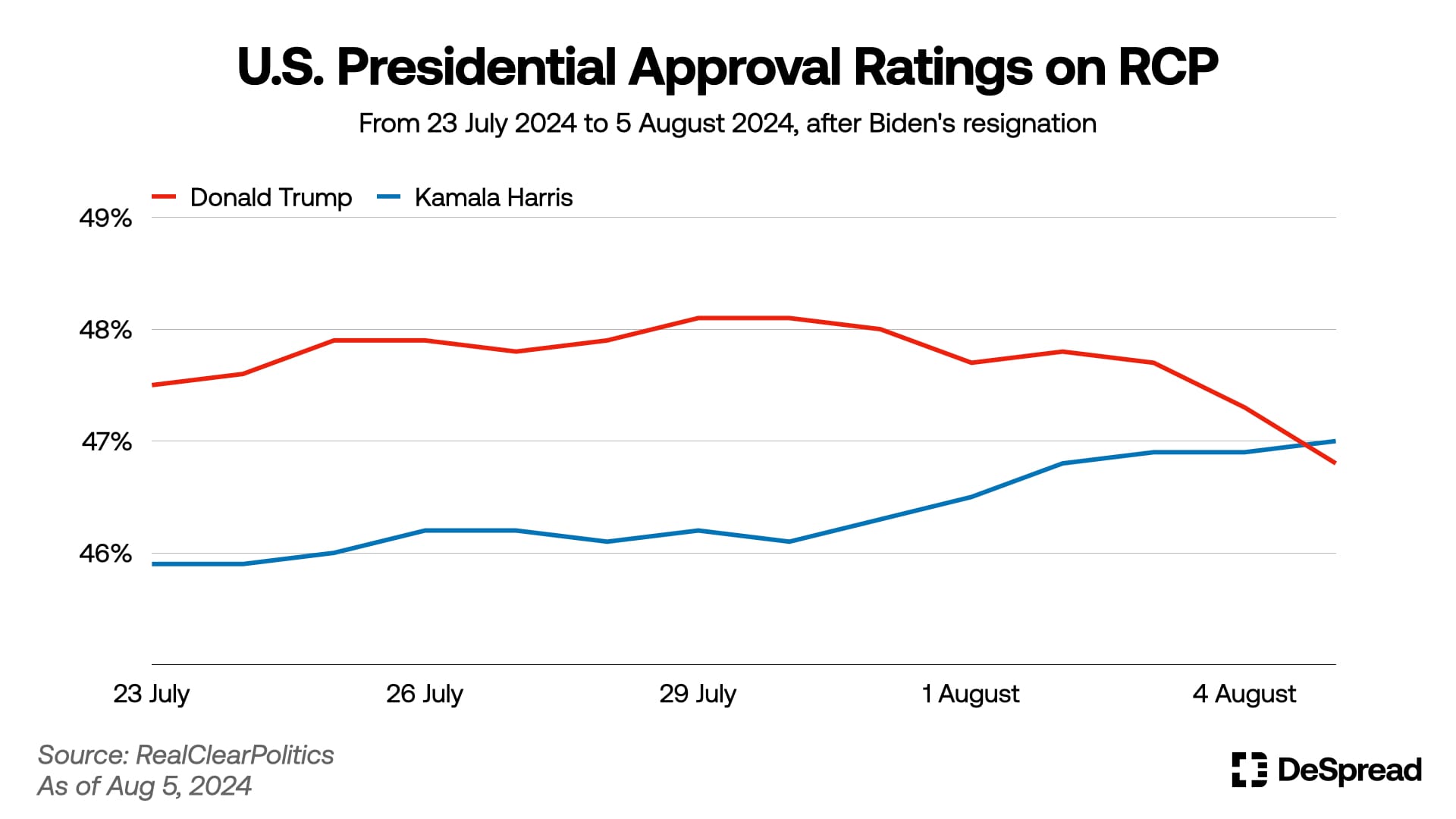

Unlike the Polymarket prediction market, which is relatively favorable to crypto assets, according to RealClearPolitics (RCP), a U.S. political news website and polling data aggregator, Kamala Harris' approval rating is rising even more steeply. In RCP, which provides an average of dozens of poll results in the U.S., Donald Trump's approval rating appeared lower, while Kamala Harris' approval rating appeared higher. Harris, who was rapidly catching up to Trump, overtook Trump on August 5 with an approval rating of 47%, while Trump recorded 46.8%.

4.3. Bitcoin Conference and Trump's Speech

Meanwhile, Trump, who is pursuing a pro-crypto policy, participated as a speaker at the Bitcoin 2024 Conference held in Nashville, Tennessee on July 28. In the speech, Trump stated that if he is elected as the president of the United States, he will implement the following policies:

- Ban CBDCs that give the federal government full authority over personal assets ("There will never be a CBDC while I'm the president of the United States.")

- Support the expansion of dollar stablecoins ("We will create a framework to enable the safe, responsible expansion of stablecoins.")

- Prohibit the sale of Bitcoin held or to be held by the U.S. government ("It will be the policy of my administration to keep 100% of all the Bitcoin the U.S. government currently holds or acquires in the future.")

In addition, Trump took strong measures in his speech to solidify his pro-crypto image and gain the hearts of the crypto camp, such as saying "Never sell your BTC", "On day one, I will fire Gary Gensler" receiving much attention and cheers from crypto market participants.

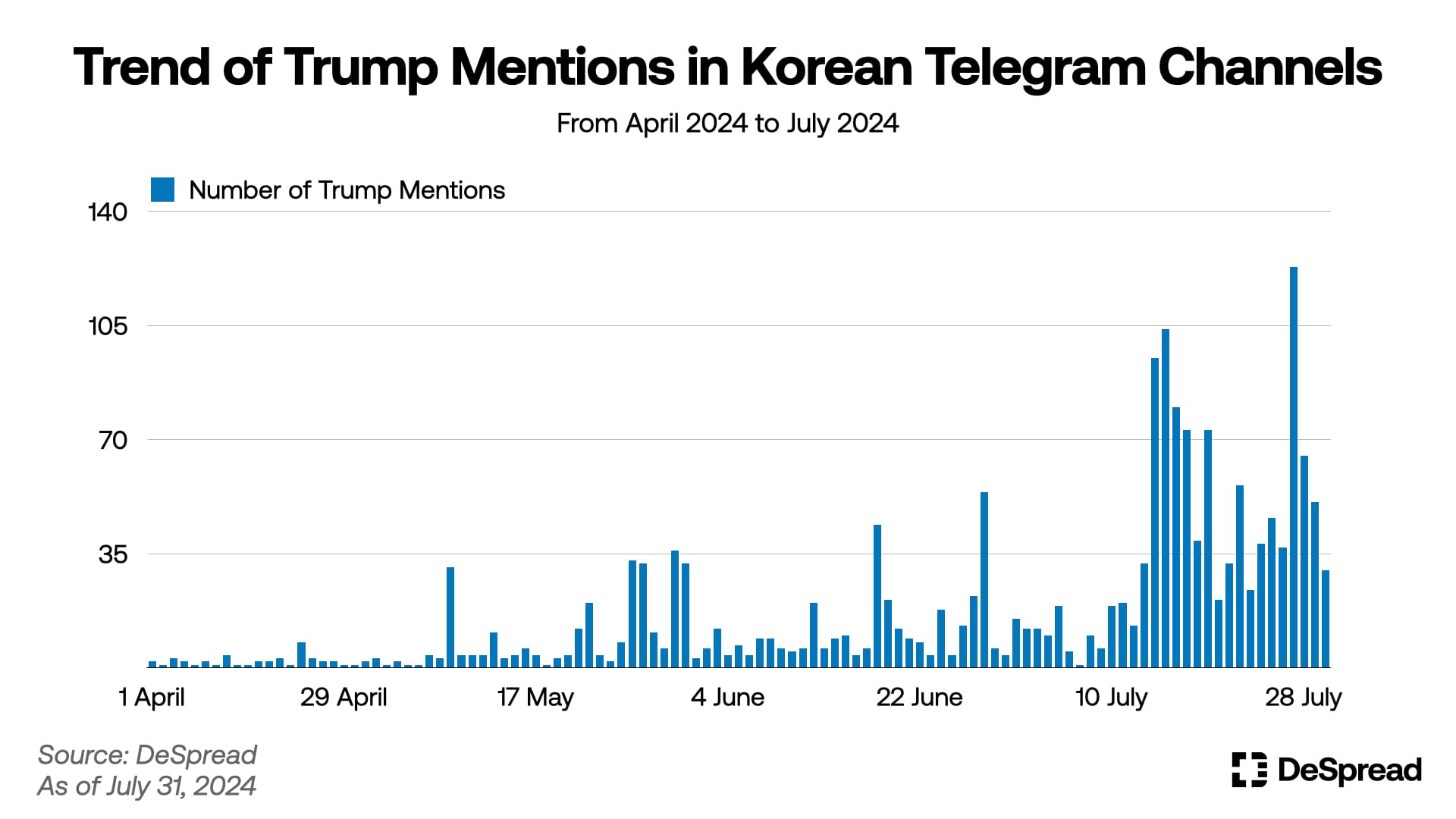

Statistics on the number of mentions of 'Trump' in domestic crypto-related Telegram channels show that Trump's Bitcoin Conference speech received a lot of attention from the domestic community. The number of mentions of the keyword 'Trump' in domestic crypto Telegram personal channels showed an upward trend as the presidential election approached, and on the day of the Bitcoin Conference speech, it recorded the highest figure of 123 times, far exceeding the previous month's average of 32.6 times.

5. Korean Market Trends

5.1. Exchange Deposit Interest Rate War

On July 19, the Act on the Protection of Cryptocurrency Users was enacted in Korea to safeguard the rights and interests of cryptocurrency users and establish orderly market transactions. Consequently, Korean cryptocurrency exchanges will be required to deposit and entrust user funds to trustworthy managing institutions such as banks and provide mandatory compensation to users for the use of their deposits.

Following the announcement of the Act on the Protection of Cryptocurrency Users, Korean exchanges individually declared the deposit usage fees they would pay to users. During this process, a competition among exchanges to offer higher deposit interest rates lasted for approximately five days in an effort to attract more users.

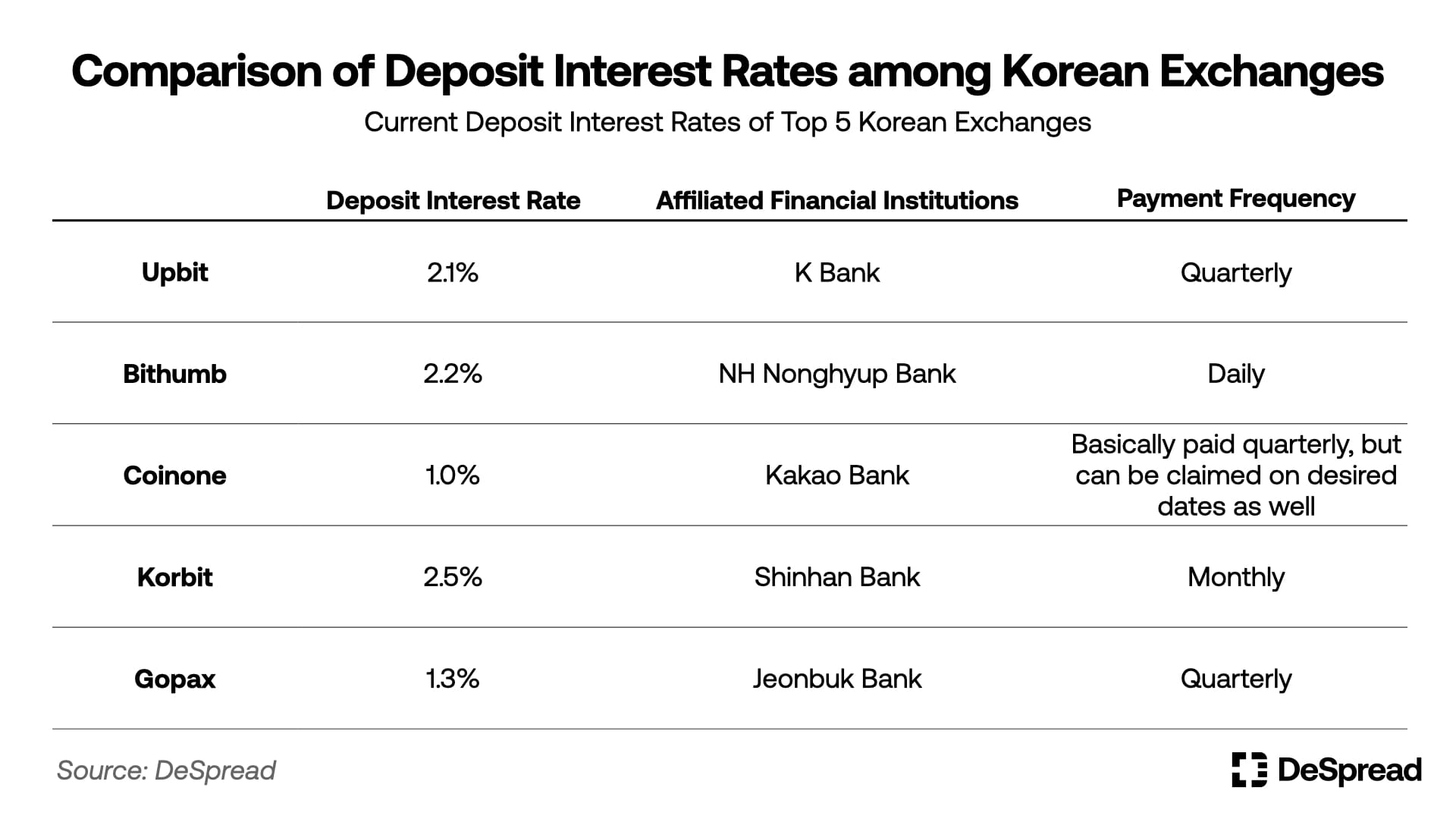

Initially, four out of the top five Korean exchanges, excluding Bithumb, announced interest rates in the 1% range as follows:

- Upbit: 1.3%

- Korbit: 1.5%

- Coinone: 1.0%

- Gopax: 1.3%

However, when Bithumb announced it would offer a 2.0% deposit interest rate, the other exchanges quickly followed suit and raised their rates:

- Upbit: Increased from 1.3% to 2.1%

- Bithumb: Minutes after Upbit's announcement, increased from 2.0% to 2.2%

- Korbit: Increased from 1.5% to 2.5%

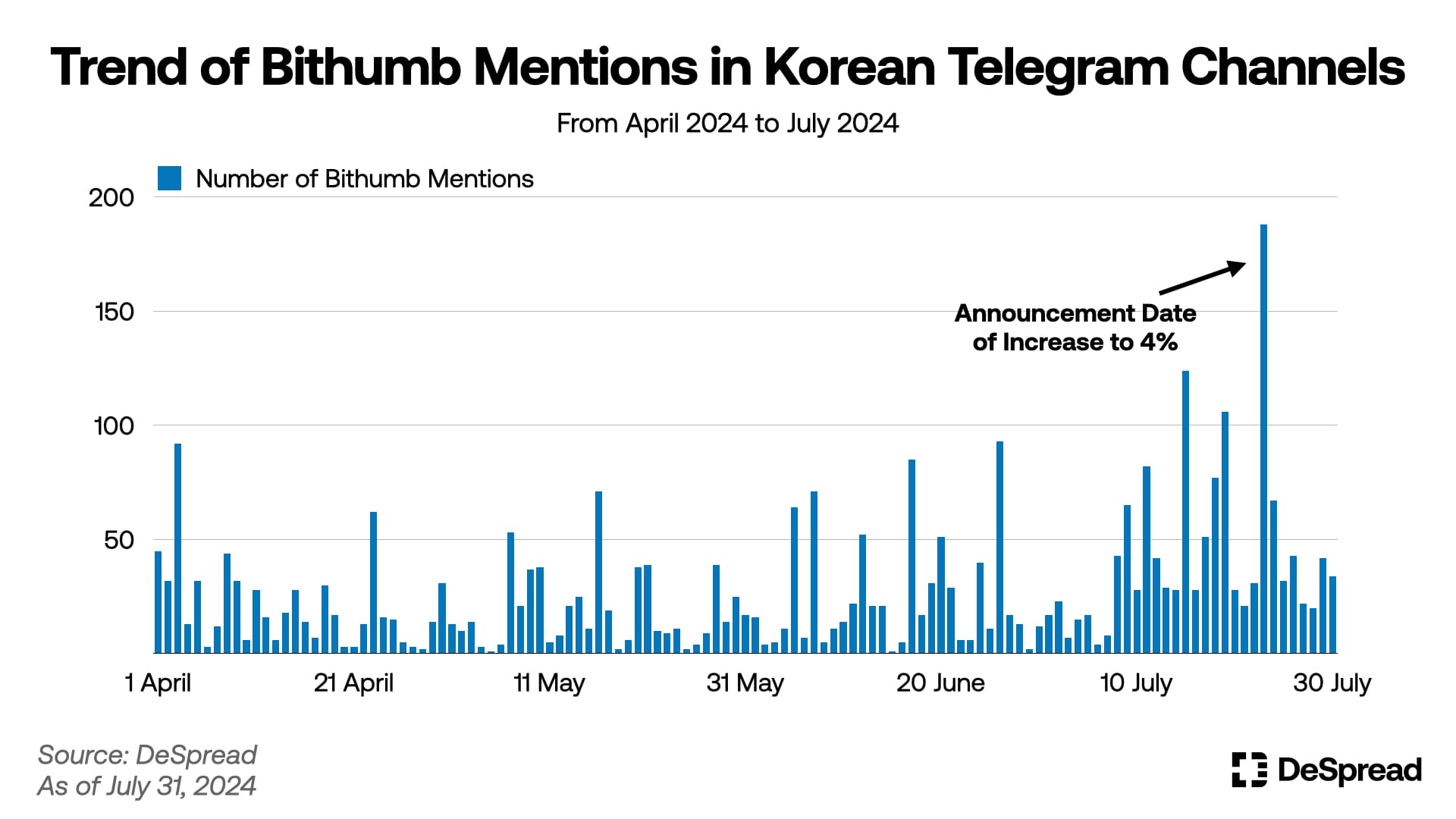

On July 23, Bithumb made a bold move by announcing a total interest rate of 4%, combining the 2% rate provided by Nonghyup Bank, the deposit managing institution, with an additional 2% rate offered by Bithumb itself. The announcement generated significant buzz, with a surge in mentions of Bithumb on Korean cryptocurrency-related Telegram channels, reflecting the heightened interest among Korean market participants.

However, the Financial Supervisory Service advised Bithumb to reconsider its proposed fee payment plan and conduct further review regarding the increased usage fee rate. Within half a day, Bithumb revised its interest rate back to the pre-raise level of 2.2%.

As of now, the deposit usage fee status for the top five Korean exchanges is as follows:

5.2. Postponement of Cryptocurrency Taxation

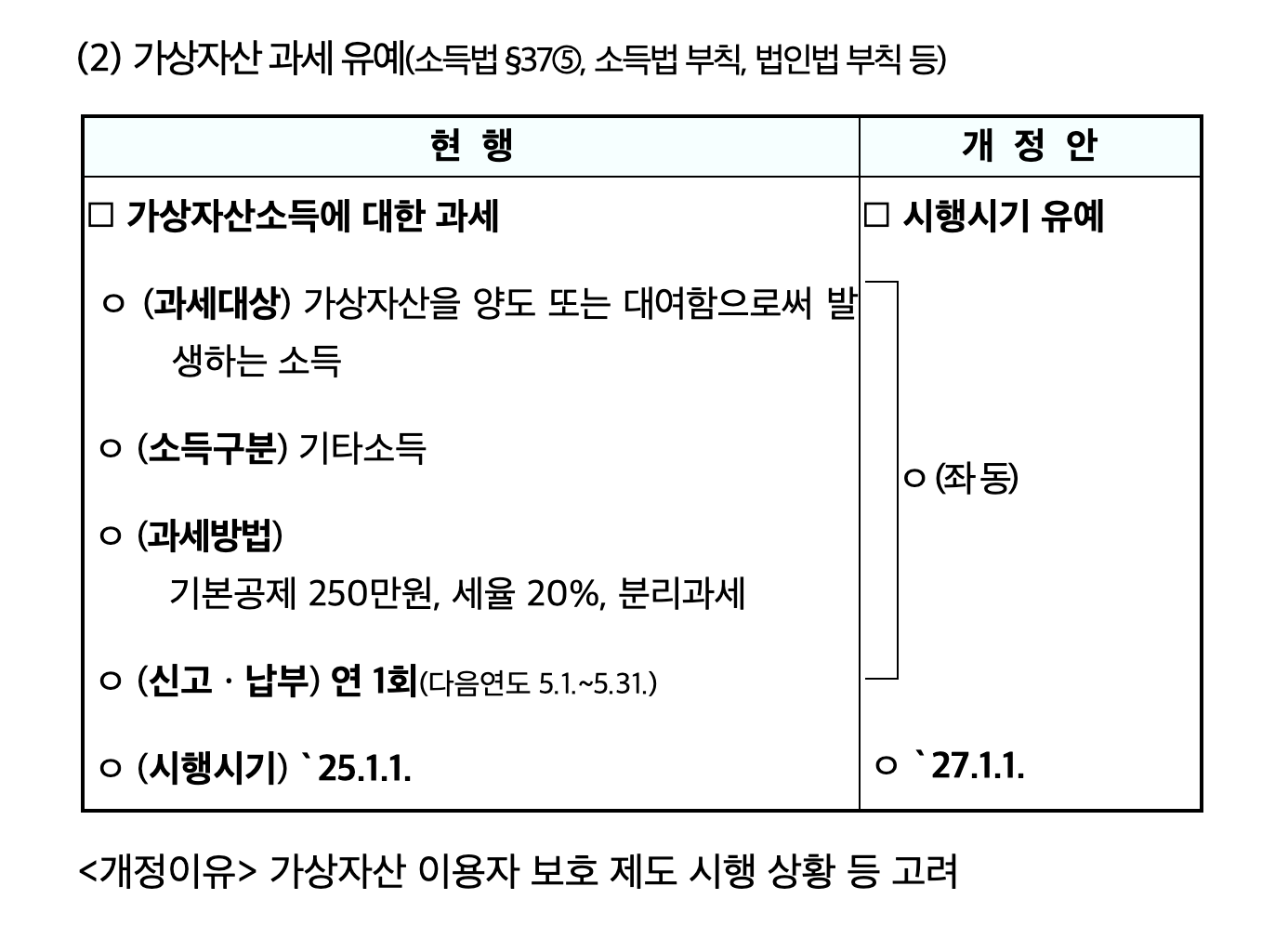

The "2024 Tax Law Amendment" introduced by the Ministry of Strategy and Finance on July 25 includes provisions for gift tax deductions, the removal of the financial investment income tax, and the postponement of cryptocurrency taxation. The latter was originally planned to be implemented from 2025 but has been delayed on the grounds that detailed guidelines and institutional foundations have not yet been thoroughly established in Korea.

Should the amendment pass, cryptocurrency taxation will be deferred until January 1, 2027. From that date, a 20% tax rate will be applied to profits exceeding 2.5 million won.

At present, discussions are actively underway concerning the implementation and methodology of the financial investment income tax. As the taxation of cryptocurrencies is influenced by amendments to the financial investment income tax, the execution and methods of taxation may change at any time. Therefore, close attention should be paid to future legislative decisions.

References

- Sahm-thing more on the Sahm rule

- Cointelegraph, Jump Trading’s Ether dump: Smart move or sign of trouble?

- Arthur Hayes, Spirited Away

- WATCH: Donald Trump Bitcoin Conference 2024 FULL REMARKS in Nashville | LiveNOW from FOX

- Ministry of Economy and Finance, Proposed Amendments to the Korean Tax Code for 2024